Earnings summaries and quarterly performance for California BanCorp \ CA.

Executive leadership at California BanCorp \ CA.

Steven Shelton

Chief Executive Officer

David Rainer

Executive Chairman

Jean Carandang

Executive Vice President, Chief Financial Officer (Bank)

Joann Yeung

Executive Vice President, Principal Accounting Officer; Chief Accounting Officer (Bank)

Manisha Merchant

Executive Vice President, Chief Legal Officer

Martin Liska

Executive Vice President, Chief Risk Officer (Bank)

Michele Wirfel

Executive Vice President, Chief Operating Officer

Peter Nutz

Executive Vice President, Chief Credit Officer (Bank)

Richard Hernandez

President

Thomas Dolan

Executive Vice President, Chief Financial Officer; Chief Strategy Officer

Board of directors at California BanCorp \ CA.

Research analysts covering California BanCorp \ CA.

Recent press releases and 8-K filings for BCAL.

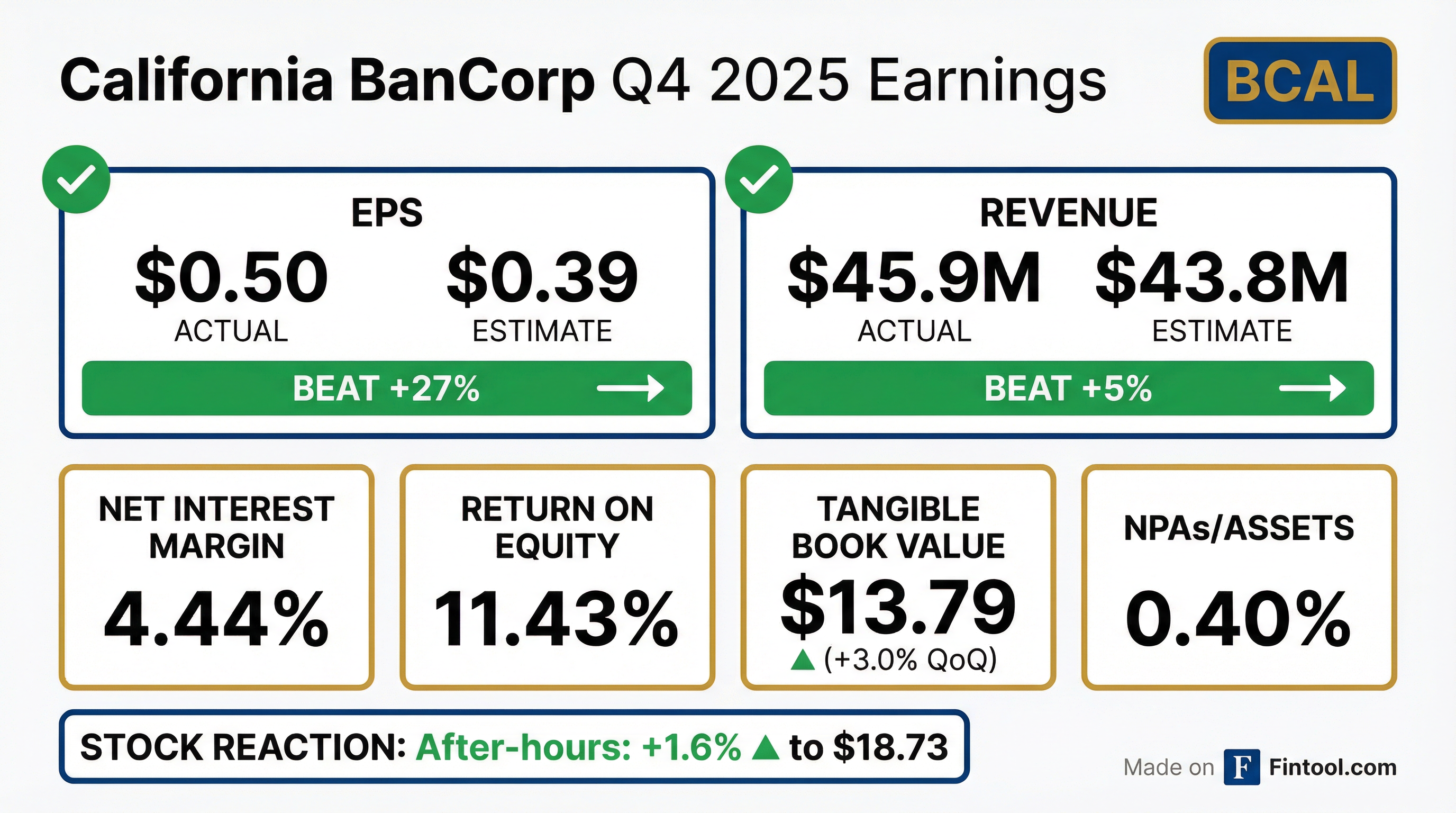

- California BanCorp reported net income of $16.4 million or $0.50 diluted earnings per share for the fourth quarter of 2025, and $63.1 million or $1.93 diluted earnings per share for the full year 2025.

- The company successfully completed and integrated its 2024 merger, restructured and derisked its balance sheet by reducing high-risk loans, and terminated dependence on high-cost brokered deposits while growing core deposits.

- Shareholder value was enhanced through the repurchase of 211,928 shares of common stock for a total cost of $3.4 million in 2025 and the implementation of a quarterly dividend of $0.10 per common share.

- For the full year 2025, key performance metrics included a net interest margin of 4.55%, return on average assets of 1.57%, and return on average common equity of 11.56%.

- California BanCorp reported net income of $16.4 million (or $0.50 per diluted share) for Q4 2025, an increase from $15.7 million (or $0.48 per diluted share) in Q3 2025. For the full year 2025, net income was $63.1 million (or $1.93 per diluted share), significantly up from $5.4 million (or $0.22 per diluted share) in 2024.

- The company's net interest margin was 4.44% in Q4 2025, compared to 4.52% in the prior quarter, and 4.55% for the full year 2025, up from 4.28% in the prior year.

- Total loans increased to $3.06 billion at December 31, 2025, up $62.0 million from September 30, 2025, while total deposits decreased to $3.37 billion at December 31, 2025, down $89.1 million from September 30, 2025.

- California BanCorp repurchased 122,428 shares of common stock for $2.0 million in Q4 2025 and declared a quarterly dividend of $0.10 per common share.

- Steven Shelton retired as Chief Executive Officer and Director of California BanCorp, effective December 31, 2025.

- David Rainer was appointed as the new Chief Executive Officer, effective December 31, 2025, in addition to his role as Chairman.

- Mr. Shelton will serve as a Strategic Transition Partner from January 1, 2026, to December 31, 2026, receiving a base salary of $16,666.66 per month.

- He will also receive a $996,400 separation payment in a lump sum on or after July 1, 2026, along with COBRA severance benefits, a potential 2025 discretionary bonus, and accelerated vesting of certain stock awards and his SERP.

- California BanCorp reported net income of $15.7 million, or $0.48 per diluted share, for the third quarter of 2025, an increase from $14.1 million, or $0.43 per diluted share, in the second quarter of 2025, and a significant improvement from a net loss of $16.5 million, or $0.59 per diluted share, in the third quarter of 2024.

- The company's Return on Average Assets was 1.54% for Q3 2025, up from 1.45% in the prior quarter, and the efficiency ratio improved to 51.75% from 56.09%. The Net Interest Margin for Q3 2025 was 4.52%, compared with 4.61% in the prior quarter.

- Total assets increased to $4.10 billion at September 30, 2025, from $3.95 billion at June 30, 2025, primarily due to a $147.4 million increase in total deposits to $3.46 billion.

- California BanCorp redeemed $20.0 million in high-cost subordinated notes during the third quarter of 2025 and repurchased 89,500 shares of common stock for $1.4 million under its stock repurchase program.

- Asset quality improved, with the non-performing assets to total assets ratio decreasing to 0.38% at September 30, 2025, from 0.46% at June 30, 2025.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more