Earnings summaries and quarterly performance for Black Stone Minerals.

Executive leadership at Black Stone Minerals.

Thomas L. Carter, Jr.

Chairman, Chief Executive Officer, and President

Chris R. Bonner

Vice President, Chief Accounting Officer

Fowler T. Carter

Senior Vice President, Corporate Development

H. Taylor DeWalch

Senior Vice President, Chief Financial Officer

L. Steve Putman

Senior Vice President, General Counsel, and Secretary

Board of directors at Black Stone Minerals.

Research analysts who have asked questions during Black Stone Minerals earnings calls.

John Annis

Texas Capital Bank

3 questions for BSM

Tim Rezvan

KeyBanc Capital Markets

3 questions for BSM

Derrick Whitfield

Texas Capital

2 questions for BSM

Timothy Rezvan

KeyBanc Capital Markets Inc.

2 questions for BSM

Recent press releases and 8-K filings for BSM.

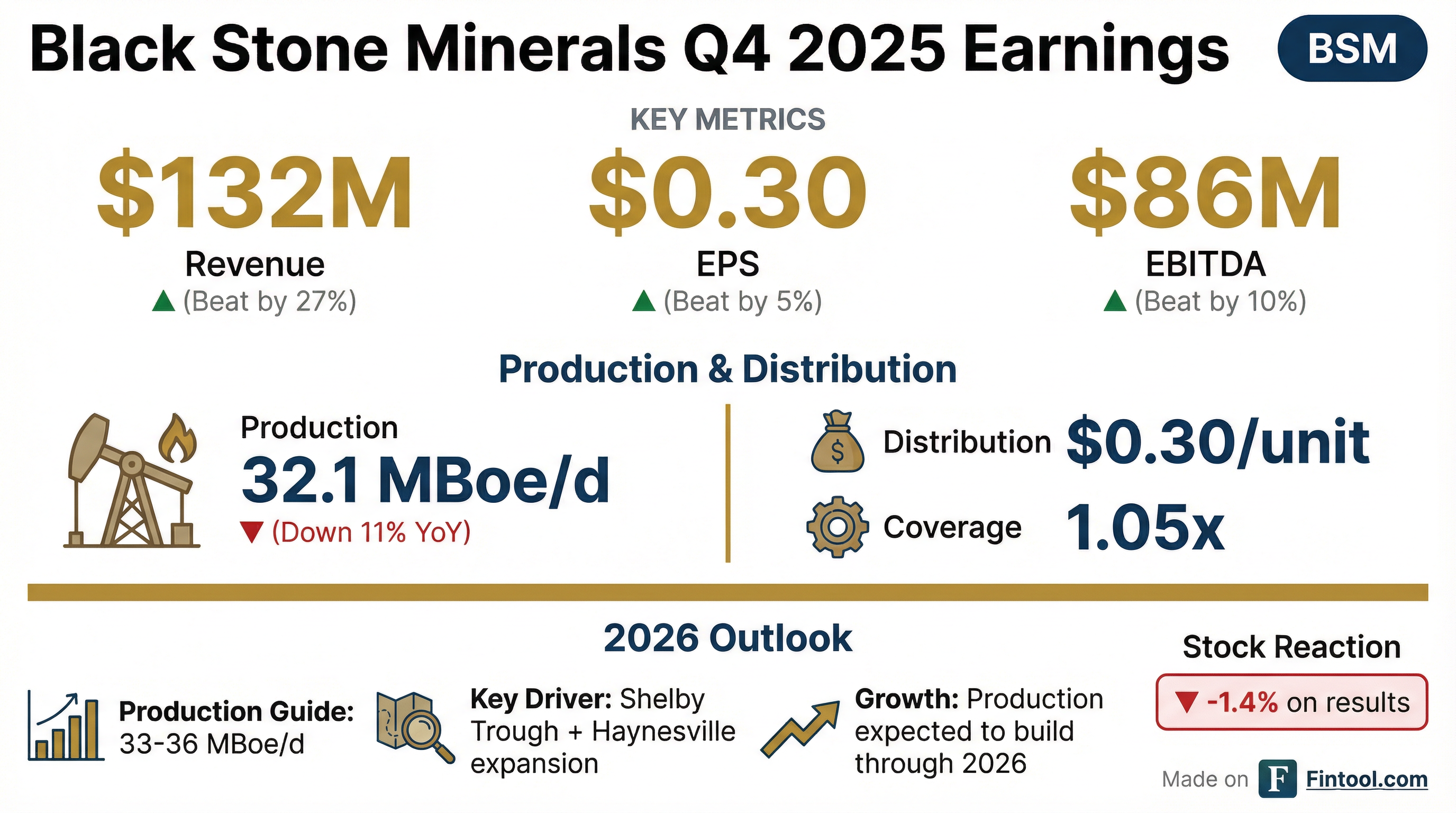

- Black Stone Minerals (BSM) reported a strong 2025, ending the year at the high end of updated guidance despite headwinds from production and oil prices.

- The company achieved significant commercial milestones, signing development agreements with Revenant Energy and Caturus Energy, placing approximately 500,000 gross acres into development with minimum drilling commitments ramping up to 37 gross wells per year by 2031 from these programs, and a total of 50 gross wells including Aethon over the same period.

- For Q4 2025, mineral and royalty production was 30.9 thousand BOE per day, total production was 32.1 thousand BOE per day. Net income was $72.2 million, Adjusted EBITDA was $76.7 million, and distributable cash flow was $66.8 million, representing 1.05 times coverage for the declared $0.30 per unit distribution.

- While full-year 2026 production guidance is roughly flat year-over-year, the company expects solid growth from Q4 2025 to Q4 2026, starting the year at about 32,000 BOE per day and increasing materially throughout 2026 due to new development agreements and high-interest projects.

- Strategic investments include initiating two substantial 3D seismic surveys covering about 360,000 gross acres in the Shelby Trough and Haynesville expansion area, with most costs expected in 2026, and investing about $240 million in accretive mineral and royalty acreage since 2023. The company is confident in funding its distribution, supported by minimum commitments and strong natural gas hedges.

- Black Stone Minerals reported Q4 2025 net income of $72.2 million, adjusted EBITDA of $76.7 million, and distributable cash flow of $66.8 million, supporting a $0.30 per unit distribution with 1.05x coverage.

- In 2025, the company signed development agreements with Revenant Energy and Katouris Energy, placing approximately 500,000 gross acres into development with minimum drilling commitments ramping up to 50 gross wells per year by 2031.

- For 2026, Black Stone Minerals anticipates material production growth throughout the year, starting from 32,000 BOE per day at the end of 2025, and is confident in funding its $0.30 distribution due to minimum commitments and strong natural gas hedges.

- The company is also strategically increasing G&A in 2026 and undertaking two substantial 3D seismic surveys covering 360,000 gross acres in the Shelby Trough and Haynesville expansion area, with most costs expected in 2026 and completion in early 2027.

- Black Stone Minerals reported net income of $72.2 million, adjusted EBITDA of $76.7 million, and distributable cash flow of $66.8 million for Q4 2025, supporting a $0.30 per unit distribution with 1.05 times coverage.

- Total production for Q4 2025 was 32.1 thousand BOE per day, and while 2026 production guidance is roughly flat year-over-year, the company expects material growth throughout 2026 from Q4 2025 to Q4 2026, with management expressing confidence in funding the distribution due to minimum commitments and strong natural gas hedges.

- Strategic initiatives include new development agreements with Revenant Energy and Caturus Energy, placing approximately 500,000 gross acres into development with drilling commitments of up to 37 gross wells per year by 2031, and two substantial 3D seismic surveys covering 360,000 gross acres in the Shelby Trough and Haynesville expansion area.

- Black Stone Minerals, L.P. announced its financial and operating results for the fourth quarter and full year of 2025 and provided guidance for 2026.

- The Partnership reported net income and Adjusted EBITDA for both the fourth quarter and full year 2025, alongside Distributable Cash Flow for the quarter.

- A cash distribution of $0.30 per common unit was announced for Q4 2025, contributing to the full-year 2025 distributions.

- Total production for Q4 and full year 2025 was reported, with 2026 production guidance indicating expected growth driven by new development agreements in the Shelby Trough and Permian.

- The company continued its strategic acquisition program, acquiring significant mineral and royalty interests in 2025, and entered into new development agreements to expand its asset base.

| Metric | Q4 2025 | FY 2025 | FY 2026 Est. |

|---|---|---|---|

| Net Income ($USD Millions) | $72.2 | $299.9 | N/A |

| Adjusted EBITDA ($USD Millions) | $76.7 | $337.4 | N/A |

| Distributable Cash Flow ($USD Millions) | $66.8 | $300.039 | N/A |

| Distribution per Common Unit ($USD) | $0.30 | $1.28 | N/A |

| Total Production (MBoe/d) | 32.1 | 34.6 | 33 - 36 |

| Mineral and Royalty Production (MBoe/d) | 30.9 | 33.3 | 32.5 - 34.5 |

| Total Debt at Period End ($USD Millions) | $154.0 | N/A | N/A |

| Cash at Period End ($USD Millions) | $1.5 | N/A | N/A |

| Mineral and Royalty Interests Acquired ($USD Millions) | N/A | $114.5 | N/A |

| Exploration Expense ($USD Millions) | $9.624 | $18.6 | $28 - 32 |

| G&A - TOTAL ($USD Millions) | $14.080 | $55.5 | $62 - 65 |

- Black Stone Minerals reported Q4 2025 revenue of $118.7 million, an increase of approximately 41.8% year-over-year, and Adjusted EBITDA of $76.7 million.

- The company's distributable cash flow of $66.8 million in Q4 2025 covered the declared quarterly distribution of $0.30 per unit at roughly 1.05x coverage.

- Management projects a material rebound in 2026 production driven by new development agreements and drilling commitments, with plans for up to 37 gross wells per year by 2031.

- Black Stone Minerals finished 2025 with $154 million of debt against a $580 million borrowing base, and public-data metrics indicate strong liquidity with a current ratio of 4.37, debt-to-equity of 0.08, and an Altman Z-Score of 14.33.

- Black Stone Minerals, L.P. reported net income of $72.2 million and Adjusted EBITDA of $76.7 million for the fourth quarter of 2025, with Distributable Cash Flow of $66.8 million.

- For the full year 2025, the company's net income was $299.9 million and Adjusted EBITDA was $337.4 million, with mineral and royalty production averaging 33.3 MBoe/d.

- The Partnership announced a distribution of $0.30 per common unit for Q4 2025, contributing to $1.28 per common unit in cash distributions for the full year 2025.

- Black Stone Minerals provided 2026 guidance, projecting total production between 33 and 36 MBoe/d and exploration expenses of $28 - $32 million.

- Estimated proved oil and natural gas reserves at year-end 2025 were 54.8 MMBoe, a 4% decrease from year-end 2024.

- Blackstone Minerals reported Q3 2025 net income of $91,700,000 and adjusted EBITDA of $86,300,000.

- Mineral and royalty production increased 5% quarter-over-quarter to 34,700 BOE per day, driven by Permian Basin volumes, with 2025 production guidance maintained at 33,000 to 35,000 BOE per day.

- The company declared a distribution of $0.30 per unit for the quarter, supported by distributable cash flow of $76,800,000, achieving 1.21 times coverage.

- Blackstone Minerals added $20,000,000 in mineral and royalty acquisitions during the quarter, contributing to a total of approximately $193,000,000 since September 2023.

- Significant development initiatives are underway, including Revenant's program starting in early 2026 and a progressing agreement for 220,000 gross acres in the Shelby Trough, which are expected to more than double the current annual drilling rate in the next five years.

- Black Stone Minerals reported net income of $91.7 million and Adjusted EBITDA of $86.3 million for Q3 2025. The company declared a distribution of $0.30 per unit, supported by $76.8 million in distributable cash flow and a 1.21x coverage ratio.

- Mineral and royalty production increased 5% quarter-over-quarter to 34,700 BOE per day, with total production reaching 36,300 BOE per day. The 2025 production guidance remains unchanged at 33,000-35,000 BOE per day.

- The company added $20 million in mineral and royalty acquisitions during the quarter, bringing the total since September 2023 to approximately $193 million. Black Stone Minerals is advancing Haynesville expansion, including a new development agreement for 220,000 gross acres and Revenant Energy's development starting in early 2026.

- Upcoming promotions were announced for Fowler Carter, Taylor DeWalch, and Chris Bonner, with Tom Carter transitioning to the role of Executive Chair.

- Black Stone Minerals reported Q3 2025 mineral and royalty production of 34.7 thousand BOE per day, a 5% increase over the prior quarter, with total production at 36.3 thousand BOE per day.

- For Q3 2025, the company achieved net income of $91.7 million and Adjusted EBITDA of $86.3 million, declaring a distribution of $0.30 per unit.

- The company added $20 million in mineral and royalty acquisitions during the quarter, bringing total acquisitions since September 2023 to approximately $193 million.

- Black Stone Minerals is progressing a framework agreement for 220,000 gross acres in the Shelby Trough, which is expected to add the equivalent of 12 additional wells annually by 2030 and more than double the current annual drilling rate in the next five years.

- Management announced upcoming promotions for Ballard Carter, Taylor DeWalch, and Chris Bonner, with Tom Carter transitioning to Executive Chair.

- Black Stone Minerals reported net income of $91.7 million and Adjusted EBITDA of $86.3 million for Q3 2025.

- Mineral and royalty production for Q3 2025 was 34.7 thousand BOE per day, an increase of 5% over the prior quarter, with total production volumes at 36.3 thousand BOE per day. The company's 2025 production guidance remains unchanged at 33-35 thousand BOE per day.

- A distribution of $0.30 per unit was declared for the quarter, supported by distributable cash flow of $76.8 million, representing 1.21 times coverage.

- The company added $20 million in mineral and royalty acquisitions during the quarter, bringing total acquisitions since September 2023 to approximately $193 million.

- Black Stone Minerals is advancing development agreements in the Shelby Trough, expecting to more than double the current annual drilling rate in the next five years, and anticipates meaningful oil volume additions from Permian projects in the next 12 to 18 months.

Quarterly earnings call transcripts for Black Stone Minerals.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more