Earnings summaries and quarterly performance for BIOMARIN PHARMACEUTICAL.

Executive leadership at BIOMARIN PHARMACEUTICAL.

Alexander Hardy

President and Chief Executive Officer

Brian R. Mueller

Executive Vice President and Chief Financial Officer

C. Greg Guyer

Executive Vice President and Chief Technical Officer

Cristin Hubbard

Executive Vice President and Chief Commercial Officer

G. Eric Davis

Executive Vice President, Chief Legal Officer and Secretary

Gregory R. Friberg

Executive Vice President and Chief Research & Development Officer

Board of directors at BIOMARIN PHARMACEUTICAL.

Athena Countouriotis

Director

Barbara W. Bodem

Director

Elizabeth McKee Anderson

Director

Ian T. Clark

Director

Mark J. Enyedy

Director

Maykin Ho

Director

Richard A. Meier

Chair of the Board

Robert J. Hombach

Director

Timothy P. Walbert

Director

Willard Dere

Director

Research analysts who have asked questions during BIOMARIN PHARMACEUTICAL earnings calls.

Cory Kasimov

Evercore ISI

8 questions for BMRN

Philip Nadeau

TD Cowen

7 questions for BMRN

Akash Tewari

Jefferies

6 questions for BMRN

Paul Matteis

Stifel

6 questions for BMRN

Salveen Richter

Goldman Sachs

6 questions for BMRN

Jessica Fye

JPMorgan Chase & Co.

5 questions for BMRN

Olivia Brayer

Cantor

5 questions for BMRN

Christopher Raymond

Piper Sandler

4 questions for BMRN

Gena Wang

Barclays

4 questions for BMRN

Joseph Schwartz

Oppenheimer

4 questions for BMRN

Mohit Bansal

Wells Fargo & Company

4 questions for BMRN

Jason Gerberry

Bank of America Merrill Lynch

3 questions for BMRN

Julian Pino

Jefferies

3 questions for BMRN

Konstantinos Biliouris

BMO Capital Markets

3 questions for BMRN

Adam Ferrari

J.P. Morgan

2 questions for BMRN

Alexandria Hammond

Wolfe Research

2 questions for BMRN

Allison Bratzel

Piper Sandler Companies

2 questions for BMRN

Andrea Park

Leerink Partners

2 questions for BMRN

Chris Raymond

Raymond James

2 questions for BMRN

Eliana Merle

UBS

2 questions for BMRN

Ellen Horste

TD Cowen

2 questions for BMRN

Huidong Wang

Barclays

2 questions for BMRN

Jasmine Fels

UBS

2 questions for BMRN

Joe Schwartz

Leerink Partners

2 questions for BMRN

Kostas Biliouris

BMO Capital Markets

2 questions for BMRN

Sean Laaman

Morgan Stanley & Co.

2 questions for BMRN

Sean Lehmann

Morgan Stanley

2 questions for BMRN

Tommie Reerink

Goldman Sachs

2 questions for BMRN

Addie

Evercore ISI

1 question for BMRN

Alex Hammond

Sidoti & Company, LLC

1 question for BMRN

Ellie Merle

UBS Group AG

1 question for BMRN

John Wang

Barclays

1 question for BMRN

Phoebe

Jefferies

1 question for BMRN

Sadia Rehman

Wells Fargo & Company

1 question for BMRN

Tommy

Goldman Sachs

1 question for BMRN

Vikram Purohit

Morgan Stanley

1 question for BMRN

Zaki Molvi

Jefferies

1 question for BMRN

Recent press releases and 8-K filings for BMRN.

- The U.S. Food and Drug Administration (FDA) has approved BioMarin Pharmaceutical Inc.'s supplemental Biologics License Application (sBLA) for PALYNZIQ to include pediatric patients 12 years of age and older with phenylketonuria (PKU).

- PALYNZIQ is the only enzyme substitution therapy approved to reduce blood phenylalanine (Phe) concentrations in people with PKU.

- The approval is based on data from the Phase 3 PEGASUS study, which showed a statistically significant blood phenylalanine (Phe) lowering in the PALYNZIQ arm compared to diet alone at Week 72.

- Common adverse reactions in adolescents included injection site reactions, arthralgia, headache, and hypersensitivity reactions; anaphylaxis was reported in 11% of PALYNZIQ-treated patients aged 12 to less than 18 years in a clinical trial.

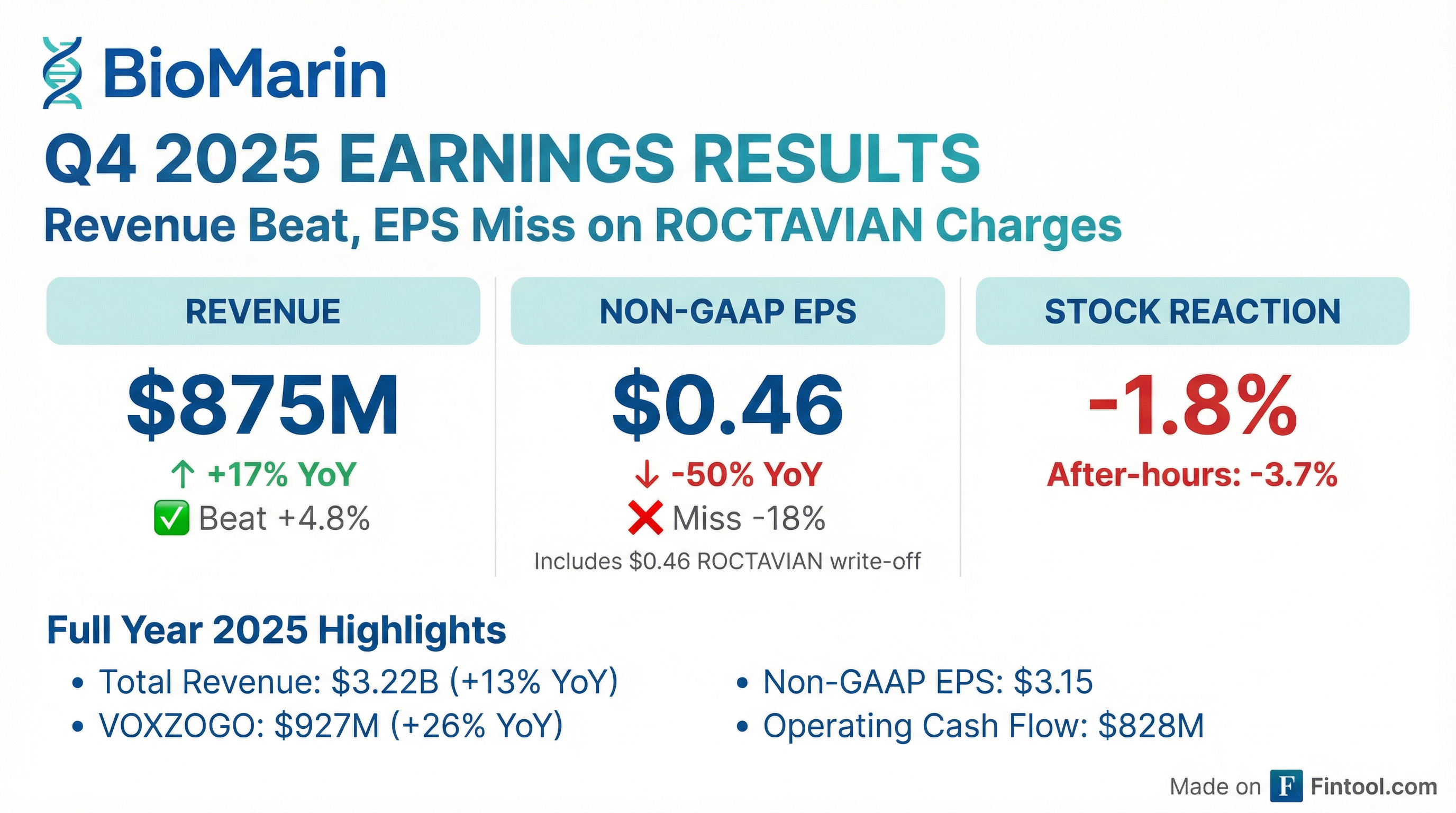

- BioMarin Pharmaceutical reported a GAAP net loss of $(47) million and Non-GAAP income of $89 million for Q4 2025, with GAAP diluted EPS of $(0.24) and Non-GAAP diluted EPS of $0.46. For the full year 2025, GAAP net income was $349 million and Non-GAAP income was $614 million, with GAAP diluted EPS of $1.80 and Non-GAAP diluted EPS of $3.15.

- VOXZOGO revenue reached $273 million in Q4 2025 and $927 million for the full year 2025, marking 26% year-over-year growth.

- Enzyme Therapies generated $1,220 million in total revenue for 2025, an 11% increase from 2024, with PALYNZIQ contributing significantly to growth.

- Significant upcoming milestones include an anticipated U.S. PDUFA target action date of February 28, 2026, for PALYNZIQ adolescent label expansion, an expected SNDA submission for full approval of VOXZOGO in Q2 2026, and the planned start of the BMN 333 Phase 2/3 study in 1H 2026. Additionally, the acquisition of Amicus, including Pombiliti + Opfolda, is expected to close in Q2 2026.

- BioMarin Pharmaceutical achieved record total revenues of $3.22 billion for the full year 2025, a 13% increase year-over-year, and $875 million for Q4 2025, up 17%. Full-year 2025 non-GAAP diluted earnings per share was $3.15, with underlying business EPS growing approximately 34%.

- Voxzogo revenue grew 26% to $927 million for the full year 2025, and enzyme therapies revenue increased 9%. For 2026, the company anticipates total revenues between $3.325 billion and $3.425 billion (excluding Amicus acquisition contributions) and non-GAAP diluted earnings per share in the range of $4.95-$5.15.

- The company is expanding its portfolio through the acquisition of Amicus, expected to close next quarter, which will add products like Galafold and Pombiliti/Opfolda to its commercial portfolio. BioMarin also made the strategic decision to withdraw Roctavian from the market, recording approximately $240 million in special items in Q4 2025.

- Key pipeline developments include potential Voxzogo indication expansion for hypochondroplasia and the advancement of BMN 333, a next-generation CNP therapy for achondroplasia, with phase 2/3 study enrollment preparing to begin.

- BioMarin Pharmaceutical achieved record total revenues of $3.22 billion for the full year 2025, marking a 13% increase year-over-year, with Q4 2025 revenues at $875 million, up 17%. Full-year 2025 non-GAAP diluted earnings per share was $3.15.

- The company issued initial 2026 guidance (excluding Amicus acquisition contributions), forecasting total revenues between $3.325 billion and $3.425 billion and non-GAAP diluted earnings per share in the range of $4.95-$5.15.

- Strategic acquisitions include Inozyme, strengthening the enzyme therapies portfolio, and the anticipated Q1 2026 close of Amicus, which will add Galafold, Pombiliti, and Opfolda to the commercial portfolio.

- BioMarin decided to withdraw Roctavian from the market, resulting in approximately $240 million in special items in Q4 2025. Additionally, Voxzogo is expected to expand its indication to hypochondroplasia with phase III data readouts in the first half of 2026 and potential approval in 2027.

- BioMarin reported record total revenues of $3.22 billion for the full year 2025, a 13% increase year-over-year, driven by a 26% rise in Voxzogo revenues and 9% increase in enzyme therapies revenue. Full-year 2025 non-GAAP diluted earnings per share was $3.15, and operating cash flow increased 45% to $828 million compared to 2024.

- The company announced the withdrawal of Roctavian from the market, resulting in approximately $240 million in special items in Q4 2025, including an inventory write-off.

- BioMarin anticipates the Amicus acquisition to close next quarter (Q1 2026), which will add Galafold, Pombiliti, and Opfolda to its commercial portfolio, significantly enhancing its 2026 outlook and enabling accelerated revenue growth through the 2030s.

- For 2026, excluding Amicus contributions, BioMarin expects total revenues between $3.325 billion and $3.425 billion, with Voxzogo revenue between $975 million and $1.025 billion, and enzyme therapies revenue between $2.225 billion and $2.275 billion. Non-GAAP diluted earnings per share is projected to be in the range of $4.95-$5.15.

- Key pipeline milestones for 2026 include anticipated Phase 3 data readouts for Voxzogo in hypochondroplasia and BMN 401 in ENPP1 deficiency, and a PDUFA action date of February 28 for the Palynziq sBLA for adolescents with PKU.

- BioMarin reported full-year 2025 total revenues of $3.2 billion, a 13% year-over-year increase, and fourth quarter 2025 total revenues of $875 million, up 17% year-over-year.

- Revenue growth was primarily driven by VOXZOGO, which increased 26% year-over-year for the full year and 31% in Q4 2025, and Enzyme Therapies, which grew 9% for the full year and 13% in Q4 2025.

- The company announced a definitive agreement to acquire Amicus Therapeutics, expected to close in Q2 2026, and voluntarily withdrew ROCTAVIAN from the market, leading to a Q4 2025 GAAP Net Loss of $(47) million.

- For full-year 2026, BioMarin provided guidance (excluding any post-close contribution from Amicus) of total revenues between $3,325 million and $3,425 million and Non-GAAP diluted EPS between $4.95 and $5.15.

- BioMarin reported full-year 2025 total revenues of $3.221 billion, a 13% increase year-over-year, and fourth-quarter 2025 total revenues of $875 million, up 17% from the same period in 2024. This growth was notably driven by 26% growth in VOXZOGO revenue and 9% growth in Enzyme Therapies revenue for the full year.

- For the fourth quarter of 2025, the company recorded a GAAP Net Loss of $47 million and Non-GAAP Income of $89 million, primarily impacted by approximately $240 million in charges related to the voluntary withdrawal of ROCTAVIAN from the market.

- BioMarin announced a definitive agreement to acquire Amicus Therapeutics, with the acquisition expected to close in Q2 2026, aiming to accelerate and diversify revenues.

- The company provided full-year 2026 guidance, projecting total revenues between $3.325 billion and $3.425 billion and Non-GAAP Diluted EPS between $4.95 and $5.15, excluding any post-close contribution from the Amicus acquisition.

- BioMarin Pharmaceutical Inc. closed a private offering of $850 million of 5.500% senior unsecured notes due 2034 on February 12, 2026.

- The proceeds from these notes, along with new $2 billion senior secured term loan B facility and $800 million senior secured term loan A facility, and cash on hand, are intended to fund the acquisition of Amicus Therapeutics, Inc..

- BioMarin also expects to enter into a $600 million senior secured revolving credit facility in connection with the acquisition.

- The gross proceeds from the notes offering are held in an escrow account, and BioMarin will be required to redeem the notes if the acquisition is not completed by December 19, 2026.

- BioMarin Pharmaceutical Inc. closed an offering of $850 million of 5.500% senior unsecured notes due 2034 at an issue price of 100.000%.

- The proceeds from the notes, along with borrowings under new $2 billion Term Loan B and $800 million Term Loan A facilities, and cash on hand, will fund the acquisition of Amicus Therapeutics, Inc. and related fees.

- BioMarin also expects to enter into a $600 million senior secured revolving credit facility in connection with the acquisition.

- The Notes are subject to a special mandatory redemption if the acquisition is not completed by December 19, 2026, requiring redemption at 100% of the initial issue price plus accrued interest.

- BioMarin Pharmaceutical Inc. priced an offering of $850 million of 5.500% senior unsecured notes due 2034, with the offering expected to close on February 12, 2026.

- The company completed the syndication of a new $2 billion senior secured term loan "B" facility and an $800 million senior secured term loan "A" facility.

- These financing activities, along with cash on hand, are intended to fund the acquisition of Amicus Therapeutics, Inc. and related fees and expenses.

- BioMarin also expects to enter into a $600 million senior secured revolving credit facility in connection with the acquisition.

- The notes will be subject to mandatory redemption if the acquisition of Amicus Therapeutics, Inc. is not completed on or prior to December 19, 2026.

Fintool News

In-depth analysis and coverage of BIOMARIN PHARMACEUTICAL.

Quarterly earnings call transcripts for BIOMARIN PHARMACEUTICAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more