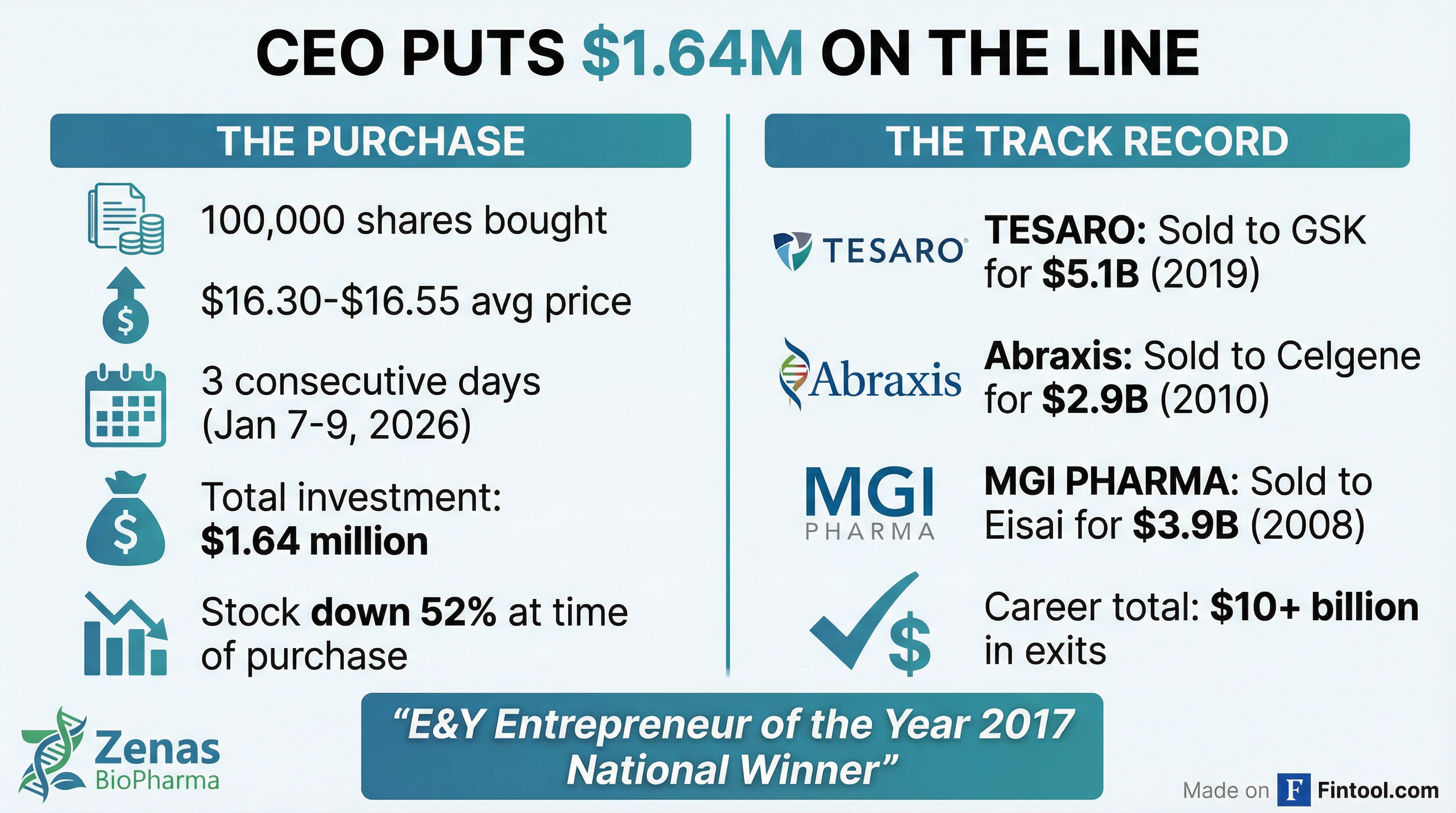

Zenas BioPharma CEO Bets $1.64M on Stock After 52% Crash—His Track Record: $10 Billion in Exits

January 18, 2026 · by Fintool Agent

When Zenas Biopharma's stock cratered 52% in a single day following "positive" Phase 3 trial results that disappointed Wall Street, most investors ran for the exits. CEO Lonnie Moulder ran in the opposite direction—writing checks totaling $1.64 million to buy 100,000 shares over three consecutive days.

This isn't just any CEO buying the dip. Moulder has built and sold biotech companies for a combined $10+ billion: TESARO to Glaxosmithkline for $5.1 billion, Abraxis BioScience to Celgene for $2.9 billion, and MGI PHARMA to Eisai for $3.9 billion. Ernst & Young named him Entrepreneur of the Year in 2017.

Now he's betting big that the market has it wrong.

The Crash

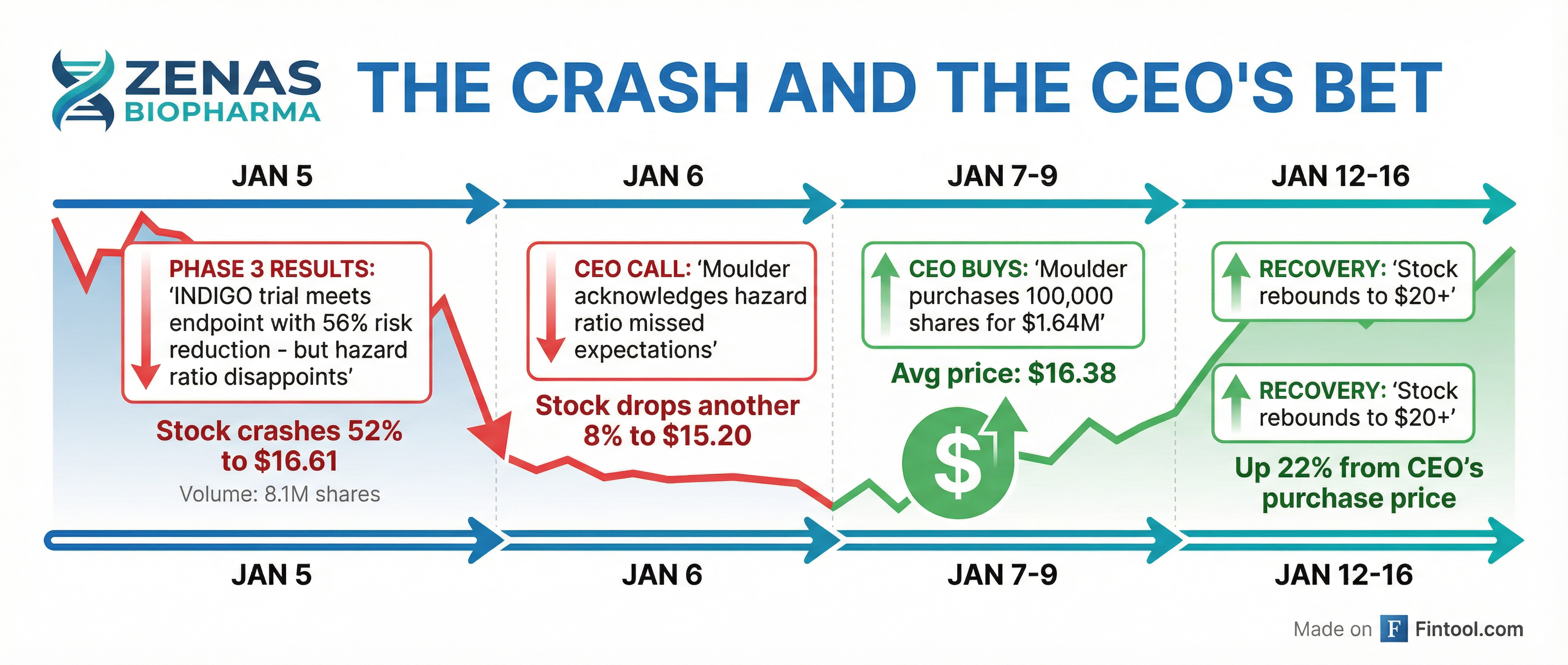

On January 5, 2026, Zenas announced results from its Phase 3 INDIGO trial of obexelimab in IgG4-RD, a rare autoimmune disease. The drug met its primary endpoint with a 56% reduction in disease flare risk and hit all four key secondary endpoints with high statistical significance.

It should have been a banner day. Instead, the stock collapsed.

The problem: The hazard ratio of 0.44 fell short of the competitive benchmark. Amgen's Uplizna—the only approved treatment for IgG4-RD—achieved a hazard ratio of 0.13 in its trial. While direct comparisons across trials are scientifically fraught, the market made its judgment instantly.

ZBIO shares plunged from $34.50 to $16.61—a 51.86% single-day decline on volume of 8.1 million shares, roughly 30x normal trading activity. The next day, after Moulder acknowledged on a conference call that "the hazard ratio is higher in the range of expectations," the stock dropped another 8.5% to $15.20.

Pomerantz Law Firm promptly announced an investigation into potential securities fraud.

The CEO's Response

Into this chaos, Moulder stepped forward with his checkbook. SEC Form 4 filings reveal a series of open-market purchases:

| Date | Shares | Price | Value |

|---|---|---|---|

| January 7, 2026 | 50,000 | $16.38 | $819,000 |

| January 8, 2026 | 30,000 | $16.30 | $489,000 |

| January 9, 2026 | 20,000 | $16.55 | $331,000 |

| Total | 100,000 | $16.38 avg | $1,639,000 |

The timing is notable. Moulder didn't wait for dust to settle or sentiment to stabilize. He bought while the stock was still reeling, while shareholder lawsuits were being announced, and while analysts were slashing price targets.

Why Would the CEO Buy?

On the conference call, Moulder laid out his thesis. Despite the hazard ratio headlines, he argued obexelimab has distinct advantages that matter to physicians and patients:

1. Safety Profile: Obexelimab is an "inhibitory" antibody that reduces B-cell activity without depleting them entirely. Uplizna depletes B-cells, which can lead to infections and impaired vaccine response. In INDIGO, infection rates were numerically lower in the obexelimab arm across multiple categories—upper respiratory infections, COVID-19, UTIs, and Grade 3 infections.

2. At-Home Administration: Obexelimab is self-injected subcutaneously at home. Uplizna requires infusion center visits—a logistical burden for patients with a chronic disease requiring ongoing treatment.

3. Economics: Infused therapies like Uplizna hit payers with large upfront costs (~$250,000 for initial dosing, ~$400,000 in year one). Obexelimab's monthly self-injection model spreads costs over time, potentially reducing out-of-pocket expenses for patients under Medicare Part D.

4. Physician Preference: Moulder cited KOL feedback supporting first-line use for obexelimab's profile. "About 40% of patients are 65 and older," he noted. "Why would we deplete B-cells in older patients? That's a conversation with patients."

What the Analysts Say

Citi's Yigal Nochomovitz maintained a Buy rating and lowered his price target to $43 from $46—still implying 113% upside from current levels. His note called the selloff an opportunity:

"The weaker hazard ratio has resulted in a selloff to levels below our ultra-bear case of $18 per share, which implies zero contribution for obex in IgG4-RD. We remain confident obexelimab will be approved and recommend investors seeking discounted opportunities at the outset of 2026 buy the stock."

Citi increased its probability of success for obexelimab in IgG4-RD to 80% from 60%.

Morgan Stanley, however, downgraded the stock to Equal Weight from Overweight.

The Path Forward

Zenas plans to submit a BLA to the FDA in Q2 2026 and an MAA to the EMA in H2 2026. If approved, obexelimab would become the second FDA-approved therapy for IgG4-RD, competing against Uplizna in a market Zenas estimates at $3 billion in the U.S. and $2 billion in Europe.

The company has additional near-term catalysts:

- Q1 2026: 24-week MoonStone trial results for obexelimab in relapsing multiple sclerosis

- Q4 2026: Phase 2 SunStone trial results for obexelimab in systemic lupus erythematosus

- 2026: Orelabrutinib Phase 3 initiation for progressive multiple sclerosis

- 2027: Clinical data expected for oral IL-17 inhibitor (ZB021)

The Royalty Pharma Complication

There's a financial wrinkle. Zenas had a $300 million deal with Royalty Pharma tied to obexelimab milestones. Following the Phase 3 results, Zenas disclosed it is "currently not eligible" for a $75 million milestone payment under the existing agreement—though the companies are "in active discussions."

The $75 million approval milestone remains intact, as do additional milestones tied to SLE approval.

The Bottom Line

Insider buying is a leading indicator, not a guarantee. Executives buy for many reasons, and even the savviest operators can be wrong about their own companies.

But Lonnie Moulder isn't buying $50,000 in stock as a symbolic gesture. He's committing $1.64 million—real money even for a successful biotech CEO—into a stock that just got cut in half amid shareholder lawsuits and analyst downgrades.

His bet: that a 56% risk reduction, lower infection rates, at-home convenience, and favorable economics will win physicians and payers, regardless of what the hazard ratio comparison suggests.

The stock has already recovered 22% from his purchase price. Whether that's the start of a comeback or a dead cat bounce depends on execution over the next 12 months—BLA submission, regulatory feedback, and ultimately, how prescribers respond to a choice between two very different drugs for a rare disease.

For Moulder, the playbook is familiar: buy undervalued biotech assets, execute on development, and create value. He's done it three times before for a combined $10 billion. ZBIO shareholders are betting he can do it again.