Earnings summaries and quarterly performance for Amer Sports.

Research analysts who have asked questions during Amer Sports earnings calls.

Matthew Boss

JPMorgan Chase & Co.

9 questions for AS

Brooke Roach

Goldman Sachs Group, Inc.

8 questions for AS

Jay Sole

UBS

8 questions for AS

Paul Lejuez

Citigroup

8 questions for AS

Michael Binetti

Evercore ISI

7 questions for AS

Jonathan Komp

Robert W. Baird & Co.

5 questions for AS

Laurent Vasilescu

BNP Paribas S.A.

5 questions for AS

Lorraine Hutchinson

Bank of America

5 questions for AS

Alex Straton

Morgan Stanley

4 questions for AS

Ike Boruchow

Wells Fargo

4 questions for AS

John Kernan

Cowen Inc.

3 questions for AS

Anna Andreeva

Piper Sandler

2 questions for AS

Lorraine Maikis

Bank of America

2 questions for AS

Recent press releases and 8-K filings for AS.

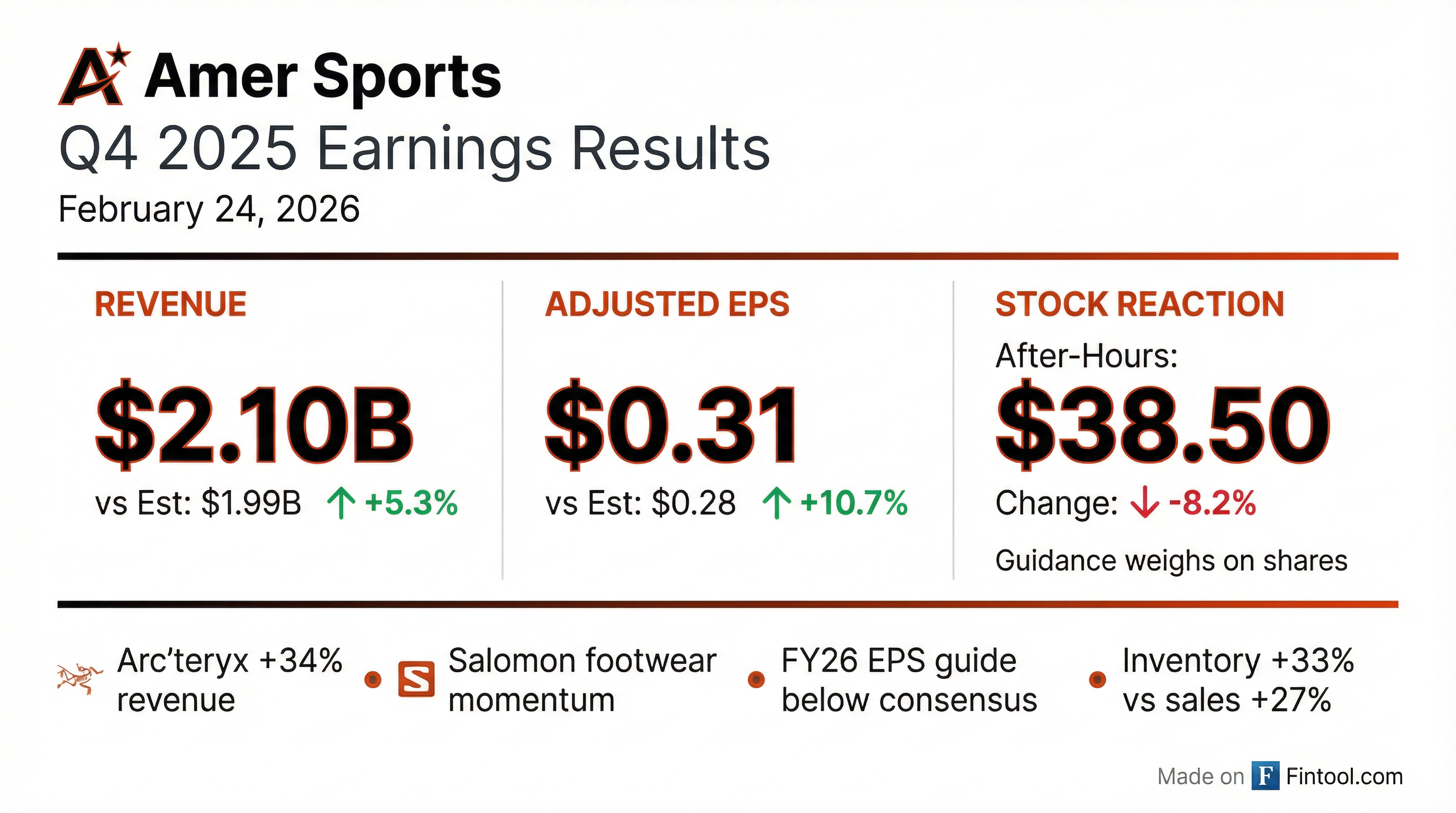

- Amer Sports reported a 27% revenue growth to $6.6 billion for the full year 2025 and 28% sales growth in Q4 2025, driven by strong performance across all segments, regions, and channels.

- For full year 2025, adjusted operating margin expanded 170 basis points to 12.8%; however, Q4 2025 adjusted operating margin declined 110 basis points to 12.5% due to accelerated SG&A investments, particularly for the Salomon brand.

- Salomon surpassed $2 billion in sales in 2025, growing 35%, and Arc'teryx continued its strong trajectory, with Technical Apparel revenues increasing 34% to $1 billion in Q4.

- The company anticipates Q1 2026 top-line growth between 22%-24% and plans to open 25-30 net new Arc'teryx stores and approximately 35 net new Salomon stores in Greater China in 2026.

- Amer Sports reported strong Q4 2025 sales growth of 28% on a reported basis and adjusted diluted EPS of $0.31, contributing to a 27% group growth and 12.8% adjusted operating margin for the full year 2025.

- The company provided full-year 2026 guidance, projecting reported group revenue growth between 16% and 18% and adjusted diluted EPS of $1.10-$1.15.

- Carrie Ask has been appointed as the next President and CEO of the Wilson brand, effective March 1st.

- Strategic investments in the Salomon brand to accelerate long-term growth led to a 490 basis point contraction in Outdoor Performance adjusted operating profit margin to 6.2% in Q4 2025.

- Amer Sports ended 2025 with a strong financial position, including $291 million of net debt and 0.3 times net leverage, and announced a $80 million redemption of senior secured notes in January.

- Amer Sports concluded 2025 with strong financial performance, reporting Q4 revenue growth of 28% and full-year 2025 revenue increasing 27% to $6.6 billion.

- For Q4 2025, adjusted diluted earnings per share was $0.31, while the adjusted operating margin declined 110 basis points to 12.5% due to accelerated SG&A investments, particularly for Salomon.

- The company provided FY 2026 guidance, expecting reported group revenue growth between 16% and 18%, an adjusted operating margin of 13.1%-13.3%, and adjusted diluted EPS of $1.10-$1.15.

- Strategic investments are focused on key brands like Arc'teryx, Salomon, and Wilson Tennis 360, with Salomon's brand awareness increasing 15 points globally since 2023.

- Amer Sports reported strong Q4 2025 revenue growth of 28% to $2,101 million, contributing to a full-year 2025 revenue of $6,566.2 million and 27% growth.

- Adjusted diluted earnings per share for Q4 2025 was $0.31, with the full-year 2025 adjusted diluted EPS reaching $0.97.

- Segment performance in Q4 2025 included Technical Apparel growth of 34%, Outdoor Performance revenue increasing 29% to $764 million, and Ball & Racquet revenue rising 14% to $337 million.

- The company announced Carrie Ask as the new Brand President and CEO for Wilson, effective March 1.

- Amer Sports reported strong full year 2025 financial results, with revenue growing 27% to $6,566 million and adjusted diluted EPS reaching $0.97.

- For the fourth quarter of 2025, revenue increased 28% to $2,101 million, and adjusted diluted EPS was $0.31.

- The company provided a positive outlook for full-year 2026, expecting reported revenue growth of 16 – 18% and fully diluted EPS of $1.10 – 1.15.

- Wilson, a brand under Amer Sports, announced Carrie Ask as its new Brand President and CEO, effective March 1.

- Amer Sports reported strong financial results for fiscal year 2025, with revenue increasing 27% to $6,566 million and adjusted diluted earnings per share (EPS) reaching $0.97.

- In the fourth quarter of 2025, revenue grew 28% to $2,101 million, and adjusted diluted EPS was $0.31, though adjusted operating margin saw a 110 basis point decline to 12.5% due to accelerated SG&A investment.

- The company provided a positive outlook for fiscal year 2026, forecasting reported revenue growth of 16 – 18% and adjusted diluted EPS in the range of $1.10 – $1.15.

- The Salomon brand surpassed the $2 billion sales mark in 2025, and Carrie Ask was appointed as the new Brand President and CEO of Wilson, effective March 1.

- Anta Sports has agreed to acquire a 29.06% stake in Puma from the Pinault family's Artemis for €1.51 billion (approximately $1.79 billion), making it Puma's largest shareholder.

- The acquisition involves purchasing 43 million shares at €35 each, which represents a 62% premium to Puma's recent share price, and will be financed using Anta's internal resources.

- Anta intends to preserve Puma's brand identity and independent governance, will seek representation on Puma's supervisory board, and currently has no plans for a full takeover.

- This transaction, expected to close by the end of 2026, is part of Anta's globalization strategy, aiming to strengthen Puma's international competitiveness and Chinese-market reach.

- ANTA Sports Products Limited, the largest shareholder of Amer Sports, Inc., will acquire a 29.06% stake in PUMA SE for 1.5 billion Euros in cash.

- This transaction is a significant step in ANTA Sports' multi-brand globalization strategy and is expected to close by the end of 2026.

- ANTA Sports will become the largest shareholder of PUMA and aims for appropriate representation on PUMA's supervisory board after the transaction.

- ANTA Sports currently has no plans for a takeover bid of PUMA.

- Anta Group, the largest shareholder of Amer Sports, Inc. , has agreed to acquire a 29.06% stake in PUMA SE from Groupe Artémis for 1.5 billion Euros in cash.

- This acquisition is a key step in Anta Group's globalization strategy, aiming to enhance its global influence and competitiveness in the sports goods market.

- The transaction is expected to be completed by the end of 2026, pending regulatory approvals.

- Anta Group currently has no plans to launch a takeover bid for PUMA.

- Anta Group, the largest shareholder of Amer Sports, Inc. (NYSE: AS), has announced an agreement to acquire 29.06% of PUMA SE shares from Groupe Artémis.

- The acquisition is a cash transaction valued at 1.5 billion Euros.

- This move is part of Anta Group's strategy to accelerate its multi-brand globalization and enhance its global market presence.

- The transaction is anticipated to conclude by the end of 2026, subject to regulatory approvals.

- Anta Group has no current plans to launch a tender offer for PUMA.

Fintool News

In-depth analysis and coverage of Amer Sports.

Quarterly earnings call transcripts for Amer Sports.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more