Earnings summaries and quarterly performance for AMICUS THERAPEUTICS.

Executive leadership at AMICUS THERAPEUTICS.

Board of directors at AMICUS THERAPEUTICS.

Research analysts who have asked questions during AMICUS THERAPEUTICS earnings calls.

Joseph Schwartz

Oppenheimer

4 questions for FOLD

Kristen Kluska

Cantor Fitzgerald

4 questions for FOLD

Anupam Rama

JPMorgan Chase & Co.

3 questions for FOLD

Dennis Ding

Jefferies Financial Group Inc.

3 questions for FOLD

Ritu Baral

TD Cowen

3 questions for FOLD

Salveen Richter

Goldman Sachs

3 questions for FOLD

Tazeen Ahmad

Bank of America

3 questions for FOLD

Dae Gon Ha

Stifel

2 questions for FOLD

Eliana Merle

UBS

2 questions for FOLD

Gil Blum

Needham & Company

2 questions for FOLD

Jeff Hung

Morgan Stanley

2 questions for FOLD

Maxwell Skor

H.C. Wainwright & Co.

2 questions for FOLD

Ellie Merle

UBS Group AG

1 question for FOLD

Joshua Fleishman

Cowen and Company, LLC

1 question for FOLD

Mark Aleynick

Goldman Sachs

1 question for FOLD

Priyanka Grover

JPMorgan Chase & Co.

1 question for FOLD

Tejas Wein

Raymond James

1 question for FOLD

Recent press releases and 8-K filings for FOLD.

- Full-year 2025 total revenues reached $634.2 million, marking a 17% increase year-over-year at constant exchange rates.

- For full-year 2025, Amicus reported a GAAP net loss of $27.1 million (or $0.09 per share) and a non-GAAP net income of $96.8 million (or $0.31 per share).

- The company's cash, cash equivalents, and marketable securities increased by $44 million in 2025, reaching $293.5 million by December 31, 2025.

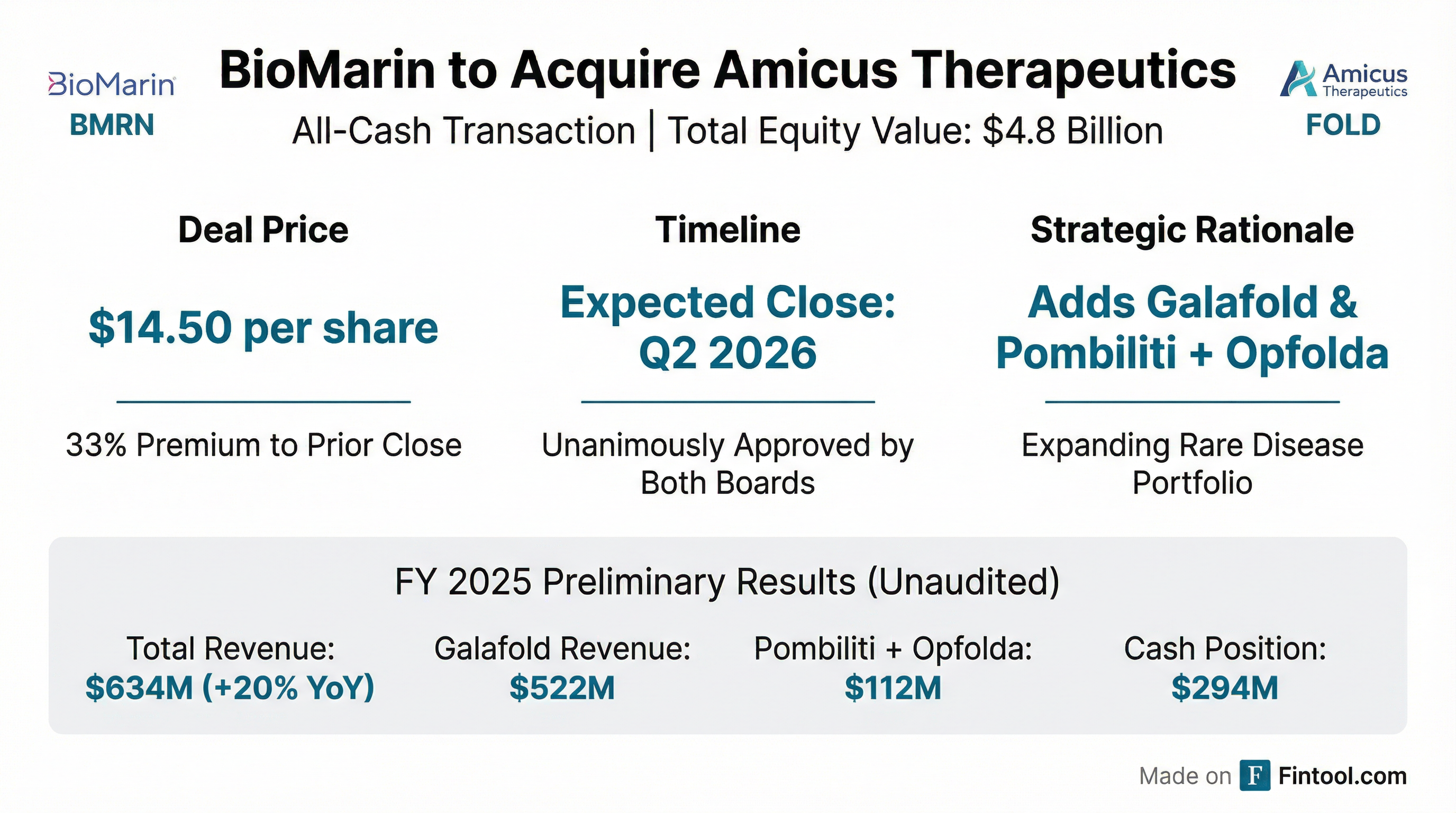

- The proposed acquisition by BioMarin for $14.50 per share, valued at approximately $4.8 billion, is anticipated to close in Q2 2026, following the FTC's early termination of the HSR Act waiting period on February 11, 2026.

- Amicus Therapeutics reported total revenues of $634.2 million for the full year 2025, reflecting a 17% year-over-year increase at constant exchange rates, with a GAAP net loss of $27.1 million ($0.09 per share) and non-GAAP net income of $96.8 million ($0.31 per share).

- The company's cash, cash equivalents, and marketable securities increased by $44 million in 2025, reaching $293.5 million as of December 31, 2025.

- Amicus Therapeutics is subject to a proposed acquisition by BioMarin Therapeutics for $14.50 per share in an all-cash transaction, totaling approximately $4.8 billion, which is expected to close in the second quarter of 2026.

- Monteverde & Associates PC is investigating the proposed sale of Amicus Therapeutics, Inc. (NASDAQ: FOLD) to BioMarin Pharmaceutical Inc.

- Under the terms of the proposed transaction, Amicus shareholders are expected to receive $14.50 per share in cash.

- A Shareholder Vote for this transaction is scheduled for March 3, 2026.

- BioMarin Pharmaceutical announced a definitive agreement to acquire Amicus Therapeutics (NASDAQ: FOLD) for $14.50 per share in cash, valuing the transaction at approximately $4.8 billion.

- The acquisition adds two marketed, high-growth rare disease therapies, Galafold for Fabry disease and Pombiliti + Opfolda for Pompe disease, which together generated $599 million in revenue over the past four quarters.

- The deal is expected to be accretive to non-GAAP EPS within 12 months of closing, with substantial accretion projected by 2027, and the resolution of U.S. Galafold patent litigation extends exclusivity to 2037.

- Amicus Therapeutics expects Galafold (Fabry disease) revenue to exceed $500 million this year, growing 10%-15%, and Pombiliti/Opfolda (Pompe disease) sales to surpass $100 million with 50%-65% growth.

- The company achieved GAAP profitability for the first time in Q3 and holds over $260 million in cash on its balance sheet.

- Amicus licensed DMX-200 for FSGS, a late-phase 3 asset, with U.S. commercial rights and anticipates top-line data in early 2028, with the FDA agreeing that proteinuria could serve as a primary endpoint and indicating potential for an accelerated path.

- Amicus Therapeutics expects Galafold revenue to exceed $500 million this year, growing at 10%-15%, and anticipates Pombiliti and Opfolda (POMOP) revenue growth of 50%-65% to over $100 million this year. The company achieved GAAP profitability in Q3 2025.

- Galafold, for Fabry disease, continues to see double-digit growth driven by patient finding initiatives and a growing market, with patent protection expected until 2037.

- The Pombiliti and Opfolda (POMOP) launch for Pompe disease is showing accelerating momentum in the U.S., with Q2 and Q3 2025 being the largest commercial quarters, and strong progress in Europe.

- Amicus licensed DMX-200 for FSGS, a rare kidney disease, securing U.S. commercial rights for a late-phase III asset with a potential $1 billion+ opportunity. Top-line data for the two-year proteinuria endpoint is anticipated in early 2028.

- The company maintains a strong financial foundation with over $260 million in cash on its balance sheet and is committed to full-year profitability, with a business development strategy focused on late-stage, de-risked assets.

- Amicus, a rare disease company, anticipates passing $600 million in revenue this year and $1 billion by 2028, with profitability expected in the second half of 2025.

- Galafold (Fabry disease) is projected for 10-15% growth this year, exceeding $500 million in sales, with IP protection into the 2040s and a key patent trial outcome expected in Q2 2026.

- Pombiliti Opfolda (Pompe disease) is experiencing 50-65% growth this year, expected to surpass $100 million in sales, driven by strong patient additions and geographic expansion, with a pediatric label expansion anticipated in mid-2026.

- The DMX-200 program for FSGS, a potential blockbuster, is nearing completion of Phase 3 enrollment by end of 2025, with top-line data expected in early 2028 and discussions for potential accelerated approval in H1 2026.

- Amicus is mitigating potential tariff impacts by transitioning Pompe manufacturing from China to Ireland by 2027 and anticipates muted effects from MFN due to a likely rare disease carve-out.

- Amicus is on track to become profitable in the second half of the year, with over $600 million in revenue this year and a target of $1 billion by 2028. The company holds over $260 million in cash and generated over $30 million in cash in Q3.

- Galafold is projected to achieve 10-15% growth and over $500 million in sales this year, with patent protection extending into the 2040s and IP litigation resolution expected in H1 next year.

- Pombiliti Opfolda, an early-launch product, is anticipated to grow 50-65% this year, surpassing $100 million in sales, driven by strong patient additions and geographic expansion into eight new countries. A pediatric label expansion is expected mid-next year.

- The company acquired US rights to DMX-200 for FSGS, a potential blockbuster opportunity. Its Phase 3 trial enrollment is over 90% complete and expected to close by year-end, with top-line data anticipated two years after the last patient randomization. Conversations for potential accelerated approval are expected in H1 next year.

- Manufacturing for Pompe is transitioning from China to Ireland, with supply expected to shift throughout next year and primarily from Ireland by 2027, aiming to mitigate tariff impacts.

- Amicus Therapeutics reported Q3 2025 total revenue of $169.1 million, a 19% increase over Q3 2024, and achieved GAAP net income of $17.3 million, or $0.06 per share, marking its first profitable quarter in 2025.

- Galafold revenue reached $138.3 million, growing 15% (12% at constant exchange rates) with 13% year-over-year patient growth.

- Pombiliti and Opfolda revenue was $30.7 million, an increase of 45% (42% at constant exchange rates), driven by strong launch momentum and expansion into 15 countries.

- The company reiterated its full-year 2025 guidance, expecting total revenue growth of 15%-22% and Pombiliti and Opfolda revenue growth of 50%-65% at constant exchange rates, and anticipates positive GAAP net income for the second half of 2025.

- Amicus remains confident in achieving $1 billion in combined sales for Galafold and Pombiliti/Opfolda by 2028 and is advancing the DMX-200 Phase III study for FSGS, which is over 90% enrolled.

- Amicus Therapeutics (FOLD) reported Q3 2025 revenue of $169 million, marking a 17% increase at constant exchange rates (CER), with non-GAAP net income reaching $54.2 million.

- Product performance highlights include Galafold revenue of $138.3 million (+12% at CER) and Pombiliti + Opfolda revenue of $30.7 million (+42% at CER) for Q3 2025.

- The company reiterated its FY 2025 financial guidance, anticipating total revenue growth of 15% to 22% and positive GAAP net income in H2 2025.

- Pombiliti + Opfolda expanded its global reach with regulatory approvals in Australia, Canada, and Japan in 2025, and is now reimbursed in 15 countries, adding 10 new countries this year.

Quarterly earnings call transcripts for AMICUS THERAPEUTICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more