Earnings summaries and quarterly performance for ALPHA & OMEGA SEMICONDUCTOR.

Executive leadership at ALPHA & OMEGA SEMICONDUCTOR.

Stephen C. Chang

Chief Executive Officer

Bing Xue

Executive Vice President of Worldwide Sales and Business Development

Mike F. Chang

Executive Vice President of Strategic Initiatives

Wenjun Li

Chief Operating Officer

Yifan Liang

Chief Financial Officer and Corporate Secretary

Board of directors at ALPHA & OMEGA SEMICONDUCTOR.

Research analysts who have asked questions during ALPHA & OMEGA SEMICONDUCTOR earnings calls.

David Williams

The Benchmark Company

6 questions for AOSL

Craig Ellis

B. Riley Securities

4 questions for AOSL

Jeremy Kwan

Stifel

4 questions for AOSL

Paulman Wang

Stifel

1 question for AOSL

Solomon Wang

Stifel

1 question for AOSL

Recent press releases and 8-K filings for AOSL.

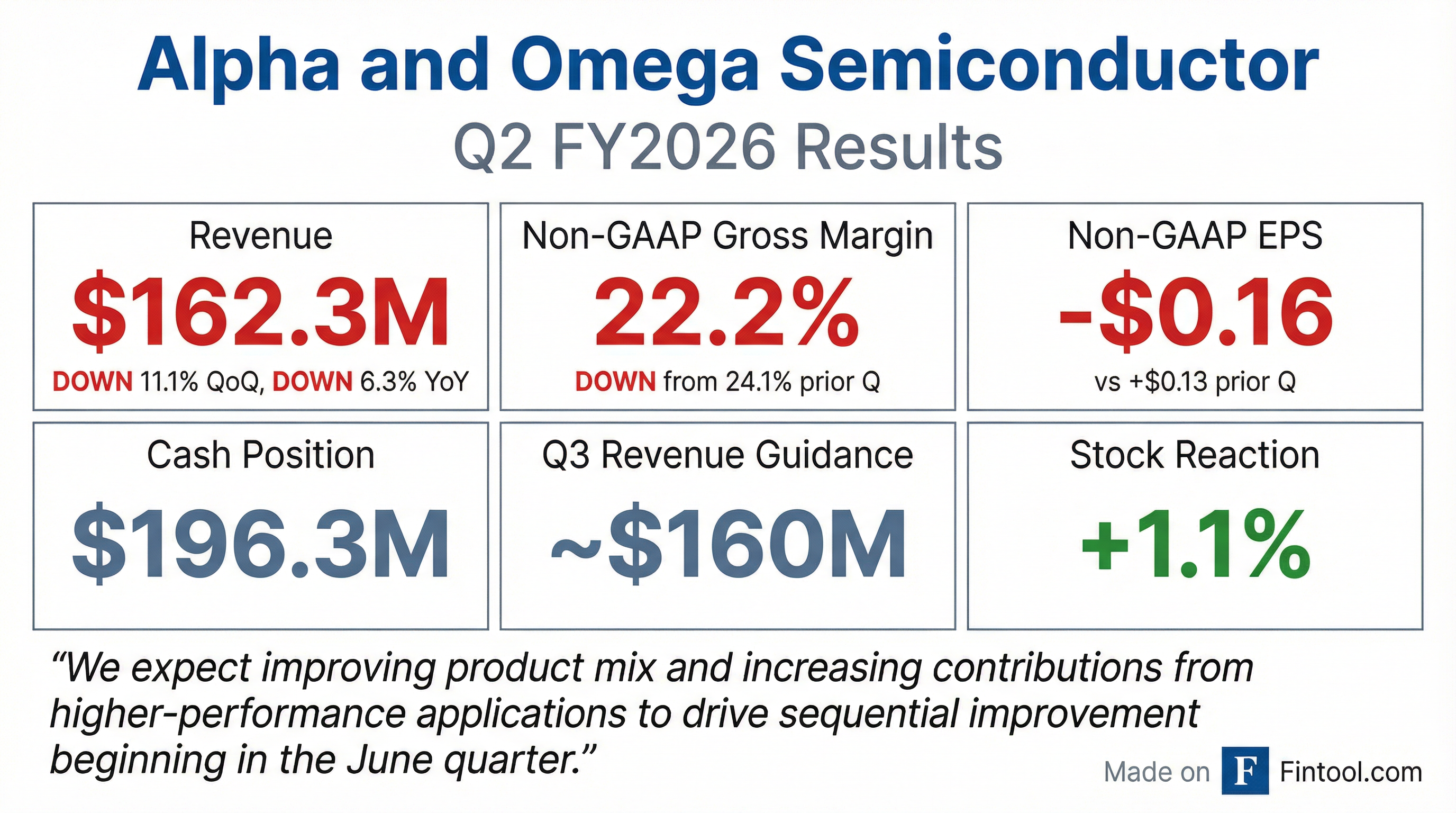

- Alpha and Omega Semiconductor reported fiscal Q2 2026 revenue of $162.3 million, an 11.1% sequential decrease and 6.3% year-over-year decrease, with a non-GAAP EPS loss of $0.16 per share.

- For the March quarter (Q3 2026), the company expects revenue to be approximately $160 million ± $10 million and non-GAAP gross margin to be 21% ± 1%. Management anticipates the March quarter to be a near-term low point for revenue and margin, with growth resuming in the June quarter.

- The company repurchased approximately $13.9 million of AOS shares (728,000 shares) in the December quarter as part of its $30 million share repurchase program.

- AOS is accelerating targeted R&D investments, with an expected increase of about 25% in calendar year 2026, focusing on AI, PC total solutions, and smartphone battery protection. This is partially funded by the monetization of a portion of its equity interest in the Chongqing joint venture.

- Alpha and Omega Semiconductor reported Q2 2026 revenue of $162.3 million and a non-GAAP EPS loss of $0.16 per share, with a non-GAAP gross margin of 22.2%.

- For Q3 2026, revenue is guided to approximately $160 million ± $10 million and non-GAAP gross margin to 21% ± 1%, with the March quarter expected to be a near-term low point before growth resumes in the June quarter.

- The company repurchased $13.9 million of shares and received $11 million from the sale of its Chongqing joint venture equity interest, with $15 million remaining to be received later in the calendar year.

- AOSL is accelerating targeted R&D investments, projecting a 25% increase in R&D expenses for calendar year 2026, focusing on AI, PC total solutions, and smartphone battery protection to drive future growth and margin expansion.

- Alpha and Omega Semiconductor (AOSL) reported Q2 2026 revenue of $162.3 million, a non-GAAP gross margin of 22.2%, and a non-GAAP EPS loss of $0.16 per share.

- The company repurchased $13.9 million of shares as part of its recently announced $30 million share repurchase program and monetized a portion of its equity interest in the Chongqing joint venture for an aggregate purchase price of $150 million, with $15 million remaining to be received later in calendar year 2026.

- For Q3 2026, AOSL expects revenue of approximately $160 million ± $10 million and a non-GAAP gross margin of 21% ± 1%.

- AOSL is accelerating targeted R&D investments, expecting a 25% increase in R&D expense for calendar year 2026, focusing on AI opportunities, PC total solutions, and smartphone battery protection, with a projected return to growth beginning in the June quarter after a near-term low in March.

- Alpha and Omega Semiconductor (AOS) reported Q2 2026 revenue of $162.3 million, representing an 11.1% sequential decrease and a 6.3% year-over-year decrease. The company posted a GAAP net loss per diluted share of $0.45 and a Non-GAAP net loss per share of $0.16 for the quarter ended December 31, 2025.

- For Q2 2026, GAAP gross margin was 21.5% and Non-GAAP gross margin was 22.2%.

- AOS projects Q3 2026 revenue to be approximately $160 million (plus or minus $10 million), with GAAP gross margin anticipated at 20.2% (plus or minus 1%) and Non-GAAP gross margin at 21.0% (plus or minus 1%).

- The company repurchased approximately $13.9 million of shares (728,000 shares) during the December quarter as part of its $30 million share repurchase program, with $16 million remaining. Cash and cash equivalents totaled $196.3 million at the end of Q2 2026.

- Management expects the March quarter to be a near-term low point for revenue and margin, with business growth projected to resume in the June quarter.

- Alpha and Omega Semiconductor (AOSL) reported revenue of $162.3 million for the fiscal second quarter of 2026, ended December 31, 2025, which represents an 11.1% decrease from the prior quarter and a 6.3% decrease from the same quarter last year.

- For the fiscal second quarter of 2026, the company recorded a GAAP net loss per diluted share of $(0.45) and a non-GAAP net loss per diluted share of $(0.16).

- GAAP gross margin was 21.5% and non-GAAP gross margin was 22.2% for the quarter, both showing a decline compared to the prior quarter and the same quarter last year.

- The company provided guidance for the fiscal third quarter of 2026, expecting revenue of approximately $160 million (plus or minus $10 million) and a non-GAAP gross margin of 21.0% (plus or minus 1%).

- CEO Stephen Chang noted strength in Communications, particularly with a Tier One U.S. smartphone customer, and anticipates sequential improvement in product mix and revenue beginning in the June quarter of calendar 2026.

- Alpha and Omega Semiconductor (AOSL) reported Q1 2026 revenue of $182.5 million, a non-GAAP gross margin of 24.1%, and non-GAAP EPS of $0.13.

- The company provided Q2 2026 revenue guidance of approximately $160 million (plus or minus $10 million) and a non-GAAP gross margin of 23% (plus or minus 1%), reflecting anticipated seasonal slowdowns in PCs/tablets and a digestion phase in AI/graphics cards.

- AOSL received the first installment payment of $94 million from the sale of a portion of its equity interest in a China joint venture, with these proceeds earmarked for accelerating strategic investments in technology, equipment, and engineering talent, particularly in the 800-volt AI power architecture.

- Power IC revenue reached a record quarterly high of $72.7 million, increasing 37.3% year over year and now representing nearly 40% of total product revenue. The company expects steady growth through 2026, followed by a stronger upturn in 2027 as programs transition to volume production.

- Alpha and Omega Semiconductor Limited reported revenue of $182.5 million and Non-GAAP net income per share of $0.13 for the fiscal first quarter of 2026 ended September 30, 2025.

- Power IC revenue increased 37.3% year-over-year to a record quarterly high, now representing nearly 40% of total product revenue, with overall growth driven by Computing and Communications segments.

- The company ended the quarter with $223.5 million in cash and cash equivalents and received a $94 million first installment payment from the sale of a portion of its equity interest in a China joint venture.

- For the fiscal second quarter ending December 31, 2025, AOSL expects revenue of approximately $160 million (plus or minus $10 million) and a Non-GAAP gross margin of 23.0% (plus or minus 1%).

- Strategic investments are focused on high-growth areas like graphics, AI, and data-center power, including support for 800 volts DC power architecture for next-generation AI data centers.

- Alpha and Omega Semiconductor (AOSL) reported revenue of $182.5 million for the fiscal first quarter of 2026, representing a 3.4% increase from the prior quarter and flat performance year-over-year.

- The company posted a GAAP diluted net loss per share of $(0.07) and a non-GAAP diluted net income per share of $0.13 for the quarter ended September 30, 2025.

- AOSL concluded the quarter with $223.5 million in cash and cash equivalents and generated $10.2 million in cash flows from operating activities.

- For the fiscal second quarter ending December 31, 2025, the company anticipates revenue to be approximately $160 million (plus or minus $10 million) and non-GAAP gross margin to be 23.0% (plus or minus 1%).

- Alpha and Omega Semiconductor (AOSL) announced its support for NVIDIA's 800 VDC power architecture for next-generation AI data centers, which are designed to power megawatt-scale racks for AI workloads.

- The 800 VDC architecture represents a fundamental shift from traditional 54V power distribution, promising significant efficiency gains, reduced copper usage, and improved reliability by reducing power conversion steps.

- AOSL's portfolio of Silicon Carbide (SiC) and Gallium Nitride (GaN) products are strategically aligned to meet the core technical demands of the 800 VDC architecture, handling higher voltages and frequencies with maximum efficiency.

- The company's solutions, including SiC devices for high-voltage conversion and GaN FETs for high-density DC-DC conversion, are expected to contribute to up to a 5% improvement in end-to-end efficiency and a 45% reduction in copper requirements.

Quarterly earnings call transcripts for ALPHA & OMEGA SEMICONDUCTOR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more