BioMarin Bets $4.8 Billion on Amicus to Create Rare Disease Powerhouse

December 19, 2025 · by Fintool Agent

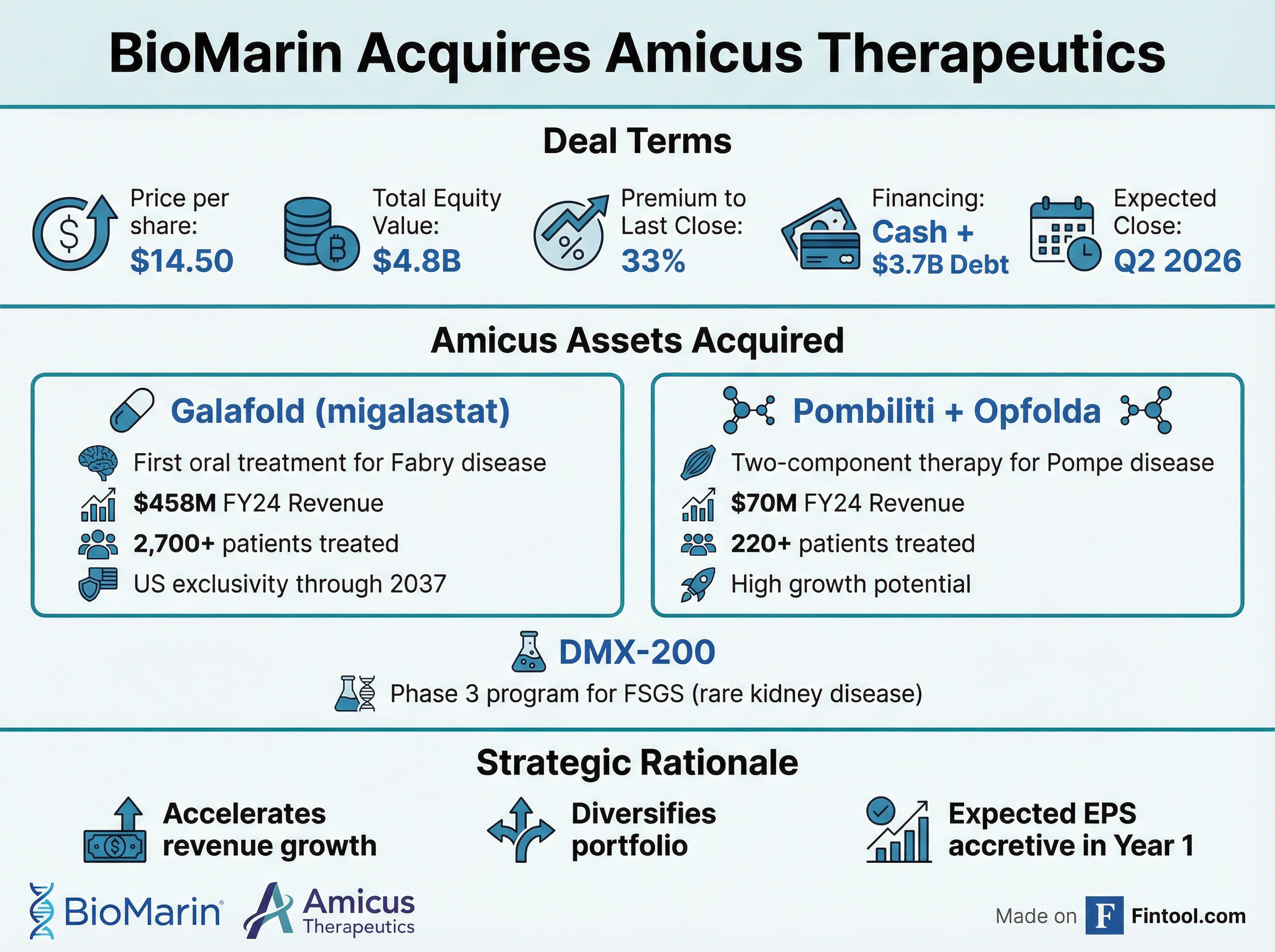

Biomarin Pharmaceutical announced Friday it will acquire Amicus Therapeutics in a $4.8 billion all-cash deal that unites two of biotech's most patient-focused rare disease companies. At $14.50 per share—a 33% premium to Thursday's close—the transaction represents BioMarin's largest acquisition ever and a strategic pivot to cement its dominance in lysosomal storage disorders.

"BioMarin's scale of operations, including our global commercial footprint and industry-leading, in-house manufacturing capabilities make the combination of these companies an exceptional strategic fit," said Alexander Hardy, BioMarin's President and CEO. "Immediately upon close, this transaction is expected to accelerate BioMarin's revenue growth and strengthen our financial outlook."

The deal arrives at an inflection point for both companies. BioMarin, which generated $2.9 billion in 2024 revenue, has been pursuing external innovation to diversify its portfolio beyond its flagship growth driver VOXZOGO. Amicus, meanwhile, has proven its commercial model works—delivering 33% revenue growth in 2024 and reaching non-GAAP profitability—but faces the challenge of scaling two complex rare disease therapies as an independent company.

The Deal: Premium Price for High-Growth Assets

BioMarin is paying handsomely for Amicus, but the math reveals why:

| Deal Term | Value |

|---|---|

| Price per Share | $14.50 |

| Total Equity Value | $4.8 billion |

| Premium to Last Close | 33% |

| Premium to 30-Day VWAP | 46% |

| Premium to 60-Day VWAP | 58% |

| Financing | Cash + $3.7B debt |

| Expected Close | Q2 2026 |

BioMarin will finance the acquisition through cash on hand and approximately $3.7 billion of non-convertible debt financing, with Morgan Stanley providing the bridge commitment. The company has committed to deleveraging to less than 2.5x gross leverage within two years of closing.

What BioMarin Gets: Two Growing Franchises in Lysosomal Storage Disorders

The crown jewels of this acquisition are Galafold and Pombiliti + Opfolda—two therapies that generated combined revenue of $599 million over the past four quarters and are positioned for continued growth.

Galafold: The Fabry Disease Standard of Care

Galafold (migalastat) is the first and only oral treatment for Fabry disease, a serious genetic condition affecting approximately 100,000 people worldwide—though most remain undiagnosed. The drug works as a "pharmacological chaperone," stabilizing patients' own dysfunctional enzymes so they can clear disease-causing substrate buildup.

| Galafold Metric | Value |

|---|---|

| FY 2024 Revenue | $458.1 million |

| YoY Growth (CER) | 19% |

| Patients Treated | 2,730 |

| Market Share (Amenable Patients) | 65% |

| Countries Approved | 40+ |

| FY 2025 Growth Guidance | 10-15% |

The growth story is compelling. Despite being on the market for nearly a decade, Galafold's new patient demand in 2024 reached its highest level since launch. Amicus estimates the segment of Fabry patients with amenable mutations could represent a $1 billion annual revenue opportunity by decade's end.

Critically, the deal includes resolution of pending patent litigation. Amicus settled with Aurobindo and Lupin, securing U.S. Galafold exclusivity through January 2037—giving BioMarin 12 years of protected runway.

Pombiliti + Opfolda: Early Days of a High-Growth Pompe Franchise

The second asset is Pombiliti + Opfolda, a novel two-component therapy for late-onset Pompe disease that launched commercially in 2024. Unlike traditional enzyme replacement therapies, this approach combines a next-generation enzyme with an oral stabilizer to improve delivery to affected tissues.

| Pombiliti + Opfolda Metric | Value |

|---|---|

| FY 2024 Revenue | $70.2 million |

| Patients Treated (End 2024) | 220 |

| FY 2025 Growth Guidance | 50-65% |

| Global Pompe Market (2024) | $1.5 billion |

| Projected Global Market (2029) | $2+ billion |

The Pompe market continues growing through improved diagnosis, and Pombiliti + Opfolda is differentiated as the only therapy with Phase 3 data demonstrating benefits in patients switching from standard of care. With 10 new launch countries expected in 2025 and regulatory approvals in Canada, Australia, and Japan already secured, the growth trajectory is intact.

Pipeline Addition: DMX-200 for Rare Kidney Disease

Beyond commercial products, BioMarin gains U.S. rights to DMX-200, a potential first-in-class small molecule in Phase 3 development for focal segmental glomerulosclerosis (FSGS)—a rare, fatal kidney disease with no approved therapies. Amicus licensed the asset from Dimerix in April 2025.

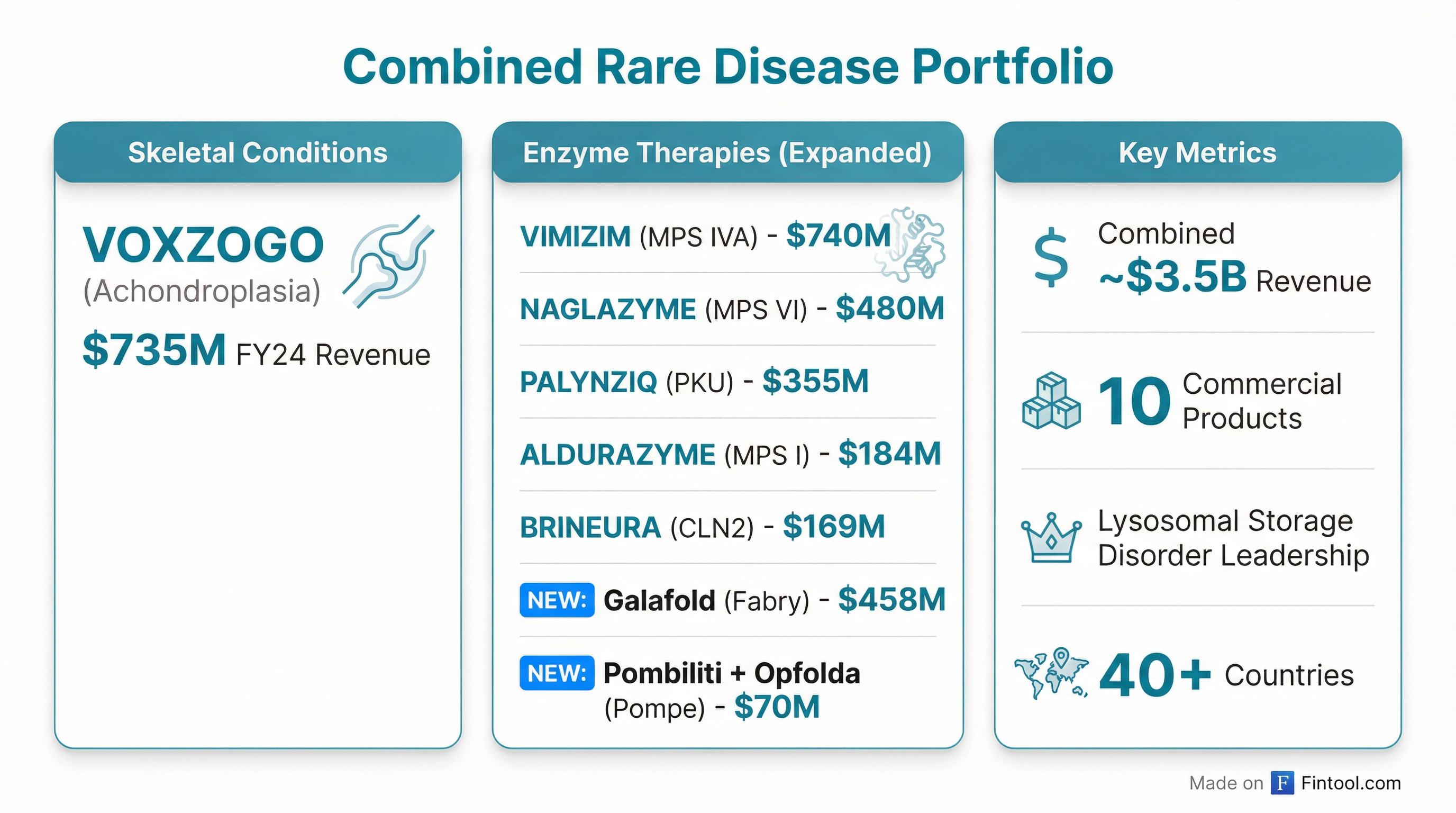

Strategic Fit: Expanding the Enzyme Therapies Empire

This acquisition extends BioMarin's position as the dominant player in lysosomal storage disorders. The combined portfolio will include treatments spanning MPS I, MPS IVA, MPS VI, CLN2, PKU, Fabry disease, and Pompe disease—an unmatched breadth in rare metabolic conditions.

| BioMarin Product | Indication | FY 2024 Revenue |

|---|---|---|

| VIMIZIM | MPS IVA | $739.8M |

| VOXZOGO | Achondroplasia | $735.1M |

| NAGLAZYME | MPS VI | $479.6M |

| PALYNZIQ | PKU | $355.0M |

| ALDURAZYME | MPS I | $183.9M |

| BRINEURA | CLN2 | $169.1M |

| Galafold (New) | Fabry Disease | $458.1M |

| Pombiliti + Opfolda (New) | Pompe Disease | $70.2M |

The logic is clear: BioMarin's global commercial infrastructure, manufacturing expertise, and established relationships with rare disease physicians create immediate value. CEO Hardy specifically cited BioMarin's "global commercial footprint and industry-leading, in-house manufacturing capabilities" as key synergy drivers.

Amicus CEO Bradley Campbell framed the rationale from the target's perspective: "With BioMarin's unwavering commitment to patients, along with greater resources and scale, Amicus' medicines will reach even more patients around the world, faster."

Financial Impact: Accretive from Day One

BioMarin projects the deal will immediately accelerate revenue growth upon closing and become accretive to Non-GAAP Diluted EPS within the first 12 months. By 2027, the company expects the acquisition to be "substantially accretive."

The target is aggressive but achievable given the assets' growth profiles. Amicus expected to surpass $1 billion in total revenue by 2028. With BioMarin's infrastructure, that timeline could compress.

BioMarin's financial trajectory provides a strong foundation to absorb the debt:

| BioMarin Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenues | $747M | $745M | $825M | $776M |

| Cash & Equivalents | $943M | $1,049M | $1,214M | $1,250M |

| Total Debt | $634M* | $602M* | $604M* | $604M* |

*Values retrieved from S&P Global

The company generated $573 million in operating cash flows in 2024, up 260% year-over-year, and is targeting more than $1.25 billion annually starting in 2027. BioMarin had approximately $1.7 billion in total cash and investments at the end of 2024.

Market Context: Big Pharma Hungry for Rare Disease Assets

The deal reflects a broader trend of large pharmaceutical companies snapping up rare disease biotechs at premium valuations. 2025 has seen unprecedented M&A activity in the space:

- Sanofi closed its $9.5 billion acquisition of Blueprint Medicines, gaining Ayvakit for systemic mastocytosis

- Novartis is reportedly pursuing Avidity Biosciences for ~$12 billion for rare neuromuscular disease therapies

- Merck KGaA acquired SpringWorks Therapeutics for $3.4 billion to strengthen rare disease/oncology

The appeal is straightforward: rare diseases offer orphan drug protections, limited competition, premium pricing, and loyal patient populations. For BioMarin, this deal reinforces its identity as a pure-play rare disease company at a time when many peers are diversifying away from the space.

What's Next: Closing Conditions and Integration

The transaction requires Amicus shareholder approval, Hart-Scott-Rodino clearance, and other customary regulatory approvals. BioMarin expects to close in Q2 2026.

Investors should watch for:

Near-term catalysts:

- Shareholder vote timing and outcome

- Regulatory clearance timeline

- Integration planning announcements

Medium-term drivers:

- Galafold's continued penetration of the diagnosed-but-untreated Fabry population

- Pombiliti + Opfolda's expansion into 10+ new countries in 2025-2026

- DMX-200 Phase 3 data readout for FSGS

Financial milestones:

- Confirmation of EPS accretion timeline

- Progress toward <2.5x leverage target

- Combined portfolio revenue growth trajectory

The Bottom Line

BioMarin is paying a substantial premium for Amicus, but the strategic logic is compelling. The company gains two commercially validated products in adjacent rare disease markets, 12 years of U.S. Galafold exclusivity, and a pathway to significantly accelerate growth in its Enzyme Therapies business unit.

For Amicus shareholders, the $14.50 per share offer provides certainty and premium value after years of building the Fabry and Pompe franchises. The deal also removes the challenge of scaling as an independent company in an increasingly competitive rare disease landscape.

For patients, the combination promises broader access to life-changing therapies through BioMarin's global reach. In rare diseases, where diagnosis is often the biggest hurdle and patients are scattered worldwide, scale matters.

The bet BioMarin is making: its commercial infrastructure can unlock Amicus's growth potential faster than Amicus could alone. If history is any guide—BioMarin has successfully commercialized eight rare disease therapies across 49 countries—that's a bet worth taking.

Related Companies