Earnings summaries and quarterly performance for Brookfield Infrastructure Partners.

Research analysts who have asked questions during Brookfield Infrastructure Partners earnings calls.

DD

Devin Dodge

BMO Capital Markets Corp.

7 questions for BIP

Also covers: BBU, GFL, NVRI +2 more

Maurice Choy

RBC Capital Markets

7 questions for BIP

Also covers: ATGFF, EMA, EMRAF +7 more

CR

Cherilyn Radbourne

TD Cowen

6 questions for BIP

Also covers: ATS, BAM, BN +1 more

FB

Frederic Bastien

Raymond James

6 questions for BIP

Also covers: CIGI, FSV, STN

Robert Hope

Scotiabank

6 questions for BIP

Also covers: AQN, ATGFF, BEP +10 more

RC

Robert Catellier

CIBC Capital Markets

4 questions for BIP

Also covers: ATGFF, ENB, PBA +3 more

RL

Ryan Levine

Citigroup

2 questions for BIP

Also covers: AEP, AES, ATO +17 more

PS

Patrick Sullivan

TD Cowen

1 question for BIP

Also covers: ATS

Recent press releases and 8-K filings for BIP.

Brookfield Infrastructure Partners Reports Strong Q4 and Full-Year 2025 Results, Increases Distribution

BIP

Earnings

Dividends

New Projects/Investments

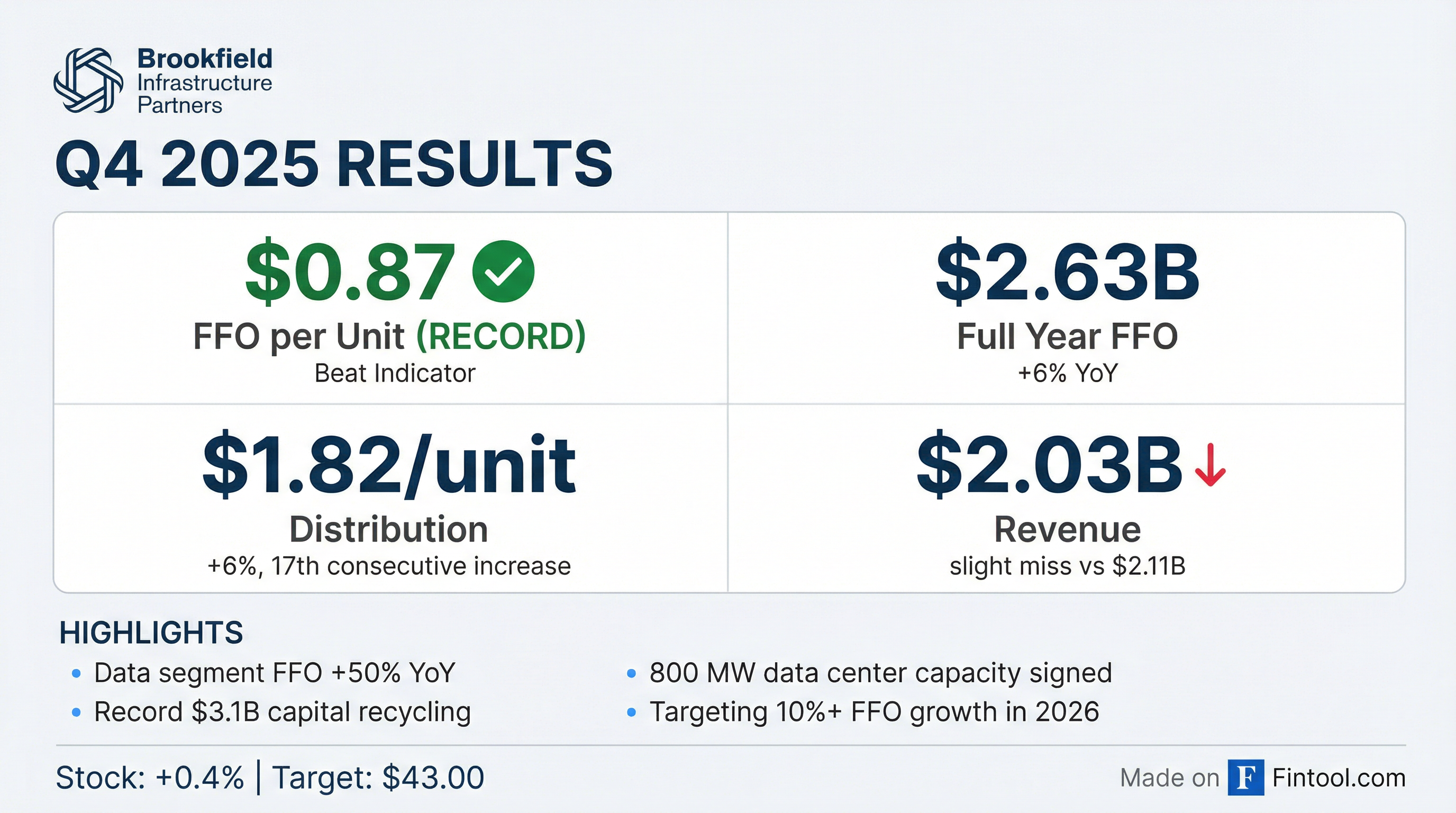

- Brookfield Infrastructure Partners (BIP) reported $2.6 billion in Funds From Operations (FFO) for the full year 2025, with normalized FFO increasing 10% compared to 2024, and a record $0.87 per unit FFO in Q4 2025.

- The board approved a 6% increase in the quarterly distribution to $1.82 per unit on an annualized basis, marking the 17th consecutive year of distribution increases of at least 5%.

- BIP exceeded its capital recycling target, raising $3.1 billion in asset sale proceeds in 2025, and invested approximately $2.2 billion of equity into growth initiatives.

- The data segment's FFO increased over 50% in 2025, driven by new investments and organic growth, including commissioning 220 megawatts of hyperscale data center capacity and executing agreements for approximately 800 MW of capacity in Q4.

Jan 29, 2026, 2:00 PM

Brookfield Infrastructure Partners Announces Strong Q4 and Full-Year 2025 Results with Distribution Increase

BIP

Earnings

Dividends

New Projects/Investments

- Brookfield Infrastructure Partners reported Funds From Operations (FFO) of $2.6 billion for 2025, with a record FFO of $0.87 per unit in Q4 2025, representing a 10% increase in normalized FFO compared to 2024.

- The company announced a 6% increase in its quarterly distribution to $1.82 per unit on an annualized basis and exceeded its capital recycling target, raising a record $3.1 billion in asset sale proceeds in 2025.

- The data segment's FFO increased over 50% year-over-year to $502 million in 2025, with its global data center platform holding development potential of approximately 3.6 gigawatts.

- BIP deployed approximately $1.5 billion into new investments in 2025, including a $50 million equity investment in a Bloom Energy partnership, a $125 million acquisition of a South Korean industrial gas business, and a $300 million equity consideration for a railcar leasing platform.

Jan 29, 2026, 2:00 PM

Brookfield Infrastructure Partners Reports Strong 2025 Results with Record FFO and Distribution Increase

BIP

Earnings

Dividends

New Projects/Investments

- Brookfield Infrastructure Partners (BIP) generated $2.6 billion in Funds From Operations (FFO) during 2025, representing a 10% increase compared to 2024 when normalized for asset sales and foreign exchange, and achieved a record $0.87 per unit FFO in the fourth quarter of 2025.

- The company exceeded its capital recycling target, raising a record $3.1 billion in asset sale proceeds in 2025, and invested approximately $2.2 billion of equity into growth initiatives.

- BIP's board of directors approved a 6% increase in the quarterly distribution to $1.82 per unit on an annualized basis, marking the 17th consecutive year of distribution increases.

- The data segment's FFO increased by over 50% to $502 million in 2025, driven by new investments and strong organic growth, including the commissioning of 220 megawatts of capacity at hyperscale data centers.

- BIP ended 2025 with record $6 billion in liquidity and anticipates returning to its 10% or higher per unit growth target in 2026 and beyond, supported by a robust pipeline of new investment opportunities and the rapid build-out of AI-related infrastructure.

Jan 29, 2026, 2:00 PM

Brookfield Infrastructure Partners Renews Normal Course Issuer Bids

BIP

Share Buyback

- Brookfield Infrastructure Partners L.P. (BIP) announced the renewal of its normal course issuer bid for its outstanding limited partnership units (LP Units) and cumulative class A preferred limited partnership units (Preferred Units).

- Under the renewed bid, BIP is authorized to repurchase up to 23,062,017 LP Units, representing 5% of the issued and outstanding LP Units as of November 19, 2025.

- BIP is also authorized to repurchase up to 10% of the total public float for each series of its Preferred Units (Series 3, Series 9, and Series 11).

- The repurchases are authorized to commence on December 2, 2025, and the normal course issuer bid will terminate on December 1, 2026.

- Under its current normal course issuer bid, which expires on December 1, 2025, BIP has repurchased 1,043,911 LP Units at a weighted average price of approximately C$39.20 as of November 19, 2025.

Nov 28, 2025, 12:20 PM

Brookfield Infrastructure Partners L.P. Reports Strong Q3 2025 Results with Significant Asset Growth

BIP

Earnings

M&A

New Projects/Investments

- Brookfield Infrastructure Partners L.P. reported revenues of $5,975 million for the third quarter of 2025, marking a $705 million increase from the same period in 2024.

- Net income for Q3 2025 reached $750 million, a substantial rise from $234 million in Q3 2024, significantly boosted by a $353 million gain on the sale of its Australian container terminal operation.

- Net income per limited partnership unit improved to $0.44 for Q3 2025, compared to $(0.18) in Q3 2024.

- Total assets grew to $124,299 million as of September 30, 2025, up from $104,590 million at December 31, 2024, primarily driven by recent acquisitions and increased capital investments.

- The Utilities segment's Adjusted EBITDA increased by 6% to $331 million for Q3 2025, attributed to inflation indexation and capital commissioned into the rate base.

Nov 13, 2025, 10:31 PM

Brookfield Infrastructure Partners Reports Strong Q3 2025 Results and Strategic Progress

BIP

Earnings

New Projects/Investments

Debt Issuance

- Brookfield Infrastructure Partners reported Q3 2025 Funds from Operations (FFO) of $654 million or $0.83 per unit, marking a 9% increase compared to the previous year.

- The Data segment FFO increased over 60% to $138 million, driven by a full quarter contribution from a tower portfolio acquisition in India and strong organic growth, while the Midstream segment FFO grew 6% to $156 million.

- The company secured six new investments totaling over $1.5 billion for the year, including a $1.3 billion enterprise value New Zealand natural gas infrastructure operation and a $1 billion enterprise value South Korean industrial gas business.

- Capital recycling initiatives generated over $3 billion in proceeds for the year, with a partial sale of its North American gas storage platform (RockPoint) contributing approximately $230 million to BIP's share of net proceeds.

- Brookfield Infrastructure Partners completed a $700 million corporate issuance of medium-term notes at a weighted average interest rate of approximately 4% and maintained a strong liquidity position of $5.5 billion at the end of the third quarter.

Nov 7, 2025, 2:00 PM

Brookfield Infrastructure Partners Reports Strong Q3 2025 FFO Growth and Active Investment/Divestment Strategy

BIP

Earnings

New Projects/Investments

M&A

- Brookfield Infrastructure Partners (BIP) reported Q3 2025 Funds from Operations (FFO) of $654 million or $0.83 per unit, marking a 9% increase compared to the previous year, primarily driven by strong organic growth.

- The company completed a $700 million corporate issuance of medium-term notes in September and maintained a robust liquidity position of $5.5 billion at the end of the quarter.

- BIP secured six new investments totaling over $1.5 billion for the year, including a $1.3 billion enterprise value New Zealand natural gas infrastructure operation, a $1 billion enterprise value South Korean industrial gas business, and its first AI-related project for 55 MW of behind-the-meter power.

- Capital recycling initiatives generated over $3 billion in proceeds for the year, including a partial sale of its North American gas storage platform (RockPoint) via IPO, which contributed approximately $230 million to BIP's net proceeds.

- The company anticipates its FFO per unit growth to "inflect higher" and expects to deploy up to $500 million annually into AI-related infrastructure in the coming years.

Nov 7, 2025, 2:00 PM

Brookfield Infrastructure Finance Entities Issue New Medium Term Notes

BIP

Debt Issuance

- Brookfield Infrastructure Finance ULC, Brookfield Infrastructure Finance LLC, Brookfield Infrastructure Finance Limited, and Brookfield Infrastructure Finance Pty Ltd (the "Issuers") are issuing a fifteenth and a sixteenth series of Medium Term Notes under supplemental indentures dated September 24, 2025.

- These notes are guaranteed by Brookfield Infrastructure Partners L.P. and several of its subsidiaries.

- Should a Change of Control Triggering Event occur (defined as a Change of Control combined with a Below Investment Grade Rating Event), the Issuers are required to offer to repurchase the notes at 101% of the aggregate principal amount plus accrued and unpaid interest.

- The guarantors have covenanted that the Funded Indebtedness of Brookfield Infrastructure Partners L.P., calculated on a consolidated basis, will not exceed 75% of Total Consolidated Capitalization.

Sep 24, 2025, 11:17 PM

Quarterly earnings call transcripts for Brookfield Infrastructure Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more