Earnings summaries and quarterly performance for Encompass Health.

Executive leadership at Encompass Health.

Mark J. Tarr

President and Chief Executive Officer

Andrew L. Price

Chief Accounting Officer

Douglas E. Coltharp

Executive Vice President and Chief Financial Officer

Edmund M. Fay

Senior Vice President and Treasurer

Elissa J. Charbonneau

Chief Medical Officer

Patrick Darby

Executive Vice President, General Counsel and Secretary

Patrick W. Tuer

Executive Vice President and Chief Operating Officer

Board of directors at Encompass Health.

Research analysts who have asked questions during Encompass Health earnings calls.

Andrew Mok

Barclays

8 questions for EHC

Jared Haase

William Blair & Company

8 questions for EHC

Ann Hynes

Mizuho Financial Group

7 questions for EHC

Brian Tanquilut

Jefferies

7 questions for EHC

Joanna Gajuk

Bank of America

7 questions for EHC

Matthew Gillmor

KeyCorp

7 questions for EHC

Pito Chickering

Deutsche Bank

7 questions for EHC

Raj Kumar

Stephens

5 questions for EHC

Whit Mayo

Leerink Partners

5 questions for EHC

A.J. Rice

UBS

2 questions for EHC

Albert Rice

UBS

2 questions for EHC

Benjamin Mayo

Leerink Partners

2 questions for EHC

James

Jefferies

2 questions for EHC

Parker Snure

Raymond James

2 questions for EHC

Scott Fidel

Stephens Inc.

2 questions for EHC

A.J. Rice

UBS Group AG

1 question for EHC

Benjamin Hendrix

RBC Capital Markets

1 question for EHC

Christian Malachy Porter

Bank of America

1 question for EHC

John Ransom

Raymond James

1 question for EHC

Kieran Ryan

Deutsche Bank

1 question for EHC

Meghan Holtz

Jefferies Financial Group Inc.

1 question for EHC

Michael Murray

RBC Capital Markets

1 question for EHC

Zachary Ignatius Haggerty

KeyBanc Capital Markets

1 question for EHC

Recent press releases and 8-K filings for EHC.

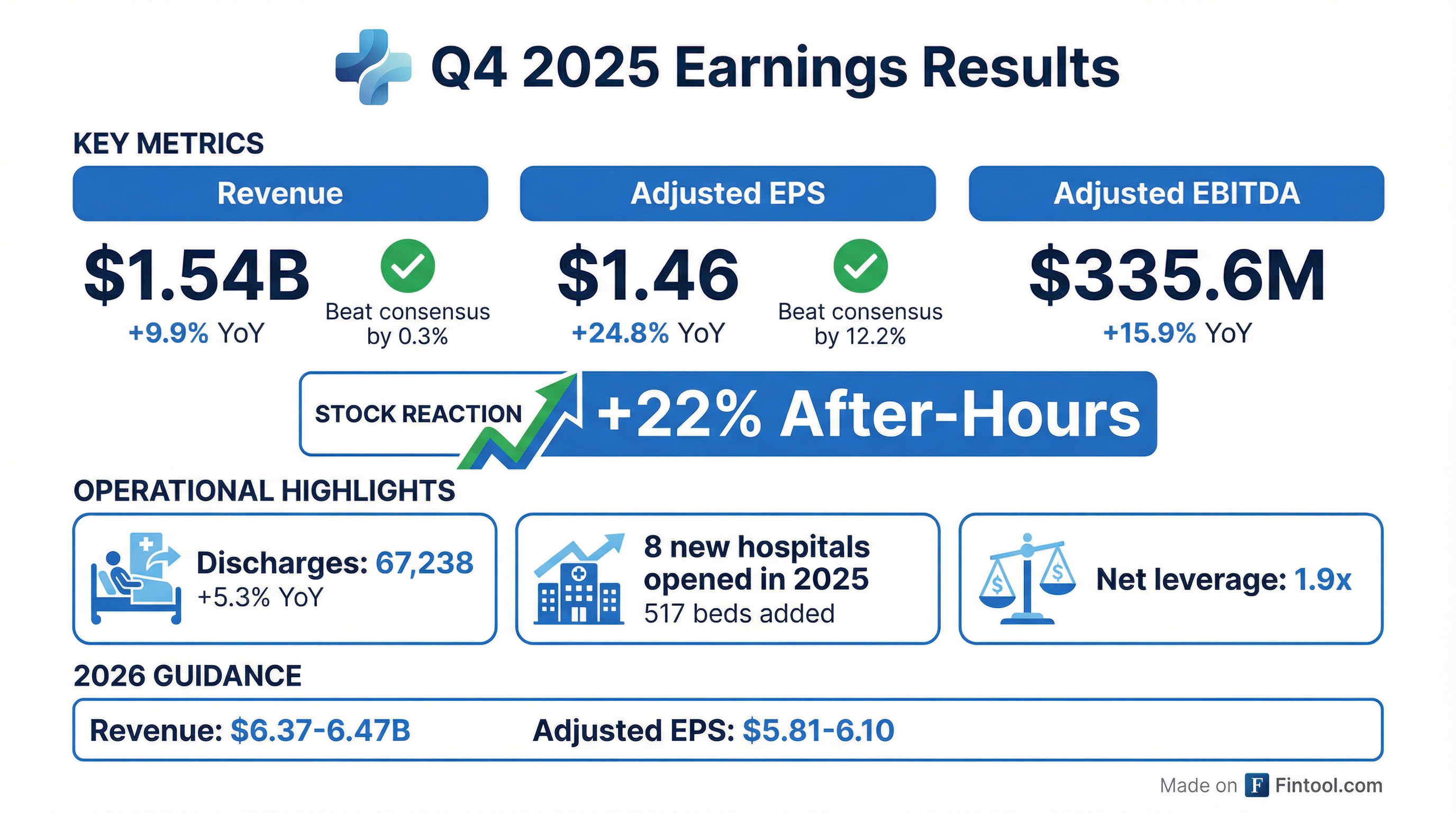

- Encompass Health reported Net operating revenue of $1,544.6 million and Adjusted EPS of $1.46 for Q4 2025, with full-year 2025 figures reaching $5,935.2 million and $5.45, respectively.

- The company provided 2026 guidance projecting Net Operating Revenue between $6,365 million and $6,465 million and Adjusted EPS between $5.81 and $6.10.

- In 2025, Encompass Health opened 8 new hospitals totaling 390 beds and added 127 beds to existing hospitals, while maintaining a net leverage of 1.9x at year-end.

- The company returned capital to shareholders, paying a quarterly dividend of $0.19 per share in October 2025 and repurchasing 1,465,233 shares for $158.0 million in 2025, with approximately $332 million remaining under the current repurchase authorization as of December 31, 2025.

- Encompass Health reported a strong Q4 2025 performance, capping a stellar 2025 with 10.5% revenue growth and 14.9% EBITDA growth for the full year. Q4 revenue increased 9.9% to $1.5 billion, and adjusted EBITDA increased 15.9% to $335.6 million.

- The company provided 2026 guidance including net operating revenue of $6.365 billion-$6.465 billion, adjusted EBITDA of $1.34 billion-$1.38 billion, and adjusted EPS of $5.81-$6.10.

- In 2025, Encompass Health added 517 beds, including 390 via eight new hospitals, and plans to introduce small format hospitals starting in 2027 as a third modality for capacity expansion.

- Encompass Health is actively managing regulatory changes, noting a 93% affirmation rate for RCD in Alabama and preparing for its expansion to Texas and California. The company also experienced challenges with a specific Medicare Advantage payer in Q4 2025 due to a significant drop in conversion rates, which it plans to address through communication with the payer and CMS, and an admit and appeal strategy.

- Encompass Health reported strong financial performance for Q4 2025, with revenue increasing 9.9% to $1.5 billion and adjusted EBITDA growing 15.9% to $335.6 million. For the full year 2025, revenue increased 10.5% and EBITDA grew 14.9%.

- The company issued 2026 guidance, projecting net operating revenue between $6.365 billion and $6.465 billion, adjusted EBITDA between $1.34 billion and $1.38 billion, and adjusted earnings per share between $5.81 and $6.10.

- Full-year 2025 adjusted free cash flow increased 18.5% to $818 million, which funded $736 million in capital expenditures, $158 million in share repurchases, and $71 million in cash dividends, while maintaining a year-end net leverage ratio of 1.9 times.

- Encompass Health added 517 beds in 2025 and plans to introduce a new modality of small format hospitals (24-bed prototype) starting in 2027 to further augment capacity expansion.

- The company is actively managing regulatory changes, including the TEAM model which began implementation on January 1, 2026, and the expansion of RCD into Texas and California in 2026, while also addressing challenges with a specific Medicare Advantage payer in Q4 2025.

- Encompass Health reported strong Q4 2025 financial results, with revenue increasing 9.9% to $1.5 billion and adjusted EBITDA up 15.9% to $335.6 million, contributing to full-year 2025 revenue growth of 10.5% and EBITDA growth of 14.9%.

- The company issued initial 2026 guidance, forecasting net operating revenue of $6.365 billion-$6.465 billion, adjusted EBITDA of $1.34 billion-$1.38 billion, and adjusted EPS of $5.81-$6.10.

- Strategic growth initiatives include adding 517 beds in 2025 and planning to introduce small format hospitals in 2027 for capacity expansion, alongside an expanded partnership with Palantir for operational efficiencies.

- Encompass Health demonstrated strong capital allocation, repurchasing $158 million in shares and distributing over $70 million in cash dividends in 2025, while maintaining a year-end net financial leverage of 1.9x.

- Management addressed regulatory developments such as the TEAM model and RCD expansion, and is actively managing a decline in conversion rates with a specific Medicare Advantage payer.

- Encompass Health Corporation reported Net operating revenue of $1,544.6 million for Q4 2025, a 9.9% increase from Q4 2024, and Adjusted EBITDA of $335.6 million, up 15.9%.

- For the full year ended December 31, 2025, Net operating revenue increased 10.5% to $5,935.2 million, and Adjusted EBITDA grew 14.9% to $1,267.9 million.

- Adjusted earnings per share for Q4 2025 was $1.46, a 24.8% increase from the prior year, and $5.45 for the full year 2025, up 23.0%.

- The company provided 2026 guidance, projecting Net operating revenue between $6,365 million and $6,465 million, Adjusted EBITDA between $1,340 million and $1,380 million, and Adjusted earnings per share between $5.81 and $6.10.

- In 2025, Encompass Health significantly expanded its capacity by adding 517 inpatient rehabilitation beds through eight new hospitals and 127 beds to existing hospitals, and repurchased 1,465,233 shares of common stock for $158.0 million.

- Encompass Health (EHC) reported net operating revenue of $1,544.6 million for the fourth quarter ended December 31, 2025, an increase of 9.9% compared to Q4 2024.

- The company's Adjusted earnings per share for Q4 2025 was $1.46, representing a 24.8% increase from Q4 2024.

- For the full year 2025, Encompass Health's revenue increased 10.5% and Adjusted EBITDA grew 14.9%.

- Encompass Health provided 2026 guidance, projecting net operating revenue between $6,365 million and $6,465 million, Adjusted EBITDA between $1,340 million and $1,380 million, and Adjusted earnings per share from continuing operations between $5.81 and $6.10.

- Encompass Health reported net operating revenue of $1,477.5 million for Q3 2025, an increase of 9.4% compared to Q3 2024, and $4,390.6 million for the nine months ended September 30, 2025, up 10.6% year-over-year.

- Adjusted EBITDA for Q3 2025 grew 11.4% to $300.1 million, while Adjusted EPS increased 19.4% to $1.23. For the nine months, Adjusted EBITDA rose 14.5% to $932.3 million and Adjusted EPS increased 22.4% to $3.99.

- The company updated its 2025 guidance as of October 29, 2025, raising Net Operating Revenue to $5,905 to $5,955 million, Adjusted EBITDA to $1,235 to $1,255 million, and Adjusted EPS to $5.22 to $5.37.

- In Q3 2025, Encompass Health opened three de novo hospitals and one satellite hospital, contributing to a total of 240 beds opened year-to-date from four de novo hospitals and one satellite hospital.

- The company retired $100 million of 5.75% Senior Notes due 2025 and repurchased 787,418 shares of common stock for $81.7 million year-to-date as of Q3 2025.

- Encompass Health reported a 9.4% increase in Q3 2025 revenue and 11.4% growth in adjusted EBITDA, reaching $300.1 million.

- The company raised its 2025 guidance, now expecting net operating revenue of $5.905 to $5.955 billion, adjusted EBITDA of $1.235 to $1.255 billion, and adjusted EPS of $5.22 to $5.37.

- EHC is accelerating capacity expansion, increasing estimated bed additions to existing hospitals to approximately 127 for 2025 and 150 to 200 for both 2026 and 2027.

- In Q3 2025, Encompass Health repurchased approximately 221,000 shares for about $25 million and declared a cash dividend of $0.19 per share.

- Encompass Health reported strong financial performance for Q3 2025, with revenue increasing 9.4% and adjusted EBITDA growing 11.4%. Year-to-date, revenue grew 10.6% and adjusted EBITDA grew 14.5%.

- The company raised its full-year 2025 guidance, now expecting net operating revenue of $5.905 to $5.955 billion, adjusted EBITDA of $1.235 to $1.255 billion, adjusted EPS of $5.22 to $5.37, and adjusted free cash flow of $730 to $810 million.

- Operational expansion continued with three new hospitals opened and 39 beds added in Q3 2025. The company increased its expected bed additions to 127 beds in 2025 and 150 to 200 in both 2026 and 2027.

- Encompass Health repurchased approximately 221,000 shares for about $25 million in Q3, bringing the year-to-date total to approximately $82 million, and declared a cash dividend of $0.19 per share.

- Encompass Health reported strong Q3 2025 financial results, with revenue increasing 9.4% and adjusted EBITDA growing 11.4% to $300.1 million.

- The company increased its 2025 guidance for net operating revenue to $5.905 billion-$5.955 billion, adjusted EBITDA to $1.235 billion-$1.255 billion, and adjusted EPS to $5.22-$5.37.

- Encompass Health is significantly expanding capacity, expecting to add approximately 127 beds to existing hospitals in 2025 and 150-200 beds in both 2026 and 2027, alongside new hospital openings.

- The company noted favorable labor trends, with Q3 2025 annualized RN turnover at 20.2% and therapist turnover at 7.8%, and premium labor costs declining $5.6 million from Q3 2024.

Quarterly earnings call transcripts for Encompass Health.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more