Earnings summaries and quarterly performance for CARPENTER TECHNOLOGY.

Executive leadership at CARPENTER TECHNOLOGY.

Tony Thene

Chief Executive Officer

Brian Malloy

President and Chief Operating Officer

James Dee

Senior Vice President, General Counsel and Secretary

Marshall Akins

Vice President and Chief Commercial Officer

Timothy Lain

Senior Vice President and Chief Financial Officer

Board of directors at CARPENTER TECHNOLOGY.

Charles McLane Jr.

Director

Colleen Pritchett

Director

Howard Yu

Director

John Hart

Director

Julie Beck

Director

Kathleen Ligocki

Director

Ramin Younessi

Director

Stephen Ward Jr.

Lead Independent Director

Steven Karol

Director

Viola Acoff

Director

Research analysts who have asked questions during CARPENTER TECHNOLOGY earnings calls.

Andre Madrid

BTIG

8 questions for CRS

Scott Deuschle

Deutsche Bank

8 questions for CRS

Bennett Moore

JPMorgan Chase & Co.

7 questions for CRS

Gautam Khanna

TD Cowen

7 questions for CRS

Philip Gibbs

KeyBanc Capital Markets

6 questions for CRS

Josh Sullivan

The Benchmark Company, LLC

5 questions for CRS

Joshua Sullivan

The Benchmark Company

3 questions for CRS

Phil Gibbs

Keybanc Capital Markets

2 questions for CRS

Spencer Breitzke

TD Cowen

1 question for CRS

Recent press releases and 8-K filings for CRS.

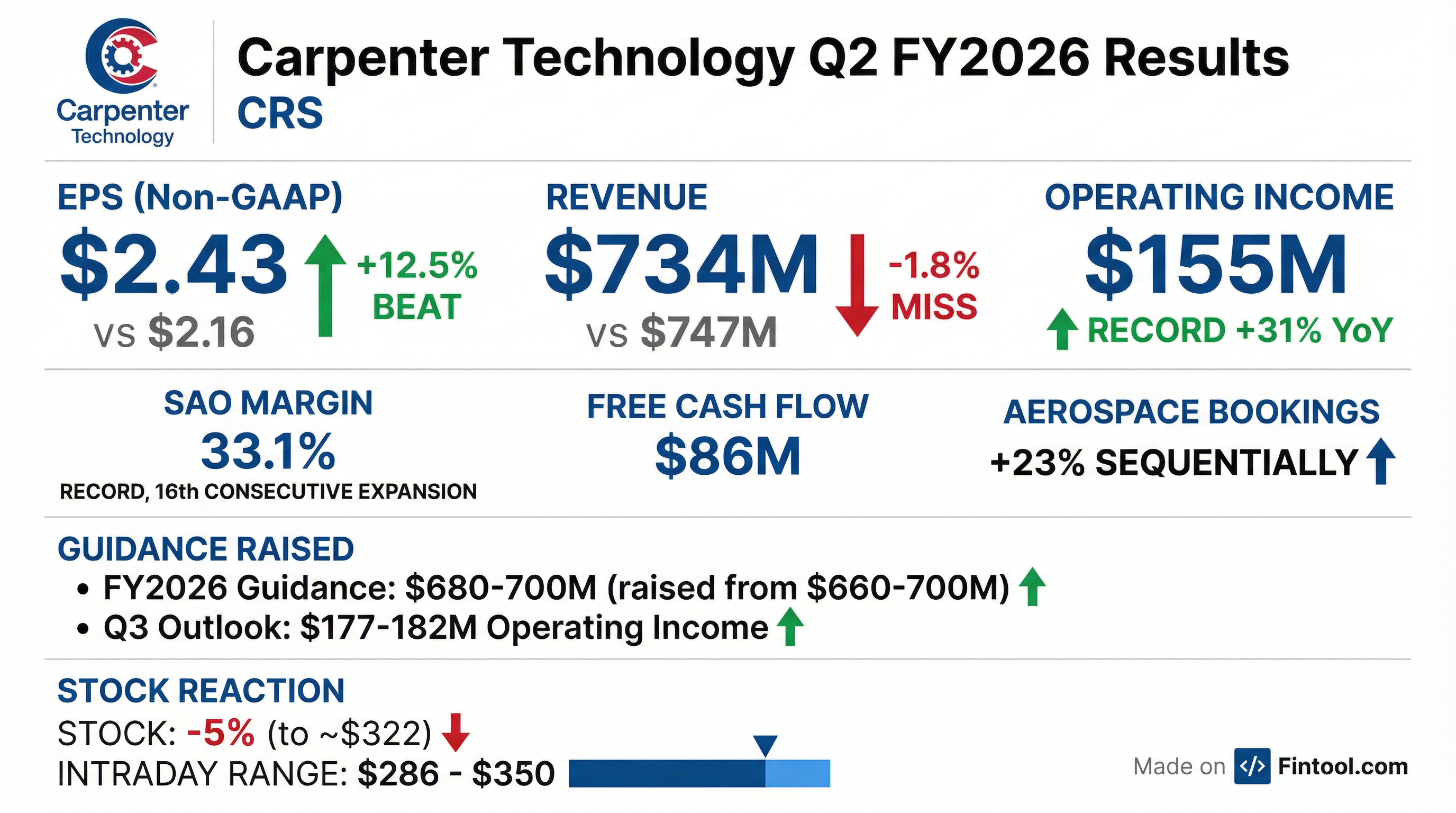

- Carpenter Technology reported record operating income of $155.2 million and adjusted earnings per diluted share of $2.33 for the second quarter of fiscal year 2026, with operating income increasing 31 percent year-over-year.

- The company increased its fiscal year 2026 operating income guidance to a range of $680 million to $700 million, representing a 30 percent to 33 percent increase over fiscal year 2025, and raised its adjusted free cash flow outlook to at least $280 million.

- The Specialty Alloys Operations (SAO) segment delivered $174.6 million in operating income and an adjusted operating margin of 33.1 percent, driven by accelerating demand in the Aerospace and Defense market with Commercial Aerospace bookings up 23 percent sequentially. The company also executed $32.1 million in share repurchases during the quarter and recorded $15.6 million in debt extinguishment losses.

- Carpenter Technology Corporation reported record operating income of $155.2 million in Q2 FY26, marking a 31% increase year-over-year, with net income of $105.3 million and diluted earnings per share of $2.09.

- The SAO segment achieved record operating income of $174.6 million, up 29% year-over-year, and a record adjusted operating margin of 33.1%.

- For Q3 FY26, SAO operating income is projected to be between $195 million and $200 million. The company also increased its FY26 outlook, anticipating adjusted operating income to be 30% to 33% higher than FY25 and adjusted free cash flow of at least $280 million.

- This strong performance is primarily driven by accelerating demand in the Aerospace and Defense market, with commercial aerospace bookings up 23% sequentially and consistently increasing pricing.

- In Q2 FY26, the company generated $85.9 million in adjusted free cash flow and repurchased $32.1 million of stock as part of its $400.0 million authorization.

- Carpenter Technology (CRS) reported record operating income of $155.2 million and adjusted earnings per diluted share of $2.33 for the second quarter of fiscal year 2026. The SAO segment achieved a record adjusted operating margin of 33.1%, marking its 16th consecutive quarter of margin expansion.

- The company raised its fiscal year 2026 operating income guidance to $680 million-$700 million, representing a 30%-33% increase over fiscal year 2025. The outlook for Q3 FY26 operating income is projected to be $177 million-$182 million.

- Demand remains strong, particularly in the aerospace and defense in-use market, with commercial aerospace bookings up 23% sequentially and aerospace engine materials order intake increasing 30% sequentially. This strong demand, coupled with a persistent supply-demand gap for nickel-based superalloys, is driving significant price increases and long-term agreements.

- CRS generated $85.9 million in adjusted free cash flow in Q2 FY26 and expects at least $280 million for the full fiscal year 2026. The company also repurchased $32.1 million of shares and completed a debt refinancing, strengthening its balance sheet and liquidity.

- Carpenter Technology Corporation reported record operating income of $155.2 million and adjusted earnings per diluted share of $2.33 for the second quarter of fiscal year 2026. This operating income represents a 31% increase over the second quarter of fiscal year 2025.

- The SAO segment achieved a record adjusted operating margin of 33.1% and record operating income of $174.6 million, marking its 16th consecutive quarter of margin expansion.

- The company raised its fiscal year 2026 operating income guidance to $680 million-$700 million, an increase from the previous range, which represents a 30%-33% increase over fiscal year 2025.

- Strong demand signals were noted, particularly in the aerospace and defense end-use market, with commercial aerospace bookings increasing 23% sequentially and aerospace engine materials order intake up 30% sequentially.

- Carpenter Technology generated $85.9 million in adjusted free cash flow in Q2 2026, repurchased $32.1 million of shares, and strengthened its balance sheet by refinancing long-term debt to 2034 and increasing its revolving credit facility to $500 million.

- Carpenter Technology reported record operating income of $155 million in Q2 fiscal year 2026, marking a 31% increase over the prior year's second quarter, and achieved a record adjusted operating margin of 33.1% in its SAO segment.

- The company raised its fiscal year 2026 operating income guidance to $680 million-$700 million, representing a 30%-33% increase over fiscal year 2025, and anticipates exceeding its fiscal year 2027 target of $765 million-$800 million.

- Demand is strengthening, particularly in the aerospace market, with commercial aerospace bookings up 23% sequentially and aerospace engine materials order intake up 30% sequentially.

- Pricing continues to be a positive tailwind due to a persistent supply-demand imbalance for nickel-based superalloys, supported by the completion of three additional long-term agreements with significant price increases and an investment in a brownfield capacity expansion to add 9,000 additional tons.

- Carpenter Technology Corporation closed a private offering of $700.0 million aggregate principal amount of 5.625% senior notes due 2034 on November 20, 2025.

- The net proceeds from this offering, along with cash on hand, will be used to redeem in full its 6.375% senior notes due 2028 and its 7.625% senior notes due 2030.

- The company also amended its credit agreement, increasing revolving commitments from $350 million of secured commitments to $500 million of unsecured commitments and extending the maturity date of the credit facility to 2030.

- Carpenter Technology Corporation announced the pricing of a $700.0 million private offering of 5.625% senior notes due 2034 on November 10, 2025.

- The offering is expected to close on November 20, 2025, subject to customary closing conditions.

- The company intends to use the net proceeds, along with cash on hand, to redeem its 6.375% senior notes due 2028 and 7.625% senior notes due 2030, and for general corporate purposes.

- Carpenter Technology Corporation (NYSE: CRS) priced a private offering of $700.0 million aggregate principal amount of 5.625% senior notes due 2034.

- The offering is expected to close on November 20, 2025.

- The net proceeds, along with cash on hand, will be used to redeem the company's 6.375% senior notes due 2028 and 7.625% senior notes due 2030, and for general corporate purposes.

- Carpenter Technology Corporation (CRS) announced a proposed $700.0 million private offering of senior notes due 2034.

- The company intends to use the net proceeds from this offering, along with cash on hand, to redeem its 6.375% senior notes due 2028 and repay its 7.625% senior notes due 2030, as well as for general corporate purposes.

- Concurrently, the company is in the process of amending its Credit Facility, which is expected to increase revolving commitments from $350 million to $500 million (unsecured) and expand the uncommitted accordion feature by up to $650 million.

- Carpenter Technology Corporation announced its intention to offer $700.0 million aggregate principal amount of senior notes due 2034 through a private offering.

- The company plans to use the net proceeds from this offering, along with cash on hand, to redeem its 6.375% senior notes due 2028 and repay its 7.625% senior notes due 2030.

- Remaining funds will be used for general corporate purposes, which may include the repayment or repurchase of other outstanding indebtedness.

Fintool News

In-depth analysis and coverage of CARPENTER TECHNOLOGY.

Quarterly earnings call transcripts for CARPENTER TECHNOLOGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more