Earnings summaries and quarterly performance for C. H. ROBINSON WORLDWIDE.

Executive leadership at C. H. ROBINSON WORLDWIDE.

Board of directors at C. H. ROBINSON WORLDWIDE.

Edward Feitzinger

Director

Jodee Kozlak

Independent Chair of the Board

Kermit Crawford

Director

Mark Goodburn

Director

Mary Steele Guilfoile

Director

Michael McGarry

Director

Paige Robbins

Director

Paula Tolliver

Director

Timothy Gokey

Director

Research analysts who have asked questions during C. H. ROBINSON WORLDWIDE earnings calls.

Jonathan Chappell

Evercore ISI

7 questions for CHRW

Bascome Majors

Susquehanna Financial Group

6 questions for CHRW

Christian Wetherbee

Wells Fargo

6 questions for CHRW

Scott Group

Wolfe Research

6 questions for CHRW

Ken Hoexter

BofA Securities

5 questions for CHRW

Tom Wadewitz

UBS Group

5 questions for CHRW

Brian Ossenbeck

JPMorgan Chase & Co.

3 questions for CHRW

Jeffrey Kauffman

Vertical Research Partners

3 questions for CHRW

Richa Harnain

Deutsche Bank

3 questions for CHRW

Thomas Wadewitz

UBS

3 questions for CHRW

Andrew Cox

Stifel

2 questions for CHRW

Ariel Rosa

Citigroup

2 questions for CHRW

Brandon Oglenski

Barclays

2 questions for CHRW

David Hicks

Raymond James

2 questions for CHRW

Reed Seay

Stephens Inc.

2 questions for CHRW

Alex Johnson

Evercore ISI

1 question for CHRW

Ben Mohr

Citigroup Inc.

1 question for CHRW

Daniel Imbro

Stephens Inc.

1 question for CHRW

Jason Seidl

TD Cowen

1 question for CHRW

J. Bruce Chan

Stifel

1 question for CHRW

Stephanie Moore

Jefferies

1 question for CHRW

Recent press releases and 8-K filings for CHRW.

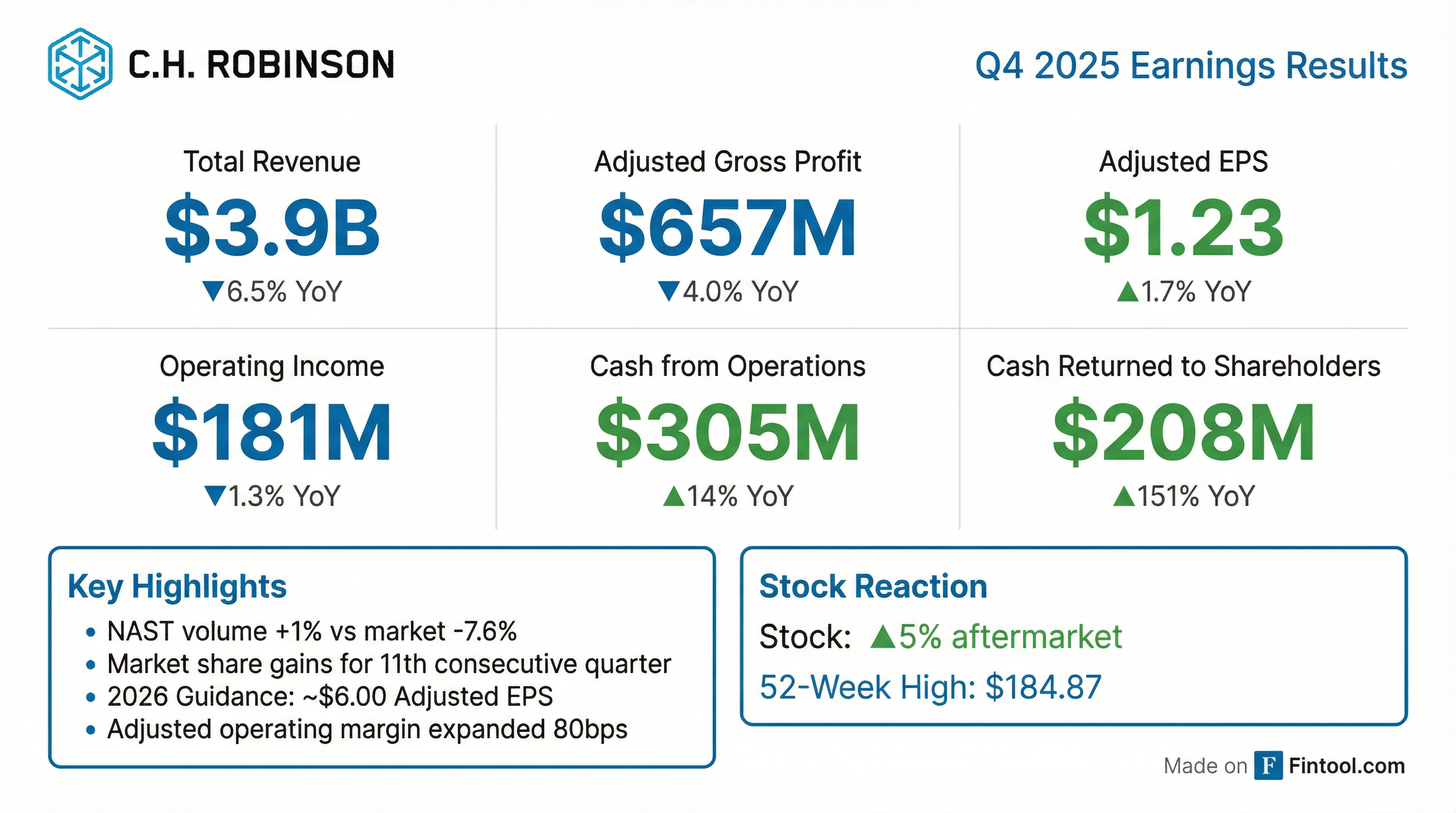

- Q4 total revenue declined 7% y/y, AGP down 4% y/y; NAST AGP rose 2%, Global Forwarding AGP fell 13%

- NAST total volume +1% and truckload volume +3%, versus a 7.6% decline in the Cass Freight Shipment Index; NAST AGP margin improved 20 bps, Global Forwarding gross margin +100 bps

- Q4 personnel expenses of $337 M (ex-restructuring $321.8 M, ‑8.2% y/y) with headcount down 12.9% y/y; SG&A expenses $138.7 M (ex-restructuring, ‑7.9% y/y); operating margin ex-restructuring expanded 320 bps (NAST +310 bps)

- 2026 guidance: personnel expenses $1.25 B–$1.35 B, SG&A $540 M–$590 M (incl. D&A $95–$105 M); expect double-digit productivity gains and a full-year tax rate of 18–20%

- In North American Surface Transportation (NAST), total volume grew 1% and truckload volume rose 3% year-over-year versus a 7.6% decline in the Cass Freight Shipment Index, marking the 13th consecutive quarter of market share gains.

- Global Forwarding gross margins expanded by 100 basis points year-over-year amid ongoing ocean rate normalization; full-year productivity improved double digits in NAST and high single digits in Global Forwarding.

- Generated $305.4 million in cash from operations in Q4, ending with $1.49 billion of liquidity and net debt/EBITDA of 1.03×; returned $207.7 million to shareholders via $133.3 million of share repurchases and $74.3 million of dividends.

- 2026 guidance: SG&A expenses of $540–590 million (including $95–105 million of depreciation & amortization), capital expenditures of $75–85 million, and a full-year tax rate of 18–20% (Q1 <15%).

- Q4 total revenue and adjusted gross profit (AGP) declined 7% and 4% year-over-year, respectively, driven by a 13% drop in Global Forwarding AGP and partially offset by a 2% increase in North American Surface Transportation (NAST) AGP.

- Operating margin excluding restructuring costs expanded by 320 bps year-over-year as personnel expenses (ex-restructuring) fell 8.2% to $321.8 million and average headcount declined 12.9%.

- Generated $305.4 million in cash from operations, ended the quarter with $1.49 billion of liquidity and net debt/EBITDA leverage of 1.03×, and returned $207.7 million to shareholders via $133.3 million in buybacks and $74.3 million in dividends.

- Provided 2026 guidance: personnel expenses of $1.25 billion–$1.35 billion, SG&A of $540 million–$590 million (including $95 million–$105 million of D&A), capital expenditures of $75 million–$85 million, and a full-year tax rate of 18%–20% with Q1 below 15%.

- Lean AI initiatives supported 3% truckload and 0.5% LTL volume growth, with double-digit gains in retail and automotive; AI agents automated 95% of missed-LTL pickup checks, cut return trips by 42%, and saved over 350 hours of manual work per day.

- C.H. Robinson’s Q4 2025 net revenues fell 6.5% to $3.9 billion, with GAAP operating income down 1.3% at $181.4 million and diluted EPS down 8.2% to $1.12; on a non-GAAP basis, operating income rose 7.1% to $197.4 million and adjusted EPS rose 1.7% to $1.23

- North American Surface Transportation (NAST) volumes increased 1% (truckload +3%), driving a 20 bp expansion in NAST adjusted gross profit margin to 14.6% despite a 7.6% market decline in the Cass Freight Shipment Index

- The company generated $305.4 million in operating cash flow, up $37.5 million, and returned $207.7 million to shareholders via $133.3 million of share repurchases and $74.3 million of dividends

- Amid significant market headwinds, C.H. Robinson’s Lean AI operating model drove continued outperformance in the quarter.

- North American Surface Transportation (NAST) volumes rose 1% overall and 3% in truckload, versus a 7.6% decline in the Cass Freight Shipment Index.

- NAST adjusted gross profit margin expanded 20 bps to 14.6%.

- Adjusted income from operations increased 7.1% to $197.4 million, while GAAP operating income decreased 1.3% to $181.4 million.

- Adjusted diluted EPS rose 1.7% to $1.23 (diluted EPS down 8.2% to $1.12); cash from operations was $305.4 million and cash returned to shareholders $207.7 million.

- C.H. Robinson operates a two-sided logistics marketplace handling 37 million shipments, serving 83,000 customers and engaging 450,000 carriers annually.

- The company has delivered a 40% productivity uplift since end-2022 by automating order-to-cash workflows with generative and agentic AI, cutting quote turnaround from 15–17 minutes to 30 seconds and boosting quote coverage to 100% from 65%.

- Productivity is defined as shipments per person per day in North American freight brokerage and files per person per month in global forwarding.

- C.H. Robinson uses an LLM-agnostic architecture—primarily Microsoft Azure’s enterprise GPT with optional Gemini and Claude—via a gateway pattern to switch models based on price-performance and optimize token costs.

- The firm leverages its proprietary Navisphere platform and a builder culture underpinned by a lean operating model and in-house tech stack to drive rapid ideation, deployment and scalable automation.

- Logistics leader: Moves 37 million shipments annually for over 83 000 customers via a two-sided marketplace with 450 000 carriers.

- AI transformation: Achieved 40 % enterprise-wide productivity gains since end of 2022, with token usage up 10× and AI costs down 25 % year-over-year.

- Flexible AI stack: Uses an abstraction layer to switch between enterprise-grade LLMs (Azure ChatGPT, Gemini, Claude) for optimal price-performance, avoiding open-source models.

- Built-in advantage: Owns and continuously evolves its Navisphere platform, enabling faster, lower-cost deployments and near-zero marginal costs versus third-party solutions.

- C.H. Robinson is one of the largest logistics providers, moving 37 million shipments annually for 83,000 customers through a two-sided marketplace of over 450,000 carriers.

- Since end-2022, the company has achieved a 40% productivity increase in its order-to-cash process by deploying generative AI—reducing quote times from 15–17 minutes to 30 seconds and boosting quote coverage from 65% to 100%.

- The shift to agentic AI—providing models with full context and access to internal tools—promises further exponential gains across both North American surface transportation and global forwarding businesses.

- A custom, builder-driven tech stack (primarily on Microsoft Azure with LLM-agnostic gateway architecture) has enabled 10× token usage growth and 25% lower AI costs year-over-year, while preserving margins through an asset-light, lean operating model.

- C.H. Robinson views lean methodology and technology as symbiotic, driving continuous innovation and enabling development of agentic AI within a robust operating model.

- The firm’s strategy is to outgrow end markets and expand operating margins through lean AI, achieving over 40% productivity gains (shipments per person per day) since end-2022 and improving quote coverage from 65% to 100%, boosting win rates in North American Surface Transportation.

- Management reaffirmed its 2026 EPS target of $6 under a zero market contribution scenario, underpinned by an upgrade to double-digit productivity expectations via agentic AI rolling out in H2 2026.

- C.H. Robinson cites a multi-layered moat—including its lean operating model, 450 internal engineers, proprietary data (37 million annual shipments plus lost-bid data) and an investment-grade balance sheet—to sustain tech leadership and execution speed.

- While open to inorganic growth, the company will pursue disciplined, value-accretive M&A—favoring niche tuck-ins and specialized tech—over large, high-risk deals, given robust organic return opportunities.

- Symbiotic Lean and technology model, integrating generative and agentic AI to drive innovation and scale.

- AI-powered quoting now covers 100% of requests in ~30 seconds, up from 65%, enhancing win rate and revenue potential.

- Achieved 40% productivity increase since end-2022 (shipments per person per day) with no exclusions.

- 2026 EPS guidance of ~$6 assumes zero market growth and leverages double-digit productivity gains, with agentic AI benefits in 2H 2026.

- Maintain multiple moats—proprietary data, 450+ in-house engineers, Lean operating model—and pursue disciplined M&A (including tuck-ins) when accretive.

Quarterly earnings call transcripts for C. H. ROBINSON WORLDWIDE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more