Earnings summaries and quarterly performance for Builders FirstSource.

Executive leadership at Builders FirstSource.

Peter Jackson

Chief Executive Officer and President

Gayatri Narayan

President, Technology and Digital Solutions

Johnny Cope

President – Commercial Operations

Matt Trester

Principal Accounting Officer

Michael Hiller

Chief Talent Officer

Paul Vaughn

President – Central Division

Pete Beckmann

Executive Vice President and Chief Financial Officer

Scott Robins

President – West Division

Steve Herron

Chief Operating Officer

Timothy Johnson

Executive Vice President, General Counsel and Corporate Secretary

Todd Vance

President – East Division

Board of directors at Builders FirstSource.

Bradley Hayes

Director

Brett Milgrim

Director

Cheryl Ainoa

Director

Cleveland Christophe

Director

Cory Boydston

Director

Craig Steinke

Director

Dave Rush

Director

Dirkson Charles

Director

James O’Leary

Director

Maria Renz

Director

Mark Alexander

Director

Paul Levy

Chairman of the Board

Research analysts who have asked questions during Builders FirstSource earnings calls.

Charles Perron-Piché

Goldman Sachs

5 questions for BLDR

David Manthey

Robert W. Baird & Co. Incorporated

5 questions for BLDR

John Lovallo

UBS Group AG

5 questions for BLDR

Ketan Mamtora

BMO Capital Markets

5 questions for BLDR

Trey Grooms

Stephens Inc.

5 questions for BLDR

Collin Verron

Deutsche Bank

4 questions for BLDR

Matthew Bouley

Barclays PLC

4 questions for BLDR

Philip Ng

Jefferies

4 questions for BLDR

Alex Rygiel

Texas Capital Securities

3 questions for BLDR

Brian Biros

Stephens Inc.

3 questions for BLDR

Jay McCanless

Wedbush Securities

3 questions for BLDR

Jeffrey Stevenson

Loop Capital Markets LLC

3 questions for BLDR

Keith Hughes

Truist Financial Corporation

3 questions for BLDR

Michael Dahl

RBC Capital Markets

3 questions for BLDR

Mike Dahl

RBC Capital Markets

3 questions for BLDR

Rafe Jadrosich

Bank of America

3 questions for BLDR

Adam Baumgarten

Zelman & Associates

2 questions for BLDR

Elizabeth Langan

Barclays

2 questions for BLDR

Ivy Lynne Zelman

Zelman & Associates

2 questions for BLDR

Sam Reid

Wells Fargo

2 questions for BLDR

Sean McAleer

Bank of America

2 questions for BLDR

Alexander Rygiel

B. Riley Securities

1 question for BLDR

Ray Singh

Bank of America

1 question for BLDR

Reuben Garner

Stifel

1 question for BLDR

Steven Ramsey

Thompson Research Group

1 question for BLDR

Recent press releases and 8-K filings for BLDR.

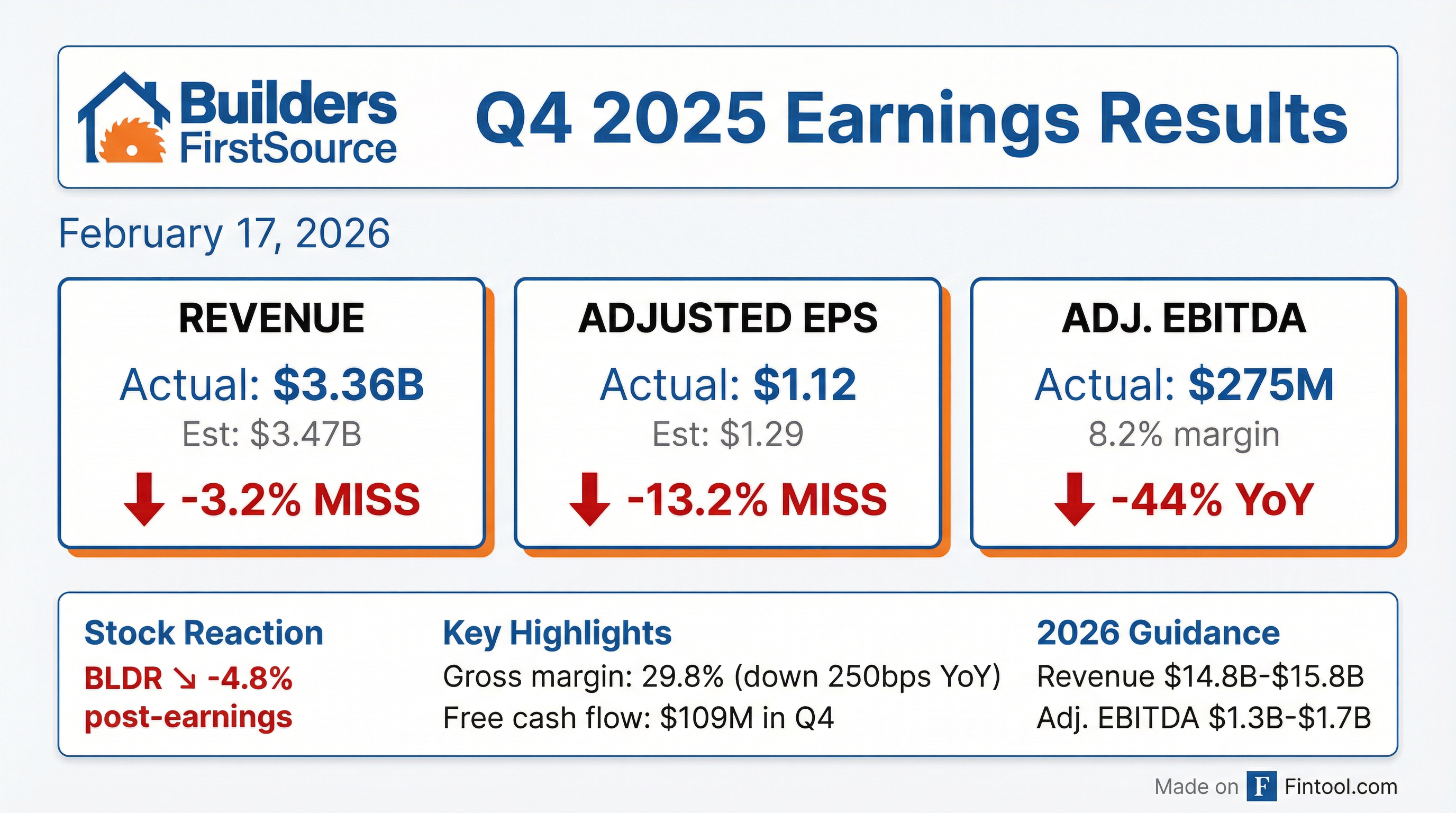

- Q4 net sales decreased 12% to $3.4 billion; gross margin was 29.8% (down 250 bps); adjusted EBITDA was $275 million (down 44%) with a margin of 8.2%; adjusted EPS was $1.12 (down 52%).

- Q4 operating cash flow was $195 million, free cash flow was $109 million, and full-year free cash flow was $874 million; net debt/Adjusted EBITDA was 2.7× with no long-term maturities until 2030.

- 2026 guidance projects net sales of $14.8 billion–$15.8 billion, adjusted EBITDA of $1.3 billion–$1.7 billion (8.8%–10.8% margin), gross margin of 28.5%–30%, and free cash flow of ≈$500 million, with a heavier second-half weighting.

- Continued strategic focus on cost efficiency and growth: $100 million in SG&A actions, 25 facility consolidations in 2025, >$110 million invested in value-added operations, and selective M&A to expand product offerings.

- Fiscal Q4 2025 net sales fell 12% to $3.4 billion, gross margin declined 250 bps to 29.8%, adjusted EBITDA decreased 44% to $275 million, and adjusted EPS was $1.12

- 2025 free cash flow totaled $874 million (8% yield), net debt/EBITDA ratio of 2.7x, with share repurchases boosting Q4 EPS by $0.04

- 2026 outlook includes net sales of $14.8–15.8 billion, adjusted EBITDA of $1.3–1.7 billion, EBITDA margin of 8.8–10.8%, and free cash flow of $500 million; Q1 sales of $3.0–3.3 billion and EBITDA of $175–225 million

- Late-2025 acquisitions (Builder’s Door & Trim, Rystin Construction, Lengefeld Lumber, Pleasant Valley Homes, Premium Building Components) mark 40 deals since 2021 totaling $2.3 billion in annual sales

- Q4 net sales decreased 12% to $3.4 billion; gross profit of $1 billion (-19%) and gross margin of 29.8% (-250 bps); Adjusted EBITDA $275 million (-44%) with margin 8.2% (-470 bps); Adjusted EPS $1.12 (-52%)

- Q4 operating cash flow of $195 million and free cash flow of $109 million; FY 2025 free cash flow of $874 million (8% yield); net debt/Adj. EBITDA ~2.7×; $500 million share repurchase capacity

- 2026 guidance: net sales of $14.8–15.8 billion, Adjusted EBITDA $1.3–1.7 billion, EBITDA margin 8.8–10.8%, and free cash flow approx. $500 million; expects flat starts in single-family and multifamily, and +1% repair & remodel

- Completed five acquisitions including Builder’s Door & Trim, Rystin Construction, Lengefeld Lumber, Pleasant Valley Homes, and Premium Building Components, expanding into modular housing and truss/wall panel operations

- Implemented $100 million in SG&A cost actions (including $75 million reductions and $25 million avoidance), consolidated 25 facilities, and continued tech and automation investments to boost productivity

- Q4 net sales of $3,357.9 million, down 12.1% year-over-year

- Q4 GAAP net income of $31.5 million and adjusted net income of $124.3 million (diluted EPS $1.12)

- Q4 adjusted EBITDA of $274.9 million with a margin of 8.2%, versus 12.9% in Q4 2024

- Q4 free cash flow of $109.1 million

- Core organic sales declined 14%, driven by single-family starts down 15% and multi-family down 20%

- Fourth quarter 2025 net sales of $3.4 billion, down 12.1% year-over-year, with gross profit margin declining to 29.8%.

- Q4 adjusted EBITDA of $274.9 million, down 44.3%, and adjusted EBITDA margin of 8.2%.

- Full-year 2025 net sales of $15.2 billion, down 7.4%, and adjusted EBITDA of $1.6 billion, down 32.0%.

- 2026 outlook: net sales of $14.8 billion to $15.8 billion, adjusted EBITDA of $1.3 billion to $1.7 billion, and free cash flow of ~$0.5 billion.

- In Q4 2025, net sales were $3.4 B, down 12.1% y/y and net income was $31.5 M (EPS $0.28).

- Q4 2025 Adjusted EBITDA declined 44.3% to $274.9 M, with margin contracting 470 bps to 8.2%.

- For full-year 2025, net sales totaled $15.2 B (–7.4%), Adjusted EBITDA was $1.6 B (–32.0%) with a 10.4% margin, and free cash flow was $874 M.

- 2026 outlook calls for net sales of $14.8–15.8 B, Adjusted EBITDA of $1.3–1.7 B, and free cash flow of approximately $0.5 B.

- Builders FirstSource reported Q4 2025 adjusted EPS of $1.12 and revenue of $3.36 B, down about 12% year-over-year, missing Street estimates.

- Full-year 2026 revenue guidance set at $14.8 B to $15.8 B (midpoint $15.3 B) and EBITDA guidance of $1.5 B, slightly above consensus on revenue and in line on EBITDA.

- Operating margin declined to 1.8% (from 8% a year earlier) and free cash flow margin fell to 3.2%, attributed to housing affordability pressures and weak consumer confidence.

- Shares dipped about 4.8% in one day and 9.5% over the past month, with a fair-value estimate near $130 cited as a potential buying opportunity.

- The “Trump Homes” initiative proposes a rent-to-own model to finance up to 1 million entry-level homes, with renters’ payments accruing toward down payments after three years.

- Builders FirstSource supplies lumber, prefabricated components, trusses, and building materials at scale, aligning with the plan’s emphasis on standardization, speed, and logistics efficiency.

- Implementation of the initiative could drive incremental volume growth across regional markets for Builders FirstSource.

- Net sales decreased 6.9% to $3.9 billion; gross profit was $1.2 billion (–13.5%), with a gross margin of 30.4% (–240 bps); adjusted EBITDA was $434 million (–31%) with an 11% margin (–380 bps).

- Operating cash flow of $548 million, free cash flow of $465 million, a 12-month free cash flow yield of ~8%, and net debt/adjusted EBITDA of 2.3x; no long-term debt maturities until 2030.

- Deployed over $100 million in return-enhancing capital in Q3, completed acquisitions including St. George Truss and Builders Door & Trim, and have $500 million remaining on the share repurchase authorization.

- Raised 2025 guidance to net sales of $15.1–15.4 billion, adjusted EBITDA of $1.625–1.675 billion, full-year gross margin of 30.1–30.5%, and free cash flow of $800 million–$1 billion.

- Continued operational discipline in a weak housing market with $11 million in productivity savings, consolidation of 16 facilities year-to-date, and maintained a 92% on-time delivery rate.

- Q3 net sales decreased 6.9% to $3.9 billion, gross margin of 30.4%, adjusted EBITDA of $434 million (11.0% margin), and adjusted EPS of $1.88.

- Operating cash flow was $548 million, free cash flow $465 million, net debt/EBITDA ~2.3×, and $500 million remaining on the share repurchase authorization.

- Deployed over $100 million in Q3 capital toward organic, M&A, and buybacks, including acquisition of St. George Truss Co., Builders Door and Trim, and Ryston Construction.

- 2025 guidance raised to net sales of $15.1–15.4 billion, adjusted EBITDA $1.625–1.675 billion, gross margin 30.1–30.5%, and free cash flow $800 million–$1 billion.

- Digital tools processed over $2.5 billion of orders and $5 billion of quotes YTD; Q3 saw key SAP conversions for accounting and reporting.

Quarterly earnings call transcripts for Builders FirstSource.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more