Earnings summaries and quarterly performance for 1 800 FLOWERS COM.

Executive leadership at 1 800 FLOWERS COM.

Adolfo Villagomez

Chief Executive Officer

James F. McCann

Executive Chairman of the Board

James Langrock

Senior Vice President, Treasurer and Chief Financial Officer

Jonathan J. Feldman

President, BloomNet

Joseph Rowland

Group President, Gourmet Foods & Gift Baskets

Michael R. Manley

Senior Vice President, General Counsel and Corporate Secretary

Board of directors at 1 800 FLOWERS COM.

Adam Hanft

Director

Celia R. Brown

Director

Christina Shim

Director

Christopher G. McCann

Director

Dina Colombo

Director

Eugene F. DeMark

Director

James A. Cannavino

Director

Larry Zarin

Director

Leonard J. Elmore

Director

Shelton Palmer

Director

Stephanie Redish Hofmann

Director

Research analysts who have asked questions during 1 800 FLOWERS COM earnings calls.

Anthony Lebiedzinski

Sidoti & Company, LLC

7 questions for FLWS

Douglas Lane

Water Tower Research

7 questions for FLWS

Michael Kupinski

Noble Capital Partners

7 questions for FLWS

Alex Fuhrman

Craig-Hallum Capital Group LLC

3 questions for FLWS

Linda Bolton-Weiser

D.A. Davidson & Co.

3 questions for FLWS

Recent press releases and 8-K filings for FLWS.

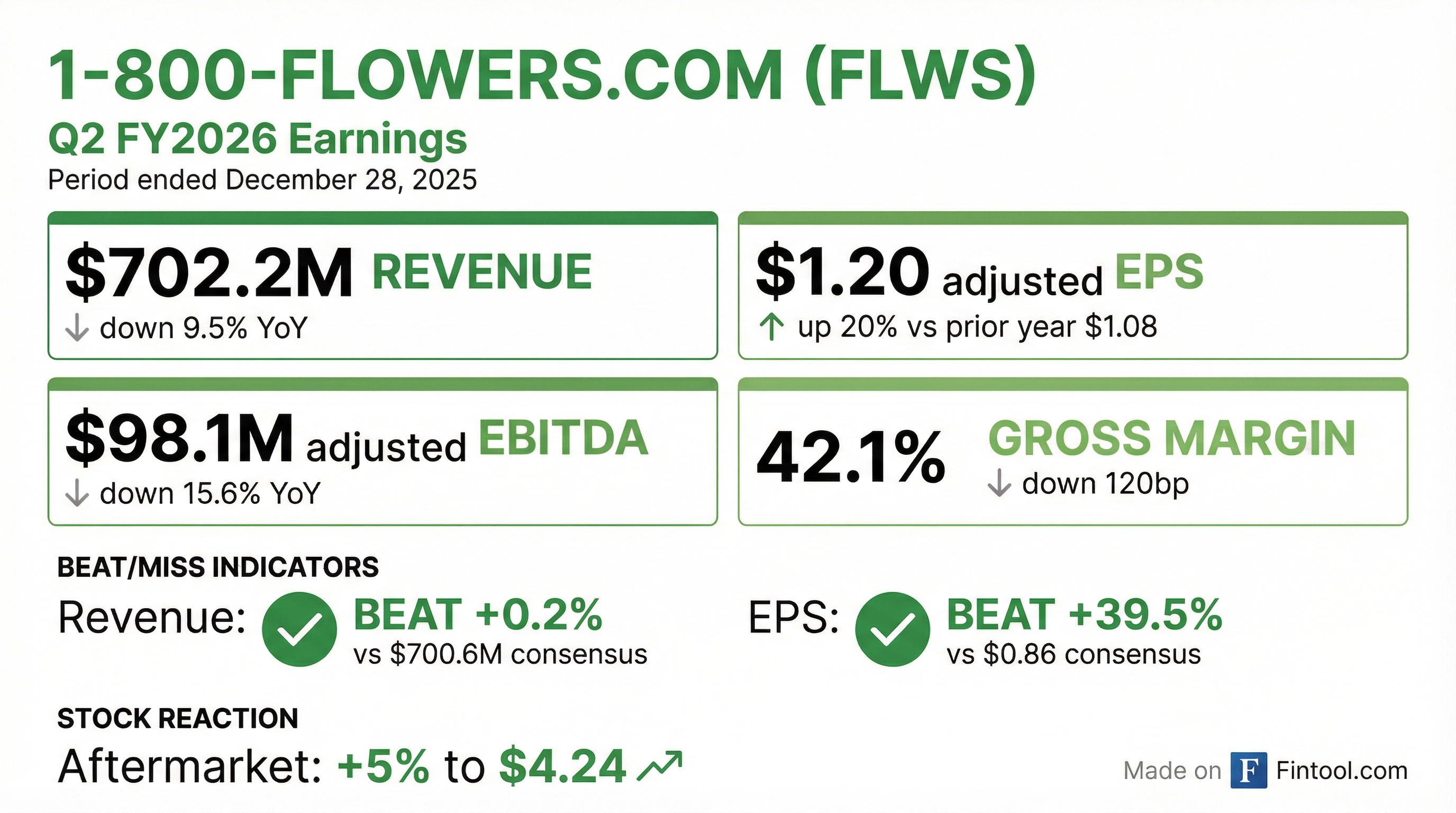

- FLWS reported a Q2 2026 revenue decrease of 9.5% and adjusted EBITDA of $98.1 million, down from $116.3 million in the prior year, primarily due to a strategic shift towards more efficient marketing and a decline in direct traffic.

- The company is undergoing significant organizational simplification, including workforce reductions and leadership realignments, which contributed to a $23.4 million decrease in operating expenses.

- FLWS has achieved approximately $15 million in annualized run-rate cost savings for fiscal 2026 and expects to reach $50 million in total cost savings across fiscal 2026 and 2027.

- For the second half of fiscal 2026, revenue is projected to decline in the low double-digit range, while Adjusted EBITDA is expected to decline slightly year-over-year, but increase slightly on a normalized basis.

- FLWS reported a 9.5% consolidated revenue decrease for Q2 2026, with Adjusted EBITDA at $98.1 million, down from $116.3 million in the prior year period.

- The company's gross margin declined 120 basis points to 42.1% due to lower fixed cost absorption, higher commodity costs, and tariffs.

- Strategic initiatives included organizational simplification, workforce reductions, and leadership realignments, resulting in approximately $15 million in annualized run-rate cost savings for fiscal 2026, with a target of $50 million across fiscal 2026 and 2027.

- For the second half of fiscal 2026, revenue is expected to decline in the low double-digit range, and Adjusted EBITDA is projected to decline slightly year-over-year, though expected to increase slightly on a normalized basis.

- The revenue decline was primarily attributed to a strategic shift towards more efficient marketing spending and a greater-than-expected decline in direct traffic, particularly impacting the Consumer Floral and Gifts segment, which saw a 22.7% decline.

- 1-800-FLOWERS.COM reported a 9.5% decline in consolidated revenue for Q2 2026, with Adjusted EBITDA at $98.1 million, primarily attributed to a strategic shift towards more efficient marketing spending and negative impacts on direct traffic from changes in search engine results pages.

- The company is undergoing organizational simplification and workforce reductions, having already achieved approximately $15 million in annualized run-rate cost savings for fiscal 2026, with a target of approximately $50 million in total cost savings across fiscal 2026 and 2027.

- For the second half of fiscal 2026, revenue is projected to decline in the low double-digit range, and Adjusted EBITDA is expected to decline slightly year-over-year, though it is anticipated to increase slightly on a normalized basis.

- The company has decided not to pursue additional pop-up store locations due to an unattractive return on invested capital, but plans to redesign its retail approach to evaluate a full-year store concept.

- 1-800-FLOWERS.COM, Inc. reported total consolidated revenues of $702.2 million for its Fiscal 2026 second quarter ended December 28, 2025, representing a 9.5% decrease compared to the prior year period.

- For the quarter, the company's net income was $70.6 million, or $1.10 per diluted share, and Adjusted EBITDA was $98.1 million.

- The gross profit margin decreased 120 basis points to 42.1% compared to the prior year period, primarily due to deleveraging on the sales decline.

- The revenue decline was mainly attributed to a strategic shift focused on improving marketing effectiveness and profitability.

- For the second half of Fiscal Year 2026, the company expects revenue to decline in the low double-digit range and Adjusted EBITDA to decline slightly compared to the prior year, with ongoing cost-optimization initiatives expected to help offset topline pressure.

- For the fiscal second quarter ended December 28, 2025, 1-800-FLOWERS.COM, Inc. reported total consolidated revenues of $702.2 million and net income of $70.6 million, or $1.10 per diluted share.

- Total consolidated revenues decreased 9.5% compared to the prior year period, mainly due to a strategic shift focused on improving marketing effectiveness and profitability.

- Adjusted EBITDA for the quarter was $98.1 million, compared with $116.3 million in the prior year period.

- For the second half of Fiscal Year 2026, the company expects revenue to decline in the low double-digit range and Adjusted EBITDA to decline slightly compared to the prior year.

- The 2025 Annual Meeting of Stockholders for 1-800-FLOWERS.COM, Inc. was held on December 10, 2025, with Chairman Jim McCann and CEO Adolfo Villagomez among the key executives present.

- Stockholders elected nine directors to serve until the 2026 Annual Meeting.

- The appointment of BDO USA, P.C. as the independent registered public accounting firm for the fiscal year ending June 28, 2026, was ratified.

- An amendment to the 2003 Long-Term Incentive and Share Award Plan, increasing the total number of authorized shares for issuance by 5 million shares, was approved.

- For Q1 2026, FLWS reported a 11.1% decrease in consolidated revenue and an adjusted EBITDA loss of $32.9 million. However, the adjusted EBITDA trend showed a slight positive improvement year-over-year after adjusting for timing-related items, marking the first such improvement in seven quarters.

- The company is implementing strategic shifts, including a focus on marketing contribution margin, expanding sales channels to include Amazon and Walmart.com, and opening holiday pop-up shops.

- FLWS has already implemented $17 million in annualized cost reductions and anticipates an additional $50 million in cost savings over the next two years on a run-rate basis, with half expected in fiscal 2026 and half in fiscal 2027.

- At quarter-end, net debt was $259.3 million, with $110 million borrowed under its revolving credit facility, which is expected to be fully repaid during the fiscal second quarter.

- 1-800-FLOWERS.COM, Inc. reported total consolidated revenues of $215.2 million for its Fiscal 2026 first quarter ended September 28, 2025, representing an 11.1% decrease compared to the prior year period.

- The company recorded a net loss of ($53.0) million, or ($0.83) per share, for the quarter, compared to a net loss of ($34.2) million, or ($0.53) per share, in the prior year period.

- Adjusted EBITDA loss for the quarter was ($32.9) million, an increase from the Adjusted EBITDA loss of ($27.9) million in the prior year period.

- The company is executing a turnaround strategy focused on marketing effectiveness and profitability, and anticipates achieving an additional $50 million in gross savings over the next two years, following $17 million in savings implemented during Fiscal 2025.

- 1-800-FLOWERS.COM reported a 6.7% decline in consolidated revenue for Q4 2025 and an 8% decline for the full fiscal year 2025, primarily driven by a 5.6% decrease in transactions and a 1.6% decrease in average order value.

- The company's Q4 2025 adjusted EBITDA loss was $24.2 million, compared to an $8.8 million loss in the prior year, and full-year adjusted EBITDA decreased to $29.2 million from $93.1 million in the prior year.

- CEO Adolfo Villagomez, who stepped into the role in May, outlined a transformation strategy focused on achieving cost savings and organizational efficiency, including a plan for $40 million in annualized savings with $17 million already implemented. The strategy also involves shifting marketing to prioritize variable contribution margin and expanding reach beyond e-commerce into new channels like physical retail and marketplaces.

- Leadership Update: New CEO Adolfo Villagomez appointed effective May 12, 2025, with key hires including a Chief AI and Transformation Officer, while Jim McCann remains Executive Chairman .

- Q3 Financials: Fiscal 2025 Q3 results showed $331.5 million in revenue with a 12.6% decline , including a 350 basis point drop in gross profit margin to 33.1%, an adjusted EBITDA loss of $34.9 million , and a $178.2 million net loss with a $138.2 million non-cash impairment charge .

- Celebrations Wave Initiative: The company launched its multi-year Celebrations Wave strategic plan to transform customer engagement using advanced technologies and AI, positioning the firm for sustainable long-term growth .

- Operational Challenges: System implementation issues resulted in a $4.6 million gross profit hit and total incremental costs of around $11 million over two quarters, expected to be fully remediated by the end of fiscal 2025 .

Quarterly earnings call transcripts for 1 800 FLOWERS COM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more