Earnings summaries and quarterly performance for Carlyle Secured Lending.

Executive leadership at Carlyle Secured Lending.

Justin Plouffe

President and Chief Executive Officer

Joshua Lefkowitz

Chief Compliance Officer and Secretary

Michael Hadley

Chief Investment Officer

Nelson Joseph

Principal Accounting Officer and Treasurer

Thomas Hennigan

Chief Financial Officer and Chief Risk Officer

Board of directors at Carlyle Secured Lending.

Research analysts who have asked questions during Carlyle Secured Lending earnings calls.

Melissa Wedel

JPMorgan Chase & Co.

4 questions for CGBD

Erik Zwick

Lucid Capital Markets

3 questions for CGBD

Finian O'Shea

Wells Fargo Securities

3 questions for CGBD

Brian McKenna

Citizens JMP Securities

2 questions for CGBD

Rick Shane

JPMorgan Chase & Co.

2 questions for CGBD

Bryce Rowe

B. Riley Securities

1 question for CGBD

Derek Hewett

Bank of America

1 question for CGBD

Robert Dodd

Raymond James

1 question for CGBD

Recent press releases and 8-K filings for CGBD.

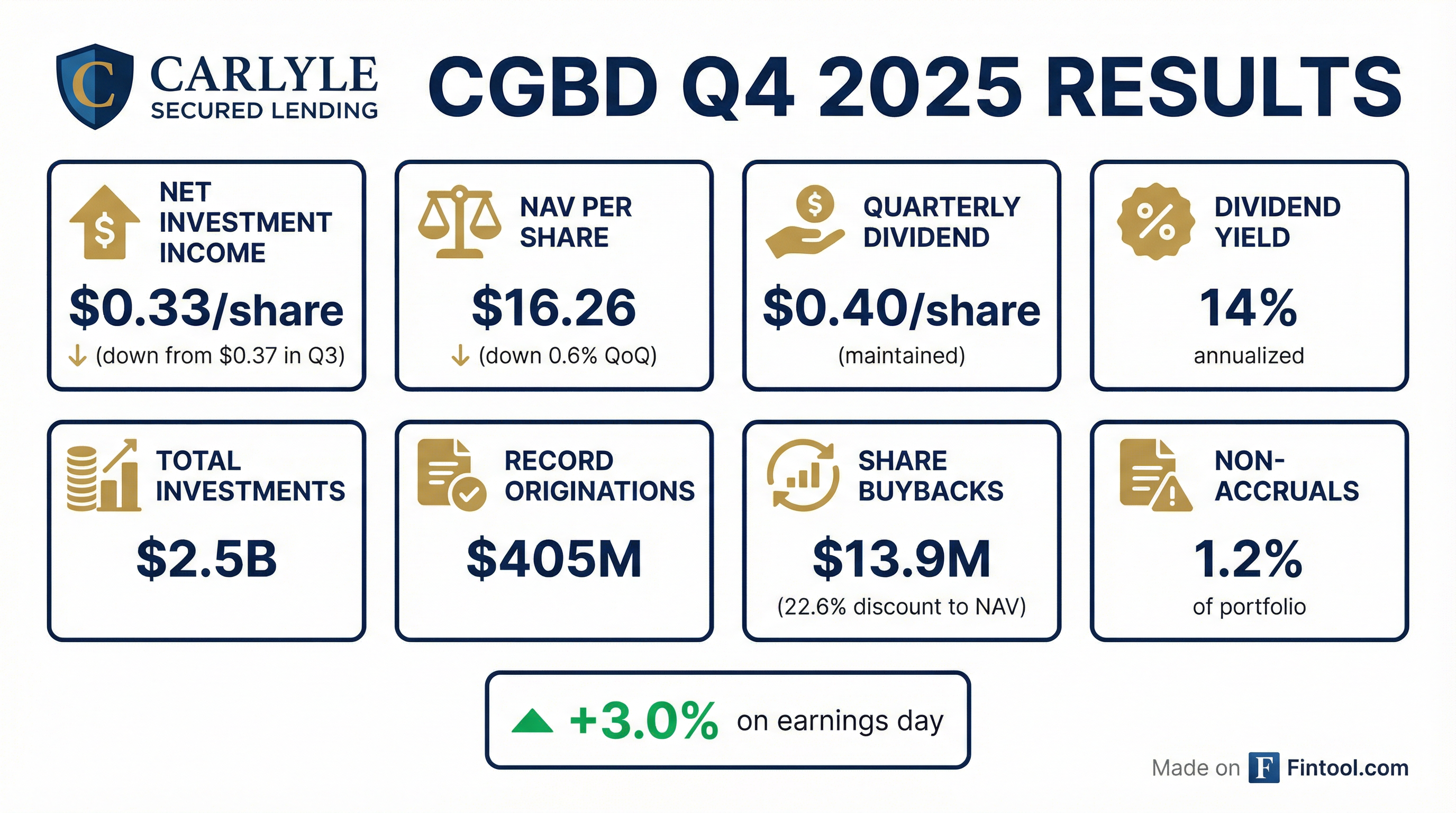

- Carlyle Secured Lending reported Q4 2025 GAAP Net Investment Income of $0.33 per share and Adjusted NII of $0.36 per share, with Net Asset Value at $16.26 per share as of December 31st.

- The Board declared a Q1 2026 dividend of $0.40 per share and authorized a $100 million upsize to the share repurchase program, bringing the total to $300 million. The company repurchased $14 million of shares in Q4 2025, resulting in $0.06 of NAV accretion per share.

- Alex Chi was appointed CEO and Director, while Thomas Hennigan was appointed President in addition to his existing CFO and Chief Risk Officer roles.

- CGBD announced the formation of Structured Credit Partners (SCP), a new joint venture with $600 million in equity commitments from four BDCs, including CGBD's $150 million commitment. This JV is expected to be highly accretive to return on equity, offering a potential 400-500 basis point uplift due to its fee-free structure.

- The company achieved record originations in 2025, deploying over $1.2 billion at CGBD, with Q4 2025 investment fundings exceeding $400 million.

- For Q4 2025, Carlyle Secured Lending generated $0.33 per common share of net investment income and $0.36 per share of adjusted net investment income, with Net Asset Value (NAV) per share at $16.26 as of December 31, 2025.

- The company declared a quarterly dividend of $0.40 for IQ26, supported by an estimated $0.74 per share in spillover income. Additionally, $13.9 million of shares were repurchased in Q4 2025, leading to $0.06 per share of NAV accretion, and the stock repurchase program was upsized by $100.0 million to $300.0 million.

- The total fair value of the portfolio increased to $2.5 billion across 165 companies, driven by record originations of $404.7 million during the quarter. Non-accrual investments remained relatively flat at 1.8% of the total portfolio based on amortized cost and 1.2% based on fair value as of December 31, 2025.

- CGBD entered into a new joint venture, Structured Credit Partners JV (SCP), committing $150 million to its initial $600 million equity capitalization.

- Alex Chi was appointed Chief Executive Officer and a Director, while Justin Plouffe resigned as CEO and President to become CFO of Carlyle. Thomas Hennigan was appointed President in addition to his existing roles as CFO and Chief Risk Officer.

- For Q4 2025, Carlyle Secured Lending reported Adjusted Net Investment Income of $0.36 per share and a Net Asset Value of $16.26 per share as of December 31st. The board declared a first-quarter 2026 dividend of $0.40 per share.

- The company achieved record originations in 2025, deploying over $1.2 billion at CGBD, with total investments increasing to $2.5 billion in Q4 2025. CGBD also announced the formation of a new joint venture, Structured Credit Partners (SCP), committing $150 million to the vehicle, which is expected to be highly accretive. Additionally, the board approved a $100 million upsize to the share repurchase program, increasing the total to $300 million, following $14 million in repurchases in Q4 2025 and another $14 million quarter-to-date in Q1 2026.

- Carlyle Secured Lending announced management changes, with Alex Chi appointed CEO and Thomas Hennigan as President, while Justin Plouffe transitioned to CFO of Carlyle.

- For Q4 2025, the company reported GAAP net investment income of $0.33 per share and adjusted net investment income of $0.36 per share, with a net asset value of $16.26 per share as of December 31st. The board declared a Q1 2026 dividend of $0.40 per share.

- CGBD repurchased $14 million of shares in Q4 2025, leading to $0.06 of NAV accretion per share, and the board approved a $100 million upsize to the share repurchase program, bringing the total to $300 million.

- The company formed a new joint venture, Structured Credit Partners (SCP), with Sixth Street, capitalized by $600 million of equity commitments (CGBD committed $150 million), which is expected to increase diversification, portfolio yield, and be highly accretive to return on equity.

- 2025 was a record year for originations, with over $1.2 billion deployed at CGBD and $400 million of investment fundings in Q4 2025, and the company expects strong deal flow in Q1 2026.

- Carlyle Secured Lending reported Net Investment Income of $0.33 per common share and Adjusted Net Investment Income of $0.36 per common share for the fourth quarter of 2025. For the full year 2025, Net Investment Income was $1.48 per common share and Adjusted Net Investment Income was $1.51 per common share.

- The company's net asset value per common share decreased by 0.6% to $16.26 as of December 31, 2025, from $16.36 on September 30, 2025. The total fair value of investments increased to $2.5 billion as of December 31, 2025.

- A quarterly common dividend of $0.40 per share was declared on February 18, 2026, payable on April 16, 2026, to common stockholders of record on March 31, 2026.

- CEO Alex Chi noted record origination volume in the fourth quarter and full year 2025, and highlighted the company's focus on expanding its origination apparatus, leveraging the OneCarlyle platform, and maintaining a strategy of stable, high-quality credits in the middle market, complemented by a newly announced structured credit joint venture.

- Carlyle Secured Lending, Inc. reported Net Investment Income of $0.33 per common share and Adjusted Net Investment Income of $0.36 per common share for the fourth quarter ended December 31, 2025. For the full year 2025, Net Investment Income was $1.48 per common share and Adjusted Net Investment Income was $1.51 per common share.

- The Board of Directors declared a quarterly common dividend of $0.40 per share for Q1 2026, payable on April 16, 2026, to common stockholders of record on March 31, 2026.

- Net asset value per common share decreased by 0.6% to $16.26 as of December 31, 2025, from $16.36 as of September 30, 2025.

- The company repurchased $13.9 million of shares during Q4 2025, resulting in $0.06 per share of NAV accretion, and in February 2026, upsized its stock repurchase program by an additional $100.0 million to a total of $300.0 million.

- The total fair value of investments increased to $2.5 billion as of December 31, 2025, with record originations of $404.7 million during Q4 2025. CGBD also entered into a new joint venture, Structured Credit Partners JV, LLC, with $150 million in equity capital commitments from CGBD.

- CGBD reported Net Investment Income per common share of $0.37 (GAAP) and $0.38 (Adjusted) for Q3 2025.

- Net Asset Value (NAV) per share was $16.36 as of September 30, 2025.

- A quarterly dividend of $0.40 was declared for 4Q25, supported by an estimated $0.86 per share in spillover income.

- The total fair value of the investment portfolio increased to $2.4 billion across 158 portfolio companies as of September 30, 2025, with a weighted average yield of 10.6%.

- In October 2025, CGBD issued $300.0 million in 5.75% unsecured notes due 2031 and announced the redemption of $85.0 million of 8.20% 2028 Notes, which is expected to lower the weighted average cost of borrowing by 10 bps and extend the maturity profile.

- Carlyle Secured Lending reported net investment income of $0.37 per share on a GAAP basis and $0.38 per share after adjusting for asset acquisition accounting for Q3 2025, with Net Asset Value (NAV) at $16.36 per share as of September 30, 2025.

- The board of directors declared a fourth-quarter dividend of $0.40 per share, payable to stockholders of record as of December 31st.

- CGBD funded $260 million of investments during the quarter, resulting in net investment activity of $117 million and increasing total investments to $2.4 billion. Non-accruals decreased to 1.6% of total investments at cost and 1% at fair value as of September 30, 2025.

- The company optimized its capital structure by raising a new five-year, $300 million institutional unsecured bond and repaying higher-priced facilities, which is expected to lower the weighted average cost of borrowing by 10 basis points.

- Strategic initiatives include growing the existing MMCF joint venture (with an upsized credit facility to $800 million and increased equity commitments to $250 million each) and advancing discussions for a potential second joint venture with a different investment strategy, though these are expected to impact earnings in the longer term.

- Carlyle Secured Lending, Inc. reported Net Investment Income of $0.37 per common share and Adjusted Net Investment Income of $0.38 per common share for the third quarter ended September 30, 2025.

- The Board of Directors declared a fourth-quarter 2025 dividend of $0.40 per common share, payable on January 16, 2026, to common stockholders of record on December 31, 2025.

- Net asset value per common share decreased by 0.4% to $16.36 as of September 30, 2025, from $16.43 as of June 30, 2025, while the total fair value of investments increased to $2.4 billion as of September 30, 2025.

- Post-quarter-end, the company issued $300.0 million in 5.75% unsecured notes due 2031 and announced the redemption of $85.0 million of 8.20% 2028 Notes on December 1, 2025.

- Carlyle Secured Lending, Inc. announced its intent to redeem all outstanding $85,000,000 aggregate principal amount of its 8.20% Notes due 2028.

- The redemption date is scheduled for December 1, 2025, with the redemption price set at 100% of the principal amount plus accrued and unpaid interest.

- In connection with this redemption, the 2028 Notes will be delisted from the Nasdaq Global Select Market.

Quarterly earnings call transcripts for Carlyle Secured Lending.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more