Earnings summaries and quarterly performance for C. H. ROBINSON WORLDWIDE.

Executive leadership at C. H. ROBINSON WORLDWIDE.

Board of directors at C. H. ROBINSON WORLDWIDE.

Edward Feitzinger

Director

Jodee Kozlak

Independent Chair of the Board

Kermit Crawford

Director

Mark Goodburn

Director

Mary Steele Guilfoile

Director

Michael McGarry

Director

Paige Robbins

Director

Paula Tolliver

Director

Timothy Gokey

Director

Research analysts who have asked questions during C. H. ROBINSON WORLDWIDE earnings calls.

Jonathan Chappell

Evercore ISI

7 questions for CHRW

Bascome Majors

Susquehanna Financial Group

6 questions for CHRW

Christian Wetherbee

Wells Fargo

6 questions for CHRW

Scott Group

Wolfe Research

6 questions for CHRW

Ken Hoexter

BofA Securities

5 questions for CHRW

Tom Wadewitz

UBS Group

5 questions for CHRW

Brian Ossenbeck

JPMorgan Chase & Co.

3 questions for CHRW

Jeffrey Kauffman

Vertical Research Partners

3 questions for CHRW

Richa Harnain

Deutsche Bank

3 questions for CHRW

Thomas Wadewitz

UBS

3 questions for CHRW

Andrew Cox

Stifel

2 questions for CHRW

Ariel Rosa

Citigroup

2 questions for CHRW

Brandon Oglenski

Barclays

2 questions for CHRW

David Hicks

Raymond James

2 questions for CHRW

Reed Seay

Stephens Inc.

2 questions for CHRW

Alex Johnson

Evercore ISI

1 question for CHRW

Ben Mohr

Citigroup Inc.

1 question for CHRW

Daniel Imbro

Stephens Inc.

1 question for CHRW

Jason Seidl

TD Cowen

1 question for CHRW

J. Bruce Chan

Stifel

1 question for CHRW

Stephanie Moore

Jefferies

1 question for CHRW

Recent press releases and 8-K filings for CHRW.

- C.H. Robinson combines a lean operating model with generative and agentic AI to drive 40% enterprise productivity improvement since end-2022 and has outgrown its markets for over 10 consecutive quarters by unlocking revenue opportunities through price and cost optimization.

- Its AI-powered quote orchestration agent now covers 100% of transactional freight quotes (up from 60–65%) and reduces cycle time from 20 minutes to 31 seconds, boosting win rates and margins without adding headcount.

- The firm’s flexible application layer can integrate any LLM, yielding an 85× increase in token usage at only a 1.5× cost rise, reflecting significant scale efficiency and contained AI infrastructure spending.

- C.H. Robinson’s proprietary dataset—the largest and most granular in the industry—combined with custom agents and lean disciplines forms a hard-to-replicate moat; AI deployments in its North American Surface (NAS) business will extend into forwarding with results expected in H2 2026.

- Management expects an exponential revenue inflection as freight markets recover, leveraging its scalable AI-driven platform to serve up to millions of quotes without proportional human or technology cost.

- C.H. Robinson employs a Lean AI operating model, combining decades-old lean principles with generative and agentic AI at the application layer, selecting LLMs by price-performance and engineering context to prevent hallucinations.

- Since end-2022, AI has driven 40% enterprise-wide productivity improvement; a quote-to-cash agent now processes 100% of transactional quotes, slashing response time from 20 minutes to 31 seconds and boosting win rates and margins.

- Over the past year, token usage surged 85× while AI costs rose just 1.5×, allowing all AI investments to remain within existing spend and yielding near-zero marginal cost per agent.

- Only a fraction of thousands of processes in the North American Surface Transportation business have been automated to date—forwarding processes will deploy AI in H2 2026—indicating the transformation is in early innings.

- C.H. Robinson is the largest global logistics platform in North America, handling 37 million shipments annually for 75,000 customers and partnering with 450,000 carriers to simplify a highly fragmented market.

- The company’s “Lean AI” approach—integrating a lean operating model with generative and agentic AI—has driven 40 % productivity improvement since end-2022 and automated quote-to-cash workflows, enabling responses to 100 % of transactional quotes in 31 seconds (down from 17–20 minutes) while boosting win rates and margins.

- A flexible, LLM-agnostic architecture on Azure AI Foundry lets C.H. Robinson optimize model selection by price/performance, achieving 85× growth in token usage at only 1.5× increase in cost, demonstrating significant leverage on AI investments.

- AI deployment remains in the “second inning,” with only a fraction of processes automated; this early-stage rollout underpins a scalable, low-cost-to-serve platform expected to deliver exponential revenue growth and asset-light operating leverage as freight markets recover.

- The firm’s competitive moat rests on the largest proprietary logistics data set, in-house AI technology, and a customized lean operating model—assets that together drive revenue management, margin expansion, and a sustainable cost-to-serve advantage.

- The company’s “Lean AI” approach integrates a 120-year lean operating model with AI technology, delivering double-digit productivity gains and cutting quote response times from ~17 minutes to ~31 seconds, now handling 100% of quotes to capture previously missed opportunities.

- Freight demand remains muted, with the Cass Freight Index down 7% in January, while Q4 cost pressures—driven by sequential winter storms and holiday capacity crunches—have persisted into Q1, impacting margins.

- With an investment-grade balance sheet and net leverage below target, management is committed to maintaining Dividend Aristocrat status, pursuing disciplined M&A, and capitalizing on current valuations through share repurchases alongside organic funding.

- After early AI success in North American Surface Transportation, the firm is extending agentic technology to Global Forwarding—automating complex quoting and order-to-cash workflows to drive similar efficiency gains.

- C.H. Robinson is a leading global 3PL handling 37 million shipments and $23 billion of freight under management for 75,000 shippers and 450,000 carriers worldwide.

- The company’s “Lean AI” model combines lean operating principles with in-house AI to drive ongoing productivity improvements, achieving 40%+ productivity gains over the past two years.

- Its AI quoting agent now processes 100% of spot quotes in ~32 seconds (down from ~17 minutes), boosting win rates, margins and customer satisfaction.

- C.H. Robinson plans to extend AI and lean practices from North American Surface Transportation into its Global Forwarding business to unlock similar efficiencies.

- With an investment-grade balance sheet, the firm prioritizes disciplined M&A, organic technology investments and share buybacks at current valuations.

- C.H. Robinson is implementing Lean AI, combining lean operating principles with AI and experienced logisticians to drive productivity and margin expansion.

- The AI-driven quoting agent reduced response times from ~17 minutes to 32 seconds, now handling 100 % of requests, boosting revenue, pricing optimization, and customer satisfaction.

- Its in-house team of 450 + engineers builds proprietary AI agents on Azure, leveraging the largest logistics dataset (~1 trillion data points) to sustain a competitive moat.

- Global Forwarding, representing ~20 % of revenue, grew quarterly while lowering expenses under the lean model, with upcoming AI integration to replicate NAS efficiencies.

- With an investment-grade balance sheet, Robinson maintains its Dividend Aristocrat status, prioritizes organic growth funding, disciplined M&A, and ongoing share repurchases amid attractive valuations.

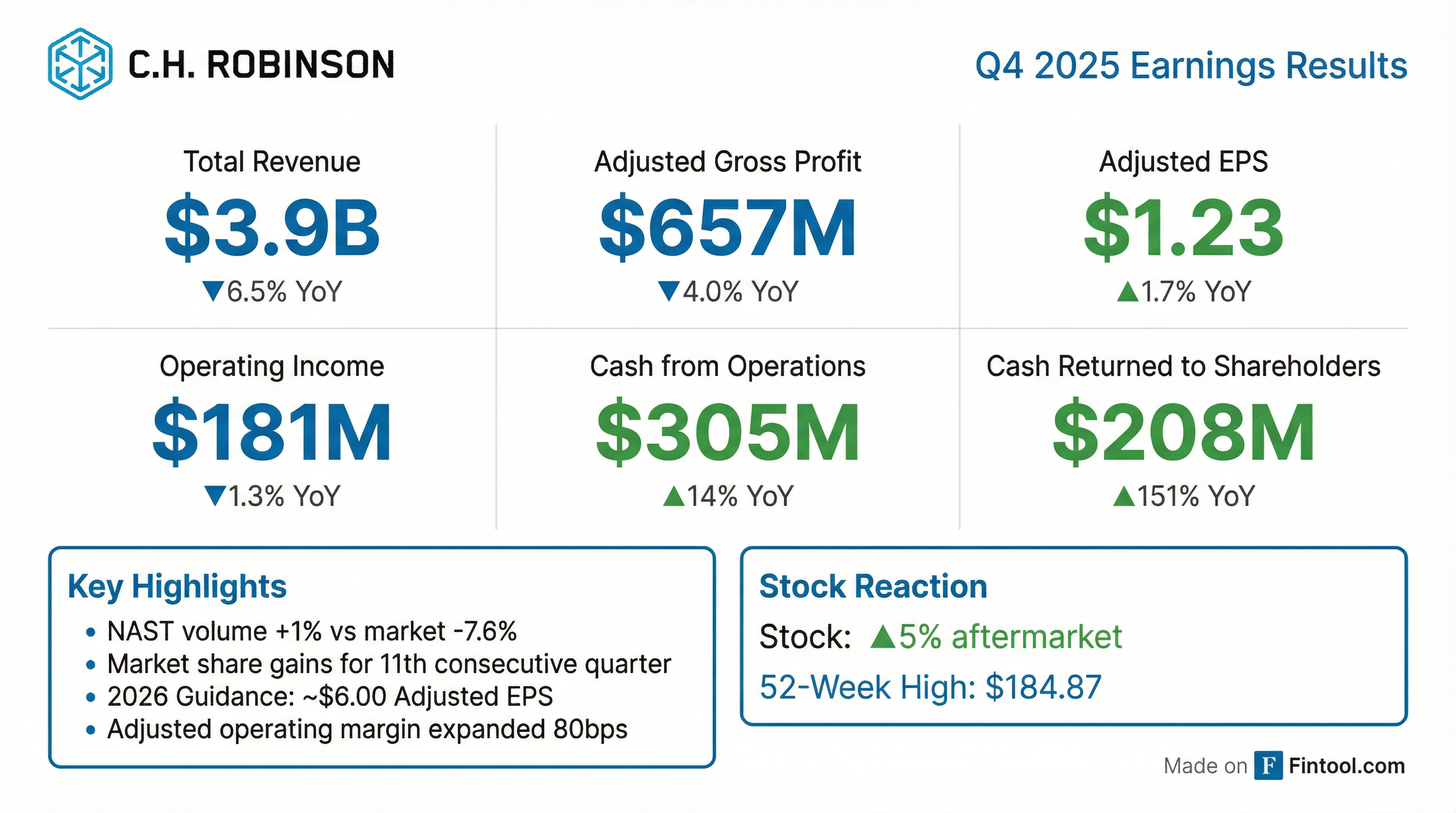

- Q4 total revenue declined 7% y/y, AGP down 4% y/y; NAST AGP rose 2%, Global Forwarding AGP fell 13%

- NAST total volume +1% and truckload volume +3%, versus a 7.6% decline in the Cass Freight Shipment Index; NAST AGP margin improved 20 bps, Global Forwarding gross margin +100 bps

- Q4 personnel expenses of $337 M (ex-restructuring $321.8 M, ‑8.2% y/y) with headcount down 12.9% y/y; SG&A expenses $138.7 M (ex-restructuring, ‑7.9% y/y); operating margin ex-restructuring expanded 320 bps (NAST +310 bps)

- 2026 guidance: personnel expenses $1.25 B–$1.35 B, SG&A $540 M–$590 M (incl. D&A $95–$105 M); expect double-digit productivity gains and a full-year tax rate of 18–20%

- In North American Surface Transportation (NAST), total volume grew 1% and truckload volume rose 3% year-over-year versus a 7.6% decline in the Cass Freight Shipment Index, marking the 13th consecutive quarter of market share gains.

- Global Forwarding gross margins expanded by 100 basis points year-over-year amid ongoing ocean rate normalization; full-year productivity improved double digits in NAST and high single digits in Global Forwarding.

- Generated $305.4 million in cash from operations in Q4, ending with $1.49 billion of liquidity and net debt/EBITDA of 1.03×; returned $207.7 million to shareholders via $133.3 million of share repurchases and $74.3 million of dividends.

- 2026 guidance: SG&A expenses of $540–590 million (including $95–105 million of depreciation & amortization), capital expenditures of $75–85 million, and a full-year tax rate of 18–20% (Q1 <15%).

- Q4 total revenue and adjusted gross profit (AGP) declined 7% and 4% year-over-year, respectively, driven by a 13% drop in Global Forwarding AGP and partially offset by a 2% increase in North American Surface Transportation (NAST) AGP.

- Operating margin excluding restructuring costs expanded by 320 bps year-over-year as personnel expenses (ex-restructuring) fell 8.2% to $321.8 million and average headcount declined 12.9%.

- Generated $305.4 million in cash from operations, ended the quarter with $1.49 billion of liquidity and net debt/EBITDA leverage of 1.03×, and returned $207.7 million to shareholders via $133.3 million in buybacks and $74.3 million in dividends.

- Provided 2026 guidance: personnel expenses of $1.25 billion–$1.35 billion, SG&A of $540 million–$590 million (including $95 million–$105 million of D&A), capital expenditures of $75 million–$85 million, and a full-year tax rate of 18%–20% with Q1 below 15%.

- Lean AI initiatives supported 3% truckload and 0.5% LTL volume growth, with double-digit gains in retail and automotive; AI agents automated 95% of missed-LTL pickup checks, cut return trips by 42%, and saved over 350 hours of manual work per day.

- C.H. Robinson’s Q4 2025 net revenues fell 6.5% to $3.9 billion, with GAAP operating income down 1.3% at $181.4 million and diluted EPS down 8.2% to $1.12; on a non-GAAP basis, operating income rose 7.1% to $197.4 million and adjusted EPS rose 1.7% to $1.23

- North American Surface Transportation (NAST) volumes increased 1% (truckload +3%), driving a 20 bp expansion in NAST adjusted gross profit margin to 14.6% despite a 7.6% market decline in the Cass Freight Shipment Index

- The company generated $305.4 million in operating cash flow, up $37.5 million, and returned $207.7 million to shareholders via $133.3 million of share repurchases and $74.3 million of dividends

Quarterly earnings call transcripts for C. H. ROBINSON WORLDWIDE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more