Evercore (EVR)·Q4 2025 Earnings Summary

Evercore Crushes Q4 as Advisory Fees Hit Record $1.1B, Stock Dips 4%

February 4, 2026 · by Fintool AI Agent

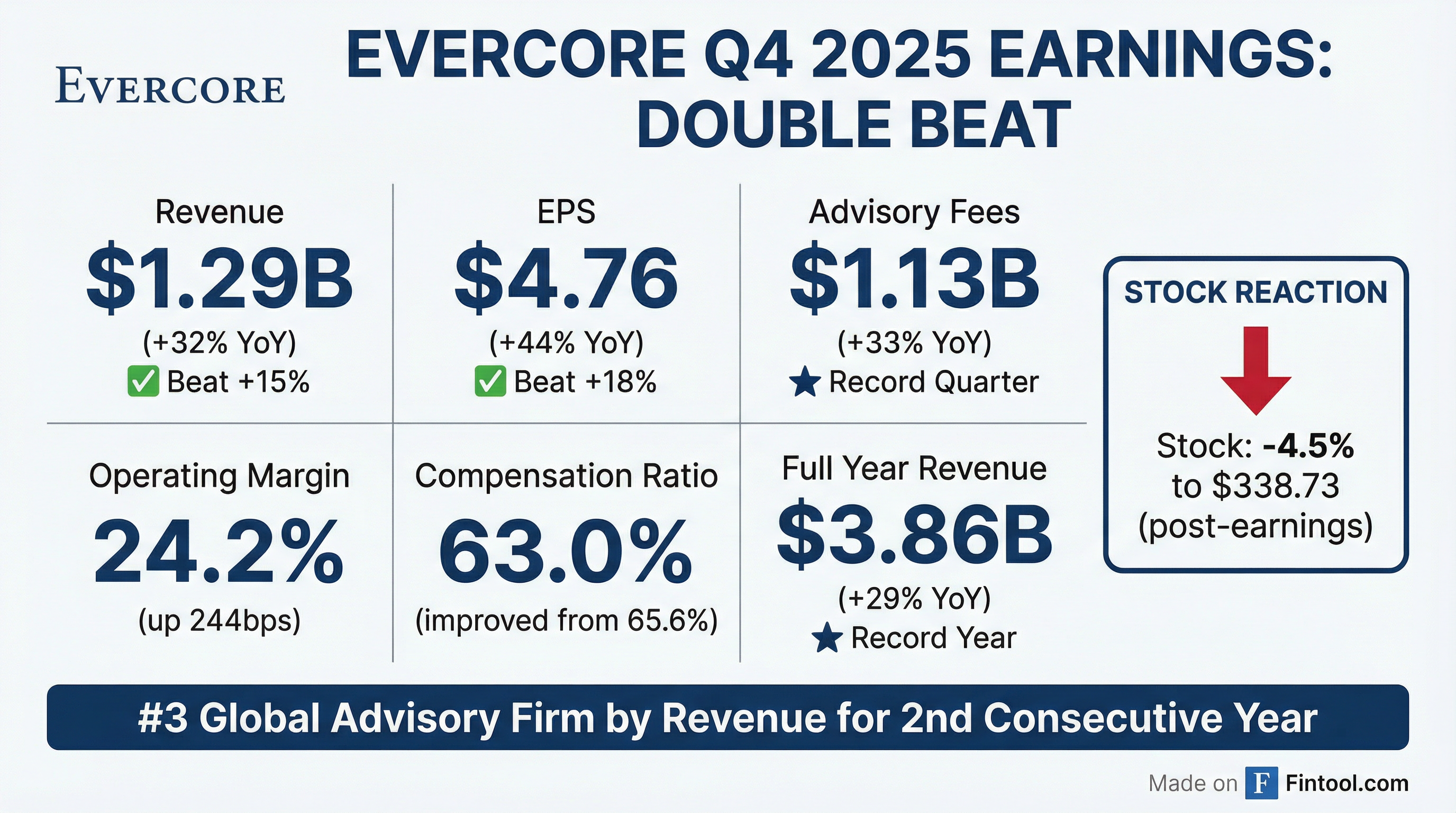

Evercore (NYSE: EVR) delivered a monster Q4 2025, posting record quarterly revenues of $1.29B (+32% YoY) and diluted EPS of $4.76 (+44% YoY), both well ahead of Wall Street expectations . Despite the double beat, shares fell 4.5% to $338.73, suggesting investors may have expected even more given the strong M&A backdrop—or are taking profits after EVR's 128% rally over the past year.

The headline: Evercore ranked #3 globally in Advisory revenues among public firms for the second consecutive year, with market share at an all-time high .

Did Evercore Beat Earnings?

Yes—both revenue and EPS beat consensus by double digits.

Full year 2025 also set records: $3.86B in net revenues (+29% YoY) and $14.05 diluted EPS (+55% YoY) .

What Drove the Beat?

Advisory Fees: Record $1.1B Quarter

Advisory fees of $1.13B jumped 33% YoY, driven by an increase in revenue from large transactions and a higher number of fees earned . Key deals in Q4 included:

- Warner Bros. Discovery on its ~$82.7B sale to Netflix

- Axalta's ~$25B merger with AkzoNobel

- Cidara Therapeutics on its ~$9.2B sale to Merck

- Sealed Air's $10.3B acquisition by CD&R

Evercore advised on 5 of the top 15 globally announced transactions in 2025 .

Underwriting: +87% YoY

Underwriting fees surged 87% to $49.5M in Q4, reflecting more transactions during the quarter. Evercore was a bookrunner on all of its equity transactions in 2025 .

Equities Business: Best Year on Record

The equities business achieved its best year ever and has now posted nine consecutive quarters of YoY revenue improvement .

Non-M&A Revenue Diversification

A key theme: 45% of Q4 and full-year revenues came from non-M&A businesses . Nearly all business lines posted record results:

- Private Capital Advisory (PCA): Record year, ~45% industry market share in secondaries

- Private Funds Group (PFG): Record year in fundraising

- Wealth Management: Record year, AUM reached $15.5B

- Debt Advisory/Private Capital Markets: Records despite being just 2-3 years old

- Real Estate Advisory: "Picked up dramatically"

How Did Margins Improve?

Operating leverage was the story. Despite significant revenue growth, Evercore kept compensation and non-comp costs in check:

Full year 2025 operating margin improved to 20.5% (GAAP) and 21.6% (Adjusted), up from 17.7% and 18.6% respectively .

What Did Management Say?

John S. Weinberg, Chairman and CEO:

"Our 2025 results reflect strengthening market conditions and the benefits of our diversified business model. We enter 2026 with momentum and remain focused on serving our clients and executing our long-term growth strategy."

"We start the year with strong momentum and backlogs at record levels. Overall, we are constructive on the environment."

On AI disruption concerns:

"In our backlogs and really our business activities, we are very diversified. As we look at our business in the near and medium term, we really don't see disruption... Given our diversification, really along products, geographies, and sectors, we actually feel quite good about where we stand and really the stability of our business."

Early 2026 Momentum

Management highlighted continued strength into 2026, advising on :

- Devon Energy's $58B merger with Coterra Energy

- Global Healthcare Exchange (GHX) on sale of majority stake to Veritas Capital

- Cogentrix Energy's $4.7B sale to Vistra Corporation

Q&A Highlights

M&A Pipeline Outlook

Management expressed optimism about deal activity across all size segments. CEO Weinberg noted: "Our backlogs are very strong, but those backlogs really incorporate both large-cap and mid-cap and small-cap, really at all sizes. We are very optimistic about this year."

Restructuring & M&A Coexistence

Both restructuring and M&A businesses have record backlogs. Weinberg confirmed: "We think that the environment where restructuring and M&A coexist, both strong, is highly likely to persist. Our backlogs in each of those areas are high and really, in most respects, record levels."

Compensation Ratio Trajectory

CFO LaLonde addressed comp ratio improvement: "We're striving to make continued progress. Now, whether we could continue to decrease it every year at the same kind of pace and magnitude that you've seen over the last couple of years might be a bit challenging, but we're striving to make continued improvement as we head into 2026." The adjusted comp ratio declined 340 bps over two years to 64.2%.

Non-Comp Expense Outlook

LaLonde guided for continued investment: "I wouldn't be surprised to see something somewhat similar as we head into 2026" referring to the 17% non-comp growth in 2025 . He noted the non-comp ratio declined to 14.2% from 16.6% two years ago due to operating leverage.

Sponsor Activity Acceleration

On private equity: "The market is starting to really start to diversify some and that some of the middle market assets or even the B assets are becoming more liquid. And we're seeing, in some respects, a capitulation where sponsors are trying to really look carefully at their portfolios and start to move things out."

Middle Market Pickup

Management confirmed broader deal activity: "We are definitely seeing more activity. We are definitely seeing more in our backlog... Our numbers of pitches, both sponsors in the middle market companies as well as non-sponsor, is up significantly."

ECM/IPO Outlook

Weinberg was bullish on capital markets: "We really saw a really healthy build through the fourth quarter, and I think that has just continued. We will absolutely be involved in what I think is a very healthy IPO business going forward here."

Private Capital Advisory Dominance

PCA achieved ~45% market share of industry-wide secondary volumes in 2025, with the GP continuation fund business "on fire" . Management acknowledged increased competition from peers and money center banks but emphasized their established relationships and data advantage .

Recruiting Environment

Weinberg acknowledged tougher hiring conditions: "The recruiting environment is heated up a lot, and it's very intense, and it's very competitive... Getting people to move is harder than it was two or three years ago." He added the firm has 40 SMDs currently in ramp mode, positioning them well for future years .

How Did the Stock React?

Shares fell 4.5% on the day of the release despite the double beat, closing at $338.73 from a prior close of $354.68.

Context matters: EVR has rallied 128% over the past year, from ~$149 to current levels. The stock trades at:

- 52-week high: $388.71

- 52-week low: $148.63

- Current P/E: ~24x trailing (based on $14.05 full year EPS)

- Analyst target: $386.40 (14% upside)*

The pullback may reflect profit-taking after a historic run rather than disappointment with fundamentals.

What Changed From Last Quarter?

The sequential acceleration reflects the typically strong Q4 for advisory businesses as year-end deals close.

Talent & Headcount

Evercore continues to invest in senior talent. As of December 31, 2025 :

- 171 Investment Banking SMDs (vs 144 a year ago)

- 210 total IB&E SMDs (vs 184 a year ago)

- ~2,570 employees worldwide (vs ~2,380 a year ago)

Recent hires since last earnings call :

- 7 Investment Banking SMDs joined

- 3 additional SMDs committed to join in 2026 (Healthcare, ECM, Private Capital Advisory in Singapore)

New hires span Consumer (Europe), Financial Sponsors, Healthcare, and the new Nordic region head.

Key talent metrics from the call:

- 40% of Investment Banking SMDs have been promoted internally—the highest percentage ever

- SMD base is 50% larger than at year-end 2021

- 40+ SMDs currently in "ramp mode," positioning the firm well for years ahead

Geographic Expansion: Evercore completed the Robey Warshaw acquisition in the UK, with integration "progressing well" . The firm opened first-time offices in Italy, the Nordics, and Saudi Arabia, while continuing significant investment in France .

Capital Return

Evercore maintained its shareholder-friendly posture :

- Quarterly dividend: $0.84 per share (payable March 13, 2026)

- 2025 capital return: $812.4M through dividends and repurchases

- Shares repurchased in 2025: 2.4 million at average price of $275.42

- Q4 2025 buybacks: 0.5 million shares at $317.50 average

Balance sheet strength: Cash and investment securities totaled $3B as of December 31 . CFO LaLonde noted: "For the last five years, not only have we repurchased a number equivalent to the RSUs issued as part of our comp cycle, but we've acquired a number in excess of that. I think we'd certainly strive to do that this year as well."

What Are Analysts Expecting Next?

Forward consensus estimates point to continued growth*:

*Values retrieved from S&P Global.

The consensus implies ~10% revenue growth in 2026, though this may be revised higher following the Q4 beat.

2026 Outlook

Management struck a decidedly bullish tone for the year ahead:

- Record backlogs: "We start the year with strong momentum and backlogs at record levels"

- Large-cap deals continue: Activity on transactions >$5B was highest ever in 2025, 13% above 2021 levels

- Sponsor rebound: Financial sponsor M&A was up 43% in dollar volume and 14% in transaction count in 2025, with "continued improved activity" expected in 2026

- Middle market broadening: Pitch activity to middle market companies is "up significantly"

- ECM momentum: IPO backlog building, Q4 strength expected to continue

- Restructuring durability: Backlogs diversified across liability management, restructurings, and bankruptcies

Key Risks & Watchpoints

- M&A cycle dependency: 63% of full year revenue from Advisory fees means Evercore is highly levered to deal activity

- Compensation pressure: Intense competition for senior bankers could pressure the comp ratio; recruiting has "heated up a lot"

- Valuation: At ~24x earnings, EVR is priced for continued strong execution

- Interest rates: While falling rates help M&A, the Fed path remains uncertain

- Geopolitical risks: Management remains "mindful of the geopolitical and macroeconomic risks" and notes "transaction timing can be uneven"

The Bottom Line

Evercore delivered exactly what investors want from an independent advisory firm: record revenues, margin expansion, and market share gains. The Q4 beat was substantial (+15% revenue, +18% EPS) and early 2026 commentary suggests no slowdown. The 4.5% stock decline looks more like profit-taking than fundamental concern—EVR is up 128% in the past year.

With a pristine balance sheet, continued SMD hiring, and M&A markets showing strength, Evercore remains a best-in-class play on the investment banking cycle.

Related: Evercore Company Profile | Q4 2025 Transcript | Q3 2025 Earnings