Earnings summaries and quarterly performance for Avidbank Holdings.

Research analysts who have asked questions during Avidbank Holdings earnings calls.

Andrew Terrell

Stephens Inc.

4 questions for AVBH

Also covers: BANC, BANR, BMRC +18 more

MC

Matthew Clark

Piper Sandler

4 questions for AVBH

Also covers: BANC, BANR, BMRC +24 more

RH

Ross Haberman

Rlh Investments

4 questions for AVBH

Also covers: BAFN, BFIN, GBLI +7 more

TC

Timothy Coffey

Janney Montgomery Scott LLC

4 questions for AVBH

Also covers: BANC, BANR, BMRC +11 more

GT

Gary Tenner

D.A. Davidson & Co.

2 questions for AVBH

Also covers: ABCB, AX, BANC +20 more

Recent press releases and 8-K filings for AVBH.

Avidbank Holdings, Inc. Reports Q4 2025 Earnings and Provides 2026 Growth Outlook

AVBH

Earnings

Guidance Update

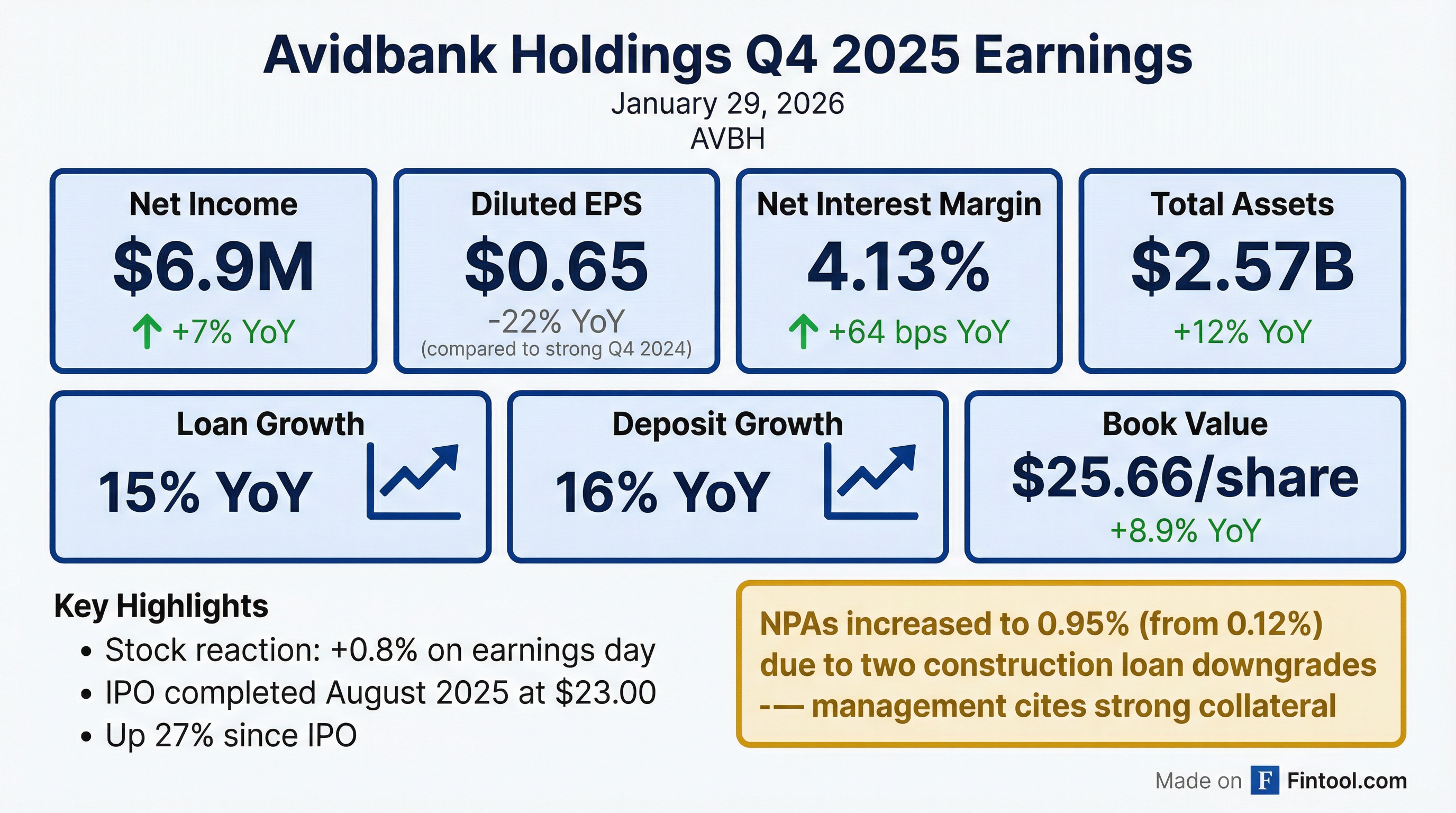

- Avidbank Holdings, Inc. reported net income of $6.9 million or $0.65 per diluted share for Q4 2025, and adjusted net income of $24.9 million or $2.80 per diluted share for the full year 2025.

- The company achieved significant balance sheet growth in Q4 2025, with loans increasing $190 million for the quarter and $283 million for the year (15% annualized growth), and deposits rising $92 million for the quarter and $241 million for the year (13% growth).

- Net Interest Margin (NIM) expanded to 4.13% in Q4 2025 from 3.90% in Q3, despite a $726,000 interest reversal from non-performing loans.

- Non-performing assets increased due to two construction loans and one sponsor finance loan, but management stated they are well collateralized and expect no losses.

- For 2026, Avidbank is targeting double-digit loan and deposit growth, aiming for 10%-15% asset growth.

8 days ago

Avidbank Holdings Reports Strong Q4 2025 Results and Provides 2026 Outlook

AVBH

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Avidbank Holdings reported net income of $6.9 million or $0.65 per diluted share for Q4 2025, with full-year adjusted net income reaching $24.9 million or $2.80.

- The company experienced strong growth in Q4 2025, with loans increasing by $190 million and deposits by $92 million, contributing to annualized growth rates of 15% and 13% respectively for the year.

- Net Interest Margin (NIM) expanded to 4.13% in Q4 2025 from 3.90% in Q3, despite a $726,000 interest reversal on non-performing loans.

- Non-performing assets (NPAs) rose, primarily due to a $16 million construction loan and two other loans, though management stated these are well collateralized and criticized classifieds remained stable.

- For 2026, management targets double-digit loan and deposit growth (10%-15%) and anticipates a non-interest expense run rate of $14 million+.

8 days ago

AVBH Reports Strong Q4 2025 Growth and Improved Financials

AVBH

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Avidbank Holdings (AVBH) reported net income of $6.9 million or $0.65 per diluted share for Q4 2025, with full-year adjusted net income of $24.9 million or $2.80.

- The company achieved significant growth in Q4 2025, with loans up $190 million and deposits up $92 million, contributing to a 15% annualized loan growth rate and a 13% deposit growth rate for the year.

- Net Interest Margin (NIM) expanded to 4.13% in Q4 2025, up from 3.90% in Q3, and the Adjusted Efficiency Ratio improved to 51.72% from 55.72%.

- Non-performing assets (NPAs) increased due to two construction loans and one sponsor finance loan, leading to a $2.8 million provision for credit losses and a $726,000 interest reversal that impacted the margin by 12 basis points.

- For 2026, AVBH is targeting double-digit loan and deposit growth (10%-15% asset growth) and expects non-interest expenses to be $14 million+ per quarter.

8 days ago

Avidbank (AVBH) Reports Q4 2025 Results with Expanded Net Interest Margin and Loan Growth

AVBH

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Avidbank (AVBH) reported diluted earnings per share of $0.65 and net income of $6.9 million for the fourth quarter of 2025.

- The company's net interest margin expanded to 4.13% in Q4 2025, an increase from 3.90% in the prior quarter and 3.49% in Q4 2024.

- Loans increased by $190 million, or 38% annualized, from September 30, 2025, and period-end deposits grew by $137 million, or 27% annualized, over the same period.

- Avidbank completed its IPO in August 2025 and repositioned its available-for-sale investment portfolio, which included selling $275 million in securities for a $62.4 million loss.

- As of December 31, 2025, nonperforming assets were 0.95% of total assets, and uninsured deposits were reduced to 42% from 85% at December 31, 2022.

8 days ago

Avidbank Holdings, Inc. Announces Q4 and Full Year 2025 Financial Results

AVBH

Earnings

New Projects/Investments

- Avidbank Holdings, Inc. reported net income of $6.9 million, or $0.65 per diluted share, for the fourth quarter of 2025, a significant improvement from a net loss of $37.7 million, or ($4.12) per diluted share, in the third quarter of 2025. For the full year 2025, the company reported a net loss of $19.6 million, or ($2.25) per diluted share, which included a $62.4 million loss on the sale of available-for-sale securities.

- The company's net interest margin expanded to 4.13% in the fourth quarter of 2025, compared to 3.90% in the third quarter of 2025 and 3.49% in the fourth quarter of 2024. Return on average assets was 1.12% for the fourth quarter of 2025, compared to (6.35%) in the third quarter of 2025.

- Period-end loans, net of deferred loan fees, increased by $189.9 million (38% annualized) from September 30, 2025, reaching $2.15 billion at December 31, 2025. Period-end deposits increased by $136.9 million (27% annualized) from September 30, 2025, totaling $2.19 billion at December 31, 2025.

- Non-performing assets to total assets increased to 0.95% as of December 31, 2025, up from 0.12% at September 30, 2025, primarily due to the downgrade of two well-collateralized construction loans and one commercial loan.

- In August 2025, the company completed an initial public offering (IPO), issuing 3,001,500 shares for $61.3 million in net proceeds, and repositioned its securities portfolio by selling $274.7 million in available-for-sale securities.

Jan 29, 2026, 9:05 PM

Avid Bank Holdings Reports Q3 2025 Results and Details IPO Impact

AVBH

Earnings

New Projects/Investments

Guidance Update

- Avid Bank Holdings (AVBH) completed its initial public offering (IPO) on August 8, 2025, issuing just over 3,000,000 shares at $23 per share and generating $61,300,000 in net proceeds.

- For Q3 2025, the company reported a GAAP net loss of $37,700,000, primarily due to a $62,400,000 pretax loss from selling $275,000,000 in available-for-sale securities as part of a portfolio repositioning. Excluding this charge, adjusted net income was $6,700,000 or $0.72 per share.

- The net interest margin expanded to 3.9% in Q3 2025, up from 3.6% in Q2, with expectations to exceed 4.1% in Q4 due to the full impact of the securities repositioning.

- The company achieved loan growth of $46,000,000 (10% annualized) and deposit growth of $72,000,000 (15% annualized) in Q3 2025, including a $58,000,000 increase in average non-interest bearing deposits.

- Credit quality remained strong, with nonperforming assets (NPAs) at 12 basis points and criticized loans declining to 148 basis points from 187 basis points in Q2. Consolidated total risk-based capital improved to 13.48% from 12.76% in Q2.

Oct 24, 2025, 3:00 PM

AVBH Announces Q3 2025 Results, Details IPO and AFS Portfolio Repositioning

AVBH

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- AVBH completed its Initial Public Offering (IPO) in August 2025, raising $61.3 million in net proceeds.

- In Q3 2025, the company repositioned its available-for-sale (AFS) securities portfolio, selling $275 million in AFS securities for a pre-tax loss of $62.4 million and reinvesting $163 million.

- These strategic actions led to an immediate improvement in profitability and a strengthened capital position, with the net interest margin expanding to 3.90% in Q3 2025, up from 3.60% in Q2 2025.

- Excluding the loss from the sale of AFS securities, the adjusted return on average assets improved to 1.13% in Q3 2025, compared to 1.00% in Q2 2025.

- The total risk-based capital ratio improved to approximately 13.48% at September 30, 2025, from 12.76% at June 30, 2025.

Oct 24, 2025, 3:00 PM

Avidbank Holdings, Inc. Reports Q3 2025 Results Following IPO and Strategic Repositioning

AVBH

Earnings

New Projects/Investments

Guidance Update

- Avidbank Holdings, Inc. (AVBH) completed its initial public offering (IPO) on August 8, 2025, generating $61.3 million in net proceeds. This enabled a strategic repositioning of its securities portfolio, involving the sale of $275 million in available-for-sale securities at a pre-tax loss of $62.4 million, leading to a GAAP net loss of $37.7 million for Q3 2025.

- Excluding the security sale charge, adjusted net income was $6.7 million, or $0.72 per share, with the net interest margin expanding to 3.90% in Q3 2025, up from 3.60% in Q2, and is projected to be over 4% in Q4.

- Core operations in Q3 2025 showed loan growth of $46 million (10% annualized) and deposit growth of $72 million (15% annualized), significantly driven by a $58 million increase in non-interest-bearing deposits.

- Credit quality remains robust, with non-performing assets at 14 basis points, and the company's consolidated total risk-based capital improved to 13.48% post-IPO.

Oct 24, 2025, 3:00 PM

Avidbank Holdings, Inc. Reports Q3 2025 Earnings and IPO Completion

AVBH

Earnings

New Projects/Investments

Guidance Update

- Avidbank Holdings, Inc. completed its initial public offering (IPO) on August 8, 2025, generating $61.3 million in net proceeds.

- The company reported a GAAP net loss of $37.7 million for Q3 2025, primarily due to a $62.4 million pre-tax loss from strategically repositioning its securities portfolio. Excluding this charge, adjusted net income was $6.7 million, or $0.72 per share.

- This repositioning contributed to a margin expansion to 3.90% in Q3 2025, up from 3.60% in Q2, with expectations for the margin to exceed 4% in the fourth quarter.

- Q3 2025 saw loan growth of $46 million (10% annualized) and deposit growth of $72 million (15% annualized), with strong pipelines expected to continue into Q4.

- Credit quality remained robust, with non-performing assets at 14 basis points and consolidated total risk-based capital improving to 13.48%.

Oct 24, 2025, 3:00 PM

Avidbank Holdings, Inc. Reports Q3 2025 Results, Completes IPO and Strategic Repositioning

AVBH

Earnings

Guidance Update

New Projects/Investments

- Avidbank Holdings, Inc. completed its initial public offering (IPO) on August 8, 2025, netting approximately $61 million.

- The company undertook a strategic repositioning of its investment portfolio, selling $275 million in available-for-sale securities, which resulted in a pre-tax loss of $62.4 million and a GAAP net loss of $37.7 million for Q3 2025. Excluding this charge, adjusted net income was $6.7 million, or $0.72 per share.

- This repositioning led to an immediate expansion of the margin to 3.90% in Q3 2025, up from 3.60% in Q2, with expectations for it to be "well above 4%" in Q4 2025.

- Avidbank reported solid core operations in Q3 2025, with loan growth of $46 million (10% annualized) and deposit growth of $72 million (15% annualized).

- Credit quality remained strong with non-performing assets at 12 basis points , and consolidated total risk-based capital rose to 13.48%.

Oct 24, 2025, 3:00 PM

Quarterly earnings call transcripts for Avidbank Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more