AMAZON COM (AMZN)·Q4 2025 Earnings Summary

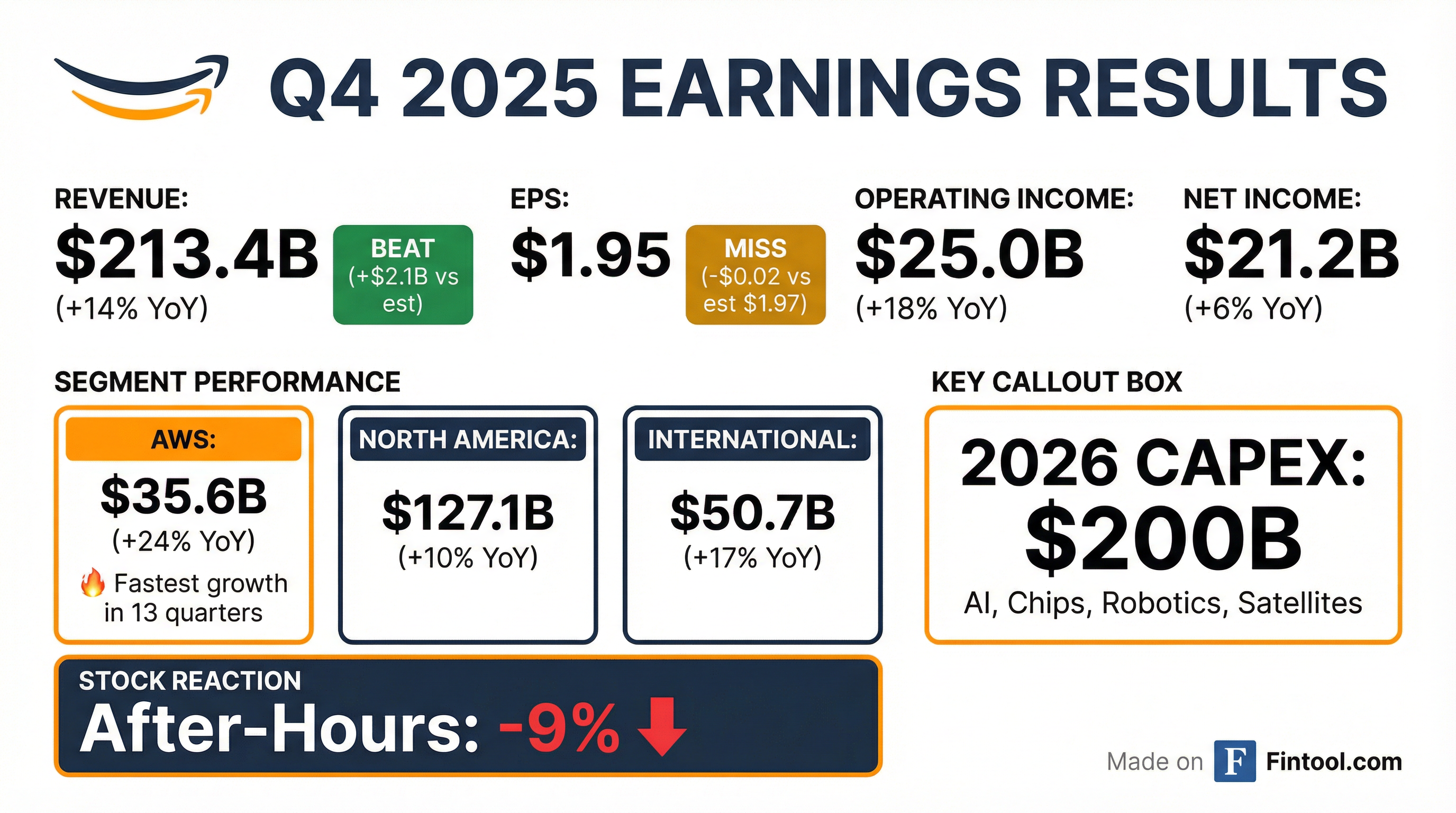

Amazon Q4 2025: Revenue Beats, EPS Misses as $200B AI Capex Spooks Investors

February 5, 2026 · by Fintool AI Agent

Amazon delivered a mixed Q4 2025, beating revenue expectations by $2.1 billion but missing EPS by $0.02. The headline numbers took a backseat to CEO Andy Jassy's announcement that Amazon plans to spend $200 billion on capital expenditures in 2026—a staggering acceleration of AI and infrastructure investment that sent shares tumbling 10% after-hours to $200.75.

AWS stole the show with 24% year-over-year growth—its fastest acceleration in 13 quarters—and an AWS backlog of $244 billion (+40% YoY). The advertising business continued its impressive run at 22% growth. But investors focused on the eye-watering capex figure and the margin pressure it implies for 2026.

Did Amazon Beat Earnings?

Revenue: Beat | EPS: Miss

The EPS miss is Amazon's first miss in 8 quarters. Contributing factors included $2.4 billion in special charges: $1.1B for Italian tax disputes and lawsuit settlements, $730M in severance costs, and $610M in physical store impairments. Adjusted operating income would have been $27.4B without these charges.

How Did the Stock React?

The market's reaction reflects three concerns:

- $200B capex in 2026 — This is nearly 60% higher than the ~$128B spent in 2025

- Free cash flow deterioration — TTM FCF dropped to $11.2B from $38.2B due to massive infrastructure investment

- Q1 operating income guidance — Range of $16.5B-$21.5B includes $1B in higher Project Leo (satellite) costs

What Did Management Guide?

Q1 2026 Guidance:

The wide operating income range ($5B spread) reflects investment uncertainty. Management flagged three headwinds for Q1:

- $1B higher Leo costs YoY as satellite network scales (20+ launches planned for 2026, 30+ for 2027)

- Quick commerce investments (Amazon Now expansion globally)

- Sharper pricing in international stores business to compete aggressively

"We expect to invest about $200 billion in capital expenditures across Amazon, but predominantly in AWS, because we have very high demand. Customers really want AWS for core and AI workloads, and we're monetizing capacity as fast as we can install it." — Andy Jassy, CEO

What Changed From Last Quarter?

The AWS acceleration is notable. Growth jumped from 19-20% in prior quarters to 24%—the fastest in 13 quarters—driven by AI workloads and custom chip demand. Trainium and Graviton now have a combined $10B+ annual revenue run rate growing at triple-digit percentages.

The $244B backlog is massive. This 40% YoY growth in committed revenue provides exceptional forward visibility and validates the $200B capex investment thesis.

International margins compressed despite 17% revenue growth, as Amazon invests in sharper pricing, Amazon Now (quick commerce), and emerging market expansion.

Segment Breakdown

AWS ($35.6B revenue, +24% YoY)

The crown jewel delivered. AWS accelerated to its fastest growth in 13 quarters, with operating income of $12.5B and 35% margins.

AWS Backlog: $244 billion — Up 40% year-over-year and 22% quarter-over-quarter. This is a massive indicator of future demand.

Power Capacity: 3.99 GW added in 12 months — That's twice what Amazon had in all of 2022 when AWS was an $80B run-rate business. Added 1.2 GW in Q4 alone. Expects to double capacity again by end of 2027.

Key AI & Infrastructure highlights:

- Bedrock is now a multi-billion dollar ARR business with 60% QoQ spend growth

- Trainium2 is fully subscribed with 1.4M chips deployed, powering majority of Bedrock inference

- Project Rainier (500K+ Trainium2 chips) is operational—used by Anthropic for next-gen Claude training

- Trainium3 shipping now, 40% more price-performant than Trainium2, nearly all 2026 supply expected committed by mid-year

- Nova Forge launched — Allows enterprises to train custom versions of Nova models on proprietary data at pre-training stage

- Strands — New service enabling agents to be created from any model

- Bedrock Agent Core — Enterprise solution for deploying AI agents at scale with security, governance, and monitoring

- Kiro (coding agent) users grew 150% QoQ

- Graviton used expansively by 90%+ of top 1,000 AWS customers, up to 40% more price-performant than x86

- New enterprise customers: OpenAI, Visa, NBA, BlackRock, HSBC, Adobe, S&P Global, London Stock Exchange, CrowdStrike

North America ($127.1B revenue, +10% YoY)

Operating income improved to $11.5B (9.0% margin) from $9.3B (8.0% margin) in Q4 2024. Key highlights:

- Fastest delivery speeds ever — nearly 70% more items delivered same-day than prior year

- Nearly 100 million customers used same-day delivery in 2025

- Rural same-day customers up ~2x YoY

- 8 billion+ items delivered same-day or next-day to U.S. Prime members in 2025, up 30% YoY

- Third-party seller unit mix reached 61%

International ($50.7B revenue, +17% YoY ex-FX)

Operating income declined to $1.0B from $1.3B YoY despite strong top-line growth. Investment in quick commerce (Amazon Now), sharper pricing, and emerging market expansion pressured margins.

"There are countries where we've had to be more aggressive to meet or beat competitors' prices. We like these investments because they will delight customers, grow our business, and we believe they will generate long-term positive return on invested capital." — Brian Olsavsky, CFO

Key Growth Drivers

Advertising ($21.3B, +22% YoY)

Advertising continues its march toward becoming Amazon's second profit engine after AWS. Key developments:

- Prime Video ads now reach 315 million viewers globally (up from 200M in early 2024)

- Thursday Night Football averaged 15 million viewers (+16% YoY), third consecutive year of double-digit growth

- Packers vs Bears wild card was most-streamed NFL game in history with 31.6 million viewers

- New Ads Agent lets brands use AI to create, optimize, and manage full-funnel campaigns

Rufus AI Shopping Assistant

Amazon's agentic AI shopping assistant was used by 300M+ customers in 2025. Customers who used Rufus are 60% more likely to complete a purchase.

New capabilities:

- Buy For Me — Rufus can now shop tens of millions of items on other online stores and make purchases on behalf of customers

- Auto-buy — Rufus can track prices and automatically purchase when target price is reached

- Lens (visual search) usage up 45% YoY

Add to Delivery (New Feature)

10% of all Prime volume now comes through "Add to Delivery," launched just 6 months ago. Allows Prime members to add items to upcoming deliveries with one tap without re-checking out.

Custom Chips

Trainium + Graviton combined: $10B+ annual revenue run rate growing triple digits YoY.

- Trainium3 shipping now, 40% more price-performant than Trainium2

- Trainium4 coming in 2027 with "very substantial interest" already

- Trainium5 conversations already underway with customers

Project Leo (Low Earth Orbit Satellites)

Amazon has launched 180 satellites with 20+ launches planned in 2026 and 30+ in 2027.

- Leo Ultra terminal delivers up to 1 Gbps download / 400 Mbps upload — "fastest satellite internet antenna ever built"

- Commercial agreements signed with AT&T, DIRECTV Latin America, JetBlue, Australia's National Broadband Network

- Commercial rollout expected later in 2026

- Costs currently expensed ($1B headwind to Q1 2026), will capitalize later in year

Alexa+

Now available to all U.S. customers — free for Prime members, $19.99/month for non-Prime.

New integrations include Samsung TVs, BMW cars, and ability to answer Ring doorbell on customer's behalf.

Capital Allocation: The $200B Question

2026 Capex Guidance: ~$200B

This represents a 56% increase in capital spending. The investment is focused on:

- AI infrastructure — Data centers, GPUs, custom chips (predominantly AWS)

- Custom silicon — Trainium and Graviton manufacturing capacity

- Robotics — Fulfillment center automation (1 million+ robots today)

- Project Leo — Low earth orbit satellite constellation

Free Cash Flow Impact:

- TTM FCF: $11.2B (down from $38.2B prior year)

- TTM Operating Cash Flow: $39.5B (+20% YoY)

When pressed on ROI guardrails, Jassy was unequivocal:

"If you look at the capital we're spending and intend to spend this year, it's predominantly in AWS... We're growing 24% year-over-year on a $142 billion annualized run rate business, you're growing a lot. And what we're continuing to see is as fast as we install this capacity, this AI capacity, we are monetizing it."

"I passionately believe that every customer experience that we know of today is going to be reinvented with AI... We're gonna invest aggressively here, and we're gonna invest to be the leader in this space."

Full Year 2025 Highlights

Amazon added 3.99 GW of power capacity in the last 12 months—twice what it had in all of 2022. AWS now has a $142B annualized run rate with 35% operating margins.

Forward Estimates

Values retrieved from S&P Global

Q&A Highlights: What Did Management Say?

On $200B Capex and Return on Invested Capital

When pressed by analysts on the massive spending, CEO Andy Jassy was emphatic:

"This is what. You know, I think this is an extraordinarily unusual opportunity to forever change the size of AWS and Amazon as a whole... We are gonna invest aggressively here to be the leaders."

CFO Brian Olsavsky emphasized that AWS operating margin was 35% in Q4, up 40 bps year-over-year despite the AI investment headwinds:

"We're seeing strong top-line growth while remaining focused on driving efficiencies across the business. This includes investing in software and process improvements to optimize server capacity, developing a more efficient network using our lower cost custom networking gear, and advancing custom silicon."

On AI Market Dynamics: The "Barbell" Market

Jassy offered a nuanced view of where AI demand stands today:

"It's really kind of a barbelled market demand, where on one end you have the AI labs who are spending gobs and gobs of compute, along with what I would consider a couple runaway applications. And then at the other side of the barbell, you've got a lot of enterprises who are getting value out of AI in doing productivity and cost avoidance types of workloads... But I think that middle part of the barbell very well may end up being the largest and the most durable."

He expects enterprise production workloads to become the largest AI revenue driver as inference costs decline and AI talent expands.

On Agentic Shopping and Rufus

Discussing the future of AI-powered retail, Jassy highlighted:

"300 million customers used Rufus in 2025. Customers who used Rufus are about 60% more likely to complete a purchase... We have to collectively figure out a better customer experience. These horizontal agents don't have any of your shopping history. They get a lot of the product details wrong. They get a lot of the pricing wrong."

Amazon's "Buy for Me" feature now allows Rufus to shop and purchase from other online stores on behalf of customers.

On Retail Efficiency and Quick Commerce

Jassy detailed the efficiency playbook for the retail business:

"We've extended the number of regions. It was 8, it's now 10... We're doing a lot of work, and we've made a huge amount of progress in being able to get more units into each box... We have over 1 million robots today in our fulfillment network."

On Quick Commerce (Amazon Now), which delivers thousands of items in ~30 minutes:

"In India, customers who try Quick Commerce are shopping with triple the frequency than they did before they tried us."

What to Watch

- AWS growth sustainability — Can 24% growth continue as the base expands to $130B+? The $244B backlog suggests yes.

- Trainium supply commitments — Jassy expects nearly all Trainium3 supply committed by mid-2026. Watch Trainium4 demand signals.

- The "middle of the barbell" — When do enterprise production AI workloads become the growth driver? This is where Jassy sees the biggest long-term opportunity.

- Project Leo commercial launch — Commercial rollout expected H2 2026. Costs will shift from expensed to capitalized.

- Quick Commerce (Amazon Now) — Triple shopping frequency in India. Expansion to more U.S. markets could be a game-changer for everyday essentials.

- Agentic commerce — Will Rufus's "Buy for Me" feature expand Amazon's reach into competitive retail territory?