Earnings summaries and quarterly performance for Century Communities.

Executive leadership at Century Communities.

Board of directors at Century Communities.

Research analysts who have asked questions during Century Communities earnings calls.

Andrew Azzi

JPMorgan Chase & Co.

5 questions for CCS

Jay McCanless

Wedbush Securities

5 questions for CCS

Alan Ratner

Zelman & Associates

4 questions for CCS

Alex Barron

Housing Research Center

3 questions for CCS

Alex Rygiel

Texas Capital Securities

3 questions for CCS

Carl Reichardt

BTIG, LLC

3 questions for CCS

Kenneth Zener

Seaport Research Partners

3 questions for CCS

Natalie Kulasekere

Zelman & Associates

3 questions for CCS

Rohit Seth

B. Riley Securities

2 questions for CCS

Alexander Rygiel

B. Riley Securities

1 question for CCS

Alex Riegel

Texas Capital

1 question for CCS

Michael Rehaut

JPMorgan Chase & Co.

1 question for CCS

Zain Razi

JPMorgan Chase & Co.

1 question for CCS

Recent press releases and 8-K filings for CCS.

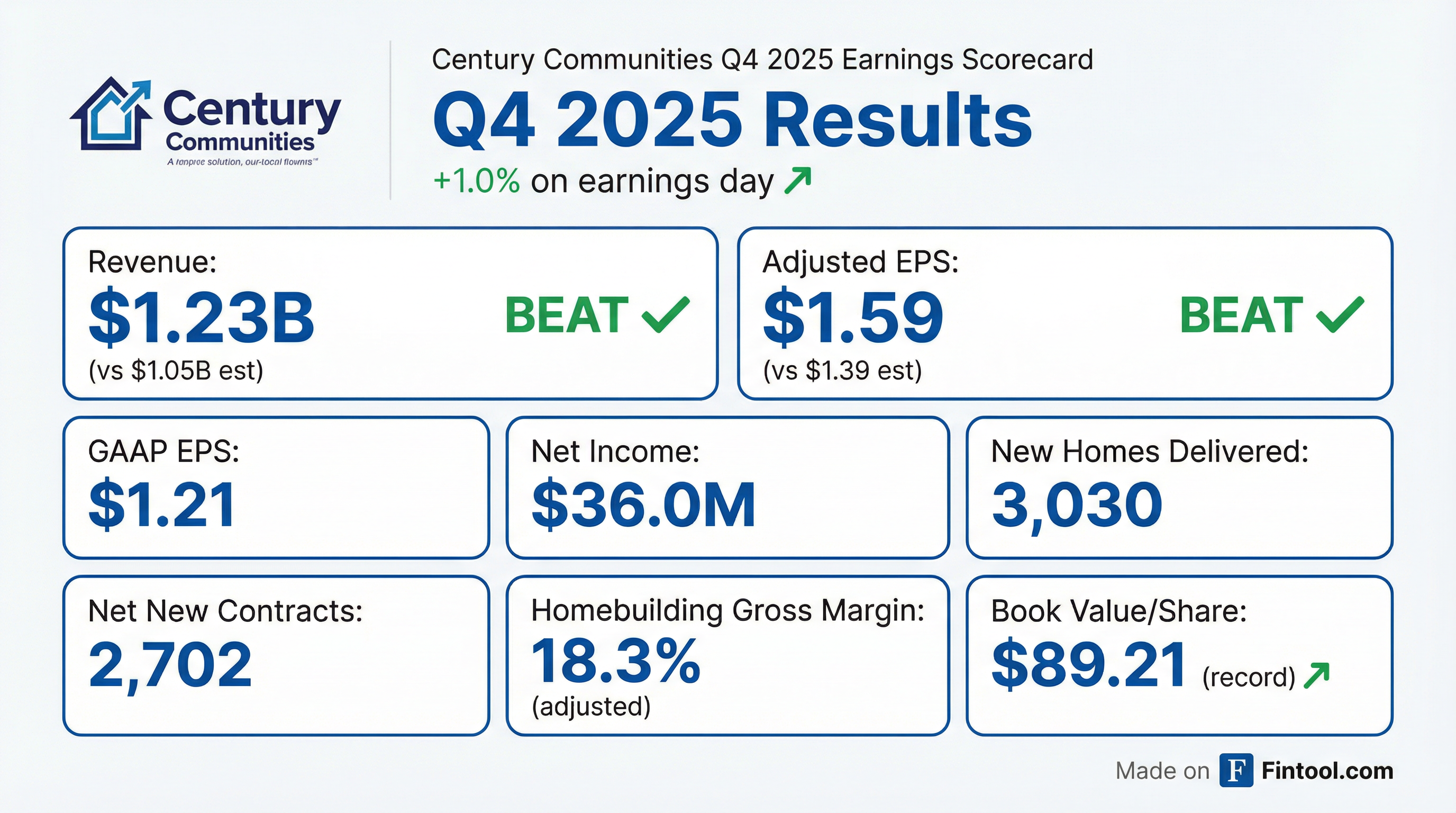

- Century Communities (CCS) exceeded Q4 2025 guidance, delivering 3,435 residential units and achieving a record 2,702 net new contracts.

- For the full year 2025, the company generated $153 million in cash flow from operations, reduced net leverage to 26%, and ended the year with a record book value per share of $89.

- CCS repurchased 2.3 million shares in 2025, representing 7% of shares outstanding, and returned a record $178 million to shareholders through dividends and buybacks.

- The company issued full-year 2026 guidance, projecting new home deliveries between 10,000 and 11,000 homes and home sales revenues between $3.6 billion and $4.1 billion.

- Operational efficiencies included reducing direct construction costs by $13,000 per home and cycle times to a record 114 calendar days.

- Century Communities reported Q4 2025 net income of $36 million, or $1.21 per diluted share, with adjusted net income of $47 million, or $1.59 per diluted share. Home sales revenues for the quarter were $1.1 billion, and the company delivered 3,030 new homes.

- For the full year 2025, the company delivered 10,792 residential units and generated $153 million in cash flow from operations. They ended the year with a record book value per share of $89.21 and reduced net leverage to 26%.

- Century Communities repurchased 2.3 million shares in 2025, representing over 7% of shares outstanding, at an average price of $63.32, and returned a record $178 million to shareholders through dividends and repurchases.

- For full year 2026, the company expects new home deliveries to range from 10,000 to 11,000 homes and home sales revenues between $3.6 billion and $4.1 billion. Q1 2026 deliveries are projected to be 2,100 to 2,300 homes, representing the low point for the year.

- The company achieved a record low cycle time of 114 calendar days in Q4 2025 and recorded net new contracts of 2,702 homes, a Q4 company record.

- For Fiscal Year 2025, Century Communities reported total revenues of $4.12 billion, net income of $147.6 million, and diluted earnings per share of $4.86. The homebuilding gross margin for the year was 17.6%.

- The company delivered 10,387 homes in 2025, with an average sales price of $378,000, and 99% of total deliveries were spec builds.

- Century Communities projects 10% delivery growth in both 2026 and 2027, assuming improved market conditions, and expects 2026 finished lot costs to increase only in the low single-digit percentage range over Q4 2025 levels.

- In 2025, the company repurchased over 7% of outstanding shares and plans to deploy excess capital to dividends and opportunistic share repurchases.

- The financial services segment contributed $86 million in revenues and $19 million in pretax income in Fiscal Year 2025, achieving a Q4 2025 capture rate of 84%.

- Century Communities reported record net new contracts of 2,702 homes in Q4 2025, a 13% sequential increase, and home sales revenues of $1.1 billion, up 16% sequentially.

- For the full year 2025, the company delivered 10,792 residential units, generated $153 million in cash flow from operations, and ended the year with a record book value per share of $89.21.

- The company's net leverage improved to 25.9% in Q4 2025, and it repurchased 2.3 million shares (7% of shares outstanding) during 2025, returning a total of $178 million to shareholders.

- Century Communities provided full-year 2026 guidance, expecting new home deliveries between 10,000 and 11,000 homes and home sales revenues ranging from $3.6 billion to $4.1 billion.

- Operational highlights include reducing cycle times to a record 114 calendar days and decreasing direct construction costs on starts by an average of $13,000 per home in 2025.

- For the fourth quarter of 2025, Century Communities reported net income of $36.0 million, or $1.21 per diluted share, on $1.2 billion in total revenues.

- For the full year 2025, net income was $147.6 million, or $4.86 per diluted share, with total revenues reaching $4.1 billion.

- The company achieved a record book value per share of $89.21 as of December 31, 2025, and repurchased 2,267,723 shares of common stock for $143.6 million during the full year 2025.

- Century Communities provided a full year 2026 outlook, expecting new home deliveries to be in the range of 10,000 to 11,000 homes and home sales revenues between $3.6 billion and $4.1 billion.

- For the fourth quarter of 2025, Century Communities reported total revenues of $1.2 billion and net income of $36.0 million, or $1.21 per diluted share. For the full year 2025, total revenues were $4.1 billion and net income was $147.6 million, or $4.86 per diluted share.

- The company achieved a record book value per share of $89.21 and maintained $1.1 billion in total liquidity as of December 31, 2025.

- In 2025, Century Communities repurchased 2,267,723 shares for $143.6 million and paid $1.16 per share in cash dividends.

- For the full year 2026, the company expects new home deliveries to be between 10,000 and 11,000 homes and home sales revenues to range from $3.6 billion to $4.1 billion.

- Century Communities reported third quarter 2025 net income of $37.4 million, or $1.25 per diluted share, and total revenues of $980.3 million.

- The company delivered 2,486 homes and achieved an adjusted homebuilding gross margin of 20.1% in Q3 2025.

- As of September 30, 2025, book value per share reached a company record of $87.74, supported by $2.6 billion of stockholders' equity and $835.8 million of total liquidity.

- During the quarter, 296,903 shares of common stock were repurchased for $20.0 million.

- The full year 2025 outlook was narrowed, with home deliveries expected to be 10,000 to 10,250 homes and home sales revenues projected between $3.8 and $3.9 billion.

- Century Communities, Inc. (CCS) issued $500 million aggregate principal amount of its 6.625% Senior Notes due 2033 on September 17, 2025.

- The Notes will mature on September 15, 2033, with interest accruing from September 17, 2025, and payable semi-annually on March 15 and September 15, commencing March 15, 2026.

- These Notes are general unsecured senior obligations of the Company and are guaranteed on an unsecured senior basis by the Guarantors, but are subordinated to the Company's and Guarantors' future secured debt and liabilities of non-guaranteeing subsidiaries.

- The Company may redeem the Notes, in whole or in part, on or after September 15, 2028, at specified redemption prices, or prior to that date at 100% of the principal amount plus a "make whole" premium.

- If the Company experiences certain change of control events accompanied by a ratings downgrade, it will be required to offer to repurchase the Notes at 101% of their principal amount.

- Q1 2025 Performance: Delivered 2,284 homes with net income of approximately $39M ($1.26/share) and adjusted net income around $42M.

- Revenue & Margins: Generated between $884M in home sales revenue and $903.2M in total revenues, with homebuilding gross margins ranging from 20% to 21.6%.

- Guidance Update: Expects Q2 2025 home deliveries of 2,300–2,500 homes and revised full‐year guidance of 10,400–11,000 deliveries with home sales revenues between $4.0–$4.2B.

- Operational Growth: Achieved a 26% YoY increase in community count to 318, a 5% growth in lot count to 79,014 lots, and secured 2,692 net new home contracts.

- Financial Performance: Increased book value per share by 11% YoY to $84.41, underpinning continued profitability.

- Capital Actions: Raised the quarterly dividend by 12% to $0.29/share and repurchased approximately 753K shares for ~$56M.

- Strategic Positioning: Operates in 17 states and over 45 markets with a land‐light, low‐risk model, maintaining 22 consecutive years of profitability and an increased senior unsecured credit facility to $1.0 billion.

- Century Communities Inc. declared a quarterly cash dividend of $0.29 per share, which is a 12% increase over the previous $0.26 per share.

- The dividend is scheduled to be paid on March 12, 2025 with stockholders of record as of February 26, 2025.

Quarterly earnings call transcripts for Century Communities.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more