Earnings summaries and quarterly performance for CHOICEONE FINANCIAL SERVICES.

Executive leadership at CHOICEONE FINANCIAL SERVICES.

Board of directors at CHOICEONE FINANCIAL SERVICES.

BF

Bradley F. McGinnis

Detailed

Director

BP

Brian P. Petty

Detailed

Director

BJ

Bruce John Essex, Jr.

Detailed

Director

CE

Curt E. Coulter, D.O.

Detailed

Director

E(

Eric (Rick) E. Burrough

Detailed

Director

GL

Greg L. Armock

Detailed

Director

GA

Gregory A. McConnell

Detailed

Chairman of the Board

HJ

Harold J. Burns

Detailed

Director

KD

Keith D. Brophy

Detailed

Director

MM

Michelle M. Wendling

Detailed

Director

RD

Randy D. Hicks, M.D.

Detailed

Director

RM

Roxanne M. Page

Detailed

Vice Chairwoman of the Board

ST

Steven T. Krause

Detailed

Director

Research analysts covering CHOICEONE FINANCIAL SERVICES.

Recent press releases and 8-K filings for COFS.

ChoiceOne Financial Services, Inc. Reports Q4 2025 Financials and Details Fentura Merger Impact

COFS

M&A

Earnings

- ChoiceOne Financial Services, Inc. (COFS) is a $4.4 billion bank holding company with a market capitalization of approximately $443 million as of December 31, 2025.

- The company completed a significant merger with Fentura Financial, Inc. in March 2025, which added approximately $1.8 billion in assets, $1.4 billion in loans, and $1.4 billion in deposits.

- This merger contributed to substantial growth, with Total Assets reaching $4,410,551 thousand, Gross Loans at $3,029,219 thousand, and Total Deposits at $3,600,025 thousand by December 31, 2025.

- In July 2024, COFS completed a public offering of 1,380,000 shares of common stock, generating approximately $34.5 million in gross proceeds.

- Asset quality metrics for Q4 2025 show Nonperforming Loans (NPLs) at 0.98% and Nonperforming Assets (NPAs) at 0.67%, with the increase in NPLs largely attributed to acquired nonperforming loans from the merger.

3 days ago

ChoiceOne Financial Services, Inc. Reports Fourth Quarter 2025 Results

COFS

Earnings

M&A

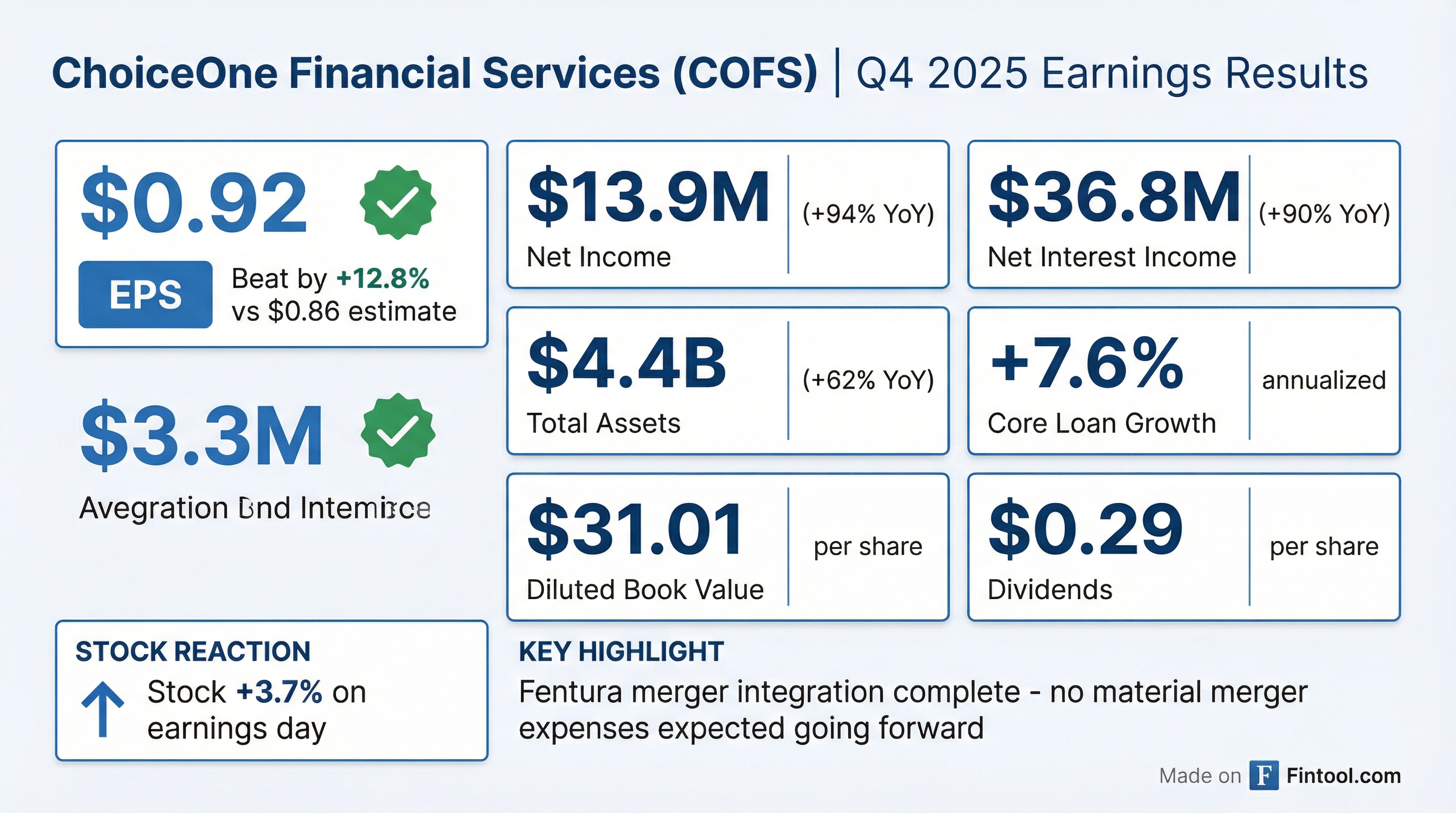

- ChoiceOne Financial Services, Inc. reported net income of $13,867,000 and diluted earnings per share of $0.92 for the fourth quarter ended December 31, 2025.

- The company completed its merger with Fentura Financial, Inc. on March 1, 2025, which added approximately $1.8 billion in total assets, $1.4 billion in loans, and $1.4 billion in deposits.

- As of December 31, 2025, total assets reached $4.4 billion and shareholders' equity grew to $465.4 million, primarily due to the Merger.

- Nonperforming loans to total loans increased to 0.98% as of December 31, 2025, from 0.69% on September 30, 2025, with 0.63% attributed to certain purchased loans identified prior to the Merger.

8 days ago

ChoiceOne Financial Services Reports Fourth Quarter and Full Year 2025 Results

COFS

Earnings

M&A

- ChoiceOne Financial Services reported net income of $13,867,000 and diluted earnings per share of $0.92 for the three months ended December 31, 2025.

- For the full year ended December 31, 2025, the company achieved net income of $28,176,000 and diluted earnings per share of $2.01.

- The company completed its merger with Fentura Financial, Inc. on March 1, 2025, which contributed approximately $1.8 billion in total assets, $1.4 billion in loans, and $1.4 billion in deposits.

- Total assets increased to $4.4 billion as of December 31, 2025, representing a $1.7 billion increase compared to December 31, 2024, primarily driven by the merger.

- Merger-related expenses, net of taxes, amounted to $13.9 million or $0.99 per diluted share for the year ended December 31, 2025, with no additional material merger expenses anticipated.

8 days ago

ChoiceOne Financial Services Inc. Reports Strong Q3 2025 Performance and Merger Impact

COFS

Earnings

M&A

Revenue Acceleration/Inflection

- ChoiceOne Financial Services, Inc. (COFS) is a $4.3 billion bank holding company with a market capitalization of approximately $435 million as of September 30, 2025.

- The company completed a significant merger with Fentura Financial, Inc. in March 2025, which added approximately $1.8 billion in total assets, $1.4 billion in loans, and $1.4 billion in deposits, expanding its presence by 20 branches.

- For Q3 2025, COFS reported strong financial performance with an annualized return on average assets (ROAA) of 1.36%, an annualized return on average equity (ROAE) of 13.39%, and a net interest margin (fully tax-equivalent) of 3.77%.

- The efficiency ratio improved to 54.76% in Q3 2025, and nonperforming loans to total loans stood at 0.69%.

- COFS manages interest rate risk through pay-fixed interest rate swaps with a total notional value of $381.3 million, and a sale of swaps in Q1 2025 generated a gain of approximately $3.6 million.

Nov 6, 2025, 1:14 PM

ChoiceOne Financial Services, Inc. Reports Strong Q3 2025 Results Driven by Fentura Merger

COFS

Earnings

M&A

Revenue Acceleration/Inflection

- ChoiceOne Financial Services, Inc. reported net income of $14.681 million and diluted earnings per share of $0.97 for the third quarter ended September 30, 2025.

- Total assets increased to $4.3 billion as of September 30, 2025, representing a $1.6 billion increase compared to September 30, 2024, primarily due to the Fentura merger completed on March 1, 2025.

- The GAAP net interest margin rose to 3.73% in the third quarter of 2025, up from 3.17% in the same period of 2024, with GAAP net interest income reaching $37.6 million.

- Asset quality remained strong, with annualized net loan charge-offs to average loans at 0.03% and nonperforming loans to total loans (excluding held for sale) at 0.69% as of September 30, 2025.

Oct 24, 2025, 11:45 AM

ChoiceOne Financial Services Reports Strong Q3 2025 Results

COFS

Earnings

M&A

- ChoiceOne Financial Services reported net income of $14.681 million for the third quarter of 2025 and $14.309 million for the nine months ended September 30, 2025. Diluted earnings per share were $0.97 for the quarter and $1.05 for the nine-month period.

- The company's results were significantly influenced by the merger with Fentura Financial, Inc. on March 1, 2025, which added approximately $1.8 billion in total assets, $1.4 billion in loans, and $1.4 billion in deposits. Merger-related expenses, net of taxes, totaled $13.9 million for the nine months ended September 30, 2025.

- Total assets increased by $1.6 billion to $4.3 billion as of September 30, 2025, compared to the prior year, primarily due to the merger. Shareholders' equity also grew substantially to $449.6 million from $247.7 million a year prior.

- The GAAP net interest margin increased to 3.73% in the third quarter of 2025, up from 3.17% in the same period of 2024, with GAAP net interest income reaching $37.6 million.

- Asset quality remained strong, with annualized net loan charge-offs to average loans at 0.03% and nonperforming loans to total loans at 0.69% as of September 30, 2025.

Oct 24, 2025, 11:30 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more