Earnings summaries and quarterly performance for DOMINION ENERGY.

Executive leadership at DOMINION ENERGY.

Robert M. Blue

Chair, President and Chief Executive Officer

Carlos M. Brown

Executive Vice President, Chief Administrative and Projects Officer and Corporate Secretary

Edward H. Baine

President – Utility Operations and Dominion Energy Virginia

Steven D. Ridge

Executive Vice President and Chief Financial Officer

Board of directors at DOMINION ENERGY.

D. Maybank Hagood

Director

James A. Bennett

Director

Jeffrey J. Lyash

Director

Joseph M. Rigby

Director

Kristin G. Lovejoy

Director

Mark J. Kington

Director

Pamela J. Royal, M.D.

Director

Robert H. Spilman, Jr.

Director

Susan N. Story

Lead Independent Director

Vanessa Allen Sutherland

Director

Research analysts who have asked questions during DOMINION ENERGY earnings calls.

Jeremy Tonet

JPMorgan Chase & Co.

6 questions for D

Nicholas Campanella

Barclays

6 questions for D

Anthony Crowdell

Mizuho Financial Group

5 questions for D

Carly Davenport

Goldman Sachs

5 questions for D

David Arcaro

Morgan Stanley

4 questions for D

Shahriar Pourreza

Guggenheim Partners

4 questions for D

Stephen D’Ambrisi

Ladenburg Thalmann

2 questions for D

Steve Fleishman

Wolfe Research, LLC

2 questions for D

David Paz

Wolfe Research, LLC

1 question for D

Durgesh Chopra

Evercore ISI

1 question for D

James Kennedy

Marathon Microfinder

1 question for D

Ross Fowler

Bank of America

1 question for D

Steven Fleishman

Wolfe Research

1 question for D

Recent press releases and 8-K filings for D.

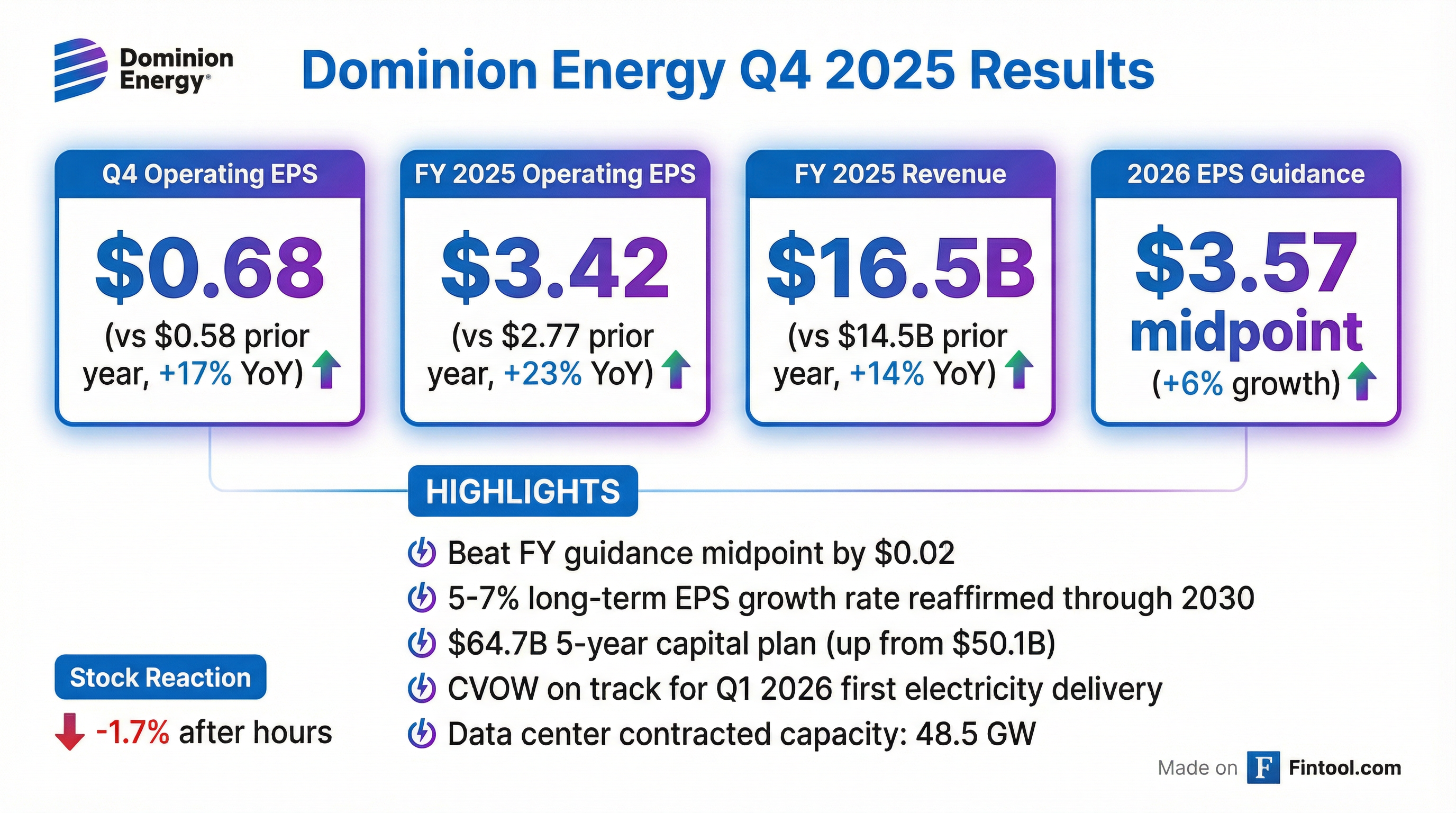

- Dominion delivered 2025 operating EPS of $3.42 ($3.33 ex-RNG credits), above the guidance midpoint, and set 2026 operating EPS guidance of $3.40–$3.60 (midpoint $3.50), a 6.1% increase on a comparable basis.

- The company increased its 5-year capital plan to ~$65 billion (up 30%), driven by Dominion Energy Virginia, with 60% funding from internal cash flow, 10% from hybrids, 10% equity programs, and 20% debt.

- Coastal Virginia Offshore Wind is >70% complete, on track for first power by March 2026 within an $11.5 billion budget (including $155 million contingency).

- Data center pipeline exceeds 48 GW, up 3% since September 2025, and forecasted demand through 2045 is fully covered by existing ESAs and CLOAs.

- Dominion Energy will report Q4 2025 results before the market opens on Feb. 23, 2026, with investors weighing EPS and revenue against varying consensus forecasts.

- Consensus forecasts differ: Benzinga expects $0.66–$0.67 EPS and $3.65 billion in revenue, while another outlet projects $0.95 EPS and $4.25 billion in revenue.

- Demand from Virginia data centers—accounting for 27% of Virginia’s energy sales—is a key driver, though rising costs and regulatory recovery uncertainties pose risks.

- Shares trade around $65.96, reflecting a 10.7% one-month price return and 20.3% one-year total return; a quarterly dividend of $0.667 per share and a history of modestly beating estimates bolster investor sentiment.

- On January 30, 2026, Dominion Energy reported an increase in CVOW total project cost from $11.2 billion to $11.5 billion, reflecting $228 million in delay-related expenses and $580 million of tariffs (exclusive of financing costs).

- The full project completion is now anticipated in early 2027, updated to reflect the BOEM suspension (December 2025) and subsequent preliminary injunction in January 2026.

- First electricity delivery remains on track for Q1 2026, with approximately 71% construction completion reported as of January 30 2026.

- U.S. District Court for the Eastern District of Virginia granted a preliminary injunction allowing construction to resume on the Coastal Virginia Offshore Wind (CVOW) project pending litigation.

- CVOW will comprise 176 turbines with 2.6 GW capacity, enough to power up to 660,000 homes as part of Dominion’s clean energy portfolio.

- Virginia Power, a Dominion subsidiary holding 50% of OSW Project LLC, will continue its lawsuit challenging the BOEM order that suspended work on the project.

- U.S. District Court preliminarily enjoins agency action, allowing Coastal Virginia Offshore Wind (CVOW) construction to recommence while legal challenge continues.

- CVOW comprises 176 turbines with 2.6 GW capacity, sufficient to power up to 660,000 homes.

- Dominion will safely restart work to begin delivering energy in the coming weeks and seeks a durable resolution with federal regulators.

- The project supports Dominion’s all-of-the-above strategy for regulated offshore wind and solar to meet regional demand.

- U.S. District Judge Jamar Walker granted Dominion Energy a preliminary injunction to resume construction of the 2.6 GW Coastal Virginia Offshore Wind project while its lawsuit against the federal pause proceeds.

- CVOW comprises 176 turbines sited 27–44 miles off Virginia’s coast and is expected to power 600,000–660,000 homes.

- The injunction blocks enforcement of the Interior Department’s December suspension of five East Coast offshore-wind projects, which cited unspecified national-security concerns.

- Dominion estimates the pause has cost millions per day, warned delays could threaten grid reliability and key data-center and defense assets, and saw its shares rise about 1% on the ruling.

- Elevate Renewables has acquired Prospect Power Storage, a 150 MW/600 MWh standalone battery asset in PJM, set to begin operations in mid-2026.

- The project is fully contracted under a 15-year power purchase agreement with Dominion Energy Virginia.

- Located in Rockingham County near Northern Virginia’s “Data Center Alley,” it will support grid reliability amid rising Mid-Atlantic power demand.

- This follows Elevate’s 2024 launch of a 15 MW/60 MWh battery project at the Arthur Kill Power Station in New York City.

- A U.S. judge granted a preliminary injunction allowing Revolution Wind to resume construction off Rhode Island, where the project is 87% complete.

- Orsted shares rose 6% on the ruling, reflecting market optimism about the project’s revival.

- The construction pause was costing Orsted at least $1.44 million per day, and a full cancellation could have entailed losses of around 20 billion Danish crowns.

- Orsted operates 9.9 GW of U.S. offshore wind and 4.8 GW of onshore/solar, with a market cap of $26.67 billion and an Altman Z-Score of 1.13 (“distress” zone).

- Suspensions on other projects (Sunrise Wind, Empire Wind, Coastal Virginia) remain subject to ongoing legal challenges.

- On December 22, 2025, the U.S. Department of Interior’s BOEM issued a 90-day suspension of all activities on the Coastal Virginia Offshore Wind project, effective immediately.

- Virginia Electric and Power Company, a Dominion subsidiary, holds 50% membership interests in OSW Project LLC, which owns the CVOW project.

- In its response, Dominion Energy emphasized CVOW’s role in supporting national security, Virginia’s rapidly growing energy demand, and providing 2,600 MW of clean power for war-fighting installations, AI data centers, and jobs.

- Dominion warned the suspension could threaten grid reliability, lead to energy inflation, and jeopardize thousands of jobs.

- Dominion Energy addresses a 90-day suspension by the U.S. Department of Interior for the Coastal Virginia Offshore Wind project, calling it essential for national security and Virginia’s fastest growing energy demand.

- The company warns the work stoppage will threaten grid reliability, drive energy inflation, and jeopardize thousands of jobs.

- CVOW is American-owned, approved by Virginia regulators in 2022, and its two pilot turbines have operated for five years without impacting national security.

- The project enjoys bipartisan support and is within months of generating 2,600 MW of carbon-free electricity to serve critical infrastructure.

- Dominion stands ready to resume work immediately to deliver vital electrons that power data centers, military installations, and warship manufacturing.

Fintool News

In-depth analysis and coverage of DOMINION ENERGY.

Quarterly earnings call transcripts for DOMINION ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more