Earnings summaries and quarterly performance for DIGITAL REALTY TRUST.

Executive leadership at DIGITAL REALTY TRUST.

Board of directors at DIGITAL REALTY TRUST.

Research analysts who have asked questions during DIGITAL REALTY TRUST earnings calls.

Eric Luebchow

Wells Fargo

6 questions for DLR

Frank Louthan

Raymond James

6 questions for DLR

Michael Elias

TD Cowen

6 questions for DLR

Michael Rollins

Citigroup

6 questions for DLR

Richard Choe

JPMorgan Chase & Co.

6 questions for DLR

Irvin Liu

Evercore ISI

5 questions for DLR

Vikram Malhotra

Mizuho Financial Group, Inc.

5 questions for DLR

David Guarino

Green Street

4 questions for DLR

Jonathan Atkin

RBC Capital Markets

4 questions for DLR

Jon Petersen

Jefferies

4 questions for DLR

Ari Klein

BMO Capital Markets

3 questions for DLR

James Schneider

Goldman Sachs

3 questions for DLR

Matthew Niknam

Deutsche Bank

3 questions for DLR

Michael Funk

Bank of America

3 questions for DLR

Nicholas Del Deo

MoffettNathanson

3 questions for DLR

Nick Del Deo

MoffettNathanson LLC

3 questions for DLR

Aryeh Klein

BMO Capital Markets

2 questions for DLR

David Barden

Bank of America

2 questions for DLR

John Hodulik

UBS Group AG

2 questions for DLR

Timothy Horan

Oppenheimer & Co. Inc.

2 questions for DLR

Alexander Waters

Bank of America

1 question for DLR

Brandon Nispel

KeyBanc Capital Markets

1 question for DLR

Erik Rasmussen

Stifel

1 question for DLR

Georgi Dinkov

Mizuho

1 question for DLR

Jim Schneider

Goldman Sachs

1 question for DLR

Jyhhaw Liu

Evercore ISI

1 question for DLR

Simon Flannery

Morgan Stanley

1 question for DLR

Recent press releases and 8-K filings for DLR.

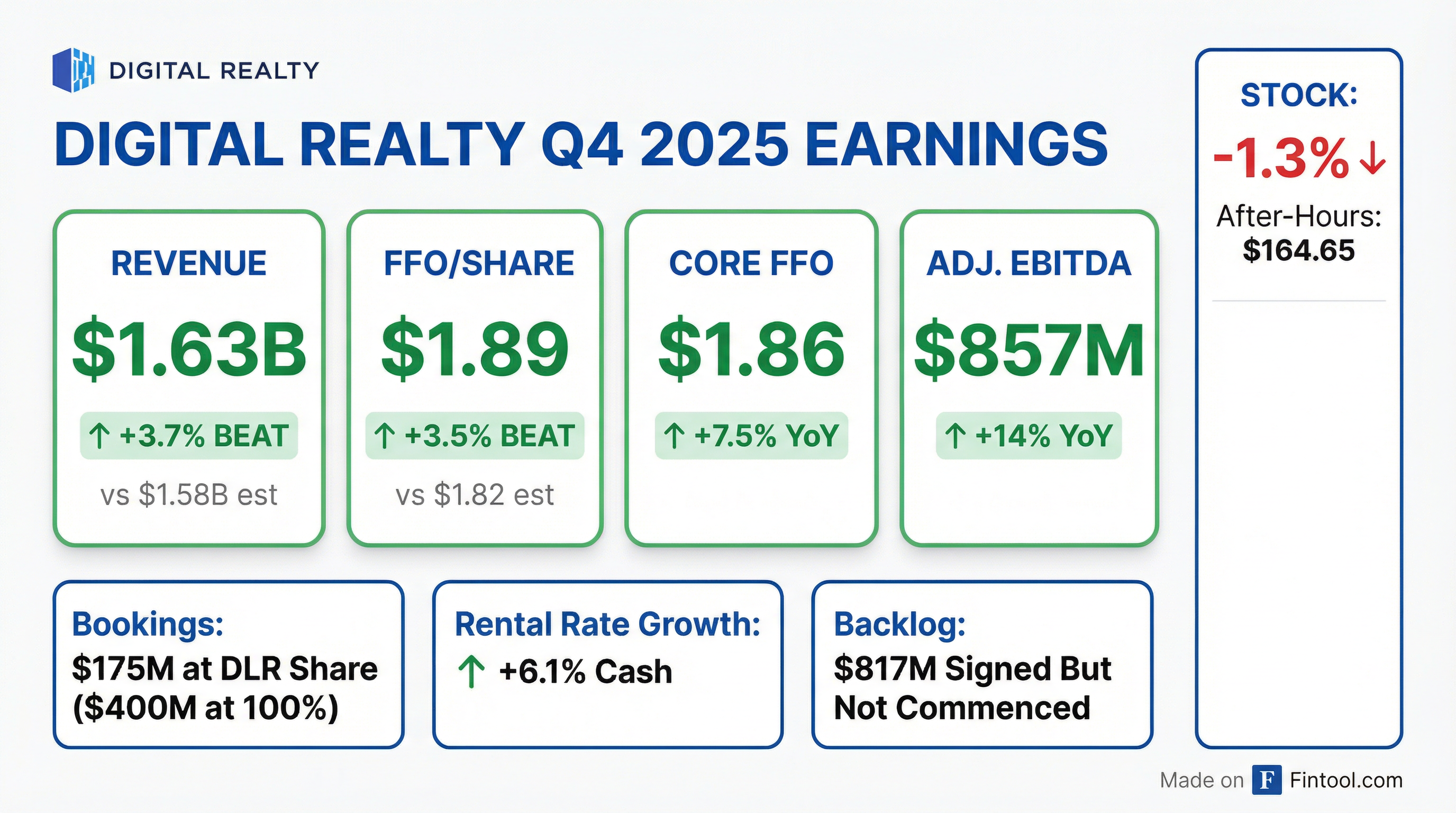

- Digital Realty delivered $400 million in 4Q25 total bookings at 100% share and ended the quarter with a $1.4 billion backlog, highlighted by a record $96 million in 0–1 MW and interconnection bookings.

- In FY 2025, the company achieved $1.2 billion in total bookings at 100% share, drove 4.5% Y/Y same-capital Cash NOI growth, and generated a record $7.39 Core FFO per share.

- Maintained ~$7 billion of liquidity at the end of Q4 2025.

- Provided 2026 guidance for $6.6–6.7 billion in total revenue, $3.6–3.7 billion in adjusted EBITDA, and Core FFO per share of $7.90–8.00.

- 2025 full-year record performance: revenue, EBITDA, and Core FFO per share exceeded guidance; signed $1.2 billion of new leases, ~70% above the five-year average.

- Q4 leasing and earnings: signed $400 million of annualized rent (100% share) / $175 million at DLR share; interconnection leasing set a new record at $96 million; Core FFO per share $1.86 (+8% YoY); full-year Core FFO $7.39 (+10% YoY).

- Development activity: net Q4 development CapEx of $930 million; delivered 90 MW (75% pre-leased), started 135 MW; pipeline stands at $10 billion with an expected stabilized yield of 11.9%.

- Balance sheet and financing: issued €1.4 billion of dual-tranche green Eurobonds (3.75% due 2033; 4.25% due 2037) and redeemed €1.075 billion; maintained leverage at 4.9×, liquidity near $7 billion, and $15 billion of private capital available.

- 2026 guidance: Core FFO of $7.90–8.00 per share (+8% YoY); revenue and Adjusted EBITDA growth >10%; same-capital cash NOI +4–5%; renewal spreads 6–8%; power-based occupancy +50–100 bps; net CapEx $3.25–3.75 billion; dispositions of $500 million–1 billion.

- Digital Realty delivered Core FFO per share of $1.86 in Q4 and $7.39 for full-year 2025, up 10% year-over-year.

- In Q4, the company signed leases representing $400 million of annualized rent at 100% share (Digital Realty share: $175 million), set a record $96 million in 0–1 MW interconnection leasing, and ended the year with a backlog of $1.4 billion.

- By year-end, Digital Realty secured €3.225 billion of LP equity commitments to its inaugural closed-end hyperscale fund, maintained leverage at 4.9×, liquidity of ~$7 billion, and had a $10 billion development pipeline.

- 2026 guidance calls for Core FFO per share of $7.90–$8.00 (+8% yoy at midpoint), revenue and Adjusted EBITDA growth >10%, same capital cash NOI growth 4–5%, and net CapEx of $3.25–$3.75 billion.

- Core FFO per share was $1.86 in Q4 and $7.39 for FY 2025, up 10% YoY; 2026 core FFO guidance is $7.90–$8.00 per share, implying ~8% growth.

- Leasing momentum continued: signed $400 M of annualized rent at 100% share (or $175 M at DLR share); set a new quarterly interconnection record of $96 M in the 0–1 MW category; full-year 2025 bookings were $1.2 B at 100% share, leaving a record backlog of $1.4 B.

- Development execution: delivered 90 MW of capacity in Q4 (75% pre-leased) and 289 MW in 2025; 769 MW under construction with a $10 B gross pipeline at an expected 11.9% stabilized yield.

- Balance sheet strength: total leverage 4.9x; liquidity nearly $7 B; raised €1.4 B via green Eurobonds and redeemed €1.075 B of higher-cost debt; maintain $15 B of private capital dry powder.

- Digital Realty generated $1.635 B in Q4 2025 revenues (up 14% Y/Y) and net income of $96 M (diluted EPS of $0.24).

- FFO per diluted share was $1.89 and Core FFO per diluted share was $1.86 in Q4, underpinning a FY 2025 record CFFO of $7.39 per share.

- Q4 signed bookings reached $1.2 B at 100% share, building a $1.4 B backlog at 100% share; same-capital Cash NOI grew 4.5% Y/Y and liquidity stood at ~$7 B at year-end.

- The company issued 2026 Core FFO per share guidance of $7.90–$8.00 on a reported and constant-currency basis.

- Digital Realty reported 4Q25 revenue of $1.6 billion, up 4% quarter-over-quarter and 14% year-over-year.

- Net income available to common stockholders was $88 million ($0.24 per share), down from $0.51 per share in 4Q24.

- Funds From Operations per share were $1.89 and Core FFO per share was $1.86 (Constant-Currency Core FFO per share of $1.81), versus $1.61 and $1.73 in 4Q24.

- Signed total bookings expected to generate $400 million of annualized GAAP rental revenue at 100% share (DLR share $175 million) and ended the year with an $817 million backlog of annualized GAAP base rent.

- Introduced 2026 Core FFO per share outlook of $7.90–$8.00 on both a reported and Constant-Currency basis.

- Digital Realty has agreed to acquire the 1.5 MW TelcoHub 1 data center in Cyberjaya, Malaysia, plus adjacent land for up to 14 MW future IT load, with closing expected in H1 2026 subject to customary conditions.

- TelcoHub 1 offers over 6,000 route km of fiber cores and hosts 40 network service providers, making it one of Malaysia’s densest dark-fiber interconnection hubs with access to AWS, Google, MY IX and DE-CIX ASEAN.

- The site will join Digital Realty’s global PlatformDIGITAL® and be enabled by ServiceFabric®, strengthening the company’s digital and AI workload capabilities across Southeast Asia.

- CSF Advisers forecasts Malaysia data center capacity growing from 1.26 GW in 2025 to 2.53 GW by 2030, underscoring accelerating demand for cloud, AI and connectivity infrastructure.

- Digital Realty agreed to acquire TelcoHub 1 in Cyberjaya, Malaysia—an operational 1.5 megawatt data center with over 6,000 fiber cores and 40+ network service providers—with closing targeted in H1 2026.

- The deal includes adjacent land capable of supporting up to 14 megawatts of additional IT load for future expansion.

- The Malaysia campus will join PlatformDIGITAL® and roll out ServiceFabric® to offer customers global connectivity and infrastructure orchestration.

- More than 40 CSF Advisers professionals, led by CEO Billy Lee, will integrate into Digital Realty’s local team, underscoring its long-term investment in Malaysia’s digital infrastructure.

- Southeast Asia hosts 290 existing and 135 upcoming colocation data centers, with Singapore dominating the existing market at >780 MW IT power capacity, supported by operators including Digital Realty.

- Malaysia, Thailand, Indonesia and the Philippines are set to account for 85%+ of planned capacity, with Malaysia alone contributing ~4.8 GW as the emerging hyperscale hub.

- Upcoming data center capacity in the region is nearly 4× the current operational capacity.

- The database offers detailed analyses of facility metrics—white-floor space, IT load, rack capacity, investment breakdowns and colocation pricing.

- The report identifies Zurich as the dominant Swiss hub, with an existing IT load capacity of around 280+ MW and an upcoming pipeline adding nearly 900 MW by 2029.

- Upcoming developments will deliver over 4.4 million sq ft of new white-floor area, more than doubling Switzerland’s current operational footprint.

- The database offers detailed analysis of 75 existing and 6 upcoming colocation facilities, covering capacity, pricing, investment, and technical standards.

- Digital Realty is named among the four major operators—alongside STACK Infrastructure, Green Datacenter, and Vantage Data Centers—shaping the Swiss market.

Quarterly earnings call transcripts for DIGITAL REALTY TRUST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more