Earnings summaries and quarterly performance for Archer-Daniels-Midland.

Executive leadership at Archer-Daniels-Midland.

Juan Luciano

Chief Executive Officer and President

Christopher Cuddy

Senior Vice President and President, Carbohydrate Solutions

Greg Morris

Senior Vice President and President, Agricultural Services and Oilseeds

Ian Pinner

Senior Vice President and President, Nutrition, and Chief Sales and Marketing Officer

Monish Patolawala

Executive Vice President and Chief Financial Officer

Regina Jones

Senior Vice President, General Counsel, and Secretary

Board of directors at Archer-Daniels-Midland.

David McAtee

Director

Debra Sandler

Director

Ellen de Brabander

Director

James Collins

Director

Kelvin Westbrook

Director

Lei Schlitz

Director

Michael Burke

Director

Patrick Moore

Director

Suzan Harrison

Director

Terrell Crews

Lead Independent Director

Theodore Colbert

Director

Research analysts who have asked questions during Archer-Daniels-Midland earnings calls.

Andrew Strelzik

BMO Capital Markets

9 questions for ADM

Manav Gupta

UBS Group

9 questions for ADM

Steven Haynes

Morgan Stanley

9 questions for ADM

Heather Jones

Heather Jones Research

8 questions for ADM

Salvator Tiano

Bank of America

8 questions for ADM

Pooran Sharma

Stephens Inc.

6 questions for ADM

Benjamin Theurer

Barclays Corporate & Investment Bank

4 questions for ADM

Ben Theurer

Barclays

4 questions for ADM

Tom Palmer

JPMorgan Chase & Co.

4 questions for ADM

Thomas Palmer

Citigroup Inc.

3 questions for ADM

Ben Bienvenu

Stephens

2 questions for ADM

Matthew Blair

TPH & Co.

2 questions for ADM

Tami Zakaria

JPMorgan Chase & Co.

2 questions for ADM

Dushyant Ailani

Jefferies

1 question for ADM

Steve Byrne

Bank of America

1 question for ADM

Recent press releases and 8-K filings for ADM.

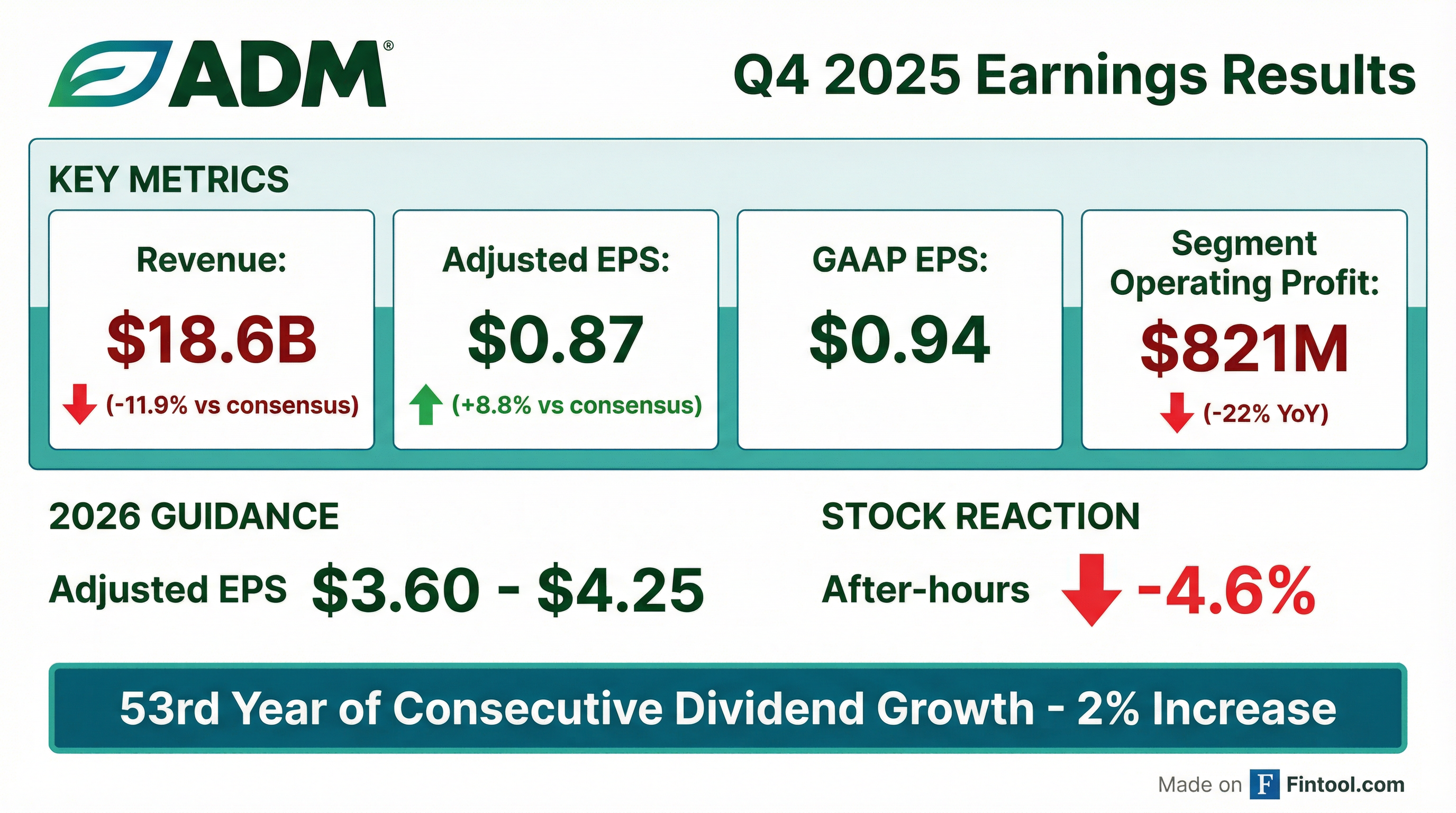

- ADM reported Q4 adjusted EPS of $0.87 and FY 2025 adjusted EPS of $3.43, with total segment operating profit of $821 million in Q4 and $3.2 billion for the full year.

- Generated $2.7 billion in operating cash flow before working capital changes, realized $1.5 billion benefit from inventory reduction, and delivered a 6.3% trailing-four-quarter adjusted ROIC.

- Carbohydrate Solutions segment operating profit was $256 million (down 16% YoY), Vantage Corn Processors profit $43 million (up 187% YoY), and Nutrition segment revenues of $1.8 billion (flat YoY) with operating profit of $78 million (down 11% YoY, impacted by lower insurance proceeds).

- For 2026, ADM expects to invest $1.3–$1.5 billion in capital expenditures, maintain an 18–20% effective tax rate, target $500–$750 million in cost savings over three to five years, and sees Q1 crush margins similar to Q4 2025.

- Announced the closure of government investigations, achieved a key decarbonization milestone via carbon capture infrastructure, and paid the 376th consecutive quarterly dividend.

- Q4 2025 segment operating profits: AS&O $444 M (-31% yoy), Carbohydrate Solutions $299 M (-6% yoy); Nutrition revenues $1.8 B (flat yoy) and operating profit $78 M (-11% yoy).

- FY 2025 segment results: AS&O $1.6 B (-34% yoy), Carbohydrate Solutions $1.2 B (-12% yoy); Human Nutrition $319 M (-2% yoy), Animal Nutrition $98 M (+66% yoy).

- Full-year 2026 outlook: adjusted EPS $3.60–$4.25, capital expenditures of $1.3–$1.5 B, an 18–20% effective tax rate, and continuation of a $500–750 M cost-savings program.

- Management notes continued weakness in Starches & Sweeteners from consumer and pricing pressures, partially offset by stronger ethanol margins and anticipated U.S. biofuel policy clarity.

- Adjusted EPS of $0.87 for Q4 and $3.43 for full-year 2025.

- Total segment operating profit of $821 M in Q4 and $3.2 B for FY 2025.

- AS&O segment operating profit was $444 M, down 31% YoY in Q4, and $1.6 B, down 34% YoY for the full year.

- Carbohydrate Solutions segment operating profit was $299 M, down 6% YoY in Q4, and $1.2 B, down 12% YoY for the full year.

- 2026 adjusted EPS guidance set at $3.60–$4.25.

- Q4 2025 GAAP EPS of $0.94 and adjusted EPS of $0.87, with net earnings of $456 M (adjusted $422 M); full-year 2025 GAAP EPS of $2.23 and adjusted EPS of $3.43; operating cash flow of $5.5 B

- Full-year 2025 net earnings were $1.1 B (adjusted $1.7 B) and total segment operating profit declined 23% to $3.2 B versus 2024

- Q4 segment operating profit was $821 M, down 22% year-over-year, with Ag Services & Oilseeds down 31% and Carbohydrate Solutions down 6%

- 2026 guidance set for adjusted EPS of $3.60–$4.25, assuming constructive trade policies and U.S. biofuel policy clarity, and capital expenditures of $1.3–$1.5 B

- Quarterly dividend increased by 2%, marking 53 consecutive years of dividend growth

- Q4 2025 net earnings were $456 million (adjusted net earnings $422 million); EPS was $0.94 (adjusted EPS $0.87).

- FY 2025 net earnings were $1.1 billion (adjusted net earnings $1.7 billion); EPS was $2.23 (adjusted EPS $3.43).

- 2026 adjusted EPS is expected to be approximately $3.60 to $4.25, reflecting potential biofuel policy clarity and margin improvements.

- Quarterly dividend increased to 52.0 cents per share, marking 53 consecutive years of dividend growth.

- ADM agreed to a $40 million settlement with the SEC over prior intersegment sales reporting, without admitting or denying wrongdoing.

- The DOJ has closed its investigation into ADM with no further action, ending both probes.

- ADM restated its 2023 Form 10-K and Q1 & Q2 2024 Forms 10-Q to correct segment reporting errors, which had no impact on consolidated earnings or cash flows.

- The company has implemented significant enhancements to its financial leadership team and controls to strengthen reporting accuracy.

- ADM agreed to pay a $40 million civil penalty to resolve SEC allegations of inflated Nutrition segment performance via non-market intersegment transactions; settlement concluded after nearly three years and is not expected to have a material financial impact.

- The SEC alleged that improper non-market intersegment transfers shifted profit to Nutrition to meet targets in fiscal years 2019–2022.

- Former executives Vince Macciocchi and Ray Young agreed to pay disgorgement and penalties totaling $1.18 million, with Macciocchi also facing a three-year officer/director ban; former CFO Vikram Luthar declined to settle and faces a separate SEC lawsuit.

- ADM cooperated with regulators and has implemented enhanced financial controls and leadership changes following the investigation.

- The company has a market capitalization of $32.79 billion and reported revenue of $83.21 billion, with operating margin of 1.83%, net margin of 1.43%, and an Altman Z-Score of 3.16.

- Archer-Daniels-Midland agreed to pay the SEC $40 million to settle an investigation into intersegment sales without admitting wrongdoing.

- The SEC’s complaint alleges retroactive rebates and price changes inflated the Nutrition segment’s operating profit to hit internal targets.

- ADM has restated prior segment reporting (including fiscal 2023 and parts of 2024) and implemented new internal controls and policies.

- The company expects the settlement to have no material impact on consolidated results and to allow it to move past the investigations.

- ADM agreed to pay $40 million to settle an SEC investigation without admitting or denying wrongdoing.

- The DOJ closed its investigation of ADM with no further action.

- In March 2024 and November 2024, ADM restated its 2023 Form 10-K and Q1/Q2 2024 Form 10-Qs to correct segment reporting errors, which did not affect consolidated earnings or cash flows.

- ADM has implemented significant enhancements to its financial controls and leadership following internal and external reviews.

- ADM generated robust cash flow in 2025 through portfolio optimization and manufacturing improvements, enabling a 2% dividend increase for the 376th consecutive quarter.

- Achieved a carbon capture milestone, connecting the Columbus, Nebraska ethanol plant to the Tallgrass Trailblazer pipeline, marking ADM’s second biofuel facility with CCS capability.

- Ag Services & Oilseeds margins were pressured by delayed RVO/SRE policy; ADM expects EPA to finalize volumes in early 2026, which should boost biofuel and crush margins thereafter.

- Nutrition segment delivered sequential improvements in Q3 with record flavors sales, animal nutrition growth, and launched a North American joint venture with Alltech in specialty segments.

- On track to realize $500 M–$750 M in cost savings over 3–5 years from SG&A reduction, plant consolidations (e.g., Bushnell shutdown, Decatur East restart) and simplification measures.

Quarterly earnings call transcripts for Archer-Daniels-Midland.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more