Earnings summaries and quarterly performance for CORVEL.

Executive leadership at CORVEL.

Board of directors at CORVEL.

Research analysts covering CORVEL.

Recent press releases and 8-K filings for CRVL.

CorVel Reports Q3 2026 Financial Results and Highlights AI Initiatives

CRVL

Earnings

Share Buyback

New Projects/Investments

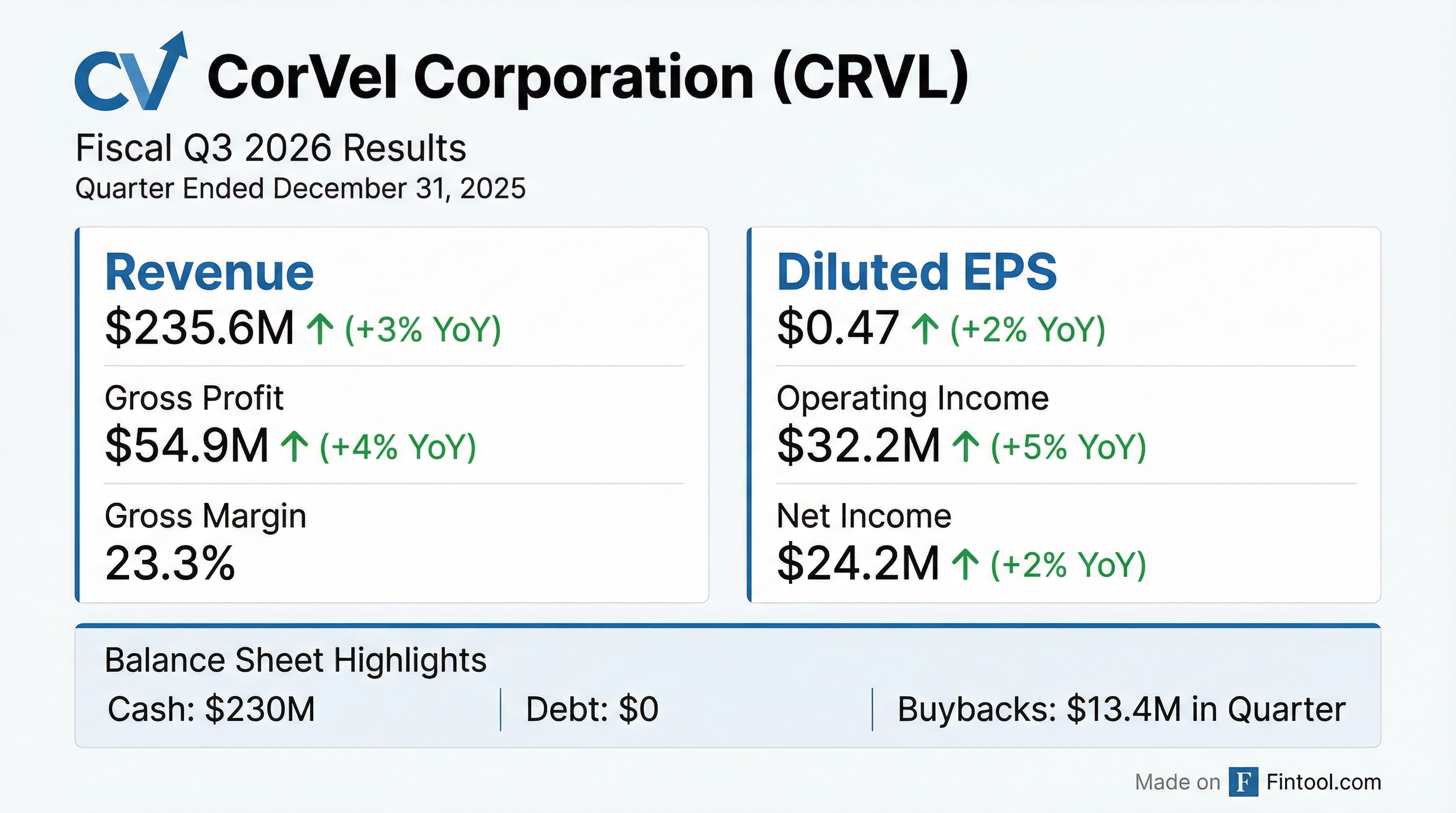

- CorVel reported Q3 2026 revenue of $236 million, a 3% increase year-over-year, and EPS of $0.47, up 2%. For the nine months ending December 31, 2025, revenue was $710 million, a 7% increase, with EPS at $1.53, up 16%.

- The company is significantly investing in AI initiatives across its products, services, and software development to drive operational efficiency and enhance client outcomes, complemented by a technology-centric acquisition in June 2025.

- During the quarter, CorVel repurchased 185,559 shares for $13.4 million, contributing to 69% of total shares outstanding repurchased since inception. The company maintains a strong, debt-free balance sheet with $230 million in cash at quarter-end.

3 days ago

CorVel Reports Q3 2026 Financial Results and Strategic AI Initiatives

CRVL

Earnings

Share Buyback

New Projects/Investments

- CorVel reported revenue of $236 million for the December 2025 quarter, a 3% increase year-over-year, and earnings per share of $0.47, up 2%. For the nine months ending December 31, 2025, revenue increased 7% to $710 million, with EPS rising 16% to $1.53.

- The company is significantly leveraging AI and automation across its business to augment development, increase operational efficiency, and enhance outcomes, expecting meaningful reductions in service delivery costs and supporting margin expansion. A technology-centric acquisition closed in June 2025 is also contributing to increased efficiency in health payment integrity services.

- During the December 2025 quarter, CorVel repurchased 185,559 shares for $13.4 million, continuing to fund repurchases from strong operating cash flow. The company ended the quarter with a $230 million cash balance and a debt-free balance sheet.

- CorVel highlighted market trends including a lower volume of work-related injuries but increasing injury severity and rising medical costs in workers' compensation, and noted record False Claims Act enforcement recoveries exceeding $6.8 billion in 2025, with $5.7 billion in healthcare.

3 days ago

CorVel Reports Q3 2026 Financial Results and Strategic AI Initiatives

CRVL

Earnings

Share Buyback

New Projects/Investments

- CorVel reported Q3 2026 revenue of $236 million, a 3% increase year-over-year, and EPS of $0.47, up 2% from the prior year's quarter. For the nine months ending December 31, 2025, revenue was $710 million, a 7% increase, with EPS at $1.53, up 16%.

- The company repurchased 185,559 shares for $13.4 million during the quarter, contributing to a total of 69% of outstanding shares repurchased since inception.

- CorVel is actively integrating AI initiatives across its operations and products, and completed a technology-centric acquisition to enhance health payment integrity services.

- The company maintains a strong financial position with a quarter-ending cash balance of $230 million and $90 million in fiscal year-to-date free cash flow, operating with a debt-free balance sheet.

3 days ago

CorVel Announces Q3 FY2026 and Nine-Month Results

CRVL

Earnings

Share Buyback

New Projects/Investments

- CorVel Corporation reported revenues of $236 million for the quarter ended December 31, 2025, a 3% increase compared to the prior year's third quarter, with diluted earnings per share of $0.47, up 2%. For the nine months ended December 31, 2025, revenues increased 7% to $710 million, and diluted earnings per share rose 16% to $1.53.

- The company's gross profit for the quarter increased 4% to $54.9 million, achieving a 23% gross margin.

- CorVel exited the quarter with $230 million in cash and cash equivalents and no borrowings, and repurchased $13.4 million of common stock during the quarter.

- The company advanced its AI initiatives, delivering tangible benefits and leveraging emerging technologies, and noted that the integration of a recent strategic acquisition is progressing ahead of plan.

4 days ago

CorVel Corporation Announces Fiscal Q3 2026 Financial Results

CRVL

Earnings

Share Buyback

New Projects/Investments

- Revenues for the third fiscal quarter of 2026 (ended December 31, 2025) were $236 million, an increase from $228 million in the prior year quarter. For the nine months ended December 31, 2025, revenues increased 7% to $710 million.

- Diluted earnings per share for the third fiscal quarter of 2026 was $0.47, compared to $0.46 in the prior year quarter. For the nine months ended December 31, 2025, diluted EPS rose 16% to $1.53.

- Gross profit for the third fiscal quarter of 2026 increased 4% to $54.9 million, achieving a 23% gross margin.

- The company ended the third fiscal quarter of 2026 with $230 million in cash, cash equivalents, and no borrowings.

- CorVel repurchased $13.4 million of common stock during the third fiscal quarter of 2026.

4 days ago

CorVel (CRVL) Highlights Financial Performance and Strategic Technology Focus

CRVL

Revenue Acceleration/Inflection

New Projects/Investments

M&A

- CorVel (CRVL) is a publicly held company on NASDAQ that applies advanced technology, including AI, machine learning, and natural language processing, to enhance care management and reduce healthcare costs across various claims for employers, TPAs, insurance companies, and government agencies.

- The company reported over $896 million in annual revenue and a revenue compounded growth rate of 7.3% over multiple decades. It also boasts an average Return on Equity (ROE) of 23.5%.

- As of February 1, 2026, CorVel's market capitalization was $3.5 billion, with a recent stock price of $69.75. The company was ranked 5th among Largest Third-Party Administrators by 2024 gross revenue, reporting $871,000,000 for that year, a 12.5% increase from $774,000,000 in 2023.

- CorVel's strategy includes M&A to expand service offerings and bolster tech expertise, and it utilizes its proprietary CareMC platform which is AI-enabled and scalable, featuring predictive analytics and real-time communication for claims management.

5 days ago

CorVel Recognized on TIME’s America’s Growth Leaders 2026 List

CRVL

Revenue Acceleration/Inflection

New Projects/Investments

- CorVel Corporation has been included on TIME’s America’s Growth Leaders 2026 Ranking, making it the only company in its industry to earn this recognition for its exceptional growth performance, financial stability, and stock performance.

- For the quarter ending September 2025, CorVel reported 7% revenue growth to $240 million and a 15% increase in gross profit to $58.2 million.

- The company is investing in workforce development through CorVel University and advancing AI-driven platforms, including Care MC Edge and emerging Agentic AI technologies, to enhance efficiency and scalability.

Nov 11, 2025, 12:18 PM

CorVel Corporation Reports Q2 2026 Financial Results and Strategic AI Initiatives

CRVL

Earnings

Share Buyback

New Projects/Investments

- CorVel Corporation reported Q2 2026 revenues of $240 million, a 7% increase year-over-year, with earnings per share of $0.54, up 20% from the prior year, adjusted for a 3-for-1 stock split.

- The company achieved an improved net income of $28 million for the quarter and maintains a strong, debt-free balance sheet with $207 million in cash.

- During the quarter, CorVel repurchased 143,774 shares for $12.8 million, bringing the total repurchased to 69% of outstanding shares since inception.

- CorVel is strategically leveraging agentic AI to enhance operational efficiency, improve service offerings, and address industry challenges, following an acquisition of a technology firm in the prior quarter.

- Brian Nichols was introduced as the new Chief Financial Officer.

Nov 4, 2025, 4:30 PM

CorVel Reports Q2 2026 Financial Results and Highlights AI and M&A Initiatives

CRVL

Earnings

Share Buyback

M&A

- CorVel Corporation reported Q2 2026 revenues of $240 million, a 7% increase over the prior year, and earnings per share of $0.54, up 20% from the September 2024 quarter, with net income reaching $28 million.

- The company is strategically leveraging agentic AI to enhance productivity, reduce costs, and accelerate decision-making across its service and property and casualty segments, leading to improved outcomes and operating leverage.

- During the quarter, CorVel repurchased 143,774 shares for $12.8 million, contributing to a total of 69% of outstanding shares repurchased since inception, funded by strong operating cash flow.

- CorVel maintains a strong, debt-free balance sheet with a $207 million cash balance and improved day sales outstanding of 40 days in the September quarter.

- The company completed an acquisition of assets and talent from a technology firm in the June quarter and plans to add resources to pursue further synergistic M&A opportunities to expand offerings and technological expertise.

Nov 4, 2025, 4:30 PM

CorVel Reports Q2 2026 Financial Results, Announces New CFO, and Highlights AI Initiatives

CRVL

Earnings

Share Buyback

CFO Change

- CorVel Corporation reported Q2 2026 (September quarter 2025) revenues of $240 million, a 7% increase compared to $224 million in the September 2024 quarter, with earnings per share (EPS) of $0.54, up 20% from $0.45 in the prior year's same quarter.

- Revenue growth was primarily driven by both patient management (contributing approximately $4 million in revenue growth) and network solution segments (increasing by $12 million).

- The company is actively leveraging agentic AI to enhance productivity, reduce costs, accelerate decision-making, and improve systems, while also investing in talent development through CorVel University.

- CorVel maintained a strong, debt-free balance sheet with a quarter-ending cash balance of $207 million and repurchased 143,774 shares for $12.8 million during the quarter.

- Brian Nichols was welcomed as CorVel's new Chief Financial Officer.

Nov 4, 2025, 4:30 PM

Quarterly earnings call transcripts for CORVEL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more