Earnings summaries and quarterly performance for AVALONBAY COMMUNITIES.

Executive leadership at AVALONBAY COMMUNITIES.

Board of directors at AVALONBAY COMMUNITIES.

Charles Mueller Jr.

Director

Christopher Howard

Director

Conor Flynn

Director

Glyn Aeppel

Director

Nnenna Lynch

Director

Richard Lieb

Director

Ronald Havner Jr.

Director

Stephen Hills

Director

Susan Swanezy

Director

Terry Brown

Lead Independent Director

Timothy Naughton

Chairman of the Board

Research analysts who have asked questions during AVALONBAY COMMUNITIES earnings calls.

Alexander Goldfarb

Piper Sandler

8 questions for AVB

Austin Wurschmidt

KeyBanc Capital Markets Inc.

7 questions for AVB

John Kim

BMO Capital Markets

7 questions for AVB

Rich Hightower

Barclays

7 questions for AVB

Steve Sakwa

Evercore ISI

7 questions for AVB

Adam Kramer

Morgan Stanley

6 questions for AVB

Eric Wolfe

Citi

5 questions for AVB

John Pawlowski

Green Street

5 questions for AVB

Alex Kim

Zelman & Associates

4 questions for AVB

Haendel St. Juste

Mizuho Financial Group

4 questions for AVB

Michael Goldsmith

UBS

4 questions for AVB

Jamie Feldman

Wells Fargo & Company

3 questions for AVB

Nick Joseph

Citigroup Inc.

3 questions for AVB

Alex Kalmus

Zelman & Associates

2 questions for AVB

Ami Probandt

UBS

2 questions for AVB

Anthony Paolone

JPMorgan Chase & Co.

2 questions for AVB

James Feldman

Wells Fargo

2 questions for AVB

Jana Galan

Bank of America

2 questions for AVB

Jana Gallen

Bank of America

2 questions for AVB

Jeffrey Spector

BofA Securities

2 questions for AVB

Linda Tsai

Jefferies

2 questions for AVB

Nicholas Yulico

Scotiabank

2 questions for AVB

Nick Yulico

Scotiabank

2 questions for AVB

Omotayo Okusanya

Deutsche Bank AG

2 questions for AVB

Richard Anderson

Wedbush Securities

2 questions for AVB

Alexander Kim

Zelman & Associates

1 question for AVB

Amy

UBS

1 question for AVB

Amy Yi Li

UBS

1 question for AVB

Ann Chan

Green Street

1 question for AVB

Austin Worschmidt

KeyBank Capital Markets

1 question for AVB

Brad Heffern

RBC Capital Markets

1 question for AVB

Cooper Clark

Wells Fargo

1 question for AVB

Joshua Dennerlein

BofA Securities

1 question for AVB

Michael Stefany

Mizuho Financial Group

1 question for AVB

Mike Coto

Mizuho Securities

1 question for AVB

Mike On

Mizuho Securities

1 question for AVB

Recent press releases and 8-K filings for AVB.

- AvalonBay is pursuing an Operating Model Transformation to leverage scale and AI, targeting $80 million of annual incremental NOI, with 60% achieved to date and $7 million more expected in 2026.

- The REIT has $3.6 billion of fully funded development under construction and plans $800 million of new starts in 2026, targeting 6.5–7% initial stabilized yields.

- Development-driven NOI is set to accelerate from $25 million in 2025 to an incremental $47 million in 2026 and $75 million in 2027, reflecting strong pipeline earnings.

- With an A- credit rating, AvalonBay is monetizing $500 million of slower-growth assets and has repurchased $600 million of stock at an average $180 per share, executing buybacks on a leverage-neutral basis.

- AvalonBay is executing an Operating Model Transformation targeting $80 million of annual incremental NOI, with ~60% achieved to date and $7 million expected in 2026.

- The company has $3.6 billion under construction (fully funded) and projects development NOI to rise from $25 million in 2025 to +$47 million in 2026 and + $75 million in 2027 at 6.5–7% initial yields.

- With an A– credit rating, AvalonBay plans $800 million of development starts in 2026, has repurchased $600 million of stock at an average of $180/share, and targets $500 million of dispositions at ~5% cap rates to fund further buybacks.

- Market fundamentals show asking rents up 2.5% YTD, turnover down 100 bps, occupancy up 20 bps, and supply down ~60% in established regions—supporting a 2% same-store NOI growth forecast for 2027.

- Operating Model Transformation: Targeting $80 million of annual incremental NOI (60% achieved) with an additional $7 million from operating initiatives in 2026.

- Development Pipeline: $3.6 billion under construction (fully funded) and $800 million of new starts planned in 2026 at 6.5–7% stabilized yields; development NOI growth forecast from $25 million in 2025 to +$47 million in 2026 and +$75 million in 2027.

- Balance Sheet & Buybacks: Maintains an A– credit rating, has repurchased $600 million of stock at $180/share funded by asset sales, and plans to sell ~$500 million of assets and buy back ~$400 million of stock on a leverage-neutral basis (4.7× net debt/EBITDA).

- 2026 Operating Outlook: Early-year metrics show asking rents +2.5%, turnover down 100 bps, and occupancy up 20 bps; expecting rent growth to accelerate in H2 2026 on easier comps and reduced supply.

- AvalonBay will participate in the 2026 Citi Global Property CEO Conference on March 2, 2026 at 11:40 AM ET.

- Physical occupancy rose 20 bps from December 2025 to February 2026; Like-Term Effective Rent Change improved from (0.5%) in January to +0.5% in February.

- Repurchased $112.8 million of common stock YTD at an average price of $176.85; authorized a new $1 billion share repurchase program, replacing the prior program with $51 million remaining capacity as of February 26, 2026.

- Closed sales of two communities YTD for $270 million of gross proceeds; under agreement to sell two more for $140 million, expected to close in H1 2026.

- 2.1% revenue growth in 2025 with a record-low 41% turnover and a mid-lease Net Promoter Score of 34, reflecting strong resident retention and satisfaction.

- Launched $1.65 billion of development at an initial yield of 6.2%, raised $2.4 billion of capital at a 5% cost, and repurchased $490 million of shares at an average price of $182.

- Guided 1.4% same-store revenue growth for 2026 with a 2% full-year effective rent increase, expecting low-1% growth in H1 and mid-2% in H2.

- Plans $800 million of new development starts at 6.5–7% yields, projecting $47 million of development NOI in 2026 and $75 million in 2027.

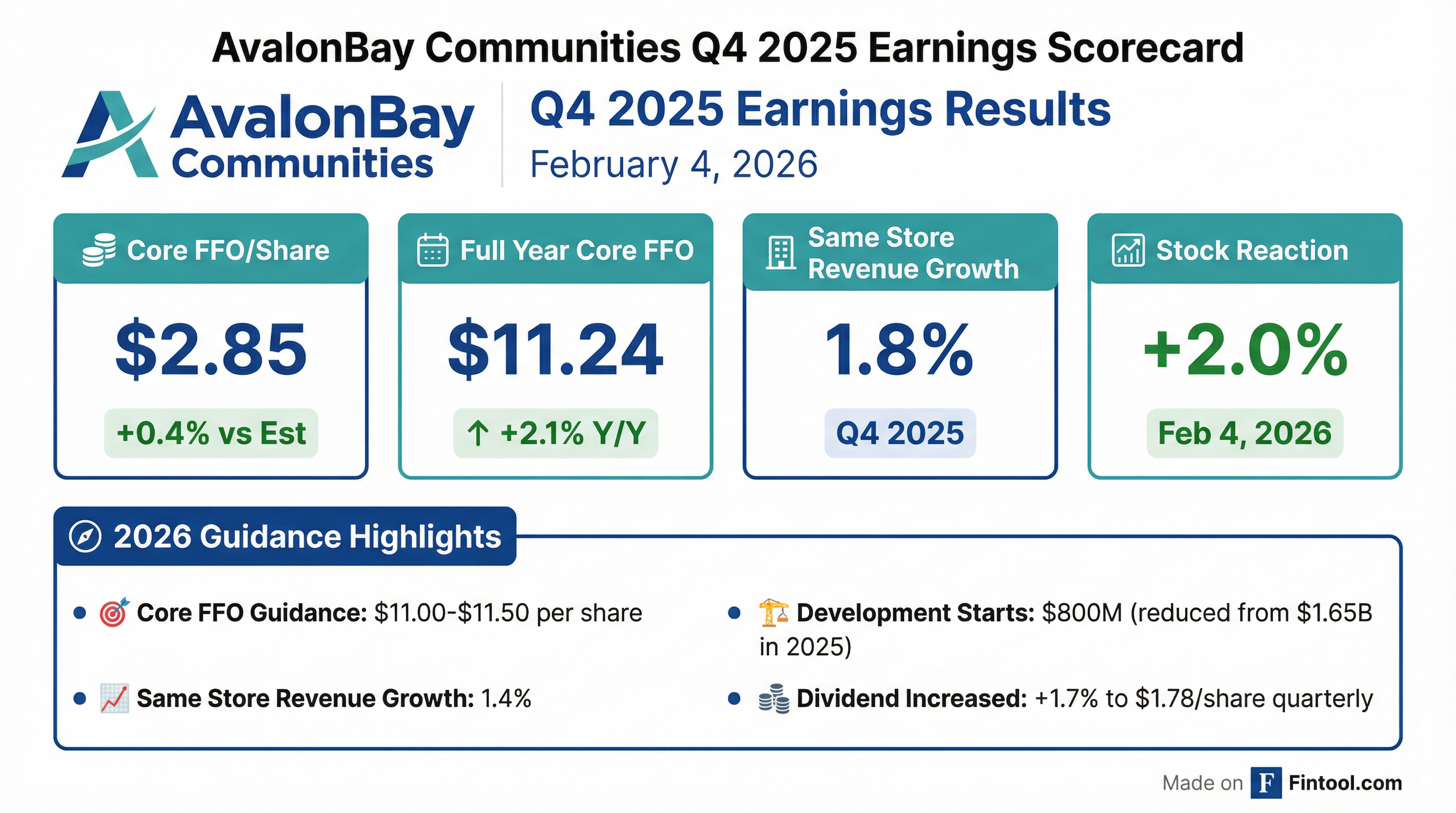

- Core FFO per share grew 1.8% in Q4 2025 and 2.1% for the full year 2025

- Same-store residential revenue increased 1.8% in Q4 2025 and 2.5% for full-year 2025

- Development starts totaled $590 M in Q4 and $1.65 B for 2025; completions were $290 M in Q4 and $560 M for the year

- Capital sourced of $480 M in Q4 and $2.5 B YTD; shares repurchased amounted to $336 M in Q4 and $488 M full-year

- Outlook: 2026 projected core FFO per share growth of 0.1% and same-store residential revenue growth of 1.4%; quarterly dividend raised ~1.7% to $1.78 per share

- Board approved a 1.7% dividend increase to $1.78 per share, maintaining a conservative payout ratio.

- 2026 guidance includes 1.4% same-store revenue growth, 2% full-year effective rent growth (H1 low 1%, H2 mid-2s), and 3.8% same-store OpEx growth.

- Core FFO per share drivers for 2026: + $0.04 from same-store NOI, + $0.10 from net development earnings, partially offset by refinancing and transaction headwinds.

- Development activity restrained to $800 million of new starts at 6.5–7% yields, with $47 million of development NOI expected in 2026 and an additional $75 million in 2027.

- In 2025, portfolio revenue grew by 2.1%, turnover hit a record low 41%, and mid-lease Net Promoter Score reached 34, reflecting strong resident retention and engagement.

- AvalonBay initiated $1.65 billion of development projects at an average initial stabilized yield of 6.2%, funded at ~5% cost, repurchased $490 million of shares at an average price of $182, and raised $2.4 billion of capital.

- For 2026, same-store revenue is guided to grow 1.4%, underpinned by a 2% like-term effective rent increase and modest job growth alongside declining supply.

- 2026 Core FFO per share is expected to reflect + $0.04 from same-store NOI, + $0.10 from development earnings, + $0.07 from structured investments and share repurchases, offset by – $0.17 from refinancing and transaction activity.

- AvalonBay delivered Q4 2025 diluted EPS of $1.17 (down 40.9% YoY), FFO per share of $2.80 (up 6.5%) and Core FFO per share of $2.85 (up 1.8%); full year 2025 EPS was $7.40 (−2.6%), FFO $11.40 (+3.8%) and Core FFO $11.24 (+2.1%).

- The Board declared a Q1 2026 dividend of $1.78 per share, a 1.7% increase, payable April 15, 2026.

- Initial 2026 guidance: Q1 EPS $2.35–$2.45, FFO $2.69–$2.79, Core FFO $2.73–$2.83; full year EPS $6.33–$6.83, FFO $10.80–$11.30, Core FFO $11.00–$11.50.

- Capital markets activity in Q4 2025 included issuance of $400 million 4.35% notes due 2030 and repurchase of 1.89 million shares for $336 million.

- Q4 2025 results: EPS $1.17 (-40.9% y/y); FFO per share $2.80 (+6.5%); Core FFO per share $2.85 (+1.8%).

- Full Year 2025 results: EPS $7.40 (-2.6% y/y); FFO per share $11.40 (+3.8%); Core FFO per share $11.24 (+2.1%).

- Declared Q1 2026 dividend of $1.78 per share, a 1.7% increase over the prior quarter.

- 2026 Outlook: Q1 EPS $2.35–$2.45, FFO $2.69–$2.79, Core FFO $2.73–$2.83; Full Year EPS $6.33–$6.83, FFO $10.80–$11.30, Core FFO $11.00–$11.50.

Quarterly earnings call transcripts for AVALONBAY COMMUNITIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more