Earnings summaries and quarterly performance for Brookfield Business Partners.

Research analysts who have asked questions during Brookfield Business Partners earnings calls.

DD

Devin Dodge

BMO Capital Markets Corp.

8 questions for BBU

Also covers: BIP, GFL, NVRI +2 more

GH

Gary Ho

Desjardins Capital Markets

8 questions for BBU

BD

Bart Dziarski

RBC Capital Markets

5 questions for BBU

Also covers: BAM, BN

Jaeme Gloyn

National Bank Financial

4 questions for BBU

Also covers: BAM, BN, FRFHF

NP

Nikolaus Priebe

CIBC

3 questions for BBU

Also covers: BAM, CIXXF, FRFHF

JG

Jamie Glowen

National Bank

2 questions for BBU

DK

Dimitry Khmelnitsky

Veritas Investment Research

1 question for BBU

GK

Geoffrey Kwan

RBC Capital Markets

1 question for BBU

Also covers: CIXXF

Nelson Ng

RBC Capital Markets

1 question for BBU

Also covers: AQN, AY, BEP +3 more

Recent press releases and 8-K filings for BBU.

BBU Reports Q4 and Full-Year 2025 Results, Announces Acquisition and Corporate Simplification

BBU

Earnings

M&A

Share Buyback

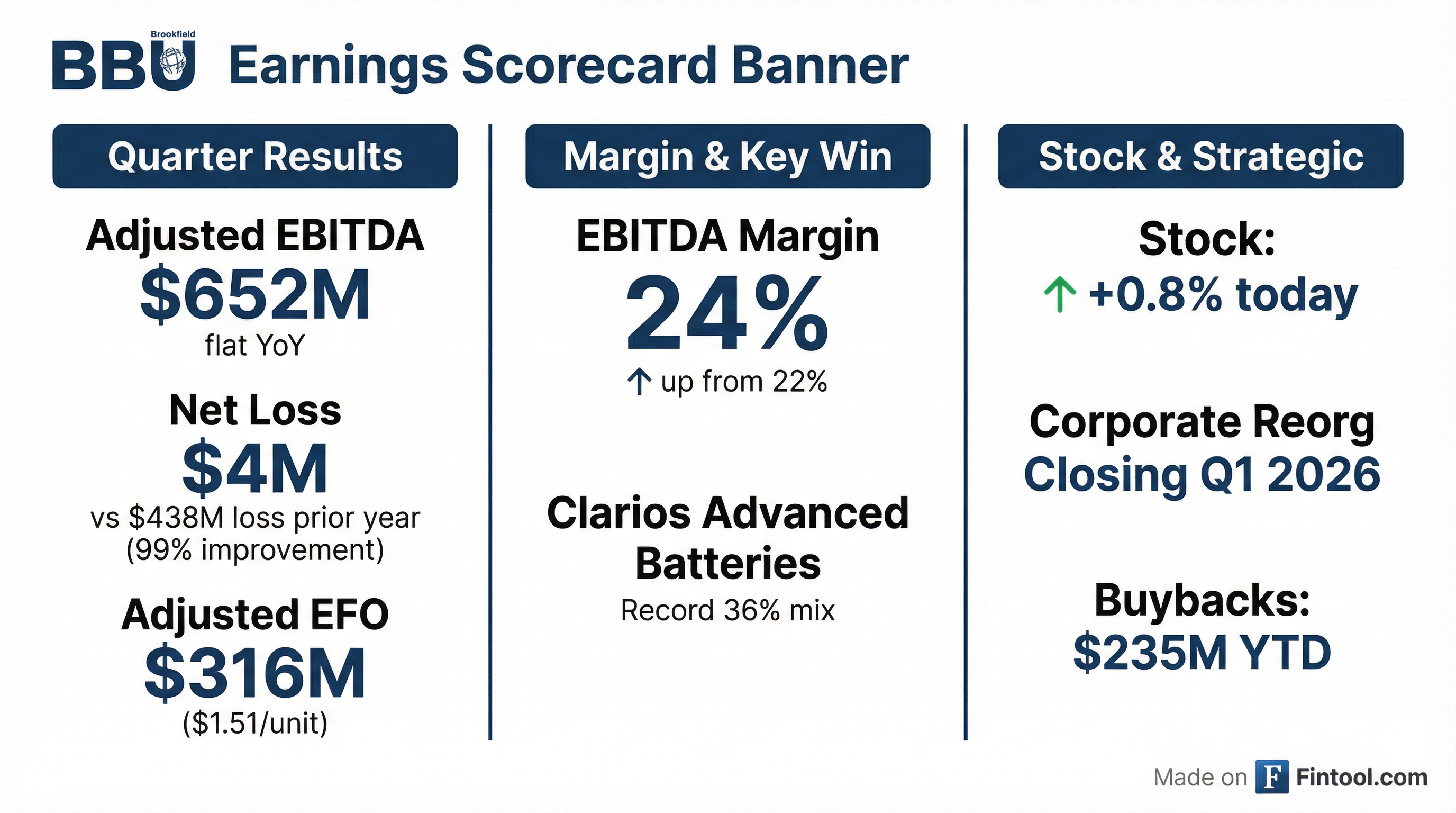

- BBU reported a net loss attributable to Unitholders of $4 million ($0.48 per unit) for the three months ended December 31, 2025, significantly improved from a $438 million loss in the prior period. For the full year ended December 31, 2025, the company achieved net income of $43 million ($0.30 loss per unit) compared to a $109 million net loss in the prior year.

- Adjusted EBITDA for the three months ended December 31, 2025, was $652 million, a slight decrease from $653 million in the prior period. For the full year 2025, Adjusted EBITDA was $2,409 million, down from $2,565 million in 2024.

- Adjusted EFO for the three months ended December 31, 2025, was $316 million ($1.51 per unit), compared to $330 million ($1.52 per unit) in the prior period. The full-year 2025 Adjusted EFO was $1,179 million ($5.57 per unit), a decrease from $1,532 million ($7.06 per unit) in 2024.

- On December 1, 2025, BBU entered an agreement to acquire Fosber, a global provider of machinery, parts, and services for the corrugated packaging industry, with the transaction expected to close in the first half of 2026.

- BBU repurchased 2.1 million units and shares for $72 million during and subsequent to the quarter ended December 31, 2025, bringing total repurchases since the beginning of 2025 to approximately $235 million for 8.8 million units and shares. Additionally, securityholder approval for the corporate structure simplification was received on January 13, 2026, with completion expected by the end of the first quarter of 2026.

8 days ago

Brookfield Business Partners Reports Q4 2025 Results, Highlights Capital Recycling and Strategic Reorganization

BBU

Earnings

Share Buyback

M&A

- Brookfield Business Partners (BBU) reported full-year Adjusted EBITDA of $2.4 billion and Adjusted EFO of $1.2 billion for 2025.

- In 2025, BBU generated over $2 billion from capital recycling, repaid approximately $1 billion in corporate borrowings, invested $700 million in four growth acquisitions, and repurchased about $235 million of stock.

- The company is nearing completion of a corporate reorganization to become a single, newly listed corporation, aiming to enhance trading liquidity and investor demand.

- Clarios saw underlying annual EBITDA increase 40% or almost $700 million since acquisition and expects to receive 45X tax credits, while BBU is evaluating a listing for BRK and exploring return of capital options for La Trobe.

8 days ago

Brookfield Business Partners Reports Q4 2025 Results, Details Capital Allocation and Reorganization Progress

BBU

Earnings

Share Buyback

M&A

- Brookfield Business Partners reported full-year Adjusted EBITDA of $2.4 billion for 2025, compared to $2.6 billion in 2024, and generated over $2 billion from capital recycling. The company also repaid roughly $1 billion of corporate borrowings, invested $700 million in four growth acquisitions, and repurchased approximately $235 million of stock.

- The company is close to completing a corporate reorganization to become a single, newly listed corporation, which is expected to improve trading liquidity and double index-driven demand for its shares.

- Key portfolio companies like Clarios saw underlying annual EBITDA increase by 40% or almost $700 million since acquisition, while Nielsen executed about $800 million of cost savings since acquisition, including over $250 million in the past year, increasing EBITDA margins by more than 350 basis points.

- Management is evaluating an IPO for BRK and reengaging with parties for potential monetization of La Trobe. The company expects a very active year for deployments in 2026, leveraging an attractive market backdrop.

8 days ago

Brookfield Business Partners Reports Q4 2025 Results, Highlights Capital Recycling and Reorganization

BBU

Earnings

Share Buyback

New Projects/Investments

- Brookfield Business Partners (BBU) reported full-year Adjusted EBITDA of $2.4 billion and Adjusted EFO of $1.2 billion for 2025.

- The company generated over $2 billion of proceeds from capital recycling, repaid approximately $1 billion of corporate borrowings, and invested $700 million in four growth acquisitions during 2025.

- BBU repurchased approximately $235 million of stock and is nearing completion of its corporate reorganization into a single, newly listed corporation.

- Operational highlights include a 40% increase in underlying annual EBITDA at Clarios since acquisition and $800 million in cost savings at Nielsen.

8 days ago

Brookfield Business Partners Proposes Corporate Structure Simplification and Sets Shareholder Meeting Date

BBU

M&A

Proxy Vote Outcomes

Delisting/Listing Issues

- Brookfield Business Partners L.P. (BBU) and Brookfield Business Corporation (BBUC) are proposing an Arrangement to simplify their corporate structure by converting into a single publicly traded corporate entity.

- Special meetings for unitholders and shareholders to vote on this reorganization are scheduled for January 13, 2026, at 10:00 a.m. and 11:00 a.m. (Toronto time), respectively.

- The proposed Arrangement is intended to drive long-term value by offering broader access to global investors, improved consolidated trading liquidity, and simplified financial and tax reporting.

- Following the completion of the Arrangement, BBU and BBUC units will be delisted from the TSX and NYSE, and both entities will become wholly-owned or controlled subsidiaries of the new Corporation, 1559985 B.C. Ltd., which was formed in October 2025 and has no separate operating history.

Nov 28, 2025, 9:13 PM

Brookfield Corporation Reports Strong Q3 2025 Results

BBU

Earnings

M&A

Share Buyback

- Brookfield Corporation reported strong financial results for the quarter ended September 30, 2025, with Distributable Earnings before realizations increasing 18% to $5.4 billion or $2.27 per share over the last twelve months.

- The company achieved a record $178 billion in deployable capital and advanced $75 billion of asset sales year-to-date.

- Strategic growth was driven by record fee-related earnings in asset management (up 17% to $754 million) and a 15% increase in wealth solutions distributable earnings.

- Key initiatives include an agreement to acquire the remaining interest in Oaktree and new partnerships for next-generation power and AI.

- Brookfield returned capital to shareholders, declaring a quarterly dividend of $0.06 per share and repurchasing over $950 million of Class A shares year-to-date.

Nov 13, 2025, 11:45 AM

Brookfield Business Partners L.P. Reports Q3 2025 Financial Results and Announces Corporate Reorganization

BBU

Earnings

M&A

Dividends

- Brookfield Business Partners L.P. reported a net loss of $(122) million for Q3 2025, a significant decrease from net income of $1,735 million in Q3 2024. For the nine months ended September 30, 2025, net income was $269 million, down from $2,003 million in the prior year period.

- Revenues for Q3 2025 decreased by $2,313 million to $6,919 million compared to Q3 2024, primarily due to the disposition of its road fuels operation and deconsolidation of its healthcare services operation.

- As of September 30, 2025, cash and cash equivalents increased to $3,500 million from $3,239 million at December 31, 2024. Total assets were $75,403 million, and total liabilities were $59,863 million.

- Subsequent to the quarter, on October 22, 2025, the partnership completed the privatization of First National Financial Corporation for $2.6 billion, with BBU's equity share being $146 million for an 11% interest.

- A corporate reorganization was announced on November 6, 2025, expected to be completed in Q1 2026, to simplify its corporate structure, and a quarterly distribution of $0.0625 per LP Unit was declared on November 4, 2025, payable on December 31, 2025.

Nov 10, 2025, 10:05 PM

Brookfield Business Partners L.P. Announces Corporate Arrangement and Share Exchange

BBU

M&A

Proxy Vote Outcomes

- Brookfield Business Partners L.P. (BBU) and Brookfield Business Corporation (BBUC) have entered into an Arrangement Agreement dated November 6, 2025, to consolidate their investments under a newly formed entity, 1559985 B.C. Ltd. (the "Corporation").

- As part of this Arrangement, BBU Unitholders will exchange their units for one (1) Class A subordinate voting share of the Corporation per unit.

- The Arrangement requires specific approvals, including an affirmative vote of a majority of outstanding BBU units for the BBU Arrangement Resolution and the BBU LPA Amendment Resolution, and not less than 66 2/3% of votes cast by BBUC shareholders.

- The Corporation holds an overriding call right to purchase BBU Units for Class A Consideration, which, if exercised, supersedes BBU's right to redeem units for cash.

Nov 6, 2025, 10:07 PM

BBU Reports Q3 2025 Financial Results and Strategic Updates

BBU

Earnings

M&A

Share Buyback

- BBU reported a net loss attributable to Unitholders of $59 million (loss of $0.28 per limited partnership unit) for the three months ended September 30, 2025, compared to net income of $301 million in the prior period.

- Adjusted EBITDA for Q3 2025 was $575 million, down from $844 million in Q3 2024; however, excluding tax benefits and acquired/disposed operations, Adjusted EBITDA increased to $512 million from $501 million.

- The company maintained corporate liquidity of $2,299 million as of September 30, 2025, including $2,190 million of availability on its credit facilities.

- Strategic initiatives include the completion of the privatization of First National Financial Corporation for which BBU invested $146 million, and an agreement to simplify the corporate structure by exchanging units/shares for new Class A shares in the first quarter of 2026.

- BBU declared a quarterly distribution and dividend of $0.0625 per unit and share, respectively, payable on December 31, 2025, and repurchased 152,586 LP units during Q3 2025 under its Normal Course Issuer Bid.

Nov 6, 2025, 2:00 PM

Brookfield Business Partners Reports Q3 2025 Results, Announces Corporate Structure Simplification

BBU

Earnings

M&A

Share Buyback

- Brookfield Business Partners reported Q3 2025 adjusted EBITDA of $575 million and adjusted EFO of $284 million.

- The company generated over $2 billion from its capital recycling program year-to-date, repaying $1 billion in corporate borrowings and investing $525 million in three strategic acquisitions, including First National Financial.

- BBU announced plans to simplify its corporate structure by converting existing units and shares into a single publicly traded Canadian corporation, a move that has already increased its consolidated market cap by nearly $1 billion and is expected to complete early next year.

- With approximately $2.9 billion in pro forma liquidity, BBU has repurchased just under $160 million of units and shares under its $250 million buyback program and sees a robust pipeline for new investments.

Nov 6, 2025, 2:00 PM

Quarterly earnings call transcripts for Brookfield Business Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more