Archer-Daniels-Midland (ADM)·Q4 2025 Earnings Summary

ADM Q4 2025: EPS Beats But Revenue Misses by 12% as Crushing Margins Collapse

February 3, 2026 · by Fintool AI Agent

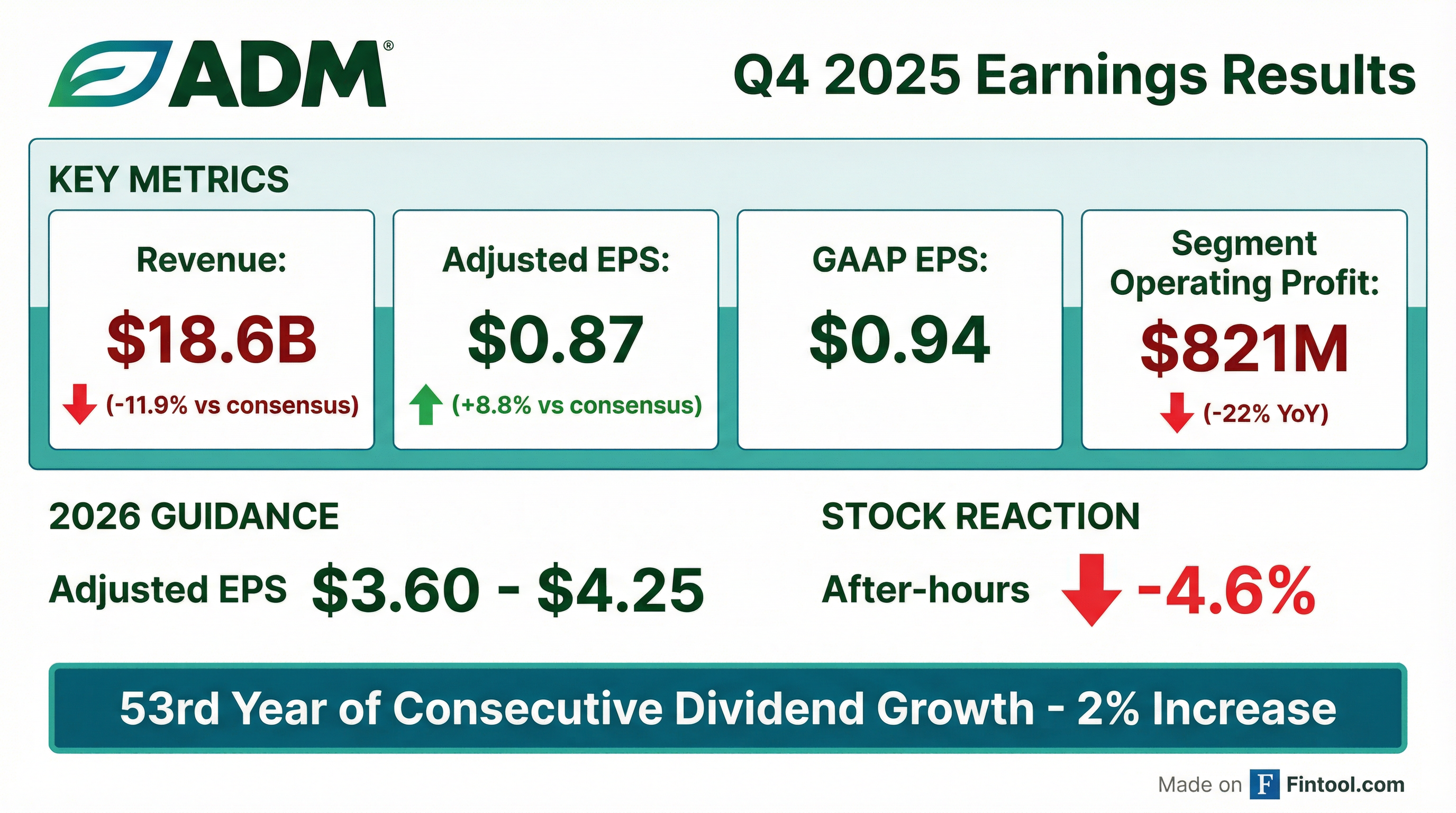

Archer-Daniels-Midland reported Q4 2025 results that beat on the bottom line but disappointed on revenue. Adjusted EPS of $0.87 topped the $0.80 consensus by 8.8%, but revenue of $18.6 billion fell 11.9% short of the $21.1 billion estimate . The stock dropped 4.6% in after-hours trading to $64.93 as investors focused on the significant revenue miss and the continued weakness in the crushing segment, which saw operating profit collapse 69% year-over-year .

Did ADM Beat Earnings?

The EPS beat despite massive revenue shortfall reflects ADM's aggressive cost actions and favorable mark-to-market timing. GAAP EPS of $0.94 included a $254 million non-cash gain from ADM's share of a Wilmar transaction-related gain, partially offset by impairment and restructuring charges .

Full-Year 2025 Results:

What Did Management Guide?

ADM provided 2026 adjusted EPS guidance of $3.60 to $4.25, representing a range from slight improvement to 24% growth versus FY 2025 .

Guidance Assumptions:

CEO Juan Luciano emphasized that "the timing of policy clarity, and in particular U.S. biofuel policy, will largely dictate ADM's ability to achieve the higher end of the range" .

Segment Outlook for 2026:

- AS&O: Year-over-year segment operating profit growth expected with improved global trade flows; Q1 crush margins expected similar to Q4 (large portion of Q1 business already booked)

- Carbohydrate Solutions: Relatively flat, with S&S softness (continued consumer behavior trends) offset by ethanol margin strength and 45Z benefits

- Nutrition: Continued growth in Flavors, recovery in specialty ingredients, margin expansion in Animal Nutrition; Alltech JV live (revenue exits, profit neutral)

Key Guidance Assumptions:

- Effective tax rate: 18-20%

- CapEx: $1.3–1.5 billion

- Corporate costs higher YoY (R&D reinvestment, digital platforms, lower incentive comp headwind)

- 45Z benefit potential: ~$100M (pending final guidance)

What Changed From Last Quarter?

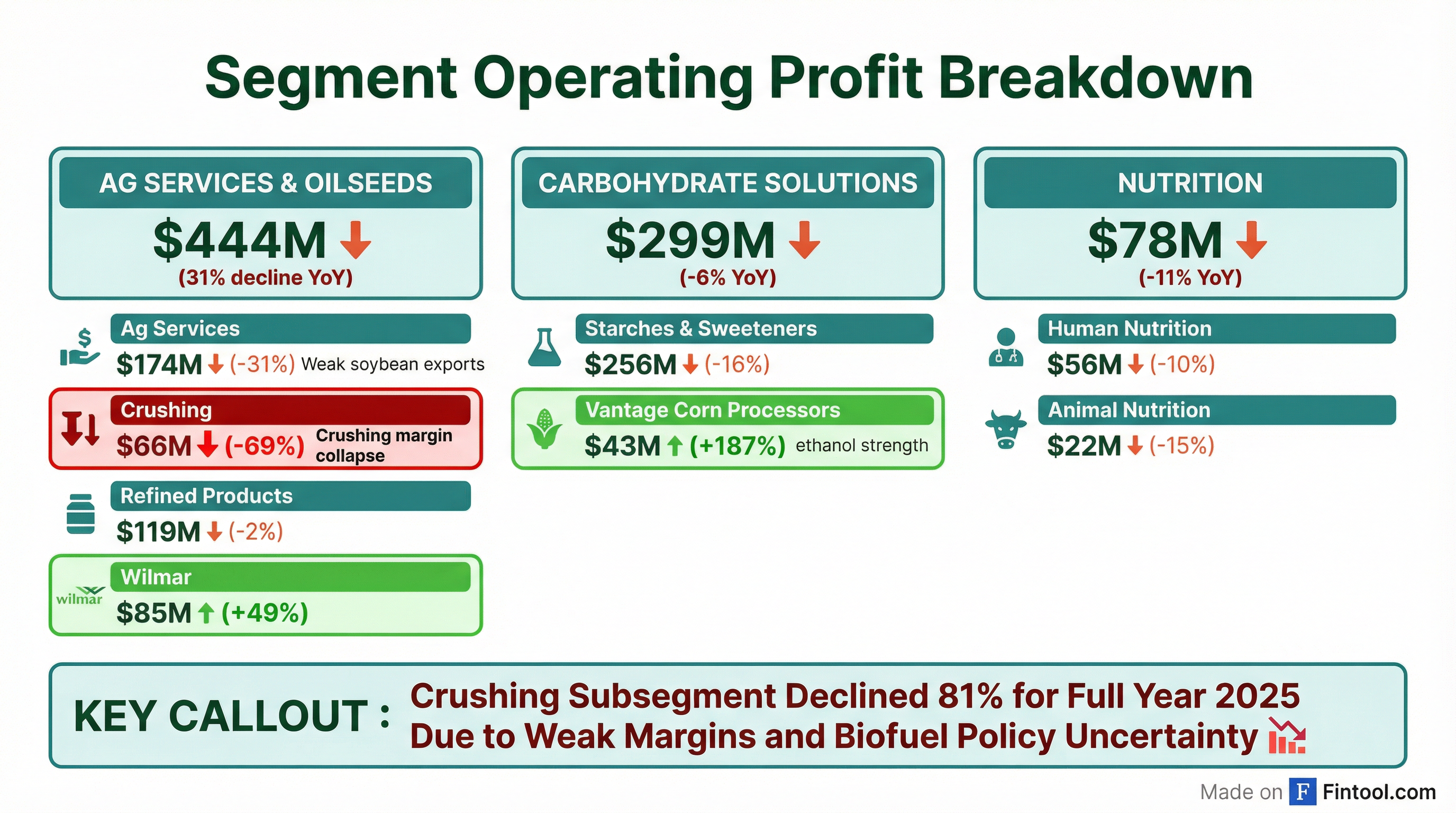

The crushing segment continued its deterioration, with Q4 2025 crushing operating profit of just $66 million — down from $212 million in Q4 2024 and representing an 81% full-year decline .

Segment Operating Profit (Q4 2025 vs Q4 2024):

Key Drivers:

-

Crushing Collapse (-69%): Weaker crush margins in North and South America, plus $20M negative mark-to-market vs. zero in prior year, plus lower insurance proceeds ($32M vs $52M)

-

Ag Services Weakness (-31%): Lower soybean export activity from North America, subdued farmer selling due to muted pricing

-

Ethanol Strength (+187%): Vantage Corn Processors benefited from firm industry margins and robust export demand that lowered industry inventory

-

Wilmar Rebound (+49%): Strong equity earnings from the Wilmar investment

How Did the Stock React?

The stock's after-hours decline suggests the market is focused on:

- The 12% revenue miss signaling weak demand fundamentals

- Continued crushing margin pressure with no near-term visibility

- Wide guidance range ($3.60–$4.25) reflecting high uncertainty around biofuel policy

ADM shares have rallied 66% from the October 2025 lows near $41 heading into earnings, suggesting some disappointment was inevitable given the strong run.

What's the Dividend Story?

ADM declared a quarterly dividend of $0.52 per share, up 2% from $0.51, marking the company's 53rd consecutive year of dividend growth .

- Dividend payable: March 10, 2026

- Record date: February 17, 2026

- 377th consecutive quarterly payment

- 94+ consecutive years of uninterrupted dividends

Key Risks and Concerns

1. Biofuel Policy Uncertainty: U.S. biofuel policy deferral continues to pressure refined products and crushing margins. Management explicitly tied the upper end of guidance to policy clarity. Even with board crush up $0.40-0.50, it "all has to translate back to cash margins" .

2. Crushing Margin Collapse: Full-year crushing operating profit fell 81% to $159M from $844M. Manufacturing costs in North America have risen post-COVID (energy, labor, contractors), contributing to underperformance vs. peers .

3. GLP-1 & Consumer Behavior Shifts: Liquid sweetener volumes down 5-7% as GLP-1 adoption reduces family consumption and shifts preferences toward protein over snacks. Consumer desire to move away from ultra-processed foods adds pressure .

4. Trade Headwinds: Lower North American soybean exports and challenged international trade flows reduced Ag Services volumes and margins. Farmer selling limited by muted pricing .

5. Insurance Proceeds Cliff: ADM received ~$32M in Decatur East insurance proceeds in Q4 2025 vs. higher amounts in Q4 2024, creating headwinds across segments through full-year comparisons .

6. EMEA Corn Quality Issues: Higher corn costs in Europe due to industry-wide crop quality issues continue to pressure Starches & Sweeteners margins .

What Management Said

CEO Juan Luciano on the 2026 outlook:

"When you think about our self-improvement plus all the policy coming our way again, that is a matter of timing, plus our growth prospects, we feel very strongly about the next few years for ADM."

On policy timing and earnings realization:

"Our business, which is a very large business, works in anticipation of the market. So we tend to sell every time we get into a quarter. We are sold maybe 60% or 70% into the following quarter. So if these things will be done at the end of Q1, for us, it will be mostly July onwards... that we will be able to realize that."

On manufacturing cost inflation vs. peers:

"Our cost in terms of energy or manpower or contractors and things like that is higher than it used to be... post-COVID, the rest of the world came back a little bit more to the pre-COVID cost standards, while North America would still have a little bit more of that."

On consumer behavior and GLP-1:

"When people adopt GLP-1s, we see their consumption drops a little bit as a family. That stabilizes after six months, but also shifts a little bit what they consume, going more into proteins and maybe less savory snacks or sweet snacks."

On the strength of ADM's diversified model:

"It speaks a lot about the strengths of our diversified model, that we are global and very diversified portfolio, that allows us to do things like invest for growth while we are able to increase the dividend... even at times in which you can consider these almost like tough conditions from an industry perspective."

Q&A Highlights

On RVO Timing and Cash Margins (Manav Gupta, UBS): Management emphasized that board crush has already moved up $0.40-$0.50 for December 2026, but "at the end of the day, we need to see cash margins moving." Because ADM books 60-70% of business into the following quarter, even if policy clarity comes at end of Q1, benefits won't materialize until July onwards .

On 45Z Tax Credit Benefit (Steven Haynes, Morgan Stanley): CEO Luciano quantified the potential 45Z benefit at approximately $100 million, though he cautioned "there are many variables" including carbon intensity by plant, prevailing wage issues, sequestration volumes, and production levels .

On Crushing Performance vs. Peers (Heather Jones, Heather Jones Research): Asked about ADM's underperformance relative to public comps in 2025, Luciano pointed to manufacturing cost inflation: "Our cost in terms of energy or manpower or contractors... is higher than it used to be. Labor has been more expensive, especially in North America... post-COVID." CFO Patolawala noted this is a key focus area for the $500-750M cost-out program .

On Starches & Sweeteners Demand Weakness (Ben Bienvenu, Stephens): Luciano attributed weakness to multiple factors including GLP-1 adoption ("when people adopt GLP-1s, we see their consumption drops a little bit as a family"), consumer shift away from ultra-processed foods, and persistent high prices. Liquid sweeteners volumes are down 5-7%. ADM is pivoting to industrial applications in mining, packaging, construction, and cosmetics to offset .

On Nutrition Recovery (Ben Theurer, Barclays): Adjusting for insurance proceeds, Q4 Nutrition showed strong performance: Flavors operating profit up ~60%, Biotics up "north of that." Specialty ingredients are recovering with Decatur East back online, though customer recapture will take time after 18 months offline .

On Guidance High-End Assumptions (Andrew Strelzik, BMO): CFO Patolawala outlined factors for the $4.25 high end: (1) faster RVO clarity and adoption timing, (2) strengthening consumer demand across S&S, Nutrition, and biofuels, (3) RINs moving up. He cautioned "it all has to translate back to cash margins" and ADM doesn't predict mark-to-market timing .

On Ethanol Export Markets (Matthew Blair, TPH): Beyond India (which hit 20% blend target), management sees opportunities in Vietnam and Japan. Luciano noted U.S. ethanol remains "very competitive" vs. Brazil and is "a very cheap oxygenate" at ~$1.60 vs. ~$2.90 for comparable oxygenates. E15 adoption is technically feasible — "30 years ago in Brazil we were already driving cars with 20-something% ethanol" .

Five Growth Platforms for 2026+

Management outlined five key focus areas for the next wave of growth :

Recent innovations include patented clean citrus flavors and a "breakthrough natural blue" pigment — addressing one of the industry's toughest challenges for a natural, stable, water-soluble blue color .

Forward Catalysts

The Bottom Line

ADM delivered an EPS beat but the 12% revenue miss and continued crushing margin deterioration overshadowed the positive. The wide 2026 guidance range ($3.60–$4.25) reflects genuine uncertainty around U.S. biofuel policy timing — management emphasized that even with board crush up $0.40-0.50, it "all has to translate back to cash margins" and ADM won't see benefits until July onwards even if policy clarity comes in Q1.

Beyond policy, ADM faces structural headwinds: GLP-1 adoption is pressuring sweetener volumes (-5-7%), North America manufacturing costs have inflated post-COVID, and the company is still recapturing customers lost during 18 months of Decatur East downtime. The bright spots are ethanol (+187% VCP operating profit growth), the ~$100M potential 45Z benefit, and five identified growth platforms (enhanced nutrition, biotics, biosolutions, precision fermentation, decarbonization) that could drive value over 3-5 years.

The stock's 4.6% after-hours decline suggests investors aren't willing to pay up for a turnaround that remains heavily dependent on policy clarity and cash margin follow-through.

Related: