Earnings summaries and quarterly performance for FIRST BUSEY CORP /NV/.

Executive leadership at FIRST BUSEY CORP /NV/.

Van Dukeman

Chairman and Chief Executive Officer

Amy Fauss

Chief Information and Technology Officer

Amy Randolph

Chief Operating Officer

Chip Jorstad

Chief Credit Officer (Busey Bank)

Christopher Chan

Chief Financial Officer

John Powers

General Counsel and Corporate Secretary

Michael Maddox

Vice Chairman and President

Monica Bowe

Chief Risk Officer

Scott Phillips

Chief Accounting Officer

Board of directors at FIRST BUSEY CORP /NV/.

Frederic Kenney

Director

Jennifer Grigsby

Director

Karen Jensen

Director

Kevin Rauckman

Director

Michael Cassens

Director

Rodney Brenneman

Lead Independent Director

Scott Wehrli

Director

Stanley Bradshaw

Director

Stephen King

Director

Steven Caple

Director

Tiffany White

Director

Research analysts covering FIRST BUSEY CORP /NV/.

Recent press releases and 8-K filings for BUSE.

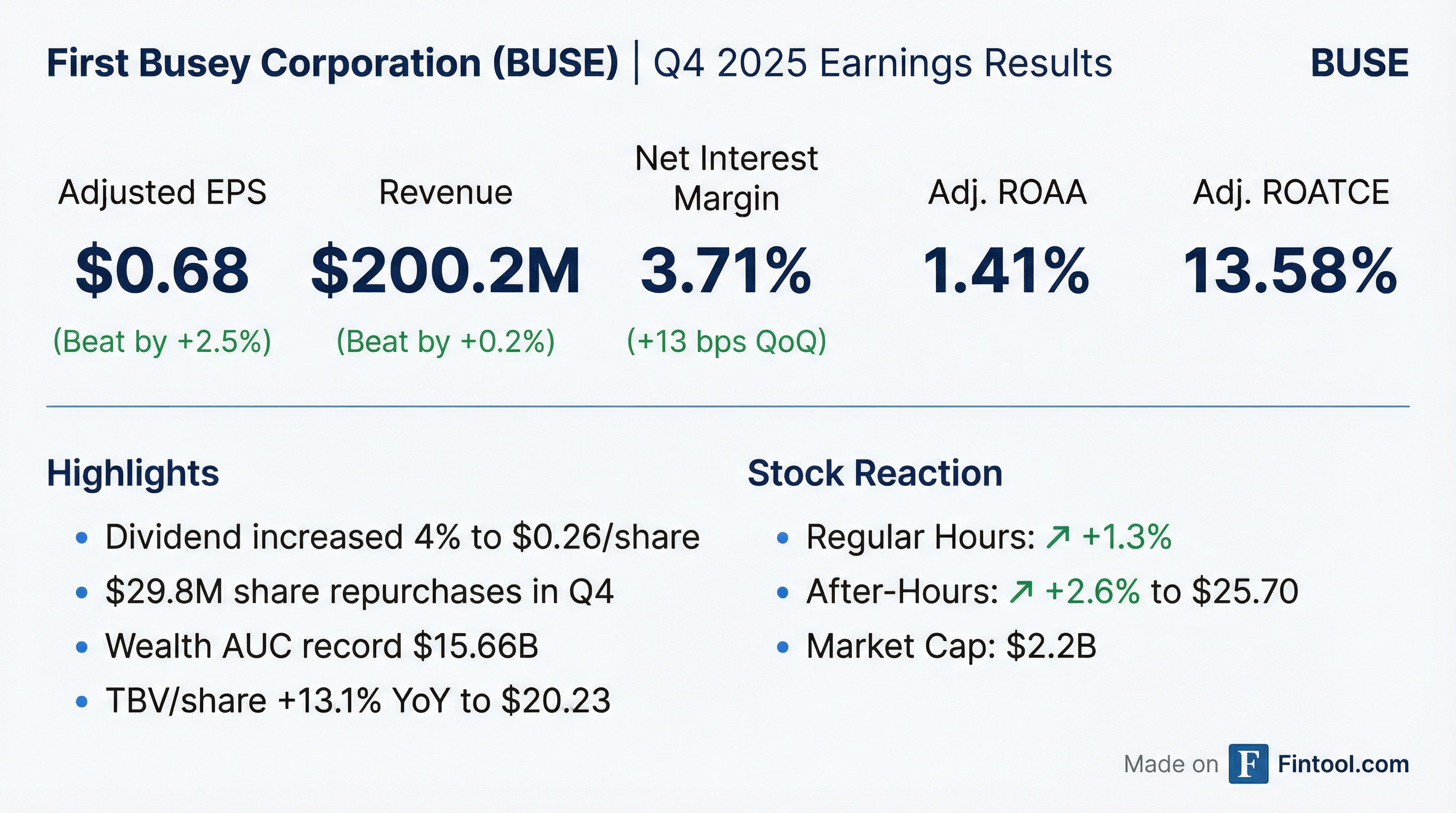

- First Busey Corporation announced net income of $60.8 million and diluted EPS of $0.63 for the fourth quarter of 2025, with adjusted diluted EPS reaching $0.68.

- The company reported improved profitability, with adjusted return on average assets increasing to 1.41% and net interest margin expanding to 3.71% in Q4 2025.

- Wealth management fee income achieved a record quarter, as assets under care grew 4.7% quarter-over-quarter to $15.66 billion.

- First Busey maintained a strong capital position, with Common Equity Tier 1 Capital to Risk Weighted Assets at 12.44% and Tangible common equity to tangible assets at 10.06% at December 31, 2025.

- The Board announced management changes, with Van A. Dukeman assuming the roles of President of First Busey Corporation and CEO of Busey Bank, and T. Anthony (Tony) Hammond appointed President of Busey Bank. Additionally, the company repurchased $29.8 million of stock in Q4 2025 and increased its quarterly common stock dividend to $0.26.

- First Busey Corporation reported Q4 2025 net income of $60.8 million (diluted EPS of $0.63) and adjusted net income of $65.2 million (adjusted diluted EPS of $0.68).

- The company's net interest margin expanded to 3.71%, and wealth management assets under care grew 4.7% quarter-over-quarter to $15.66 billion.

- Capital remained strong, with Common Equity Tier 1 Capital to Risk Weighted Assets at 12.44%, and $29.8 million of stock was repurchased in Q4 2025.

- Deposits decreased by $164.2 million, driven by an intentional $180.0 million runoff of brokered and high-cost, non-relationship funding.

- Van A. Dukeman assumed the roles of President of First Busey Corporation and CEO of Busey Bank, following the separation of Michael J. Maddox.

- First Busey Corporation reported net income of $57.1 million, or $0.58 per diluted common share, for the third quarter of 2025, with adjusted diluted EPS reaching $0.64. The company's Net Interest Margin was 3.58%, adjusted return on average assets (ROAA) improved to 1.33%, and adjusted return on average tangible common equity (ROATCE) was 13.20%.

- As of September 30, 2025, First Busey Corporation had total assets of $18.19 billion and total deposits of $15.07 billion. During Q3 2025, the company executed a strategic reduction of $794.6 million in high-cost, non-relationship deposits, which had a weighted average cost of 4.45%. Excluding this targeted runoff, deposits grew by $63.0 million.

- Capital remained robust, with Common Equity Tier 1 Capital growing to 12.33% and tangible common equity to tangible assets reaching 9.9%. Tangible book value per common share increased 10.1% since year-end. The company returned $13.5 million to shareholders in Q3 2025 by repurchasing 580,000 shares at a weighted average price of $23.36 per share, bringing the year-to-date total to $40 million.

- First Busey Corporation reported strong Q2 2025 financial highlights, including $18.9 billion in total assets, a net interest margin of 3.49%, and an adjusted efficiency ratio of 55.3%.

- The company completed the merger of CrossFirst Bank into Busey Bank on June 20, 2025, and is on track to realize ~$25 million in expected cost savings, with ~70% already realized by the end of Q2 2025.

- First Busey returned $26.5 million to shareholders year-to-date through June 30, 2025, via an active share repurchase plan.

- The CrossFirst acquisition expanded Busey's presence into new high-growth markets, including Dallas Fort-Worth, Phoenix, and Denver, and has shown early success in attracting new wealth management assets and talent.

- The company maintains a robust capital foundation with a total capital ratio of 15.8% and core deposits representing 92.5% of total deposits as of June 30, 2025.

Fintool News

In-depth analysis and coverage of FIRST BUSEY CORP /NV/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more