Earnings summaries and quarterly performance for Princeton Bancorp.

Executive leadership at Princeton Bancorp.

Edward Dietzler

Detailed

President and Chief Executive Officer

CEO

CT

Christopher Tonkovich

Detailed

Executive Vice President and Chief Credit Officer

DO

Daniel O’Donnell

Detailed

Executive Vice President, General Counsel and Chief Operating Officer

GR

George Rapp

Detailed

Executive Vice President and Chief Financial Officer

JH

Jeffrey Hanuscin

Detailed

Senior Vice President, Treasurer and Chief Accounting Officer

MC

Matthew Clark

Detailed

Executive Vice President and Chief Information Officer

SA

Stephanie Adkins

Detailed

Executive Vice President and Chief Lending Officer

Board of directors at Princeton Bancorp.

Research analysts covering Princeton Bancorp.

Recent press releases and 8-K filings for BPRN.

Princeton Bancorp Reports Q4 and Full-Year 2025 Results

BPRN

Earnings

Share Buyback

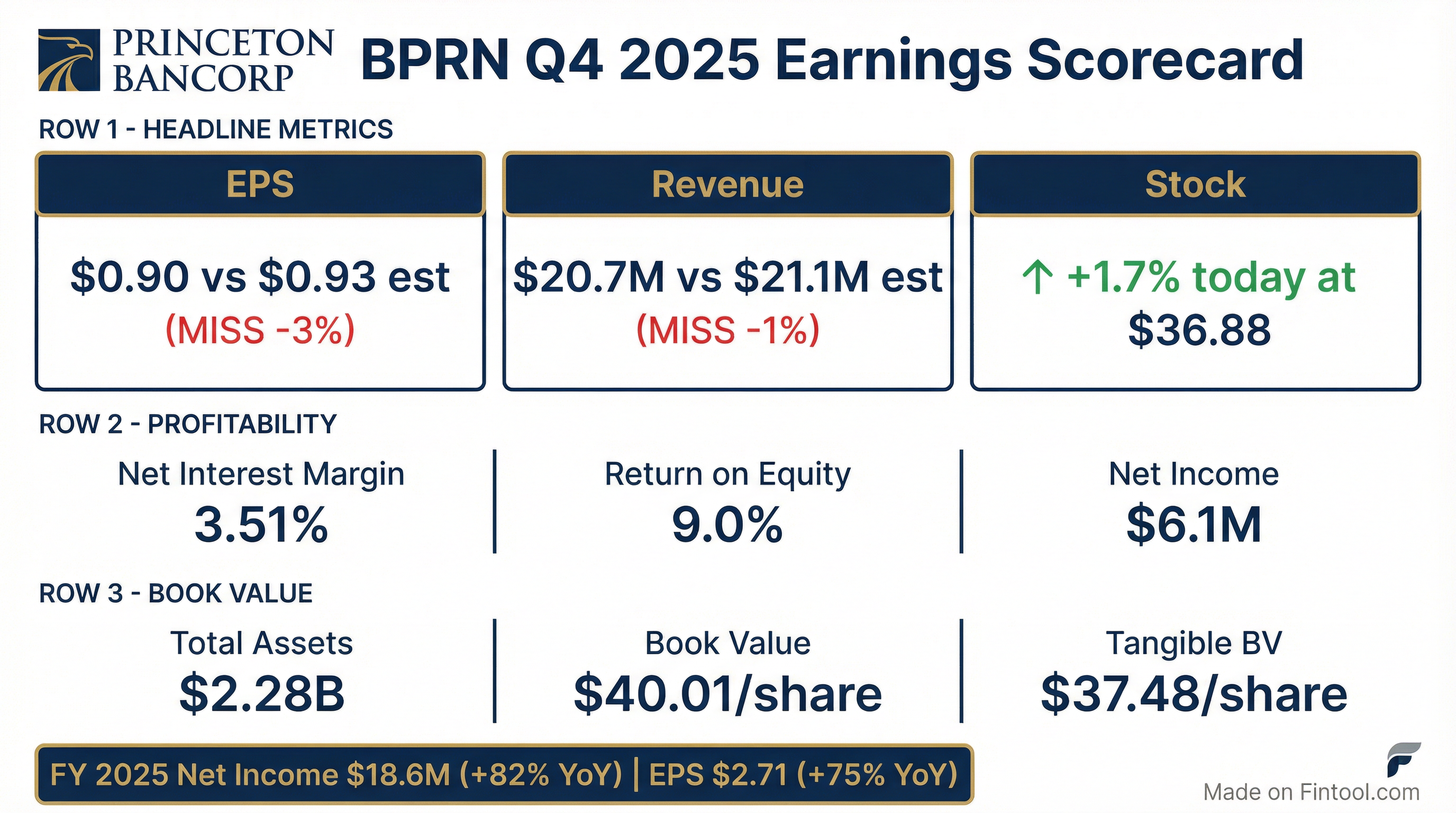

- Princeton Bancorp reported net income of $6.1 million and diluted EPS of $0.90 for the fourth quarter of 2025. This compares to $6.5 million net income and $0.95 diluted EPS in Q3 2025, and $5.2 million net income and $0.75 diluted EPS in Q4 2024.

- Total assets decreased by $57.1 million (2.44%) to $2.28 billion at December 31, 2025, primarily due to a $66.6 million decrease in investment securities. Concurrently, total deposits decreased by $56.4 million (2.78%) to $1.976 billion at December 31, 2025.

- Non-performing assets totaled $16.5 million at December 31, 2025, representing a decrease of $10.6 million compared to December 31, 2024.

- Total stockholders' equity increased by $8.7 million (3.31%) to $270.7 million at December 31, 2025, leading to an improvement in the equity to total assets ratio to 11.9% from 11.2% at December 31, 2024.

Jan 29, 2026, 9:00 PM

Princeton Bancorp Announces Q4 and Full-Year 2025 Results

BPRN

Earnings

Share Buyback

Demand Weakening

- Princeton Bancorp reported net income of $6.1 million and diluted EPS of $0.90 for the fourth quarter of 2025, which is a decrease from $6.5 million and $0.95, respectively, in Q3 2025, but an increase from $5.2 million and $0.75 in Q4 2024.

- For the full year 2025, net income was $18.6 million, or $2.71 per diluted common share, a significant increase from $10.2 million and $1.55 per diluted common share in 2024.

- Total assets at December 31, 2025, decreased by 2.44% to $2.28 billion, and total deposits decreased by 2.78% to $1.98 billion compared to December 31, 2024.

- The net interest margin for Q4 2025 was 3.51%, a decrease of 26 basis points from Q3 2025 but an increase of 23 basis points from Q4 2024.

- Non-performing assets at December 31, 2025, totaled $16.5 million, representing a decrease of $10.6 million compared to December 31, 2024, and the equity to total assets ratio improved to 11.9% from 11.2% year-over-year.

Jan 29, 2026, 9:00 PM

Princeton Bancorp, Inc. Announces Cash Dividend

BPRN

Dividends

- Princeton Bancorp, Inc. announced a cash dividend of $0.35 per share of common stock on October 29, 2025.

- This dividend represents a 16.7% increase.

- The dividend will be payable on November 26, 2025, to shareholders of record as of November 7, 2025.

Oct 29, 2025, 8:20 PM

Princeton Bancorp Announces Strong Third Quarter 2025 Results

BPRN

Earnings

Revenue Acceleration/Inflection

- Princeton Bancorp, Inc. reported net income of $6.5 million and diluted earnings per share of $0.95 for the third quarter of 2025. This compares to $688 thousand, or $0.10 per diluted common share, for the second quarter of 2025, and a net loss of ($4.5) million, or ($0.68) per diluted common share, for the third quarter of 2024.

- The company's net interest margin increased to 3.77% in Q3 2025, a 23-basis-point increase compared to the prior quarter.

- Total assets at September 30, 2025, were $2.23 billion, representing a 4.75% decrease from December 31, 2024.

- Total deposits at September 30, 2025, decreased by $104.0 million, or 5.12%, when compared to December 31, 2024.

- Non-performing assets totaled $16.7 million at September 30, 2025, a $10.4 million decrease compared to December 31, 2024.

Oct 29, 2025, 8:00 PM

Princeton Bancorp Announces Third Quarter 2025 Results

BPRN

Earnings

M&A

- Princeton Bancorp, Inc. reported net income of $6.5 million and diluted earnings per share (EPS) of $0.95 for the third quarter of 2025. This is a significant increase compared to a net income of $688 thousand ($0.10 diluted EPS) in Q2 2025 and a net loss of ($4.5) million (($0.68) diluted EPS) in Q3 2024.

- The strong Q3 2025 performance was primarily due to a $7.6 million decrease in provision for credit losses compared to Q2 2025, and the absence of $7.8 million in Cornerstone Bank merger-related expenses that were recorded in Q3 2024. The net interest margin also increased by 23 basis points to 3.77% compared to the prior quarter.

- As of September 30, 2025, total assets were $2.23 billion, and total deposits were $1.93 billion. Total stockholders' equity increased by $4.6 million (1.74%) to $266.6 million compared to December 31, 2024, and non-performing assets decreased by $10.4 million to $16.7 million over the same period.

Oct 29, 2025, 8:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more