Earnings summaries and quarterly performance for Ameris Bancorp.

Executive leadership at Ameris Bancorp.

H. Palmer Proctor, Jr.

Chief Executive Officer

Douglas D. Strange

Corporate Executive Vice President and Chief Credit Officer

James A. LaHaise

Corporate Executive Vice President and Chief Strategy Officer

Jody L. Spencer

Corporate Executive Vice President and Chief Legal Officer

Lawton E. Bassett, III

Corporate Executive Vice President, Chief Banking Officer and Bank President

Michael T. Pierson

Corporate Executive Vice President, Chief Governance Officer and Corporate Secretary

Nicole S. Stokes

Corporate Executive Vice President and Chief Financial Officer

Ross L. Creasy

Corporate Executive Vice President and Chief Information Officer

William D. McKendry

Corporate Executive Vice President and Chief Risk Officer

Board of directors at Ameris Bancorp.

Claire E. McLean

Director

Daniel B. Jeter

Director

James B. Miller, Jr.

Chairman of the Board

Leo J. Hill

Lead Independent Director

Robert P. Lynch

Director

Rodney D. Bullard

Director

William H. Stern

Director

William I. Bowen, Jr.

Director

Wm. Millard Choate

Director

Research analysts who have asked questions during Ameris Bancorp earnings calls.

Russell Gunther

Stephens Inc.

8 questions for ABCB

Catherine Mealor

Keefe, Bruyette & Woods

6 questions for ABCB

Christopher Marinac

Janney Montgomery Scott LLC

5 questions for ABCB

Stephen Scouten

Piper Sandler & Co.

5 questions for ABCB

David Feaster

Raymond James

4 questions for ABCB

Manuel Navas

D.A. Davidson & Co.

4 questions for ABCB

David Pfister

Raymond James & Associates Inc.

2 questions for ABCB

Gary Tenner

D.A. Davidson & Co.

2 questions for ABCB

John McDonald

Truist Securities

2 questions for ABCB

Brandon King

Truist Securities

1 question for ABCB

Steven Scoutin

Piper Sandler

1 question for ABCB

William Jones

Truist Securities

1 question for ABCB

Recent press releases and 8-K filings for ABCB.

- Ameris Bancorp reported record earnings for the full year 2025, with net income exceeding $412 million and diluted EPS reaching $6 per share, a 15% increase year-over-year.

- The company achieved a full-year PPNR ROA of 2.25% and improved its efficiency ratio to 50% for 2025, alongside tangible book value growth of over 14%.

- Capital levels remained robust, with Common Equity Tier 1 at 13.2% and a tangible common equity ratio of 11.4% at year-end 2025. Ameris Bancorp repurchased $77 million of its stock (2% of the company) for the year, including $40.8 million in Q4.

- Loan production in Q4 2025 was $2.4 billion, a 16% increase over Q3, contributing to nearly 5% loan growth for the quarter. Asset quality was strong, with the allowance for loan losses at 1.62% of total loans and full-year net charge-offs at 18 basis points.

- The net interest margin (NIM) expanded 5 basis points to 3.85% in Q4 2025, with the full-year NIM reaching 3.79%. Management anticipates slight margin compression of 5-10 basis points over the next few quarters due to deposit costs.

- Ameris Bancorp reported record net income of $412.2 million and diluted EPS of $6 per share for the full year 2025, representing a 15% increase in EPS year-over-year.

- The company achieved 6% revenue growth and a 1% decline in expenses for the year, resulting in an improved efficiency ratio of 50% for 2025, compared to 53.2% in 2024.

- Loan growth was almost 5% in Q4 2025, with loan production reaching $2.4 billion, a 16% increase over Q3 levels. The net interest margin expanded 5 basis points to 3.85% in Q4, though management anticipates slight compression of 5-10 basis points over the next few quarters due to deposit cost pressure.

- Capital ratios remained strong, with Common Equity Tier 1 at 13.2% and tangible common equity at 11.4% at year-end. The company was active in share repurchases, buying back $77 million (2% of the company) in 2025 at an average price under $67.

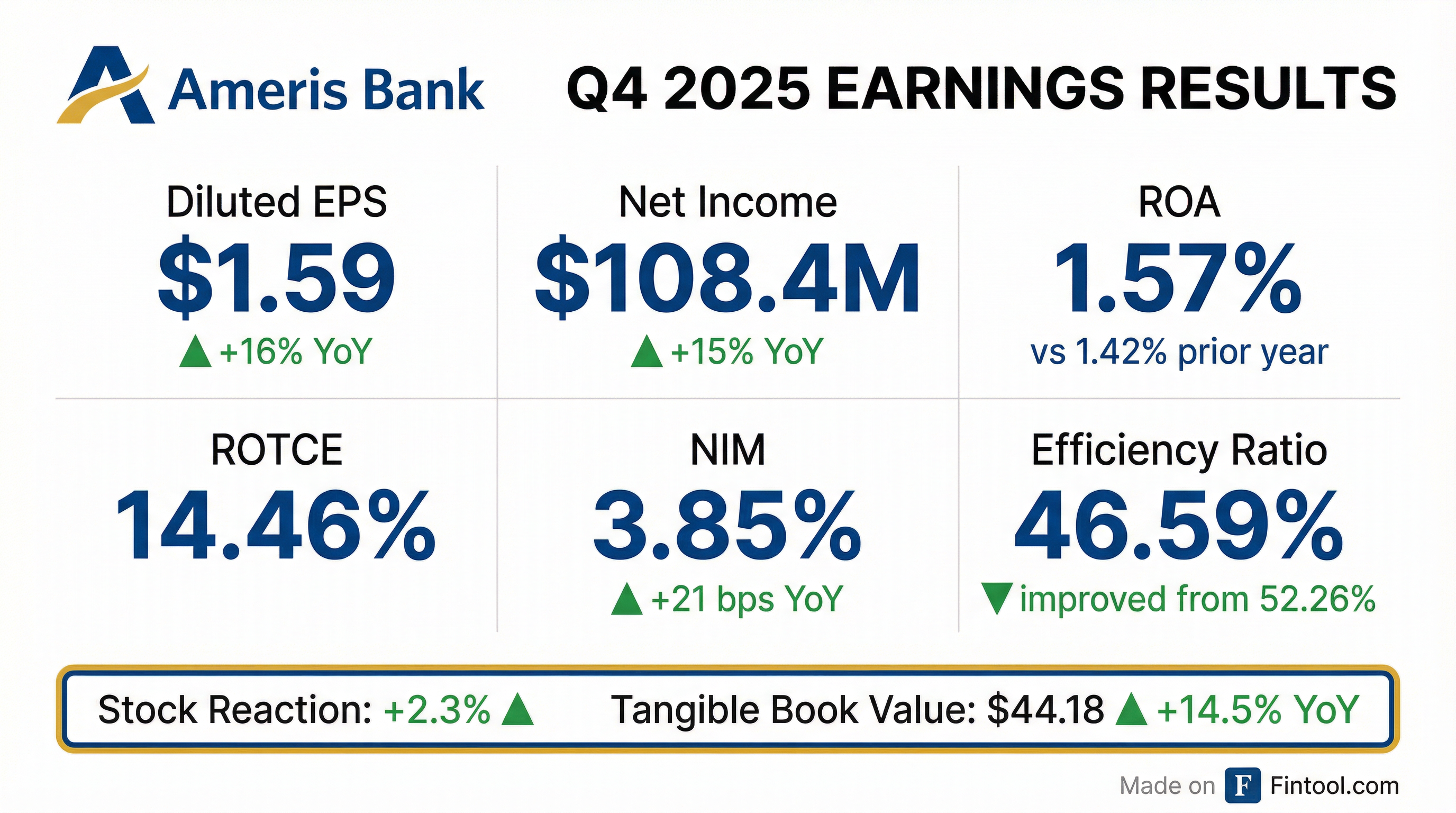

- Ameris Bancorp (ABCB) reported record earnings of over $412 million and diluted EPS of $6 per share for the full year 2025, representing a 15% increase year-over-year. For Q4 2025, net income was $108.4 million or $1.59 per diluted share.

- The company achieved a 50% efficiency ratio for the full year 2025, improving from 53.2% in 2024, driven by 6% revenue growth and a 1% decline in expenses.

- Net interest margin expanded 5 basis points to 3.85% in Q4 2025, and to 3.79% for the full year 2025, though management anticipates slight margin compression of 5-10 basis points over the next few quarters.

- Capital levels remained strong, with Common Equity Tier 1 at 13.2% and tangible common equity ratio at 11.4% at year-end 2025. The company repurchased $77 million of stock (2% of the company) during the year.

- Loan growth was robust, increasing almost 5% in Q4 2025, with loan production of $2.4 billion (a 16% increase over Q3 levels), despite over $500 million in elevated CRE payoffs.

Ameris Bancorp reported strong financial performance for the fourth quarter and full year ended December 31, 2025.

- The company achieved significant net income and diluted earnings per share for both the quarter and the full year.

- Profitability metrics, including return on average assets and return on average tangible common equity, remained robust.

- Net interest margin (TE) expanded in the fourth quarter, contributing to an improved efficiency ratio for the period and the full year.

- Tangible book value per share increased to $44.18 at December 31, 2025, and the company executed share repurchases totaling $77.1 million for the full year.

- Credit quality remained sound, with an allowance for loan losses of 1.62% of loans and a net charge-off ratio of 0.18% for the full year 2025.

| Metric | Q4 2025 | FY 2025 |

|---|---|---|

| Net income ($USD Thousands) | $108,356 | $412,154 |

| Net Income Per Diluted Share ($USD) | $1.59 | $6.00 |

| Return on average assets (%) | 1.57% | 1.54% |

| Return on average tangible common equity (%) | 14.46% | 14.51% |

| Efficiency ratio (%) | 46.59% | 50.00% |

| Net interest margin (TE) (%) | 3.85% | 3.79% |

| Tangible book value per share (period end) ($USD) | $44.18 | N/A |

| Share repurchases ($USD Millions) | $40.8 | $77.1 |

| Allowance for loan losses (% of loans, as of Dec 31, 2025) | 1.62% | N/A |

| Net charge-off ratio (% of average total loans) | N/A | 0.18% |

| Nonperforming assets (% of total assets, as of Dec 31, 2025) | 0.44% | N/A |

- Ameris Bancorp reported net income of $108.4 million, or $1.59 per diluted share, for the fourth quarter of 2025, and $412.2 million, or $6.00 per diluted share, for the full year 2025.

- The company achieved a Return on Average Assets (ROA) of 1.57% for Q4 2025 and 1.54% for the full year 2025, with net interest margin (TE) expanding to 3.85% in Q4 2025 and reaching 3.79% for the full year.

- Tangible book value per share grew to $44.18 at December 31, 2025, reflecting 14.5% growth for the full year.

- The company increased share repurchases, totaling $40.8 million in Q4 2025 and over $77 million for the full year 2025.

- Ameris Bancorp reported net income of $106 million and $1.54 diluted earnings per share for Q3 2025, achieving a return on assets of 1.56% and a return on tangible common equity of 14.6%. The efficiency ratio improved to 49.19%, driven by 18% annualized revenue growth.

- The company experienced 5% annualized deposit growth and 4% annualized loan growth, primarily in C&I and CRE. The net interest margin expanded to 3.80% , and tangible book value per share grew by 15.2% annualized to $42.90.

- Ameris Bancorp repurchased $8.5 million of common stock during the quarter and announced a new $200 million share repurchase plan approved by its board. Management anticipates slight margin compression over the next few quarters and expects the efficiency ratio to return above 50% in Q4. The company expresses strong optimism for organic loan growth in the mid-single-digit range, with potential for acceleration to upper single or double digits in 2026.

- Ameris Bancorp reported net income of $106 million, or $1.54 per diluted share, for Q3 2025, achieving a return on assets of 1.56% and a return on tangible common equity of 14.6%.

- The company saw 18% annualized revenue growth and an improved efficiency ratio of 49.19%, with its net interest margin expanding to 3.80%.

- Loan growth was 4% annualized, in line with mid-single-digit guidance, and deposits grew 5% annualized, maintaining non-interest-bearing deposits at over 30%.

- Capital levels strengthened, with common equity tier one at 13.2% and tangible common equity at 11.31%. The company repurchased $8.5 million in common stock and approved a new $200 million share repurchase plan.

- Management expressed optimism for future organic loan growth, potentially accelerating beyond mid-single digits, and prioritizes these opportunities over M&A.

- Ameris Bancorp reported net income of $106 million, or $1.54 per diluted share, for Q3 2025, with a 1.56% return on assets and 14.6% return on tangible common equity.

- The company achieved 18% annualized revenue growth and an improved efficiency ratio of 49.19%, alongside a 3.80% net interest margin.

- Tangible book value per share grew to $42.90, representing 15.2% annualized growth, and the company repurchased $8.5 million of common stock while authorizing a new $200 million share repurchase plan.

- Management anticipates slight margin compression and the efficiency ratio to return above 50% in Q4, but remains optimistic about accelerating loan growth to potentially upper single-digits or double-digits in 2026, driven by market disruption and improving economic conditions.

- Ameris Bancorp reported net income of $106.0 million, or $1.54 per diluted share, for the third quarter of 2025. This represents an increase from $99.2 million, or $1.44 per diluted share, in the third quarter of 2024.

- The company achieved a return on average assets of 1.56% and a return on average tangible common equity of 14.57%. The net interest margin (TE) expanded by 3 basis points to 3.80%, and the efficiency ratio improved to 49.19% in Q3 2025.

- Tangible book value grew by $1.58 per share, or 15.2% annualized, reaching $42.90 at September 30, 2025. The tangible common equity (TCE) ratio increased to 11.31%.

- Loan growth was $216.9 million, or 4.1% annualized, and deposits grew 5% annualized during the third quarter of 2025, with noninterest-bearing deposits remaining strong at 30.4% of total deposits. Annualized net charge-offs were stable at 0.14% of average total loans.

- The Board authorized a new $200 million share repurchase program in October 2025, following the repurchase of 125,900 shares for $8.5 million during the quarter.

- Ameris Bancorp reported net income of $106.0 million, or $1.54 per diluted share, for the third quarter of 2025.

- The company achieved a return on average assets of 1.56% and a return on average tangible common equity of 14.57% for the third quarter of 2025.

- Tangible book value per share grew by $1.58, or 15.2% annualized, to $42.90 at September 30, 2025.

- The board of directors authorized a new share repurchase program of up to $200 million of outstanding common stock, effective through October 31, 2026.

Quarterly earnings call transcripts for Ameris Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more