Earnings summaries and quarterly performance for Flywire.

Executive leadership at Flywire.

Board of directors at Flywire.

Research analysts who have asked questions during Flywire earnings calls.

Tien-tsin Huang

JPMorgan Chase & Co.

5 questions for FLYW

Timothy Chiodo

UBS Group AG

5 questions for FLYW

Daniel Perlin

RBC Capital Markets

4 questions for FLYW

Darrin Peller

Wolfe Research, LLC

4 questions for FLYW

Charles Nabhan

Stephens Inc.

3 questions for FLYW

Cristopher Kennedy

William Blair & Company

3 questions for FLYW

John Davis

Raymond James Financial

3 questions for FLYW

Ken Suchoski

Autonomous Research

3 questions for FLYW

Michael Infante

Morgan Stanley

3 questions for FLYW

Andrew Bauch

Wells Fargo & Company

2 questions for FLYW

Andrew Schmidt

Citigroup Inc.

2 questions for FLYW

Nate Svenson

Deutsche Bank Securities

2 questions for FLYW

Nate Svensson

Deutsche Bank

2 questions for FLYW

Christopher Svensson

Deutsche Bank AG

1 question for FLYW

James Faucette

Morgan Stanley

1 question for FLYW

Jeff Cantwell

Seaport Research Partners

1 question for FLYW

Patrick Ennis

Credit Suisse

1 question for FLYW

Tyler DuPont

Bank of America

1 question for FLYW

William Nance

The Goldman Sachs Group, Inc.

1 question for FLYW

Recent press releases and 8-K filings for FLYW.

- Flywire achieved 17% organic RLAS growth in 2025, outperforming initial guidance due to better-than-expected performance in Canada and Australia, and strong results in the U.K. and U.S.. The company has diversified beyond cross-border education, with increasing growth in domestic business, enterprise clients, and software solutions.

- For 2026, Flywire anticipates U.S. visas for first years to be down about 30%, Canada down around 10%, and U.K. and Australia to be flat. Despite the projected U.S. visa decline, the U.S. business is expected to achieve low single-digit growth, primarily driven by the faster-growing domestic segment.

- The company's Student Financial Services (SFS) product has a 10% attach rate among its U.S. institutions, with 110 new SFS clients signed in 2025. SFS adoption is seen as a significant growth driver, potentially acting as a 3-5x revenue multiplier and 2-3x gross profit multiplier.

- Gross margin experienced a 600 basis point decline in Q4 2025 due to business mix shifts, FX on settlement, and a temporary payment processing ramp. While mix will continue to be a 100-200 bps headwind into 2026, FX on settlement is expected to be a tailwind in H1 2026, and the payment processing ramp should normalize by Q4 2026.

- Flywire is targeting 70%-75% free cash flow conversion for 2026, a substantial increase from 2025, which was impacted by restructuring, M&A costs, and prepayments. The company's capital allocation priorities are organic investment (SFS, travel, AI/data architecture), followed by buybacks, and then M&A.

- Flywire reported 17% organic RLAS growth in 2025, outperforming estimates by an average of 6%, attributed to diversification into domestic, enterprise, and software segments, alongside a focus on margin and cash.

- For 2026, the company anticipates significant visa declines in the U.S. (down 30%) and Canada (down 10%), while U.K. and Australia are expected to be flat; however, growth in the domestic U.S. business and SFS client wins are expected to mitigate pressure.

- SFS adoption, currently at about 10% of U.S. legacy cross-border institutions, is a key growth driver, with potential for a 3-5x revenue multiplier and 2-3x gross profit multiplier per client.

- Gross margin experienced a 600 bps decline in Q4 2025, primarily due to business mix, FX on settlement, and a temporary payment processing ramp, with the latter expected to normalize by Q4 2026.

- Flywire forecasts a significant increase in free cash flow conversion to 70%-75% for 2026, following a depressed 2025 due to restructuring, M&A costs, and prepayments; capital allocation prioritizes organic investment, share buybacks, and then M&A.

- Flywire achieved 17% organic RLAS growth in 2025 and anticipates 70%-75% free cash flow conversion in 2026, a significant increase from 2025 which was impacted by restructuring and M&A costs.

- The company is diversifying beyond cross-border education, with the U.K. as its largest education market growing at 25%, and strong demand for its SFS product, which has a 10% attach rate in the U.S..

- Gross margin in Q4 2025 saw a 600 bps decline due to business mix, FX on settlement, and a temporary payment processing ramp, with the mix expected to be a 100-200 bps headwind into 2026.

- Strategic capital allocation prioritizes organic investments in SFS, travel, AI, and data architecture, followed by share buybacks, and then M&A, with a focus on integrating recent acquisitions.

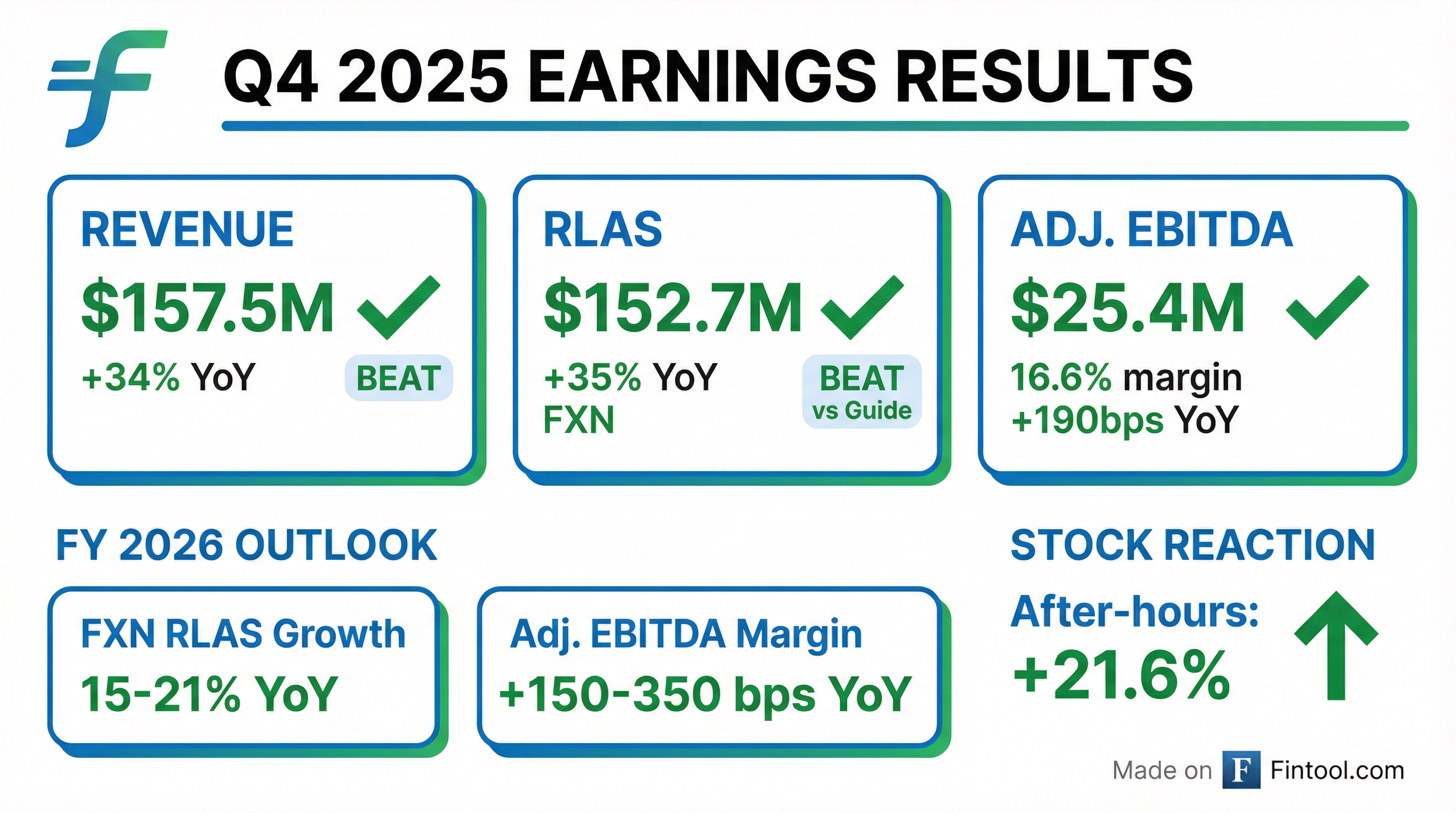

- Flywire exceeded its Q4 2025 guidance, reporting Total Revenue Less Ancillary Services (RLAS) of $152.7 million and Adjusted EBITDA of $25.4 million, beating guidance midpoints of $145 million and $23 million, respectively.

- For the full year 2025, the company achieved Total Revenue of $623.0 million and GAAP Net Income of $13.5 million. RLAS grew 27% year-over-year to $603 million, and Adjusted EBITDA increased 55% year-over-year to $120.6 million, representing a 20.0% margin.

- Flywire's client base expanded to approximately 5,000 clients in 2025. The company also repurchased approximately 8 million shares at an average price of $14.75 since the share buyback program began in Q3 2024, with $182 million remaining under the $300 million authorization.

- For 2026, the company anticipates approximately 1% inorganic growth from Sertifi and 2% from payment processing ramp, with Adjusted Gross Profit margin expected to decline 200-300 basis points due to the payment processing ramp.

- Flywire reported Q4 2025 revenue of $152.7 million, a 32.6% increase on an FX neutral basis, and achieved $13.5 million in GAAP net income for the full year 2025.

- The company provided 2026 guidance expecting 15%-21% FX neutral revenue growth and an adjusted EBITDA margin projected to expand by 150 to 350 basis points, reaching 22.5% at the midpoint.

- Adjusted gross profit margin is anticipated to decline by 200-300 basis points in 2026 due to early-stage ramp economics from payment processing programs, though gross profit dollars are still expected to grow in the mid-teens.

- Flywire maintains a strong balance sheet with a $200 million net cash position, having deployed $118 million in share buybacks with $180 million remaining authorized, and improved operational efficiency with sales and marketing expenses declining from approximately 25% to 20% of revenue from 2022 to 2025.

- Flywire reported strong Q4 2025 financial performance, with revenue of $152.7 million, representing 32.6% FX neutral growth, and an adjusted EBITDA margin of 16.6%, expanding 190 basis points year-over-year.

- For the full year 2025, the company achieved $13.5 million in GAAP net income and generated $62 million in free cash flow.

- The company provided 2026 guidance, projecting 15%-21% FX neutral revenue growth and adjusted EBITDA margin expansion of 150 to 350 basis points, targeting 22.5% at the midpoint.

- Flywire expects GAAP net income to grow approximately 3-4x versus 2025 and anticipates free cash flow conversion in the 70%-75% range.

- The company continues its share repurchase program, having deployed $118 million with approximately $180 million remaining authorized, which contributed to a year-over-year decline in diluted weighted average shares outstanding.

- Flywire delivered strong Q4 2025 performance with $152.7 million in revenue, representing 32.6% FX neutral growth, and an adjusted EBITDA margin of 16.6%, expanding 190 basis points year-over-year. For the full year 2025, the company achieved $13.5 million in GAAP net income and scaled free cash flow to $62 million.

- For 2026, Flywire projects 15%-21% FX neutral revenue growth and anticipates 150 to 350 basis points of EBITDA margin expansion, reaching 22.5% at the midpoint of guidance. GAAP net income is expected to grow approximately 3-4x versus 2025.

- The company maintains a strong competitive position with below 1% revenue churn across education and travel, leveraging deep integrations and a proprietary global payment network. Strategic priorities include accelerating product innovation, building a scalable enterprise growth engine, and internal transformation with AI.

- Flywire's capital allocation includes disciplined share buybacks, with $118 million deployed since the program's launch, resulting in negative net dilution for 2025. The company aims to limit net dilution to approximately 3% over time.

- The 2026 outlook incorporates prudent macro assumptions, such as U.S. first-year visas down approximately 30% and Canada down 10%, with growth driven by share gains and SFS expansion rather than a rebound in global student mobility.

- Flywire reported strong Fourth Quarter 2025 financial results, with revenue increasing 34.0% to $157.5 million and Adjusted EBITDA rising to $25.4 million from $16.7 million in the prior year.

- The company achieved near break-even net income in Q4 2025, a significant improvement from a net loss of ($15.9) million in Q4 2024.

- Flywire provided a positive outlook for Fiscal Year 2026, forecasting FX-Neutral Revenue Less Ancillary Services growth of 15-21% and Adjusted EBITDA Margin growth of +150-350 basis points year-over-year.

- In Q4 2025, the company repurchased approximately 0.7 million shares for $10.0 million, with $182 million remaining in its share repurchase program.

- Patrick Blanc was appointed Chief Technology Officer, effective February 23, 2026, strengthening the executive team.

- Flywire reported Fourth Quarter 2025 revenue of $157.5 million, marking a 34.0% increase year-over-year, with net income being near break-even compared to a net loss of ($15.9) million in the Fourth Quarter of 2024.

- Adjusted EBITDA for the Fourth Quarter of 2025 increased to $25.4 million, up from $16.7 million in the prior year, with the Adjusted EBITDA margin expanding by approximately 190 basis points year-over-year to 16.6%.

- Total Payment Volume grew 35.6% to $9.3 billion in the Fourth Quarter of 2025, and Revenue Less Ancillary Services increased 35.3% to $152.7 million.

- For Fiscal Year 2026, Flywire anticipates FX-Neutral Revenue Less Ancillary Services growth of 15-21% year-over-year and Adjusted EBITDA Margin growth of +150-350 basis points year-over-year.

- Flywire anticipates a mid-single-digit headwind to revenue growth for both 2025 and 2026, amounting to approximately $30 million, primarily from the Canadian, Australian, and U.S. education markets. Despite this, the overall U.S. education business is still growing in the low single digits due to offsetting factors like improved retention and adding cross-border schools.

- The company expects to achieve a long-term EBITDA margin of 25% plus, with anticipated mid-30s incremental margins on revenue for 2026. Flywire also plans to reduce stock-based compensation as a percentage of revenue from the current 12% and aims to manage dilution to 3% or lower.

- Flywire's healthcare segment is growing in the low teens in 2025 and is expected to accelerate in 2026, driven by significant client wins like Cleveland Clinic, though some growth may be at a lower margin due to payment processing.

- Growth in cross-border education outside the "Big Four" countries (U.S., Canada, Australia, UK) is a key driver, representing a low to mid-teens percentage of 2024 revenue and growing faster than the company average, as Flywire's software solutions replace manual processes in these markets.

Quarterly earnings call transcripts for Flywire.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more