Zoom's $51 Million Anthropic Bet Could Be Worth $4 Billion

January 26, 2026 · by Fintool Agent

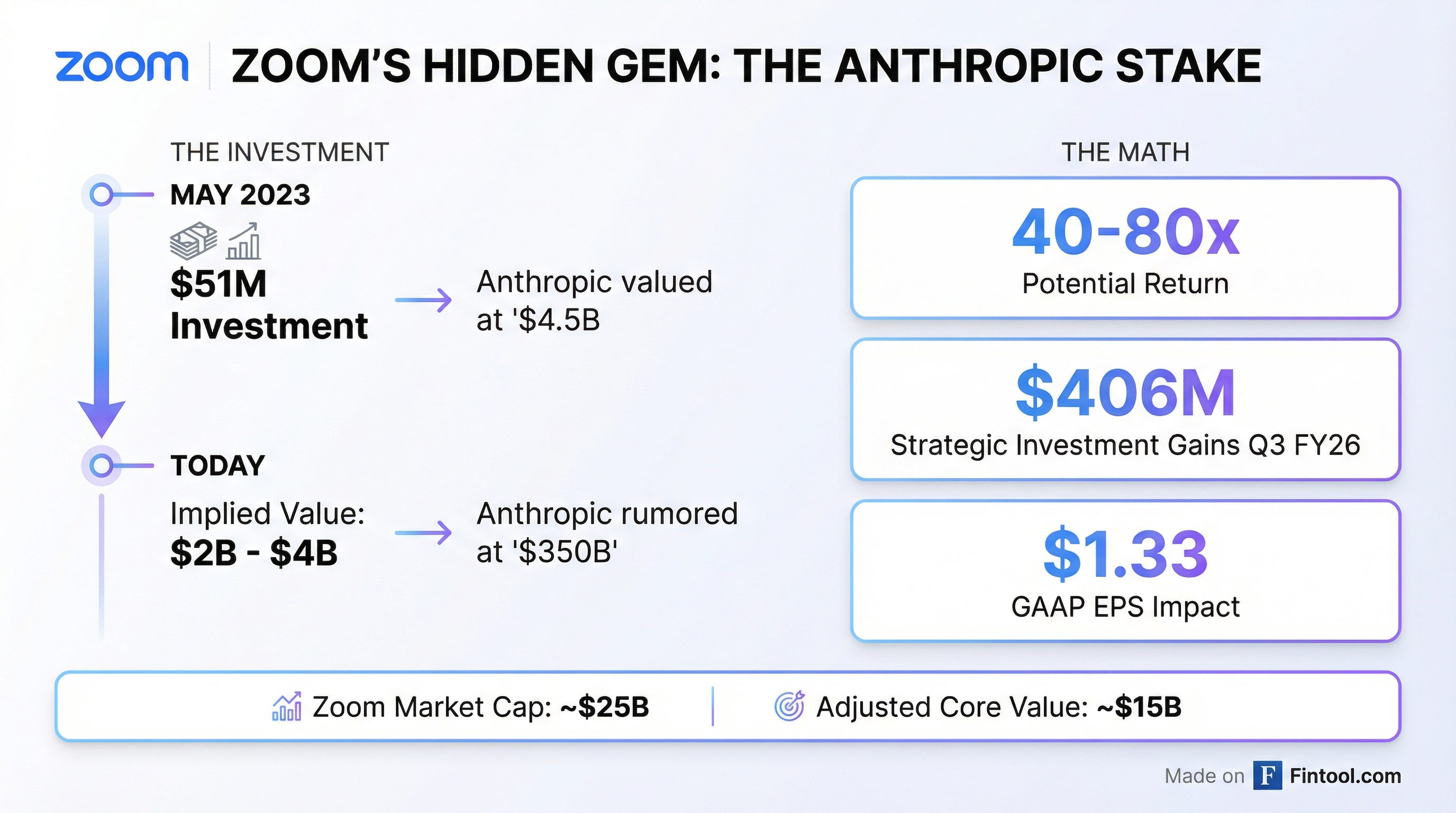

Zoom Communications shares surged nearly 10% Monday after analysts at Baird highlighted what they called a "hidden gem"—the video conferencing company's May 2023 investment in AI startup Anthropic could now be worth $2 billion to $4 billion, representing a potential 40-80x return on a $51 million stake.

The revelation reframes how investors should think about Zoom's valuation. With a market cap of roughly $25 billion and enterprise value of approximately $17 billion, adjusting for a $2 billion Anthropic stake would imply Zoom's core video communications business trades at just $15 billion—a significant discount to where most investors have been valuing it.

The Math Behind the 'Hidden Gem'

When Zoom announced its partnership with Anthropic in May 2023, the AI company was valued at approximately $4.5 billion following its Series C round. Zoom reported making $51 million in "strategic investments" that quarter in SEC filings, and Baird's analysts believe all or the "vast majority" went to Anthropic.

Anthropic is now reportedly raising $10 billion at a $350 billion valuation—making it the world's third most valuable private company behind only OpenAI ($500B) and SpaceX ($400B). That valuation growth—from $4.5 billion to $350 billion in less than three years—suggests Zoom's stake could have appreciated roughly 78 times.

Baird analyst William Power maintained an Outperform rating with a $95 price target on Zoom shares, noting: "ZM is literally invested in Anthropic's Claude success, and as Anthropic IPO rumors accelerate, the investment could become even more meaningful."

Already Showing Up in Earnings

The Anthropic investment isn't just theoretical value. Zoom's Q3 FY2026 results show $406 million in gains on strategic investments—up from just $6.3 million in the year-ago quarter—which Baird believes was largely driven by the Anthropic stake appreciation.

This gain contributed $1.33 to Zoom's GAAP earnings per share in the quarter, turning what would have been a solid quarter into a standout one.

| Metric | Q3 FY2026 | Q3 FY2025 | Change |

|---|---|---|---|

| Revenue | $1.23B | $1.18B | +4.4% |

| Net Income | $612.9M | $207.1M | +196% |

| Strategic Investment Gains | $406.1M | $6.3M | +6,324% |

The filings confirm these gains were "primarily driven by changes in the fair value of our privately held securities"—Anthropic being the most significant such holding.

Zoom's 'Federated AI' Strategy

The Anthropic investment wasn't purely financial—it's central to Zoom's product strategy. The company has built what it calls a "federated AI approach" that dynamically leverages multiple large language models, including Claude from Anthropic alongside models from OpenAI and Meta.

From Zoom's most recent 10-K: "Our federated approach to AI dynamically leverages multiple Large Language Models (including those from OpenAI, Anthropic, and Meta), as well as Small Language Models, making AI more accessible and affordable so that more people can incorporate it in their day-to-day workflows."

CEO Eric Yuan has emphasized this approach on earnings calls, noting that Zoom can "use specialized small language models where appropriate while leveraging large models for more complex reasoning, driving both quality and cost efficiency."

Stock Surges to 52-Week High

Zoom shares jumped to $94.83 intraday Monday—a new 52-week high and the highest level since August 2022. The stock closed up 9.9% at $94.26.

The move comes despite Zoom shares having been essentially flat year-to-date prior to the Baird note. While the pandemic-era highflyer has struggled to recapture its 2020 glory—when shares topped $500—the Anthropic stake represents an unexpected source of potential value creation.

| Stock Metrics | Value |

|---|---|

| Today's Close | $94.26 |

| Day Change | +9.9% |

| 52-Week High | $95.83 (Today) |

| 52-Week Low | $64.41 |

| Market Cap | $28B |

| YTD Performance | +11% |

What to Watch

Anthropic IPO timing: Reports suggest Anthropic is planning a new $10 billion fundraise at a $350 billion valuation, with IPO rumors intensifying. Any public offering would provide a liquidity event for Zoom's stake and a more precise valuation of its holdings.

Dilution assumptions: Baird's $2-4 billion range reflects uncertainty around how much Zoom's stake has been diluted by subsequent funding rounds. Amazon alone has invested $8 billion in Anthropic, and Google has committed up to $2 billion.

Mark-to-market volatility: As a privately held investment, Zoom must periodically revalue its Anthropic stake. While Q3 showed a $406 million gain, future quarters could show gains or losses depending on Anthropic's trajectory and funding round pricing.

Claude performance: Zoom is directly exposed to Anthropic's competitive position in the AI race. Claude's success—or struggles against OpenAI's GPT models and Google's Gemini—will impact both the investment value and Zoom's own AI product capabilities.

Related Companies: Zoom Communications