Earnings summaries and quarterly performance for FARMERS NATIONAL BANC CORP /OH/.

Executive leadership at FARMERS NATIONAL BANC CORP /OH/.

Kevin Helmick

President and Chief Executive Officer

Amber Wallace

Senior Executive Vice President, Chief Retail and Marketing Officer

Mark Wenick

Senior Executive Vice President, Chief Wealth Management Officer

Myke Matuszak

Senior Executive Vice President, Chief Operating Officer

Sherry Commons

Chief Accounting Officer

Timothy Shaffer

Senior Executive Vice President, Chief Credit Officer

Troy Adair

Senior Executive Vice President, Chief Financial Officer and Secretary

Board of directors at FARMERS NATIONAL BANC CORP /OH/.

Andre Thornton

Director

Carl Culp

Director

David Paull

Director

Edward Muransky

Director

Frank Monaco

Director

Gina Richardson

Director

Gregory Bestic

Director

Neil Kaback

Director

Nicholas Varischetti

Director

Terry Moore

Chair of the Board

Research analysts covering FARMERS NATIONAL BANC CORP /OH/.

Recent press releases and 8-K filings for FMNB.

- Farmers National Banc Corp. and Middlefield Banc Corp. jointly announced on February 5, 2026, that they have received all regulatory approvals necessary to complete their proposed merger.

- The merger is expected to be completed during the first quarter of 2026.

- As of December 31, 2025, Farmers National Banc Corp. reported $5.2 billion in banking assets and $4.7 billion in wealth management assets under care.

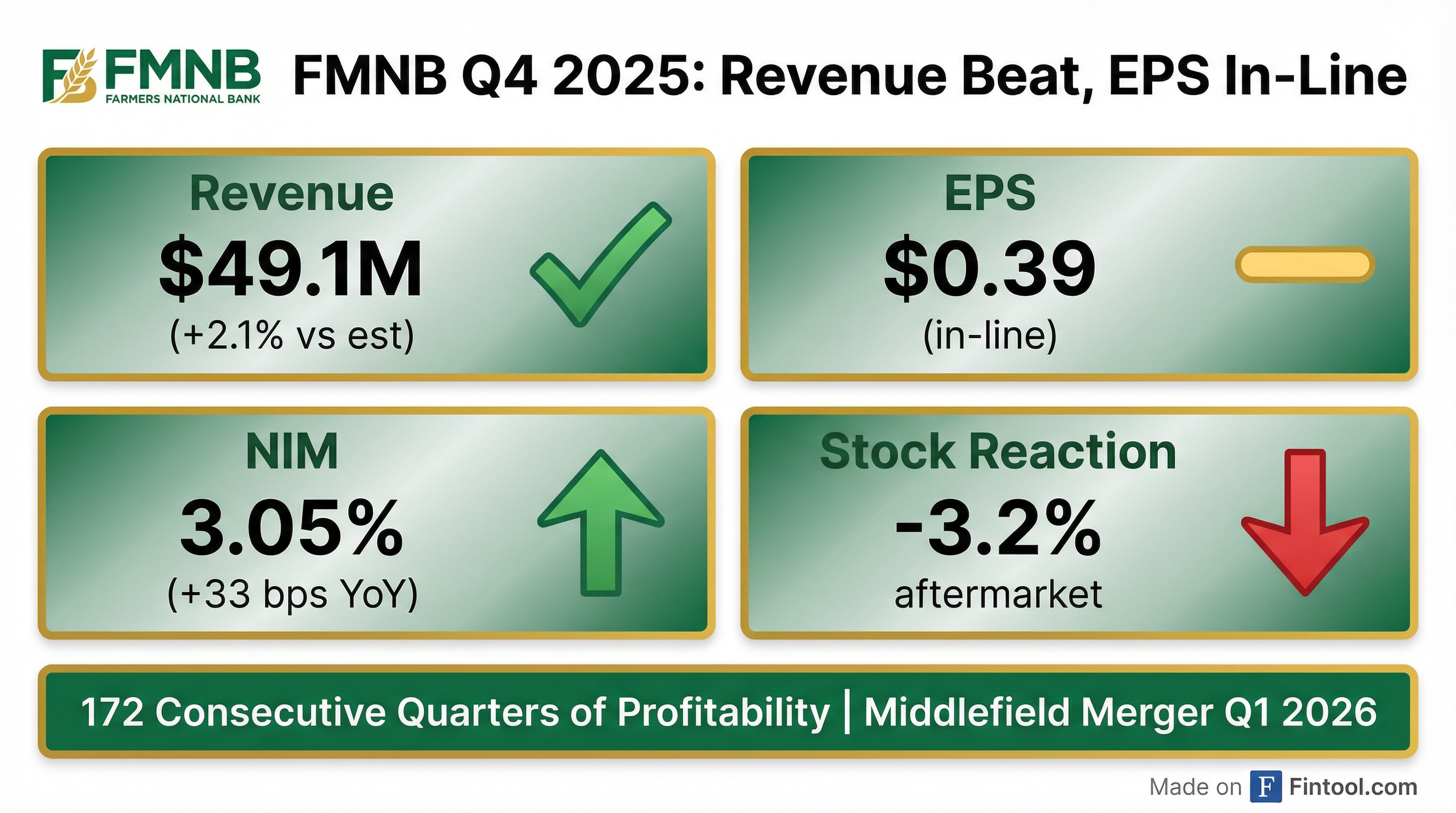

Farmers National Banc Corp. announced its fourth quarter and full year 2025 earnings, reflecting ongoing strength in its community banking platform. The company experienced an increase in its net interest margin and an improved efficiency ratio in Q4 2025 compared to the prior quarter and year. Total assets and stockholders' equity grew by the end of 2025 compared to the previous year, while loans saw a slight decline from the prior quarter but were up year-over-year. Nonperforming loans significantly declined in the fourth quarter of 2025 from the third quarter, indicating improved credit quality. Additionally, Farmers National Banc Corp. announced a merger with Middlefield Banc Corp. in Q4 2025, which is anticipated to close in Q1 2026, and reported customer deposit growth of $151.0 million (3.6%) for the full year 2025, excluding brokered CDs.

| Metric | Q4 2024 | Q3 2025 | Q4 2025 |

|---|---|---|---|

| Net Income ($USD Thousands) | $14,391 | $12,461 | $14,638 |

| Diluted EPS ($USD) | $0.38 | $0.33 | $0.39 |

| Net Interest Margin (%) | 2.72% | 3.00% | 3.05% |

| Efficiency Ratio (%) | 56.42% | 62.66% | 57.11% |

| Total Assets ($USD Thousands) | $5,118,924 | $5,235,575 | $5,245,870 |

| Loans ($USD Thousands) | $3,268,346 | $3,337,780 | $3,304,713 |

| Total Deposits ($USD Thousands) | $4,266,779 | $4,400,515 | $4,342,778 |

| Total Stockholders' Equity ($USD Thousands) | $406,028 | $465,949 | $485,725 |

| Nonperforming Loans ($USD Thousands) | $22,818 | $35,344 | $26,215 |

- Farmers National Banc Corp. reported net income of $14.6 million and $0.39 per diluted share for the fourth quarter of 2025, an increase from $14.4 million and $0.38 per diluted share in the fourth quarter of 2024.

- The net interest margin improved to 3.05% in the fourth quarter of 2025, up from 3.00% in the third quarter of 2025 and 2.72% in the fourth quarter of 2024.

- Total assets increased to $5.25 billion at December 31, 2025, compared to $5.24 billion at September 30, 2025, and $5.12 billion at December 31, 2024.

- Nonperforming loans declined to $26.2 million in the fourth quarter of 2025 from $35.3 million in the third quarter of 2025.

- The company announced a merger with Middlefield Banc Corp. in the fourth quarter of 2025, which is expected to close in the first quarter of 2026.

- Farmers National Banc Corp. is reminding shareholders to cast their votes FOR the proposed merger with Middlefield Banc Corp..

- The deadline for shareholders to vote is February 9, 2026, at 11:59 p.m., Eastern Time, in advance of the virtual shareholder meeting scheduled for February 10, 2026.

- The Farmers Board of Directors recommends voting FOR the merger proposal, stating it presents an opportunity to enhance long-term shareholder value, strengthen market position, expand geographic footprint, and support future growth.

- Farmers National Banc Corp. (FMNB) is reminding shareholders to vote FOR the proposed merger with Middlefield Banc Corp. (MBCN).

- The virtual shareholder meeting is scheduled for February 10, 2026, with a voting deadline of February 9, 2026, at 11:59 p.m., Eastern Time.

- The Farmers Board of Directors recommends a FOR vote, stating the merger will enhance long-term shareholder value by strengthening market position and expanding geographic footprint.

- Monteverde & Associates PC is investigating the merger of Farmers National Banc Corp. (FMNB) with Middlefield Banc Corp..

- Under the proposed transaction, Middlefield shareholders are set to receive 2.6 shares of Farmers common stock per share of Middlefield common stock.

- The shareholder vote for this merger is scheduled for February 10, 2026.

- Farmers National Banc Corp. (FMNB) entered into an Agreement and Plan of Merger with Middlefield Banc Corp. on October 22, 2025, under which Middlefield will merge into FMNB.

- Pursuant to the agreement, each common share of Middlefield Banc Corp. will be converted into the right to receive 2.6 common shares of Farmers National Banc Corp..

- Following the merger, the number of directors on Farmers National Banc Corp.'s board will increase by two, and two non-employee directors from Middlefield will be appointed to the FMNB board.

- As of October 22, 2025, Middlefield Banc Corp. had 8,086,886 common shares issued and outstanding.

- Farmers National Banc Corp (FMNB) and Middlefield Banc Corp have signed a definitive merger agreement, where Middlefield will merge into Farmers.

- Middlefield shareholders will receive 2.60 shares of Farmers' common stock for each Middlefield share, valuing the transaction at approximately $299 million or $36.17 per share based on Farmers' October 20 closing price.

- The transaction is expected to increase Farmers' assets to $7.2 billion from $5.2 billion.

- The merger is projected to be approximately 7% accretive to diluted EPS for 2027 and result in a 4.4% tangible book value per share dilution, which is expected to be earned back in approximately three years.

- The deal is anticipated to close in the first quarter of 2026, with a core conversion scheduled for August 2026, which will contribute to an estimated 38% cost savings based on Middlefield's expense run rate.

- Farmers National Banc Corp. (FMNB) is acquiring The Middlefield Banking Company (MBCN) in a 100% stock-for-stock transaction with an aggregate deal value of $299.0 million.

- The acquisition is expected to create a pro forma franchise with $7.4 billion in assets, $5.0 billion in loans, and $6.1 billion in deposits, operating 84 locations.

- The transaction is anticipated to be accretive to EPS by approximately 7% annually with a tangible book value earn-back of approximately 3 years.

- The deal is expected to close by the end of the first quarter of 2026.

- Farmers National Bancorp (FMNB) and Middlefield Bancorp announced a definitive all-stock merger agreement.

- Middlefield shareholders will receive 2.6 shares of FMNB common stock for each Middlefield share, valuing the transaction at approximately $299 million or $36.17 per share based on FMNB's closing share price on October 20.

- The combined company will have $7.2 billion in assets and 83 branch locations across Northeast, Central, and Western Ohio and Western Pennsylvania.

- The transaction is expected to be 7% accretive to diluted EPS in 2027 and result in a 4.4% tangible book value per share dilution, which is anticipated to be earned back in approximately three years.

- Cost savings are estimated at 38% of Middlefield's expense run rate, in addition to $2 million in annual savings from a new core platform conversion scheduled for August 2026.

Quarterly earnings call transcripts for FARMERS NATIONAL BANC CORP /OH/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more