Earnings summaries and quarterly performance for Archer-Daniels-Midland.

Executive leadership at Archer-Daniels-Midland.

Juan Luciano

Chief Executive Officer and President

Christopher Cuddy

Senior Vice President and President, Carbohydrate Solutions

Greg Morris

Senior Vice President and President, Agricultural Services and Oilseeds

Ian Pinner

Senior Vice President and President, Nutrition, and Chief Sales and Marketing Officer

Monish Patolawala

Executive Vice President and Chief Financial Officer

Regina Jones

Senior Vice President, General Counsel, and Secretary

Board of directors at Archer-Daniels-Midland.

David McAtee

Director

Debra Sandler

Director

Ellen de Brabander

Director

James Collins

Director

Kelvin Westbrook

Director

Lei Schlitz

Director

Michael Burke

Director

Patrick Moore

Director

Suzan Harrison

Director

Terrell Crews

Lead Independent Director

Theodore Colbert

Director

Research analysts who have asked questions during Archer-Daniels-Midland earnings calls.

Andrew Strelzik

BMO Capital Markets

9 questions for ADM

Manav Gupta

UBS Group

9 questions for ADM

Steven Haynes

Morgan Stanley

9 questions for ADM

Heather Jones

Heather Jones Research

8 questions for ADM

Salvator Tiano

Bank of America

8 questions for ADM

Pooran Sharma

Stephens Inc.

6 questions for ADM

Benjamin Theurer

Barclays Corporate & Investment Bank

4 questions for ADM

Ben Theurer

Barclays

4 questions for ADM

Tom Palmer

JPMorgan Chase & Co.

4 questions for ADM

Thomas Palmer

Citigroup Inc.

3 questions for ADM

Ben Bienvenu

Stephens

2 questions for ADM

Matthew Blair

TPH & Co.

2 questions for ADM

Tami Zakaria

JPMorgan Chase & Co.

2 questions for ADM

Dushyant Ailani

Jefferies

1 question for ADM

Steve Byrne

Bank of America

1 question for ADM

Recent press releases and 8-K filings for ADM.

- ADM’s Carbohydrate Solutions segment completed CCS tie-ins on its Columbus, Nebraska dry and wet mills, creating the world’s largest biorefinery with carbon capture and sequestration capacity.

- The company is scaling three growth platforms—decarbonization, precision fermentation, and BioSolutions—leveraging its low-CI energy and integrated network.

- In 2025, Ag Services & Oilseeds delivered the safest year in ADM history, set record Q4 crush volumes, exited over a dozen underperforming elevators, and tightened working capital management.

- Cash soybean crush margins have lagged “board crush” due to weak meal and oil basis amidst rising capacity and policy uncertainty; ADM expects clearer biofuels mandates to drive basis convergence.

- Biofuels policy tailwinds, including proposed RVOs and the 45Z credit, are expected to add $100 million in ethanol segment benefit in 2026, with flexibility to utilize 45Q if needed.

- ADM has tied its Columbus, Nebraska biorefinery into the Trailblazer pipeline, creating the world’s largest CCS-enabled biorefinery, and has sequestered 4.5 million metric tons at its Decatur, Illinois site to date, with additional wells planned.

- In Ag Services and Oilseeds, 2025 featured the safest year in ADM history, record Q4 global crush volumes, the exit of over a dozen underperforming grain elevators, new cottonseed crush joint ventures, and enhanced working capital discipline to bolster 2026 performance.

- ADM noted that cash crush margins have trailed board crush due to weaker product basis amid expanded crush capacity and biofuel policy uncertainty, but expects basis levels—and thus cash margins—to improve as RVO clarity boosts soybean oil and meal demand.

- Ethanol exports grew 13% to 2.2 billion gallons in 2025, and the 45Z carbon‐capture tax credit is forecast to deliver a $100 million tailwind, with ADM able to utilize both 45Z and 45Q credits at its CCS-enabled sites.

- ADM is advancing precision fermentation and BioSolutions platforms—partnering on CO₂-derived chemicals with OCOchem, producing renewable natural gas from waste streams, and exploring Sustainable Aviation Fuel—to offset declining high-fructose corn syrup volumes.

- In 2025, Carbohydrate Solutions delivered a 5th consecutive year of stable earnings, leveraged strong ethanol margins and completed the world’s largest CCS-enabled biorefinery tie-in at Columbus, Nebraska, while advancing decarbonization, precision fermentation and BioSolutions platforms.

- Ethanol exports grew 13% to 2.2 billion gallons in 2025, and ADM anticipates a $100 million benefit from the Section 45Z carbon capture credit, subject to final GREET and prevailing wage rules.

- Ag Services faced 2025 headwinds from trade uncertainties and biofuels policy delays but achieved the safest year on record, set global production records (including Q4 crush highs), exited non-core grain elevators and tightened working capital management.

- ADM highlighted a widening discount of cash crush margins versus board crush due to weaker product basis amid growing crush capacity, expecting policy clarity to narrow the gap.

- The Starches & Sweeteners segment maintains plant flexibility via its “fight for the grind” strategy to offset HFCS volume declines (~1.5% yr) through ethanol integration and emerging growth areas in decarbonization, low-CI products and industrial BioSolutions.

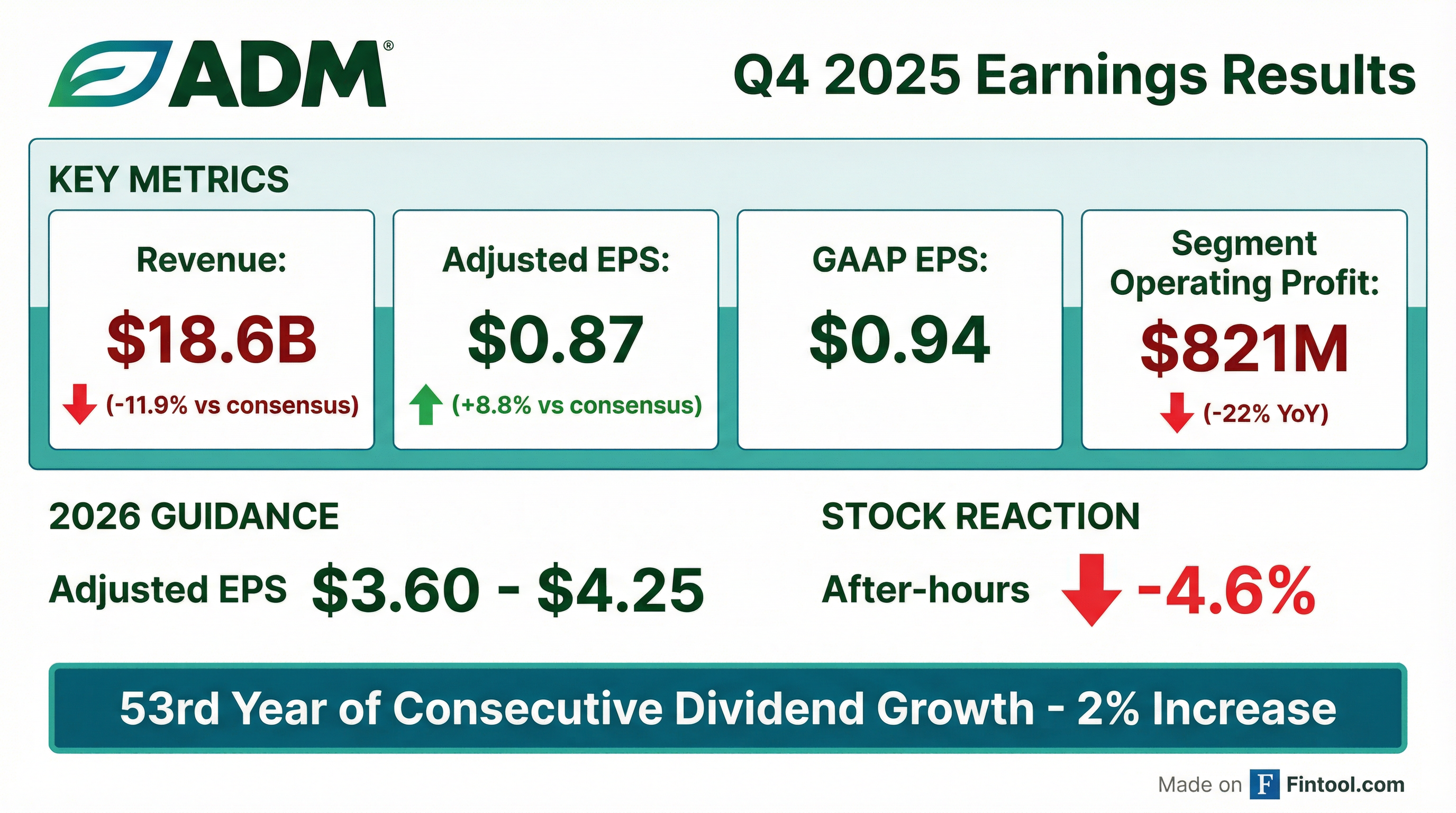

- ADM reported Q4 adjusted EPS of $0.87 and FY 2025 adjusted EPS of $3.43, with total segment operating profit of $821 million in Q4 and $3.2 billion for the full year.

- Generated $2.7 billion in operating cash flow before working capital changes, realized $1.5 billion benefit from inventory reduction, and delivered a 6.3% trailing-four-quarter adjusted ROIC.

- Carbohydrate Solutions segment operating profit was $256 million (down 16% YoY), Vantage Corn Processors profit $43 million (up 187% YoY), and Nutrition segment revenues of $1.8 billion (flat YoY) with operating profit of $78 million (down 11% YoY, impacted by lower insurance proceeds).

- For 2026, ADM expects to invest $1.3–$1.5 billion in capital expenditures, maintain an 18–20% effective tax rate, target $500–$750 million in cost savings over three to five years, and sees Q1 crush margins similar to Q4 2025.

- Announced the closure of government investigations, achieved a key decarbonization milestone via carbon capture infrastructure, and paid the 376th consecutive quarterly dividend.

- Q4 2025 segment operating profits: AS&O $444 M (-31% yoy), Carbohydrate Solutions $299 M (-6% yoy); Nutrition revenues $1.8 B (flat yoy) and operating profit $78 M (-11% yoy).

- FY 2025 segment results: AS&O $1.6 B (-34% yoy), Carbohydrate Solutions $1.2 B (-12% yoy); Human Nutrition $319 M (-2% yoy), Animal Nutrition $98 M (+66% yoy).

- Full-year 2026 outlook: adjusted EPS $3.60–$4.25, capital expenditures of $1.3–$1.5 B, an 18–20% effective tax rate, and continuation of a $500–750 M cost-savings program.

- Management notes continued weakness in Starches & Sweeteners from consumer and pricing pressures, partially offset by stronger ethanol margins and anticipated U.S. biofuel policy clarity.

- Adjusted EPS of $0.87 for Q4 and $3.43 for full-year 2025.

- Total segment operating profit of $821 M in Q4 and $3.2 B for FY 2025.

- AS&O segment operating profit was $444 M, down 31% YoY in Q4, and $1.6 B, down 34% YoY for the full year.

- Carbohydrate Solutions segment operating profit was $299 M, down 6% YoY in Q4, and $1.2 B, down 12% YoY for the full year.

- 2026 adjusted EPS guidance set at $3.60–$4.25.

- Q4 2025 GAAP EPS of $0.94 and adjusted EPS of $0.87, with net earnings of $456 M (adjusted $422 M); full-year 2025 GAAP EPS of $2.23 and adjusted EPS of $3.43; operating cash flow of $5.5 B

- Full-year 2025 net earnings were $1.1 B (adjusted $1.7 B) and total segment operating profit declined 23% to $3.2 B versus 2024

- Q4 segment operating profit was $821 M, down 22% year-over-year, with Ag Services & Oilseeds down 31% and Carbohydrate Solutions down 6%

- 2026 guidance set for adjusted EPS of $3.60–$4.25, assuming constructive trade policies and U.S. biofuel policy clarity, and capital expenditures of $1.3–$1.5 B

- Quarterly dividend increased by 2%, marking 53 consecutive years of dividend growth

- Q4 2025 net earnings were $456 million (adjusted net earnings $422 million); EPS was $0.94 (adjusted EPS $0.87).

- FY 2025 net earnings were $1.1 billion (adjusted net earnings $1.7 billion); EPS was $2.23 (adjusted EPS $3.43).

- 2026 adjusted EPS is expected to be approximately $3.60 to $4.25, reflecting potential biofuel policy clarity and margin improvements.

- Quarterly dividend increased to 52.0 cents per share, marking 53 consecutive years of dividend growth.

- ADM agreed to a $40 million settlement with the SEC over prior intersegment sales reporting, without admitting or denying wrongdoing.

- The DOJ has closed its investigation into ADM with no further action, ending both probes.

- ADM restated its 2023 Form 10-K and Q1 & Q2 2024 Forms 10-Q to correct segment reporting errors, which had no impact on consolidated earnings or cash flows.

- The company has implemented significant enhancements to its financial leadership team and controls to strengthen reporting accuracy.

- ADM agreed to pay a $40 million civil penalty to resolve SEC allegations of inflated Nutrition segment performance via non-market intersegment transactions; settlement concluded after nearly three years and is not expected to have a material financial impact.

- The SEC alleged that improper non-market intersegment transfers shifted profit to Nutrition to meet targets in fiscal years 2019–2022.

- Former executives Vince Macciocchi and Ray Young agreed to pay disgorgement and penalties totaling $1.18 million, with Macciocchi also facing a three-year officer/director ban; former CFO Vikram Luthar declined to settle and faces a separate SEC lawsuit.

- ADM cooperated with regulators and has implemented enhanced financial controls and leadership changes following the investigation.

- The company has a market capitalization of $32.79 billion and reported revenue of $83.21 billion, with operating margin of 1.83%, net margin of 1.43%, and an Altman Z-Score of 3.16.

Quarterly earnings call transcripts for Archer-Daniels-Midland.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more