Earnings summaries and quarterly performance for EVEREST GROUP.

Executive leadership at EVEREST GROUP.

Jim Williamson

President and Chief Executive Officer

Anthony Vidovich

Executive Vice President and General Counsel

Gail Van Beveren

Executive Vice President and Chief Human Resources Officer

Mark Kociancic

Executive Vice President and Chief Financial Officer

Ricardo Anzaldua

Executive Vice President and General Counsel

Board of directors at EVEREST GROUP.

Allan Levine

Director

Darryl Page

Director

Gerri Losquadro

Director

Hazel McNeilage

Director

John A. Graf

Chair of the Board

John Howard

Director

John J. Amore

Director

Laura J. Hay

Director

Meryl Hartzband

Director

Roger M. Singer

Lead Independent Director

William F. Galtney Jr.

Director

Research analysts who have asked questions during EVEREST GROUP earnings calls.

Alex Scott

Barclays PLC

8 questions for EG

David Motemaden

Evercore ISI

8 questions for EG

Meyer Shields

Keefe, Bruyette & Woods

8 questions for EG

Brian Meredith

UBS

6 questions for EG

Michael Zaremski

BMO Capital Markets

5 questions for EG

Andrew Andersen

Jefferies

4 questions for EG

C. Gregory Peters

Raymond James

4 questions for EG

Elyse Greenspan

Wells Fargo

4 questions for EG

Josh Shanker

Bank of America

4 questions for EG

Joshua Shanker

Bank of America Merrill Lynch

4 questions for EG

Ryan Tunis

Cantor Fitzgerald

4 questions for EG

Tracy Benguigui

Wolfe Research

3 questions for EG

Brian Robert Meredith

UBS Investment Bank

2 questions for EG

Christian Getzoff

Wells Fargo Securities LLC

2 questions for EG

Elyse Beth Greenspan

Wells Fargo Securities LLC

2 questions for EG

Katie Sakys

Autonomous Research

2 questions for EG

Wesley Carmichael

Autonomous Research

2 questions for EG

Andrew Kligerman

TD Cowen

1 question for EG

Charles Gregory Peters

Raymond James & Associates Inc.

1 question for EG

Charles Peters

Raymond James

1 question for EG

Gregory Peters

Raymond James Financial, Inc.

1 question for EG

Michael Zarembski

BMO

1 question for EG

Yaron Kinar

Oppenheimer & Co. Inc.

1 question for EG

Recent press releases and 8-K filings for EG.

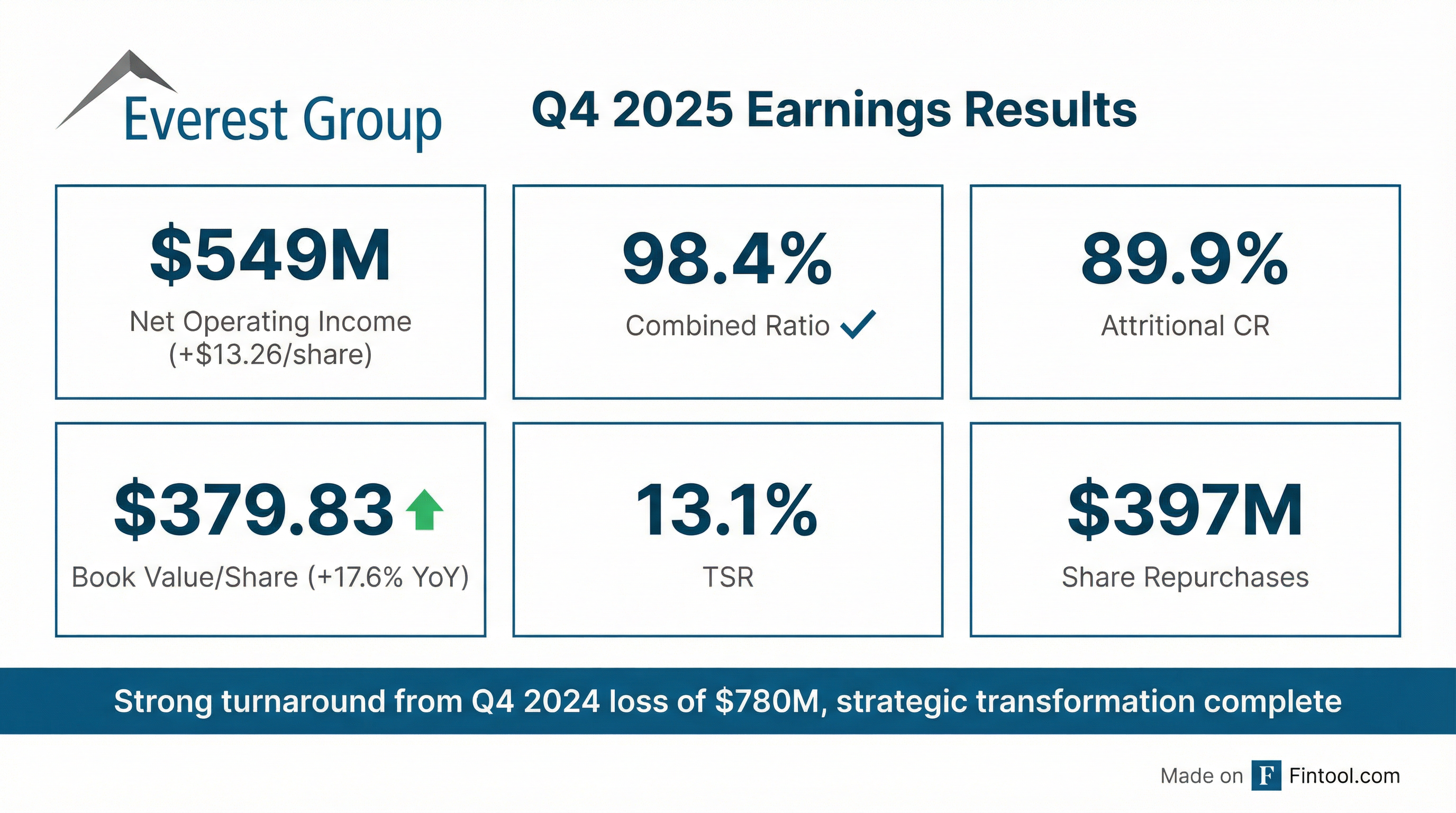

- Q4 gross written premiums of $4.3 billion, net investment income of $562 million, and a combined ratio of 98.4% (attritional 89.9%); achieved 12.4% operating ROE and 13.1% TSR in 2025.

- Sold renewal rights to its European, U.S., and Asian commercial retail insurance businesses to AIG for $426 million, simplifying the portfolio and set to ease expense‐ratio pressure in coming quarters.

- Go-forward Global Wholesale & Specialty platform recorded $3.6 billion gross written premium at year-end 2025, including $1.2 billion of facultative business.

- Prioritized share repurchases, buying back $400 million of stock in Q4 (1.2 million shares at $320.59 average) and $100 million in January 2026; $800 million repurchased in 2025.

- Gross written premiums of $3.9 B, net written premiums of $3.2 B, combined ratio of 86.5%, and NOIAT of $450 M ($11.50 per share) in Q4 2025

- Reinsurance GWP rose 12% YoY with an 84.2% combined ratio, while Insurance GWP fell 8% YoY (up 5% excl. sale) with an 89.1% combined ratio

- Returned $200 M to shareholders through repurchases and dividends and maintained a strong capital position with $325 adjusted book value per share

- Outlook: targeting a mid-80s combined ratio in 2026, double-digit growth in Global Wholesale & Specialty Insurance, and mid-teens TSR over the cycle

- Everest reported gross written premiums of $4.3 billion in Q4 2025, down 8.6% in constant dollars due to the sale of its commercial retail business and targeted underwriting actions.

- The company generated net operating income of $549 million, achieved an operating ROE of 14.2%, and recorded a combined ratio of 98.4% (attritional combined ratio of 89.9%) for the quarter.

- Net investment income increased to $562 million, with a book yield of 4.5% and a new money yield of about 4.7%.

- Book value per share rose to $379.83, up 20.1% from year-end 2024, and Everest repurchased $400 million of shares in Q4 2025 (plus $100 million in January 2026), totaling $800 million of buybacks at an average price of $333 per share for the full year.

- Strategic actions included selling renewal rights to its European, U.S., and Asian commercial retail insurance businesses to AIG for $426 million and incurring $122 million of adverse development cover premium in the quarter.

- Net operating income of $549 million in Q4, with an operating ROE of 14.2% and annualized TSR of 13.1%.

- Gross written premiums of $4.3 billion (8.6% decline in constant dollars), combined ratio of 98.4%, and attritional combined ratio of 89.9%.

- Net investment income rose to $562 million, maintaining a book yield of 4.5% and new money yield of 4.7%.

- Capital returns: repurchased $400 million of shares in Q4 and an additional $100 million in January 2026, with a quarterly buyback floor of $200 million planned.

- Net income of $1.6 billion and net operating income of $1.9 billion; 10.5% ROE on net income, 12.4% ROE on operating income, TSR of 13.1%

- Gross written premium of $17.7 billion, down 3.1% YoY; combined ratio 98.6%, attritional combined ratio 89.6%

- Record net investment income of $2.1 billion and operating cashflow of $3.1 billion, including adverse development cover cost

- Share repurchases of $397 million in Q4 and $797 million for full year 2025

- Reported full-year 2025 net income of $1.6 billion and net operating income of $1.9 billion, with a Net Income ROE of 10.5%, Operating Income ROE of 12.4%, and TSR of 13.1%.

- Achieved $17.7 billion in full-year gross written premiums (down 3.1% YoY) and a combined ratio of 98.6% (attritional 89.6%).

- Generated a record $2.1 billion in net investment income (up $170 million) and $3.1 billion in operating cash flow for the year.

- In Q4 2025, delivered net income of $446 million and net operating income of $549 million on $4.3 billion of gross written premiums, with a combined ratio of 98.4%.

- Repurchased $797 million of common shares in 2025, including $397 million in Q4.

- On November 20, 2025, Everest Group named Elias Habayeb to join as Executive Vice President and Group Chief Financial Officer effective May 1, 2026, reporting to CEO Jim Williamson.

- He will succeed Mark Kociancic, who will retire after the Q1 2026 reporting cycle and remain as a special advisor through the transition period.

- Habayeb’s compensation includes a $910,000 base salary, a target annual bonus of 175% of base salary, equity awards at 275% of base salary, sign-on cash awards totaling $3.3 million, and restricted stock units valued at $7.4 million.

- He brings over 30 years of financial leadership, most recently serving as CFO of Corebridge Financial since September 2022 and previously holding CFO roles at AIG and Deloitte & Touche.

- Board of Directors declared a dividend of $2.00 per common share.

- Dividend will be payable on or before December 12, 2025 to shareholders of record as of November 26, 2025.

- Everest common stock (NYSE: EG) is a component of the S&P 500 index.

- Everest Group agreed to sell the renewal rights of its Global Retail Commercial Insurance business—covering the U.S., U.K., Europe, and Asia Pacific—to AIG, representing an estimated $2 billion in aggregate gross premiums.

- The ROW Master Transaction Agreement closed October 26, 2025, for $252 million; a separate EU agreement for $49 million awaits EU antitrust approval; AIG will also pay $30 million for origination and transition services, with final purchase price set at 15% of actual 2025 premiums.

- The divestiture refocuses Everest on its core global reinsurance and its Global Wholesale & Specialty Insurance businesses.

- Jason Keen has been appointed CEO of Global Wholesale and Specialty Insurance to drive growth in the excess and surplus market.

- Everest reported Q3 2025 gross written premiums of $4.375 billion and YTD premiums of $13.446 billion.

- Net operating income was $316 million for Q3 and $1.326 billion YTD, with Q3 net investment income of $540 million.

- The combined ratio stood at 103.4% for Q3 and 98.7% YTD; the company strengthened U.S. casualty reserves by $393 million and recorded total adverse reserve development of $478 million pre-tax.

- Completed a $1.2 billion gross adverse development cover purchase covering $5.4 billion of reserves effective October 1, 2025; announced sale of $2 billion GWP renewal rights to AIG with a $250–$350 million pre-tax charge over 2025–26.

Quarterly earnings call transcripts for EVEREST GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more