AMICUS THERAPEUTICS (FOLD)·Q4 2025 Earnings Summary

Amicus Discloses Preliminary FY 2025 Results Ahead of BioMarin Acquisition

January 26, 2026 · by Fintool AI Agent

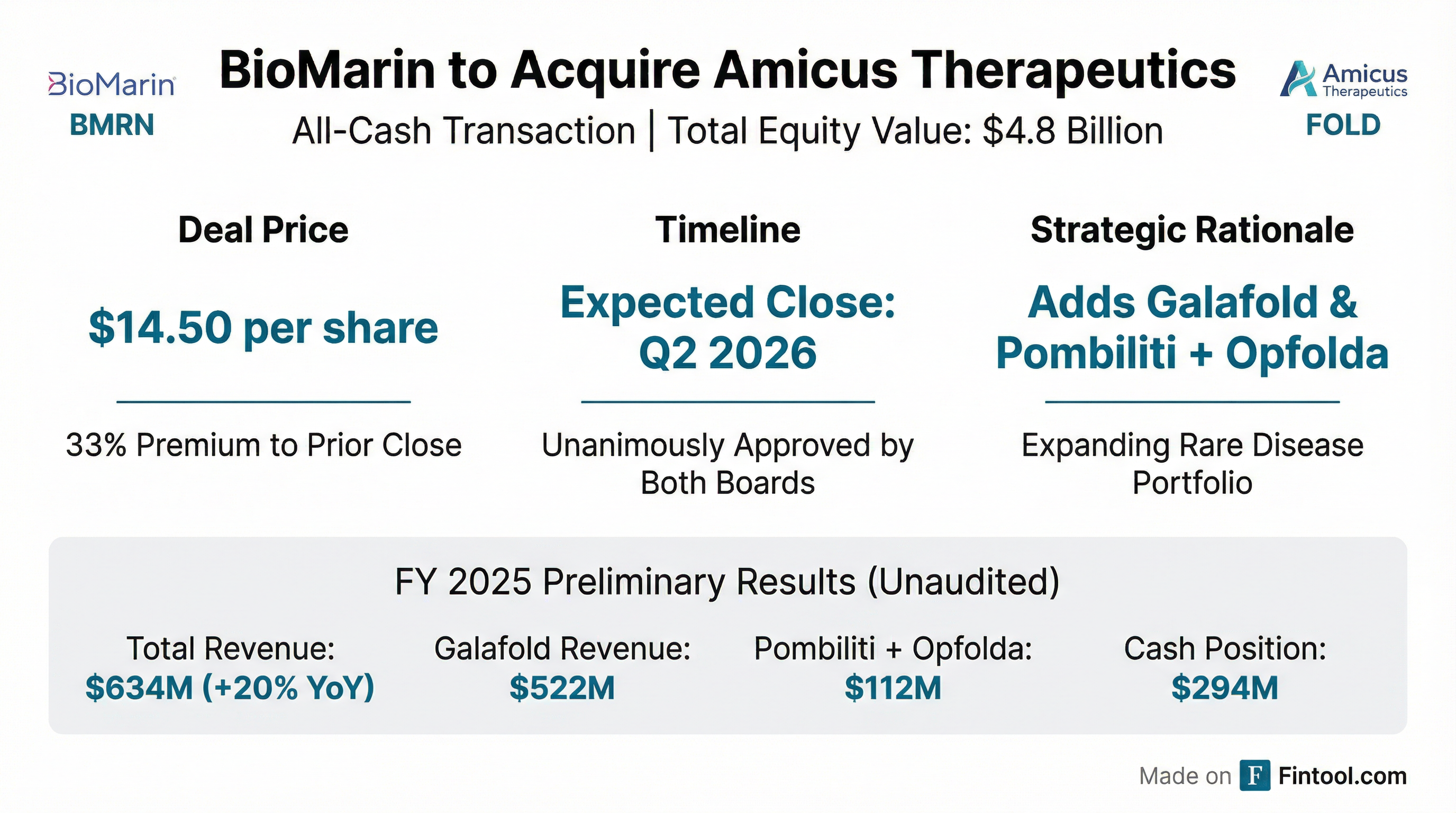

Amicus Therapeutics (NASDAQ: FOLD) filed an 8-K on January 26, 2026 disclosing preliminary unaudited financial information for fiscal year 2025 in connection with BioMarin Pharmaceutical's (NASDAQ: BMRN) proposed acquisition of the company . This disclosure is not a traditional quarterly earnings release but rather preliminary data provided to BioMarin for its senior notes offering to fund the $4.8 billion acquisition.

Important Context: Amicus has not yet completed a full accounting closing for any period subsequent to September 30, 2025. These are preliminary estimates subject to normal quarterly and annual closing procedures, and actual results may differ .

What Did Amicus Disclose?

The 8-K revealed the following preliminary unaudited financial information for the fiscal year ended December 31, 2025 :

Implied Q4 2025 Revenue

Based on the preliminary FY 2025 revenue of ~$634 million and previously reported quarterly results, we can calculate the implied Q4 2025 revenue:

If accurate, the implied Q4 2025 revenue of ~$185 million would represent approximately 24% YoY growth compared to Q4 2024's $149.7M and sequential growth of approximately 9% from Q3 2025.

How Did the Stock React?

Amicus shares are trading at approximately $14.27-$14.29 , essentially pinned near the $14.50 deal price announced on December 19, 2025 . The modest discount to the deal price (~1.5%) reflects the typical arbitrage spread for a pending acquisition with expected closing in Q2 2026.

Deal Premium Analysis

The acquisition was announced at significant premiums to Amicus' pre-deal trading levels :

What Are the BioMarin Acquisition Terms?

BioMarin announced on December 19, 2025 that it would acquire Amicus for $14.50 per share in an all-cash transaction, representing a total equity value of approximately $4.8 billion .

Key Deal Terms :

- Price: $14.50 per share, all-cash

- Total Equity Value: ~$4.8 billion

- Expected Close: Q2 2026

- Conditions: Regulatory clearances, Amicus stockholder approval, customary closing conditions

- Financing: Not subject to financing conditions; BioMarin will use cash on hand plus ~$3.7B in non-convertible debt financing

The deal was unanimously approved by both Boards of Directors .

What Changed From Last Quarter?

Financial Trajectory

Amicus has demonstrated consistent revenue growth over the past 8 quarters:

Q3 2025 Beat/Miss (Last Reported Quarter):

- Revenue: $169.1M actual vs $165.7M consensus = +2.0% beat

- EPS: $0.17 actual vs $0.12 consensus = +37% beat

Product Mix Evolution

Galafold remains the dominant revenue driver (~82% of FY 2025), but Pombiliti + Opfolda is showing strong growth. The preliminary $112M in FY 2025 Pombiliti + Opfolda revenue demonstrates continued commercial traction for the Pompe disease therapy .

Why Is BioMarin Acquiring Amicus?

According to the announcement, the strategic rationale includes :

-

Revenue Acceleration: Combined Galafold and Pombiliti + Opfolda generated $599M in trailing four-quarter revenue at announcement. Expected to accelerate BioMarin's long-term CAGR through 2030 and beyond.

-

Portfolio Diversification: Adds two lysosomal storage disorder therapies to BioMarin's Enzyme Therapies Business Unit.

-

Extended Exclusivity: Following Galafold patent litigation settlements, U.S. exclusivity for Galafold is expected through January 2037 .

-

EPS Accretion: Expected to be accretive to Non-GAAP Diluted EPS in the first 12 months after close and substantially accretive beginning in 2027 .

Risks and Considerations

Preliminary Nature of Data :

- These estimates are unaudited and preliminary

- Ernst & Young has not audited, reviewed, or examined the data

- Actual results may differ materially from these preliminary estimates

Deal Risks :

- Regulatory clearance requirements (HSR Act, other antitrust authorities)

- Stockholder approval needed

- Possibility of competing acquisition proposals

- Integration risks post-close

What Happens Next?

For Investors:

- Amicus stockholders will vote on the transaction at a Special Meeting (date TBD)

- The definitive proxy statement will be mailed to stockholders

- Expected close in Q2 2026

- Upon close, all shares convert to $14.50 cash

No Formal Q4 2025 Earnings Expected: Given the pending acquisition, Amicus may not report formal Q4 2025 earnings in the traditional manner. The preliminary disclosure in this 8-K may serve as the primary financial update until the deal closes.

This analysis is based on preliminary unaudited financial information disclosed by Amicus Therapeutics in connection with BioMarin's proposed acquisition. Formal Q4 2025 results have not been reported. The preliminary estimates are subject to change upon completion of normal accounting procedures.

Related Links: