Earnings summaries and quarterly performance for ACV Auctions.

Executive leadership at ACV Auctions.

George Chamoun

Chief Executive Officer

Craig Anderson

Chief Corporate Development and Strategy Officer

Leanne Fitzgerald

Chief Legal Officer and Secretary

Michael Waterman

Chief Sales Officer

Vikas Mehta

Chief Operating Officer

William Zerella

Chief Financial Officer

Board of directors at ACV Auctions.

Research analysts who have asked questions during ACV Auctions earnings calls.

Naved Khan

B. Riley Securities

6 questions for ACVA

Rajat Gupta

JPMorgan Chase & Co.

6 questions for ACVA

Bob Labick

CJS Securities

5 questions for ACVA

Christopher Pierce

Needham & Company

4 questions for ACVA

Eric Sheridan

Goldman Sachs

4 questions for ACVA

John Colantuoni

Jefferies

3 questions for ACVA

Ronald Josey

Citigroup Inc.

3 questions for ACVA

Andrew Boone

JMP Securities

2 questions for ACVA

Chris Pierce

Needham

2 questions for ACVA

Gary Prestopino

Barrington Research

2 questions for ACVA

Josh Beck

Raymond James

2 questions for ACVA

Nicholas Jones

Citizens JMP

2 questions for ACVA

Stephen McDermott

Bank of America

2 questions for ACVA

Alexander Potter

Piper Sandler Companies

1 question for ACVA

Curtis Nagle

Bank of America

1 question for ACVA

Glenn Shell

Raymond James & Associates, Inc.

1 question for ACVA

Jeff Lack

Stephens Inc

1 question for ACVA

Jeff Lick

Stephens Inc.

1 question for ACVA

John Healy

Northcoast Research

1 question for ACVA

Michael Graham

D.A. Davidson & Co.

1 question for ACVA

Peter Lukas

CJS Securities

1 question for ACVA

Recent press releases and 8-K filings for ACVA.

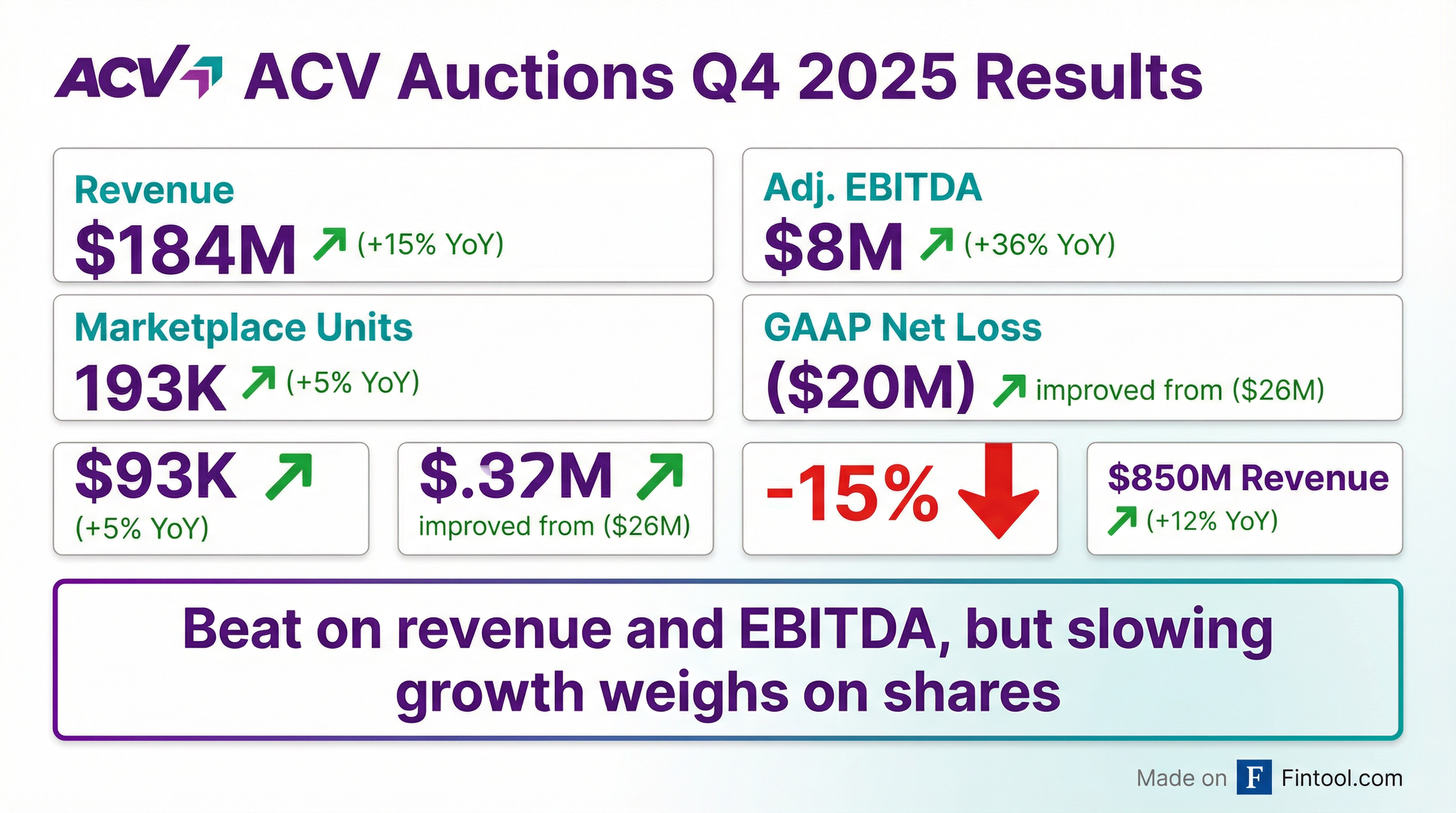

- ACV Auctions reported Q4 2025 revenue of $184 million, a 15% year-over-year increase, and adjusted EBITDA of $8 million, up 36% year-over-year. For the full year 2025, revenue grew 19% and adjusted EBITDA grew over 100%.

- The company provided Q1 2026 revenue guidance of $200 million to $204 million and adjusted EBITDA of $14 million to $16 million. For full-year 2026, revenue is projected to be $845 million to $855 million (11%-13% growth), with adjusted EBITDA expected to be $73 million to $77 million (approx. 28% growth).

- ACVA plans significant investments in 2026, including approximately $11 million in additional go-to-market spending and high single-digit millions in CapEx for the VIPER rollout. These investments are anticipated to drive market share gains and slightly higher growth in the second half of the year.

- Operational highlights include 193,000 units sold in Q4 2025 , strong revenue growth in ACV Transportation (20%) and ACV Capital (48%), and an increase in ACV Guarantee mix to 19%. The company also expanded its dealer network, transacting with 15,000 unique sellers and 22,000 unique buyers in 2025.

- ACV Auctions reported Q4 2025 revenue of $184 million, representing a 15% year-over-year increase, with Adjusted EBITDA reaching $8 million.

- For the full year 2025, the company achieved revenue of $760 million, an increase of 19% year-over-year, and Adjusted EBITDA of $59 million.

- The company provided Q1 2026 revenue guidance between $200 million and $204 million and full-year 2026 revenue guidance between $845 million and $855 million.

- ACV also guided for Q1 2026 Adjusted EBITDA of $14 million to $16 million and full-year 2026 Adjusted EBITDA of $73 million to $77 million.

- As of December 31, 2025, ACV held $271 million in cash and cash equivalents and generated $78 million in operating cash flow for 2025.

- ACV Auctions reported Q4 2025 revenue of $184 million, a 15% year-over-year increase, and adjusted EBITDA of $8 million, up 36% year-over-year.

- For the full year 2025, the company achieved 19% revenue growth and over 100% adjusted EBITDA growth.

- The company provided 2026 revenue guidance of $845 million to $855 million (11%-13% growth) and adjusted EBITDA guidance of $73 million to $77 million (approximately 28% year-over-year growth).

- Strategic initiatives include leveraging AI, expanding ACV MAX adoption, and improving arbitration costs through stricter policies and increased inspector validation, with Q4 conversion rates up year-over-year.

- ACV plans to invest approximately $11 million in additional go-to-market spending and high single-digit millions in CapEx for VIPER in 2026, with adjusted EBITDA margin expected to increase by approximately 100 basis points year-over-year.

- ACV Auctions reported Q4 2025 revenue of $184 million, representing a 15% year-over-year increase, and Adjusted EBITDA of $8 million, up 36% year-over-year. For the full year 2025, revenue grew 19% and units sold increased by 12%.

- The company provided 2026 guidance, expecting full-year revenue between $845 million and $855 million (11%-13% growth) and Adjusted EBITDA of $73 million to $77 million (approximately 28% growth).

- Strategic investments for 2026 include approximately $11 million in additional go-to-market spending and high single-digit millions in CapEx for the VIPER rollout, totaling nearly $20 million. Management anticipates a flat dealer wholesale market for 2026.

- ACV is leveraging AI to attract buyers and sellers, expanding its dealer network, and seeing strong traction with ClearCar and ACV MAX. The VIPER product is being rolled out to 100-200 dealers in 2026, with plans to scale early next year. Arbitration costs are expected to normalize in 2026 due to implemented litigation steps and stricter marketplace rules.

- ACV Auctions Inc. reported Q4 2025 revenue of $184 million and full-year 2025 revenue of $760 million, representing a 15% year-over-year increase for Q4 and 19% for the full year.

- The company achieved Q4 2025 Adjusted EBITDA of $8 million, exceeding the high-end of guidance, and full-year 2025 Adjusted EBITDA of $59 million.

- For 2026, ACV expects total revenue between $845 million and $855 million, indicating 11% to 13% year-over-year growth, and Adjusted EBITDA of $73 million to $77 million.

- ACV reported fourth quarter 2025 revenue of $184 million and full-year 2025 revenue of $760 million, reflecting year-over-year increases of 15% and 19%, respectively.

- The company achieved Adjusted EBITDA of $8 million for the fourth quarter of 2025, exceeding the high-end of guidance, and $59 million for the full-year 2025.

- For full-year 2026, ACV anticipates revenue between $845 million and $855 million, representing 11% to 13% year-over-year growth, and Adjusted EBITDA of $73 million to $77 million, an approximate 28% year-over-year increase at the midpoint of guidance.

- First quarter 2026 guidance projects total revenue of $200 million to $204 million and Adjusted EBITDA of $14 million to $16 million.

- ACV Auctions Inc. (ACVA) filed an 8-K on December 18, 2025, announcing Amendment No. 1 to its Revolving Credit and Security Agreement.

- The original Revolving Credit and Security Agreement was dated June 20, 2024, with the amendment dated December 12, 2025.

- The agreement involves ACV Capital Funding II LLC as the borrower and Citibank, N.A. as the Administrative Agent and a Committed Lender.

- The total commitment from Citibank, N.A. as a Committed Lender/Funding Agent is $200,000,000.

- The Scheduled Commitment Termination Date for the facility is December 10, 2027.

- ACVA reported Q3 2025 revenue of $200 million, a 16% year-over-year increase, and adjusted EBITDA of $19 million, with margin improving 280 basis points year over year.

- The company updated its full-year 2025 revenue guidance to $756-$760 million (19% year-over-year growth) and adjusted EBITDA to $56-$58 million (approximately 100% year-over-year growth).

- Q4 2025 revenue is projected to be $180-$184 million and adjusted EBITDA $5-$7 million, reflecting weakening market conditions in the dealer wholesale market and higher expected arbitration costs.

- ACVA sold 218,000 vehicles in Q3, a 10% year-over-year increase, and saw ACV Guarantee units sold rise from 11% in Q2 to 18% in Q3.

- ACV Capital recorded $7 million in reserves in Q3 and reduced its Q4 revenue forecast by $2 million due to a review of its loan portfolio and the bankruptcy of a former customer, Tricolor.

- ACVA reported Q3 2025 revenue of $200 million, a 16% year-over-year increase, with Adjusted EBITDA reaching $19 million, or a 9% margin.

- Non-GAAP Net Income for Q3 2025 was $11 million (6% margin), which excludes $18.7 million in operating expenses related to an ACV Capital customer bankruptcy.

- The company demonstrated margin improvement, with non-GAAP cost of revenue at 46% and non-GAAP operating expense (excluding cost of revenue) at 48% of revenue in Q3 2025.

- For Q4 2025, ACVA projects revenue between $180 million and $184 million and Adjusted EBITDA between $5 million and $7 million, anticipating a mid-single digit decline in the dealer wholesale market.

- Full-year 2025 guidance includes revenue of $756 million to $760 million and Adjusted EBITDA of $56 million to $58 million.

- ACV reported record revenue of $200 million for the third quarter ended September 30, 2025, marking a 16% increase year over year. The company also achieved non-GAAP net income of $11 million and Adjusted EBITDA of $19 million for the quarter.

- The company updated its full-year 2025 guidance, projecting total revenue between $756 million and $760 million, and Adjusted EBITDA between $56 million and $58 million.

- For the fourth quarter of 2025, ACV expects total revenue of $180 million to $184 million and Adjusted EBITDA of $5 million to $7 million.

- The updated guidance reflects ongoing macroeconomic crosscurrents, with the dealer wholesale market expected to decline in the mid-single digits year over year in Q4, a higher decline than previously anticipated.

Quarterly earnings call transcripts for ACV Auctions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more