Earnings summaries and quarterly performance for DIGITAL REALTY TRUST.

Executive leadership at DIGITAL REALTY TRUST.

Board of directors at DIGITAL REALTY TRUST.

Research analysts who have asked questions during DIGITAL REALTY TRUST earnings calls.

Eric Luebchow

Wells Fargo

6 questions for DLR

Frank Louthan

Raymond James

6 questions for DLR

Michael Elias

TD Cowen

6 questions for DLR

Michael Rollins

Citigroup

6 questions for DLR

Richard Choe

JPMorgan Chase & Co.

6 questions for DLR

Irvin Liu

Evercore ISI

5 questions for DLR

Vikram Malhotra

Mizuho Financial Group, Inc.

5 questions for DLR

David Guarino

Green Street

4 questions for DLR

Jonathan Atkin

RBC Capital Markets

4 questions for DLR

Jon Petersen

Jefferies

4 questions for DLR

Ari Klein

BMO Capital Markets

3 questions for DLR

James Schneider

Goldman Sachs

3 questions for DLR

Matthew Niknam

Deutsche Bank

3 questions for DLR

Michael Funk

Bank of America

3 questions for DLR

Nicholas Del Deo

MoffettNathanson

3 questions for DLR

Nick Del Deo

MoffettNathanson LLC

3 questions for DLR

Aryeh Klein

BMO Capital Markets

2 questions for DLR

David Barden

Bank of America

2 questions for DLR

John Hodulik

UBS Group AG

2 questions for DLR

Timothy Horan

Oppenheimer & Co. Inc.

2 questions for DLR

Alexander Waters

Bank of America

1 question for DLR

Brandon Nispel

KeyBanc Capital Markets

1 question for DLR

Erik Rasmussen

Stifel

1 question for DLR

Georgi Dinkov

Mizuho

1 question for DLR

Jim Schneider

Goldman Sachs

1 question for DLR

Jyhhaw Liu

Evercore ISI

1 question for DLR

Simon Flannery

Morgan Stanley

1 question for DLR

Recent press releases and 8-K filings for DLR.

- Digital Realty is launching its Digital Realty Innovation Lab (DRIL) in Singapore, Japan and London, marking its first expansion into Asia Pacific and Europe following the Northern Virginia pilot, to accelerate AI and hybrid cloud deployments in these regions.

- The Singapore DRIL will serve as a regional innovation hub; the Japan DRIL, located at the NRT12 data center, will feature 20 liquid-cooled racks for high-performance computing; and the London DRIL offers a dedicated environment for enterprise validation of AI and hybrid cloud architectures.

- Key capabilities include high-density AI/HPC testing up to 150 kW per cabinet, energy- and cooling-aware testing, and direct hybrid cloud connectivity via ServiceFabric®, enabling customers to optimize and de-risk infrastructure before full-scale rollout.

- APAC Debut: Digital Realty expanded its Innovation Lab (DRIL) network into Singapore and Japan, following the inaugural facility in Northern Virginia in September 2025.

- Testing Capabilities: The new labs provide real-world environments for AI and hybrid cloud validation, featuring high-density AI/HPC testing, energy and cooling-aware assessments, and ServiceFabric® interconnection.

- Facility Details: The Japan DRIL will be housed at the NRT12 data center in Greater Tokyo with 20 direct liquid cooling racks supporting high-power-density workloads.

- Strategic Alignment: The expansion leverages Singapore’s digital economy growth (18.6% of GDP) and aligns with Japan’s ¥10 trillion investment plan in semiconductors and AI by 2030.

- Digital Realty Trust, Inc. and its operating partnership filed a new automatic shelf registration on Form S-3ASR (Registration Nos. 333-293494 and 333-293494-01), effective February 17, 2026, replacing the prior registration set to expire March 16, 2026.

- The company concurrently filed an ATM Prospectus Supplement under a December 23, 2024 Sales Agreement, providing for up to $1.886 billion in aggregate gross offering price of common stock, of which $1.114 billion has been sold to date.

- An opinion of Venable LLP regarding the validity of the shares to be issued was attached as Exhibit 5.1 to the Form 8-K.

- Digital Realty’s upcoming NRT14 facility in Greater Tokyo will be among the first in Japan to earn NVIDIA DGX-Ready Data Center certification for liquid-cooled GB200 GPU systems.

- The data center supports high-density AI workloads of 100 kW+ per rack powered by NVIDIA Grace Blackwell architecture, enabling faster insights and reduced operational costs.

- Achieved by MC Digital Realty, the 50/50 joint venture with Mitsubishi Corporation, the certification expands Digital Realty’s AI infrastructure footprint in Asia Pacific, now comprising six NVIDIA-certified sites.

- This milestone extends Digital Realty’s collaboration with NVIDIA following the NVIDIA AI Factory Research Center in Northern Virginia, offering scalable, high-density AI-ready infrastructure worldwide.

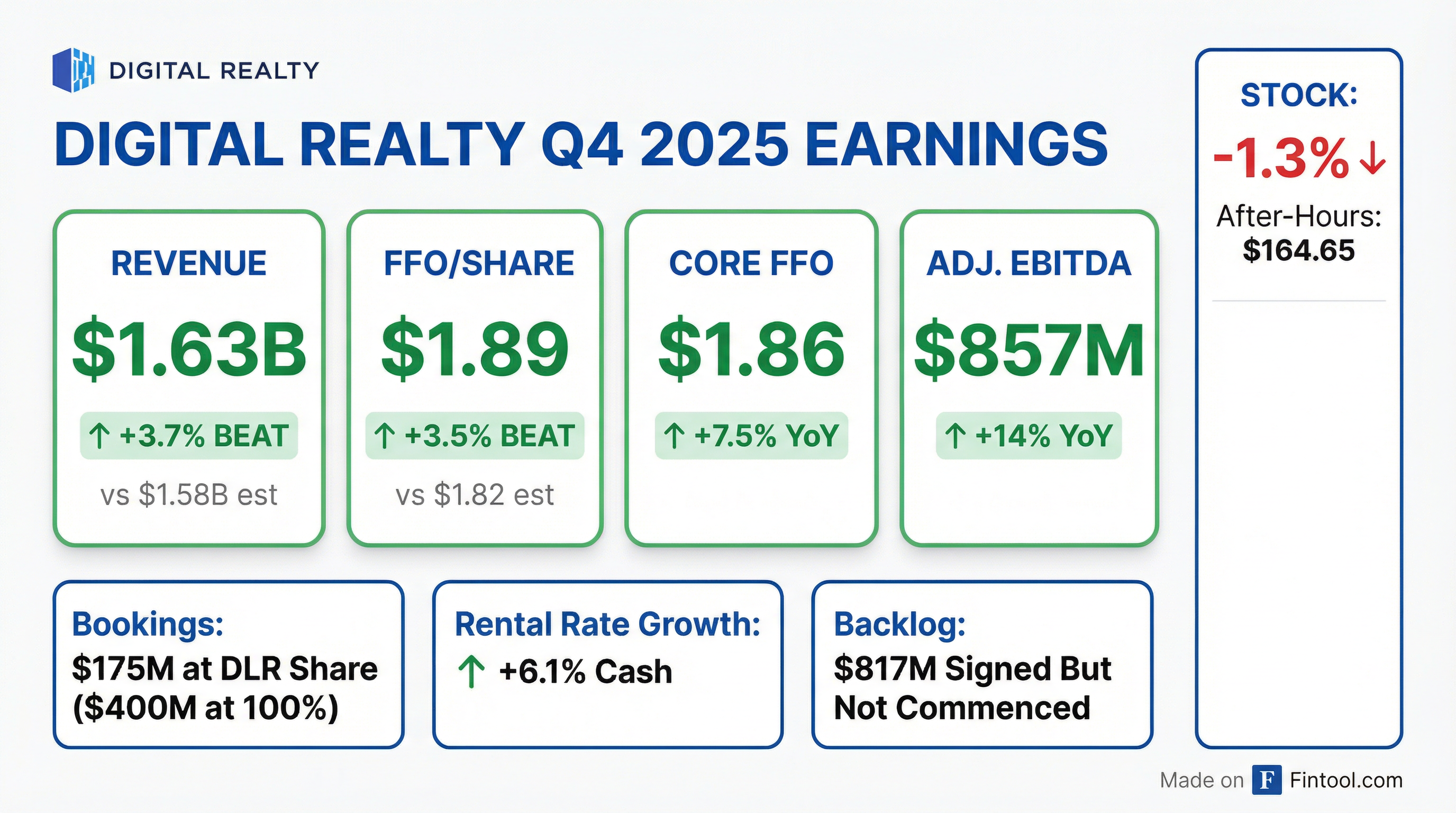

- Digital Realty delivered $400 million in 4Q25 total bookings at 100% share and ended the quarter with a $1.4 billion backlog, highlighted by a record $96 million in 0–1 MW and interconnection bookings.

- In FY 2025, the company achieved $1.2 billion in total bookings at 100% share, drove 4.5% Y/Y same-capital Cash NOI growth, and generated a record $7.39 Core FFO per share.

- Maintained ~$7 billion of liquidity at the end of Q4 2025.

- Provided 2026 guidance for $6.6–6.7 billion in total revenue, $3.6–3.7 billion in adjusted EBITDA, and Core FFO per share of $7.90–8.00.

- 2025 full-year record performance: revenue, EBITDA, and Core FFO per share exceeded guidance; signed $1.2 billion of new leases, ~70% above the five-year average.

- Q4 leasing and earnings: signed $400 million of annualized rent (100% share) / $175 million at DLR share; interconnection leasing set a new record at $96 million; Core FFO per share $1.86 (+8% YoY); full-year Core FFO $7.39 (+10% YoY).

- Development activity: net Q4 development CapEx of $930 million; delivered 90 MW (75% pre-leased), started 135 MW; pipeline stands at $10 billion with an expected stabilized yield of 11.9%.

- Balance sheet and financing: issued €1.4 billion of dual-tranche green Eurobonds (3.75% due 2033; 4.25% due 2037) and redeemed €1.075 billion; maintained leverage at 4.9×, liquidity near $7 billion, and $15 billion of private capital available.

- 2026 guidance: Core FFO of $7.90–8.00 per share (+8% YoY); revenue and Adjusted EBITDA growth >10%; same-capital cash NOI +4–5%; renewal spreads 6–8%; power-based occupancy +50–100 bps; net CapEx $3.25–3.75 billion; dispositions of $500 million–1 billion.

- Digital Realty delivered Core FFO per share of $1.86 in Q4 and $7.39 for full-year 2025, up 10% year-over-year.

- In Q4, the company signed leases representing $400 million of annualized rent at 100% share (Digital Realty share: $175 million), set a record $96 million in 0–1 MW interconnection leasing, and ended the year with a backlog of $1.4 billion.

- By year-end, Digital Realty secured €3.225 billion of LP equity commitments to its inaugural closed-end hyperscale fund, maintained leverage at 4.9×, liquidity of ~$7 billion, and had a $10 billion development pipeline.

- 2026 guidance calls for Core FFO per share of $7.90–$8.00 (+8% yoy at midpoint), revenue and Adjusted EBITDA growth >10%, same capital cash NOI growth 4–5%, and net CapEx of $3.25–$3.75 billion.

- Core FFO per share was $1.86 in Q4 and $7.39 for FY 2025, up 10% YoY; 2026 core FFO guidance is $7.90–$8.00 per share, implying ~8% growth.

- Leasing momentum continued: signed $400 M of annualized rent at 100% share (or $175 M at DLR share); set a new quarterly interconnection record of $96 M in the 0–1 MW category; full-year 2025 bookings were $1.2 B at 100% share, leaving a record backlog of $1.4 B.

- Development execution: delivered 90 MW of capacity in Q4 (75% pre-leased) and 289 MW in 2025; 769 MW under construction with a $10 B gross pipeline at an expected 11.9% stabilized yield.

- Balance sheet strength: total leverage 4.9x; liquidity nearly $7 B; raised €1.4 B via green Eurobonds and redeemed €1.075 B of higher-cost debt; maintain $15 B of private capital dry powder.

- Digital Realty generated $1.635 B in Q4 2025 revenues (up 14% Y/Y) and net income of $96 M (diluted EPS of $0.24).

- FFO per diluted share was $1.89 and Core FFO per diluted share was $1.86 in Q4, underpinning a FY 2025 record CFFO of $7.39 per share.

- Q4 signed bookings reached $1.2 B at 100% share, building a $1.4 B backlog at 100% share; same-capital Cash NOI grew 4.5% Y/Y and liquidity stood at ~$7 B at year-end.

- The company issued 2026 Core FFO per share guidance of $7.90–$8.00 on a reported and constant-currency basis.

- Digital Realty reported 4Q25 revenue of $1.6 billion, up 4% quarter-over-quarter and 14% year-over-year.

- Net income available to common stockholders was $88 million ($0.24 per share), down from $0.51 per share in 4Q24.

- Funds From Operations per share were $1.89 and Core FFO per share was $1.86 (Constant-Currency Core FFO per share of $1.81), versus $1.61 and $1.73 in 4Q24.

- Signed total bookings expected to generate $400 million of annualized GAAP rental revenue at 100% share (DLR share $175 million) and ended the year with an $817 million backlog of annualized GAAP base rent.

- Introduced 2026 Core FFO per share outlook of $7.90–$8.00 on both a reported and Constant-Currency basis.

Quarterly earnings call transcripts for DIGITAL REALTY TRUST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more