Earnings summaries and quarterly performance for FIRST KEYSTONE.

Executive leadership at FIRST KEYSTONE.

Jack W. Jones

Detailed

President and Chief Executive Officer

CEO

CA

Christopher A. Zlobik

Detailed

Chief Banking Officer

DR

David R. Saracino

Detailed

Secretary

JE

John E. Arndt

Detailed

Vice Chairman of the Board

JR

Jonathan R. Littlewood

Detailed

Chief Lending Officer

MJ

Mark J. McDonald

Detailed

Chief Credit Officer

MM

Michelle M. Karas

Detailed

Senior Vice President and Chief Operating Officer

RA

Robert A. Bull

Detailed

Chairman of the Board

SL

Stacy L. Gordner

Detailed

Interim Chief Financial Officer

Board of directors at FIRST KEYSTONE.

Research analysts covering FIRST KEYSTONE.

Recent press releases and 8-K filings for FKYS.

First Keystone Announces Full Year 2025 Earnings

FKYS

Earnings

Dividends

Revenue Acceleration/Inflection

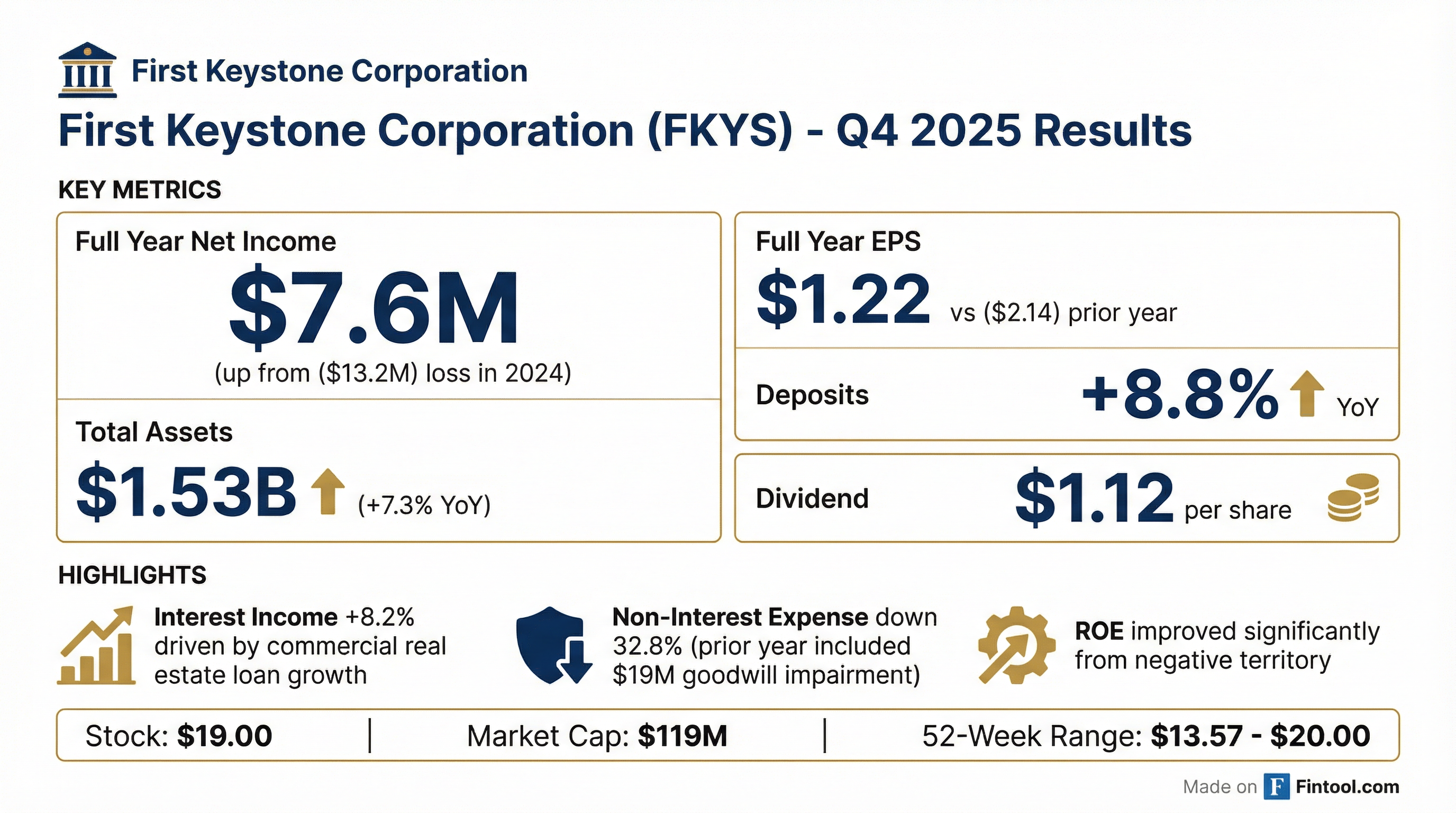

- First Keystone reported net income of $7,622,000 for the year ended December 31, 2025, an increase of $20,825,000 compared to 2024, primarily due to the absence of a $19,133,000 goodwill impairment charge recognized in the first quarter of 2024.

- For the full year 2025, net income per share was $1.22 and dividends totaled $1.12 per share.

- Total Assets increased by 7.3% to $1,532,439,000 at December 31, 2025, and Deposits grew by 8.8% to $91,557,000 compared to December 31, 2024, with a shift from transactional deposits to retail CDs.

- Interest income for the year ended December 31, 2025, rose by 8.2% or $5,843,000, mainly driven by growth in commercial real estate loans.

7 days ago

First Keystone Corporation Announces Q4 Dividend and Q3 2025 Financial Results

FKYS

Dividends

Earnings

Revenue Acceleration/Inflection

- First Keystone Corporation (FKYS) declared a $0.28 per share quarterly cash dividend, payable December 30, 2025, to shareholders of record on December 11, 2025.

- Year-to-date cash dividends for 2025 totaled $1.12 per share, consistent with the prior year.

- For Q3 2025, the Corporation reported Assets of $1,582,377,000 (up 10.0%), Total Net Loans of $949,733,000 (up 2.5%), and Total Deposits of $1,192,494,000 (up 16.9%).

- Year-to-date through Q3 2025, Net interest income increased 17.6% to $27,779,000, and Net income grew 143.7% to $6,775,000, or $1.09 per share.

Nov 26, 2025, 7:13 PM

First Keystone Announces Third Quarter 2025 Earnings

FKYS

Earnings

Dividends

Revenue Acceleration/Inflection

- For the nine months ended September 30, 2025, net income was $6,775,000, with net income per share of $1.09 and dividends totaling $0.84 per share.

- Interest income increased by $4,073,000 or 7.7% for the nine months ended September 30, 2025, mainly due to growth in commercial real estate loans, while total interest expense decreased by $76,000 or 0.3%.

- Non-interest expense decreased significantly due to a $19,133,000 goodwill valuation impairment charge recorded in the first quarter of 2024, contributing to a $22,265,000 increase in net income compared to the same period in 2024.

- Total Assets increased to $1,582,377,000 (up 10.0%), and Deposits increased by $172,585,000 or 16.9% at September 30, 2025, compared to September 30, 2024.

Oct 31, 2025, 8:45 PM

First Keystone Corporation Announces Third Quarter Dividend and Q2 2025 Financial Results

FKYS

Dividends

Earnings

- First Keystone Corporation declared a $0.28 per share quarterly cash dividend for shareholders of record as of September 11, 2025, payable on September 30, 2025.

- Cash dividends amounted to $0.84 per share year-to-date as of September 30, 2025, which is the same as the prior year's comparable period.

- The Corporation achieved record balance sheet levels and strong year-to-date income statement results as of June 30, 2025. Key financial metrics are detailed below :

| Metric | Q2 2025 | Growth Rate |

|---|---|---|

| Assets ($USD) | $1,437,389,000 | 1.4% |

| Total Net Loans ($USD) | $952,008,000 | 4.1% |

| Total Deposits ($USD) | $1,057,278,000 | 7.4% |

| Net Interest Income (YTD $USD) | $18,275,000 | 18.1% |

| Net Income (YTD $USD) | $3,967,000 | 123.3% |

| EPS (YTD $USD) | $0.64 | 123.1% |

Aug 28, 2025, 4:51 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more