Earnings summaries and quarterly performance for CIRRUS LOGIC.

Executive leadership at CIRRUS LOGIC.

John M. Forsyth

Chief Executive Officer

Andrew Brannan

Executive Vice President, Worldwide Sales

Carl J. Alberty

Executive Vice President, Mixed-Signal Products

Denise Grodé

Executive Vice President, Chief Human Resources Officer

Gregory Scott Thomas

Executive Vice President, General Counsel

Jeff Woolard

Chief Financial Officer

Jeffrey W. Baumgartner

Executive Vice President, Research and Development

Justin Dougherty

Executive Vice President, Global Operations

Board of directors at CIRRUS LOGIC.

Research analysts who have asked questions during CIRRUS LOGIC earnings calls.

Tore Svanberg

Stifel Financial Corp.

8 questions for CRUS

David Williams

The Benchmark Company

6 questions for CRUS

Christopher Rolland

Susquehanna Financial Group

4 questions for CRUS

Thomas O’Malley

Barclays Capital

3 questions for CRUS

Alek Valero

Loop Capital Markets

2 questions for CRUS

Dylan Olivier

Susquehanna International Group

2 questions for CRUS

Gary Mobley

Loop Capital

2 questions for CRUS

Jillian Olivier

Susquehanna

2 questions for CRUS

Ananda Baruah

Loop Capital Markets LLC

1 question for CRUS

Recent press releases and 8-K filings for CRUS.

- Cirrus Logic reported strong Q3 fiscal year 2026 revenue of $580.6 million, exceeding the top end of its guidance range, and delivered record non-GAAP earnings per share of $2.97.

- For Q4 fiscal year 2026, the company expects revenue to be in the range of $410 million to $470 million, with a GAAP gross margin projected between 51% and 53%.

- The company is expanding its presence in the PC market, anticipating PC revenue to roughly double in fiscal year 2026 from the low $10s of millions in fiscal year 2025, driven by increased adoption of the SoundWire Device Class Audio (SDCA) interface and new components for AI-enabled PCs.

- Cirrus Logic is also developing new products for the automotive market, with a potential serviceable addressable market (SAM) of over $800 million by 2029 for its products in this sector.

- Cirrus Logic reported Q3 fiscal year 2026 revenue of $580.6 million, exceeding the top end of its guidance range, driven by strong demand for components in smartphones and a favorable mix of end devices.

- The company achieved record non-GAAP earnings per share of $2.97 in Q3 fiscal year 2026, with non-GAAP net income of $156.7 million.

- For Q4 fiscal year 2026, Cirrus Logic expects revenue in the range of $410 million to $470 million, with non-GAAP operating expense projected to be between $124 million and $130 million.

- The balance sheet remains strong, ending Q3 fiscal year 2026 with $1.08 billion in cash and investments and no debt outstanding. The company also utilized $70 million to repurchase approximately 591,000 shares of common stock during the quarter.

- Strategic growth areas include expanding in the PC market, where revenue is expected to roughly double in fiscal 2026 from fiscal 2025, and developing new products for automotive haptics and AI-enabled PCs.

- Cirrus Logic reported Q3 fiscal year 2026 revenue of $580.6 million, exceeding the top end of its guidance range, and achieved record non-GAAP earnings per share of $2.97.

- For Q4 fiscal year 2026, the company expects revenue in the range of $410 million to $470 million.

- The company is expanding its presence in new markets, with PC revenue in fiscal year 2026 expected to roughly double from fiscal year 2025, and is sampling new components for AI-enabled PCs and automotive haptics.

- Cirrus Logic repurchased approximately 591,000 shares of its common stock for $70 million during Q3 fiscal year 2026, with $344.1 million remaining on its share repurchase authorization.

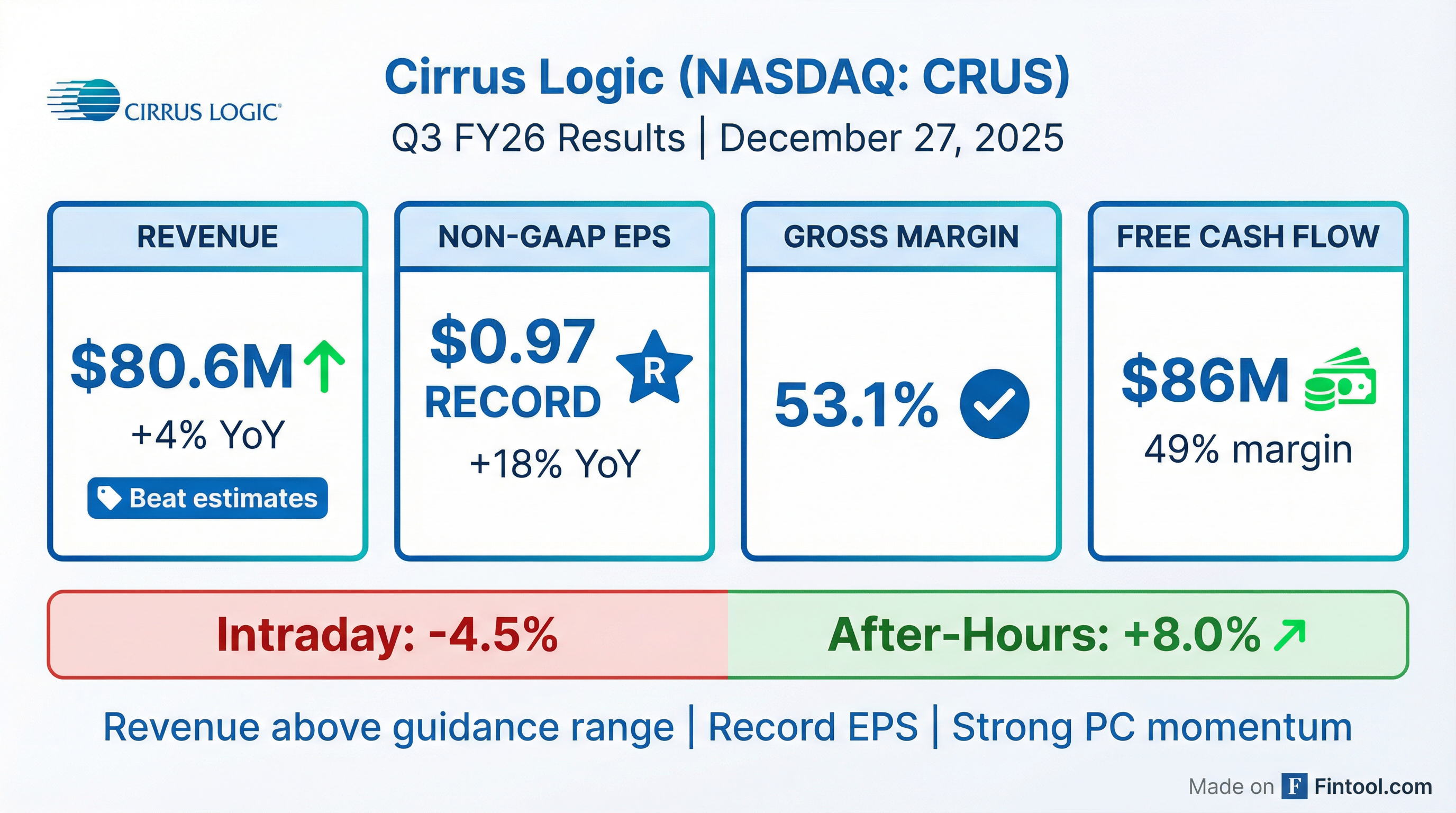

- Cirrus Logic reported Q3 FY26 revenue of $581M and a gross margin of 53.1%.

- For Q4 FY26, the company provided guidance for revenue between $410M and $470M and a gross margin of 51% to 53%.

- The company ended Q3 FY26 with $1.08B in total cash and investments, generated $291M in cash from operations, and repurchased $70M in shares.

- A significant customer concentration was noted, with the largest customer representing 94% of total revenue in Q3 FY26.

- Cirrus Logic's growth strategy focuses on maintaining smartphone audio leadership, increasing High-Performance Mixed-Signal (HPMS) content in smartphones, and expanding into new applications such as PCs, tablets, and AR/VR.

- Cirrus Logic reported Q3 FY26 revenue of $580.6 million, exceeding guidance, with GAAP earnings per share of $2.66 and non-GAAP earnings per share of $2.97, and a gross margin of 53.1 percent.

- For Q4 FY26, revenue is expected to range between $410 million and $470 million, with a GAAP gross margin forecast of 51 percent to 53 percent and non-GAAP operating expenses between $124 million and $130 million.

- The strong Q3 performance was driven by stronger-than-anticipated demand for components shipping into smartphones and progress in expanding into new markets with products for AI-enabled PCs and automotive haptics.

- The company repurchased $70.0 million of common stock during Q3 FY26, with $344.1 million remaining in its share repurchase authorization.

- Cirrus Logic reported fiscal third quarter FY26 revenue of $580.6 million, exceeding the high end of its guidance range due to stronger-than-anticipated demand for smartphone components.

- For Q3 FY26, the company achieved GAAP earnings per share of $2.66 and non-GAAP earnings per share of $2.97, with a GAAP and non-GAAP gross margin of 53.1 percent.

- The company is actively diversifying its product portfolio, including sampling a new component for AI-enabled PCs and adding new product families for prosumer and automotive markets.

- For the fourth quarter of fiscal year 2026, Cirrus Logic anticipates revenue to range between $410 million and $470 million, with GAAP gross margin forecasted to be between 51 percent and 53 percent.

- Cirrus Logic is positioning itself for AI at the edge, leveraging its power-efficient chips and voice-enabling IP for conversational interfaces in devices like phones, PCs, and new AI categories.

- The company announced its entry into the automotive haptics market with new auto-qualified products, aiming to improve the user experience in car cabins, though material revenue contribution is expected to take some time.

- Cirrus Logic projects strong growth in the PC market, with revenue expected to be in the low tens of millions of dollars in fiscal 2025 and to double in fiscal 2026. This growth is driven by the transition to SDCA audio architecture, where Cirrus Logic holds an estimated 75% market share in migrated products, and increasing penetration into mainstream devices.

- For smartphones, the company anticipates continued expansion in camera controllers, which have seen a six-fold increase in processing power since their first generation, with features typically introduced in pro-level devices and then cascading down to other models.

- Cirrus Logic's capital allocation strategy prioritizes funding organic growth opportunities, followed by inorganic opportunities (M&A) to accelerate growth, with share buybacks as the third priority. The company still has over $400 million remaining on its buyback authorization.

- Cirrus Logic anticipates playing a significant role in AI at the edge, leveraging its power-efficient chips and voice-enabling IP for conversational interfaces.

- The company recently announced automotive haptics products designed to enhance in-car user experience, though material revenue contribution is expected in late 2027 or 2028 due to long automotive design cycles.

- Cirrus Logic projects its PC market revenue to be in the low tens of millions of dollars for fiscal 2025, with expectations to double in fiscal 2026, driven by the transition to SDCA audio architecture and penetration into mainstream devices.

- Content expansion in camera controllers for smartphones is expected to continue, with new features typically introduced in pro-level devices and then waterfalling down to other models.

- Cirrus Logic's capital allocation strategy prioritizes funding organic growth and pursuing M&A opportunities to accelerate growth, with over $400 million remaining on its share buyback authorization.

- Cirrus Logic announced new automotive haptics products that are auto-qualified, with material revenue contribution anticipated in the late 2027 or 2028 timeframe.

- The company expects its PC-related revenue to be in the low tens of millions of dollars for FY 2025 and to double in FY 2026, driven by the transition to SDCA audio architecture and penetration into mainstream devices.

- Cirrus Logic sees significant opportunity in AI at the edge, leveraging its power-efficient chips, small packages, and voice-enabling IP, and continues to expand content in smartphone camera controllers and power conversion control.

- The capital allocation strategy prioritizes funding organic growth, followed by inorganic opportunities, with over $400 million remaining on its share buyback authorization as a third priority.

- Cirrus Logic reported record Q2 fiscal 2026 revenue of $561 million and non-GAAP earnings per share of $2.83, driven by strong demand for smartphone components.

- For Q3 fiscal 2026, the company anticipates revenue in the range of $500 million to $560 million and a non-GAAP gross margin between 51% and 53%.

- The company is expanding its presence in the PC market, securing its first mainstream consumer design and developing AI-enabled PC products, with the first product sampling expected in the December quarter.

- During Q2 fiscal 2026, Cirrus Logic repurchased approximately 362,000 shares of its common stock for $40 million at an average price of $110.55.

- The company highlighted a change in business seasonality, primarily due to camera content becoming a larger and earlier portion of total revenue.

Quarterly earnings call transcripts for CIRRUS LOGIC.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more