Earnings summaries and quarterly performance for EnerSys.

Executive leadership at EnerSys.

Shawn O’Connell

President and Chief Executive Officer

Andrea Funk

Executive Vice President & Chief Financial Officer

Chad Uplinger

President, Motive Power Global

Joseph Lewis

Chief Legal & Compliance Officer and Secretary

Keith Fisher

President, Energy Systems Global

Mark Matthews

President, Specialty Global and Acting Chief Technology Officer

Board of directors at EnerSys.

Caroline Chan

Director

Dave Habiger

Director

Howard Hoffen

Director

Lauren Knausenberger

Director

Paul Tufano

Independent Non-Executive Chair

Ronald Vargo

Director

Rudolph Wynter

Director

Steven Fludder

Director

Tamara Morytko

Director

Research analysts who have asked questions during EnerSys earnings calls.

Brian Drab

William Blair & Company

6 questions for ENS

Noah Kaye

Oppenheimer & Co. Inc.

6 questions for ENS

Chip Moore

EF Hutton

4 questions for ENS

Gregory Lewis

BTIG, LLC

3 questions for ENS

Alfred Moore

C.L. King & Associates

2 questions for ENS

Greg Lewis

BTIG

2 questions for ENS

Gregory Wasikowski

Webber Research & Advisory LLC

1 question for ENS

Recent press releases and 8-K filings for ENS.

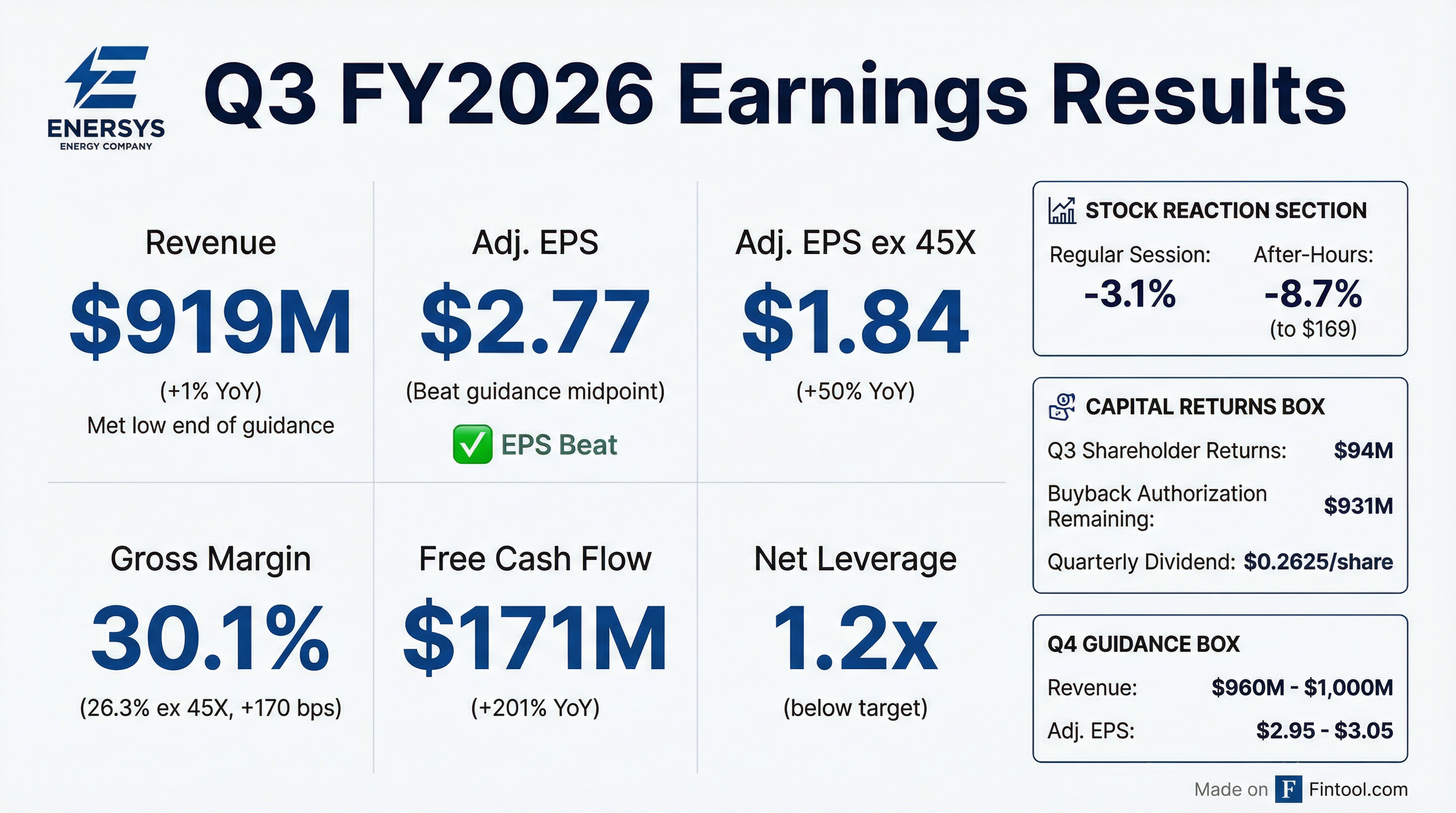

- ENS reported Q3 2026 Adjusted EPS ex 45X of $1.84, a 50% increase year-over-year, with Net Sales growing 1% year-over-year to $919 million.

- Free Cash Flow for Q3 2026 was $171 million, an increase of $115 million year-over-year, and the Net Leverage Ratio improved to 1.2x.

- The company returned capital to shareholders with $84 million in share buybacks and $10 million in dividends during the quarter.

- For Q4 2026, ENS expects Net Sales to be between $960 million and $1,000 million and Adjusted EPS ex 45X to range from $1.91 to $2.01.

- EnerSys delivered strong Q3 2026 earnings, with adjusted diluted EPS ex 45X of $1.84, marking a 50% increase year-over-year and a company record for the fiscal third quarter. Net sales grew 1%, aligning with the low end of guidance, while adjusted operating earnings and adjusted EBITDA (both excluding 45X) rose 34% and 30%, respectively.

- The company generated $171 million in free cash flow during the quarter and returned $94 million to shareholders through share repurchases and dividends. Specifically, EnerSys repurchased 672,000 shares for $84 million at an average price of approximately $128 per share.

- EnerSys is navigating mixed market conditions, with data center sales up 28% year-over-year, but motive power revenue decreased 2% due to ongoing market softness. Despite a 40% increase in December forklift orders, the company anticipates continued slowness in motive power into mid-fiscal 2027.

- Strategic initiatives are progressing, including the substantial completion of the Monterrey battery plant closure and ongoing discussions with the Department of Energy regarding a lithium cell factory. EnerSys is also developing a lithium battery product for data centers, aiming to capture market share in greenfield projects where it currently holds 0%.

- For the fourth quarter of fiscal 2026, EnerSys expects net sales in the range of $960 million to $1 billion and adjusted diluted EPS (excluding 45X benefits) between $1.91 and $2.01 per share, which would be a 10% year-on-year increase at the midpoint.

- EnerSys reported strong Q3 Fiscal 2026 results, with adjusted diluted EPS (excluding 45X benefits) of $1.84, up 50% year-over-year, and net sales of $919 million, up 1%. Adjusted operating earnings and adjusted EBITDA (excluding 45X benefits) also saw significant increases of 34% and 30%, respectively.

- The company generated $171 million in free cash flow and returned $94 million to shareholders through share repurchases and dividends during the quarter.

- For Q4 Fiscal 2026, EnerSys expects net sales between $960 million and $1 billion, and adjusted diluted EPS (excluding 45X benefits) of $1.91-$2.01 per share, representing a 10% year-on-year increase at the midpoint.

- EnerSys noted mixed end-market demand, with strong growth in the data center business (Q3 sales up 28% year-over-year) and robust A&D activity, offsetting near-term softness in Motive Power and transportation segments. Strategic initiatives are progressing, including the substantial completion of the Monterrey battery plant closure and ongoing discussions with the Department of Energy regarding the lithium cell factory.

- ENS reported strong Q3 2026 financial results, with adjusted diluted EPS (excluding 45X) of $1.84, a 50% increase year-over-year and a company record for the third fiscal quarter, on net sales of $919 million, up 1% from the prior year.

- For Q4 2026, the company expects net sales in the range of $960 million-$1 billion and adjusted diluted EPS (excluding 45X) of $1.91-$2.01 per share, projecting a 10% year-on-year increase at the midpoint.

- ENS returned $94 million to shareholders in Q3 2026 through share repurchases and dividends, supported by a strong balance sheet with net debt of $743 million and a 1.2x EBITDA leverage ratio.

- The company experienced mixed end-market demand, with Q3 sales in data centers up 28% year-over-year and robust A&D activity, offsetting near-term softness in motive power and transportation. Operational improvements, including completed reduction in force actions and the Monterrey plant closure, contributed to significant margin expansion in the Energy Systems and Specialty segments.

- EnerSys reported net sales of $919.1 million for the third quarter of fiscal 2026, an increase of 1.4% compared to the prior year period.

- Adjusted diluted EPS for Q3 Fiscal 2026 was $2.77, while adjusted diluted EPS excluding IRC 45X was $1.84, representing a 50% increase.

- The company returned approximately $93.7 million to shareholders in Q3 Fiscal 2026, comprising $84.1 million in share repurchases and $9.6 million in dividends.

- EnerSys' net leverage ratio stood at 1.2 X EBITDA as of December 28, 2025, which is below the low end of its target range.

- For the fourth quarter of fiscal 2026, EnerSys expects net sales in the range of $960 million to $1,000 million and adjusted diluted EPS in the range of $2.95 to $3.05.

- EnerSys reported net sales of $919.1 million for the third quarter of fiscal 2026, a 1% increase compared to the prior year, and $2,763.4 million for the nine months of fiscal 2026, up 4.6%.

- Diluted EPS for Q3 FY26 was $2.40, a 17% decrease from the prior year, while adjusted diluted EPS excluding IRC 45X increased 50% to $1.84. The Q3 Gross Margin was 30.1%, or 26.3% excluding IRC 45X, which was up 170 basis points ex 45X.

- The company returned $94 million to shareholders in Q3 FY26 through buybacks and dividends, with $931 million remaining in buyback authorization as of February 3, 2026.

- For the full fiscal year 2026, EnerSys expects capital expenditures of approximately $80 million and anticipates full-year adjusted operating earnings growth (excluding 45X benefits) to outpace revenue growth.

- ENS reported record Q2 net sales of $951 million, an 8% increase year-over-year, and record Q2 adjusted EPS ex 45X benefits of $1.51, up 15% year-over-year.

- The company returned $78 million to shareholders through buybacks and dividends in Q2 FY'26.

- Free cash flow significantly increased to $197.1 million in Q2 2026, compared to $3.2 million in the prior year period.

- Orders for Q2'26 were $851 million, a 1% decrease year-over-year, with a book-to-bill ratio of 0.90, reflecting fluctuating demand.

- ENS provided Q3 guidance, expecting net sales to increase by 4% year-over-year and adjusted EPS ex 45X to increase by 8% at the midpoint.

- EnerSys (ENS) reported record Q2 2026 net sales of $951 million, an 8% increase year-over-year, and record adjusted diluted EPS of $2.56 per share, up 21% from the prior year. Excluding 45X benefits, adjusted diluted EPS was $1.51 per share, a 15% increase.

- The strong performance was driven by growth in data center, industrial, and A&D markets, with Energy Systems revenue increasing 14% to $435 million. Motive Power revenue, however, decreased 2% to $360 million due to lower volumes.

- The company is implementing an $80 million annual cost-saving initiative from reduction in force actions, with early benefits materializing and expected to grow in the third and fourth quarters.

- For Q3 2026, ENS anticipates net sales between $920 million and $960 million and adjusted diluted EPS of $2.71-$2.81 per share. Excluding 45X benefits, adjusted diluted EPS is projected to be $1.64-$1.74 per share, representing a 46% increase at the midpoint.

- ENS returned $78 million to shareholders in Q2 through share repurchases and dividends and plans to continue buying back stock, particularly when the share price is considered undervalued.

- EnerSys reported net sales of $951.3 million for the second quarter of fiscal year 2026, an increase of 7.7% compared to the prior year period.

- Diluted EPS for Q2 FY26 was $1.80, while adjusted diluted EPS increased 21% to $2.56.

- The company's Board of Directors declared a quarterly cash dividend of $0.2625 per share for the third quarter of fiscal year 2026, payable on December 26, 2025.

- EnerSys returned $78 million to shareholders in Q2 FY26 through buybacks and dividends, with $958 million remaining in buyback authorization as of November 4, 2025.

- For the third quarter of fiscal year 2026, EnerSys expects net sales in the range of $920 million to $960 million and adjusted diluted EPS between $2.71 and $2.81.

- EnerSys reported net sales of $951.3 million for the second quarter of fiscal year 2026, an 8% increase from the prior year.

- Diluted EPS was $1.80, down 10%, while adjusted diluted EPS rose 21% to $2.56.

- The company returned $78 million to shareholders through buybacks and dividends in Q2 FY2026, with $958 million remaining in buyback authorization as of November 4, 2025.

- EnerSys expects third quarter fiscal 2026 net sales between $920 million and $960 million and adjusted diluted EPS between $2.71 and $2.81.

Quarterly earnings call transcripts for EnerSys.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more