Earnings summaries and quarterly performance for Bunge Global.

Executive leadership at Bunge Global.

Board of directors at Bunge Global.

Adrian Isman

Director

Anne Jensen

Director

Carol Browner

Director

Christopher Mahoney

Director

Eliane Aleixo Lustosa de Andrade

Director

Jay Winship

Director

Kenneth Simril

Director

Linda Jojo

Director

Mark Zenuk

Chair of the Board

Markus Walt

Director

Monica McGurk

Director

Research analysts who have asked questions during Bunge Global earnings calls.

Heather Jones

Heather Jones Research

8 questions for BG

Manav Gupta

UBS Group

8 questions for BG

Salvator Tiano

Bank of America

8 questions for BG

Steven Haynes

Morgan Stanley

8 questions for BG

Andrew Strelzik

BMO Capital Markets

7 questions for BG

Derrick Whitfield

Texas Capital

7 questions for BG

Pooran Sharma

Stephens Inc.

5 questions for BG

Thomas Palmer

Citigroup Inc.

5 questions for BG

Benjamin Theurer

Barclays Corporate & Investment Bank

3 questions for BG

Ben Theurer

Barclays

2 questions for BG

Ben Toyrer

Barclays

2 questions for BG

Matthew Blair

Tudor, Pickering, Holt & Co.

2 questions for BG

Puran Sharma

Stevens Inc.

2 questions for BG

Tom Palmer

JPMorgan Chase & Co.

2 questions for BG

Andrew Stravik

BMO Capital Markets

1 question for BG

Rahi Parikh

Barclays

1 question for BG

Tami Zakaria

JPMorgan Chase & Co.

1 question for BG

Recent press releases and 8-K filings for BG.

- Completed Viterra combination, realizing > $70 million in run‐rate synergies by end-2025 and targeting $190 million of synergies in 2026 (run rate $220 million by year-end).

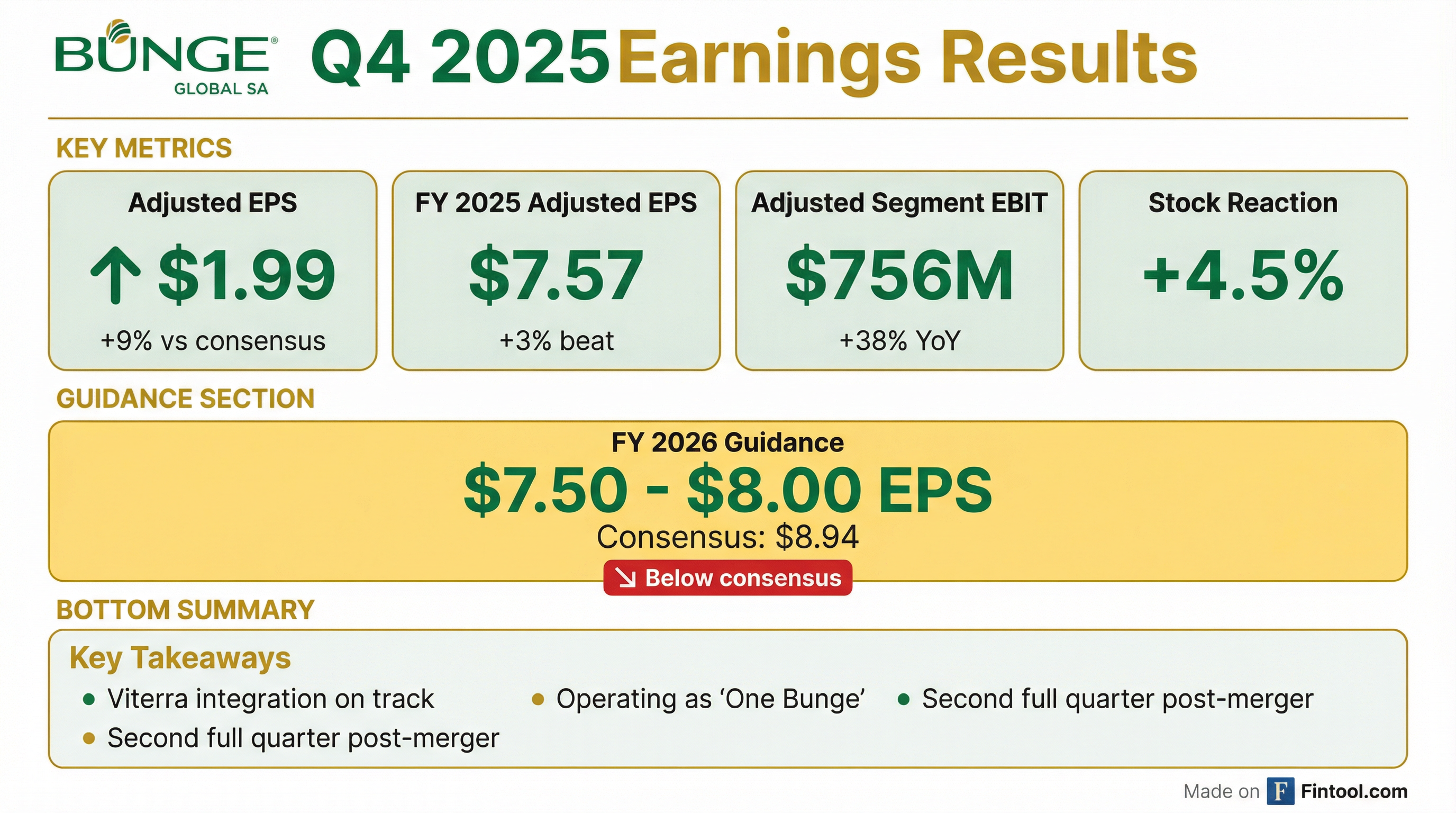

- Q4 2025: reported EPS $0.49 vs. $4.36 LY; adjusted EPS $1.99 vs. $2.13 LY; adjusted EBIT $756 million vs. $546 million LY; results included mark-to-market timing and integration costs.

- 2026 guidance: adjusted EPS $7.50–$8.00, annual tax rate 23–27%, net interest expense $575–$625 million, CapEx $1.5–$1.7 billion, D&A ~$975 million.

- FY 2025 cash flow and leverage: adjusted FFO $1.7 billion, discretionary cash flow $1.25 billion, year-end net debt $700 million (ex-RMI), and adjusted leverage 1.9×.

- Q4 adjusted EPS was $1.99 (vs. $2.13 in Q4 2024) and Q4 adjusted Total EBIT reached $622 M (vs. $445 M).

- FY 2025 adjusted EPS declined to $7.57 (from $9.19 in FY 2024) while FY 2025 adjusted Total EBIT was $2.034 B (vs. $2.017 B).

- The company generated FY 2025 discretionary cash flow of $1.248 B, allocating $459 M to dividends, $1.173 B to growth capex and $551 M to share buybacks.

- For FY 2026, Bunge guides adjusted EPS of $7.50–$8.00, with net interest expense of $575 M–$625 M and capex of $1.5 B–$1.7 B.

- Q4 reported EPS of $0.49 was weighed down by a $0.55 mark-to-market timing charge and $0.95 of notable items; adjusted EPS was $1.99 vs $2.13 in Q4 2024, and adjusted EBIT rose to $756 million from $546 million year-over-year.

- Integration of Viterra completed in 2025, with $70 million of synergies realized; management now targets $190 million of synergy capture in 2026 and a year-end run rate of $220 million.

- For 2026, Bunge forecasts adjusted EPS of $7.50–$8.00, an effective tax rate of 23–27%, net interest expense of $575–$625 million, capital expenditures of $1.5–$1.7 billion, and depreciation & amortization of ~$975 million.

- At year-end, net debt (ex-RMI) stood at $700 million with an adjusted leverage ratio of 1.9×, and liquidity remained strong with $9 billion of undrawn committed credit facilities.

- Completed the Viterra integration and expects $190 million of realized synergies in 2026, with a $220 million run rate by year-end

- Q4 2025 reported EPS of $0.49 (Q4 2024: $4.36) and adjusted EPS of $1.99, with adjusted EBIT of $756 million

- Issued 2026 guidance of $7.50–$8.00 adjusted EPS; effective tax rate 23%–27%; net interest expense $575–$625 million; CapEx $1.5–$1.7 billion; depreciation & amortization ~$975 million

- 2025 capital allocation: generated $1.7 billion of adjusted funds from operations, paid $459 million in dividends, and repurchased 6.7 million shares for $551 million

- Full-year GAAP diluted EPS of $4.93 vs. $7.99 in 2024; adjusted EPS of $7.57 vs. $9.19

- Q4 GAAP diluted EPS of $0.49 vs. $4.36 in Q4 2024; adjusted EPS of $1.99 vs. $2.13

- Adjusted total EBIT of $622 million in Q4 and $2,034 million for the full year

- 2026 guidance: adjusted EPS of $7.50–$8.00; adjusted tax rate 23–27%; net interest expense $575–$625 million; capex $1.5–$1.7 billion

- Completed combination with Viterra, advancing growth projects and capturing operational synergies.

- Reported full-year GAAP diluted EPS of $4.93 vs $7.99 prior year and adjusted EPS of $7.57 vs $9.19.

- Delivered Q4 GAAP diluted EPS of $0.49 vs $4.36 prior year and adjusted EPS of $1.99 vs $2.13.

- Issued 2026 guidance for adjusted EPS of $7.50–$8.00, tax rate 23–27%, net interest expense $575–$625 million, and CapEx $1.5–$1.7 billion.

- Third-quarter net sales rose 72% to $22.15 billion on volume growth and the Viterra acquisition.

- Net income declined to $166 million from $221 million a year earlier.

- Adjusted EPS of $2.27 topped analyst estimates.

- Company maintained full-year adjusted EPS guidance of $7.30–$7.60.

- Announced a $545 million share repurchase program to support shareholder value.

- Delivered adjusted EPS of $2.27 and adjusted EBIT of $924 million in Q3 2025, despite reported EPS of $0.86 including mark-to-market and transaction charges.

- First quarter operating as a combined Bunge-Viterra entity, with reportable segments realigned into soybean processing, softseed processing, other oilseeds processing, and grain merchandising and milling to enhance end-to-end value-chain integration.

- Reaffirmed full-year 2025 adjusted EPS guidance of $7.30–$7.60 (second-half EPS of $4.00–$4.25), with net interest expense expected at $380–$400 million and capital expenditures of $1.6–$1.7 billion.

- Year-to-date generated $1.2 billion of adjusted funds from operations and $900 million of discretionary cash flow; deployed $324 million to dividends, $903 million to growth CapEx, and repurchased 6.7 million shares for $545 million.

- At quarter-end, net debt exceeded readily marketable inventories by ~$900 million, adjusted leverage was 2.2×, and $9.7 billion of committed credit facilities remained unused.

- Adjusted EPS of $2.27 in Q3 2025 was essentially flat year-over-year, while net income per diluted share from continuing operations declined to $0.86 from $1.56 a year ago.

- Adjusted Segment EBIT rose to $924 million (Q3 2024: $559 million) and Adjusted Total EBIT increased to $757 million (Q3 2024: $491 million), driven by integration benefits.

- Maintained full-year 2025 guidance for adjusted EPS of $7.30–$7.60, including H2 EPS of $4.00–$4.25, with a 23–25% tax rate, $380–$400 million net interest expense, $1.6–$1.7 billion capex and ~$710 million D&A.

- Management noted favorable industry trends but highlighted ongoing uncertainty from macroeconomic, trade and biofuel policy dynamics.

- Reported Q3 EPS of $0.86 and adjusted EPS of $2.27, with adjusted segment EBIT rising to $924 million from $559 million year-over-year.

- Completed first quarter operating as a combined company with Viterra, realizing early integration benefits across origination and processing and capturing initial commercial synergies.

- Maintains full-year 2025 adjusted EPS guidance of $7.30–$7.60, with H2 adjusted EPS expected at $4.00–$4.25; 2025 capex is pegged at $1.6–$1.7 billion and net interest expense at $380–$400 million.

- Generated approximately $1.2 billion of YTD adjusted funds from operations and repurchased 6.7 million shares for $545 million, with $255 million remaining under the Viterra buyback program.

Quarterly earnings call transcripts for Bunge Global.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more