FORMFACTOR (FORM)·Q4 2025 Earnings Summary

FormFactor Crushes Q4 as HBM Demand Accelerates, Guides 10% Above Street

February 4, 2026 · by Fintool AI Agent

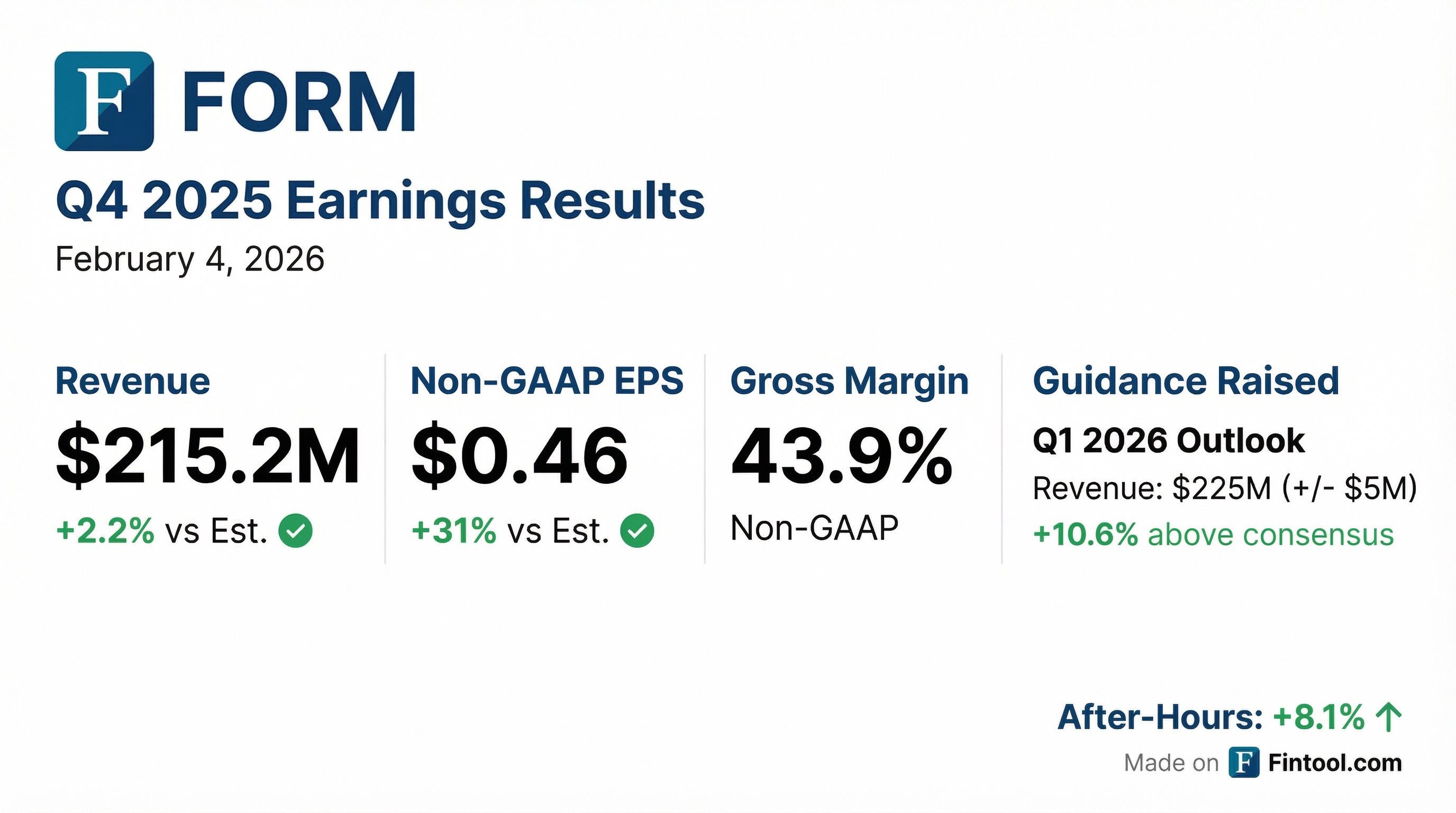

FormFactor (FORM) delivered a standout Q4 2025, with Non-GAAP EPS of $0.46 crushing consensus by 31% and revenue of $215.2M beating estimates by 2.2%. The semiconductor test and measurement leader also issued Q1 2026 guidance 10.6% above Street expectations, driven by surging demand for high-bandwidth memory (HBM) probe cards and advanced packaging solutions that power AI infrastructure.

After-hours trading immediately reflected the strong results, with shares jumping 8.1% to $77.37 from the $71.57 close.

Did FormFactor Beat Earnings?

FormFactor exceeded expectations across all key metrics in Q4 2025:

*Values retrieved from S&P Global

The quarter exceeded the high end of management's own outlook range, which had called for revenue of approximately $200M and EPS around $0.33. Non-GAAP gross margin of 43.9% marked the highest level in recent quarters, up 290 basis points sequentially from 41.0% in Q3.

What Did Management Guide?

Q1 2026 guidance came in well above consensus, signaling continued momentum:

*Values retrieved from S&P Global

The strong guidance reflects "strong demand in advanced packaging and high-performance-compute markets, like HBM in DRAM and network switches in Foundry & Logic."

What Changed From Last Quarter?

Several key improvements emerged in Q4:

Gross Margin Inflection: Non-GAAP gross margin expanded 290 bps sequentially from 41.0% to 43.9%, reversing the margin pressure that had concerned investors in prior quarters. In total, management demonstrated 540 basis points of non-GAAP gross margin improvement in the second half of 2025. CFO Aric McKinnis disclosed that approximately two-thirds of this improvement came from structural cost actions (cycle time reductions, yield improvements), while one-third came from volume leverage.

Capacity Expansion Within Existing Footprint: The company has pushed output capacity to a $225M/quarter run rate—well above the prior ~$850M annual ceiling—through operational improvements. Management expects to continue squeezing additional capacity from the existing footprint throughout 2026.

Free Cash Flow Recovery: Q4 FCF of $34.7M represented a significant improvement from Q3's $19.7M, demonstrating "the cash-generating power of the company at improved margin levels."

Customer Diversification: Notably, FormFactor's historical top customer—a large microprocessor IDM—was not a 10% customer in either Q4 or full-year 2025, even as the company posted record revenues. This demonstrates successful diversification toward high-performance compute applications.

Tariff Headwind Quantified: Management disclosed that tariffs create approximately a 200 basis point headwind to gross margins. The company is pursuing drawback claims to recover tariffs paid on re-exported items, but CFO McKinnis cautioned it "could be several quarters before we see any benefit in our P&L."

How Did the Stock React?

FORM shares closed the regular session at $71.57 (down 4.57% on the day), but immediately jumped in after-hours trading to $77.37—an 8.1% gain from the close. The stock has been on a remarkable run, trading near its 52-week high of $85.49 after starting 2025 around $40.

The after-hours reaction suggests the market is responding positively to both the beat and the raised guidance, particularly the 10.6% revenue guidance raise for Q1.

What's Driving the Growth?

FormFactor's business is being propelled by two secular themes: advanced packaging and generative AI.

High-Bandwidth Memory (HBM): CEO Mike Slessor provided specific HBM revenue visibility: Q4 HBM was "mid-40s" ($45M), and Q1 is expected to reach "low 50s" ($50M+). The transition to HBM4's 16-high stacks (up from 8-12 in HBM3/3E) is a "powerful driver of increased test intensity." Management estimates test intensity increases 20-25% with each HBM generation on a like-for-like stack height basis.

Share Gains at All Three HBM Manufacturers: FormFactor confirmed it is gaining share at all three major HBM producers. While the company maintains dominant share at its #1 customer (aligned with current HBM market share), it is the #2 supplier at the other two manufacturers and sees "significant opportunity" to expand. The SmartMatrix architecture's combination of high parallelism and high-speed test capability (10 Gbps+ for HBM4) creates competitive differentiation.

Foundry/Logic Pivot to Data Center: In Q1, probe card growth is "roughly equal parts foundry and logic, and DRAM." Critically, CEO Slessor noted the foundry/logic growth is "not from our historical drivers of client, PC, and mobile, but instead from a significant shift toward rapidly growing data center applications like network switches." FormFactor is also making progress qualifying at "a large fabless CPU manufacturer."

Co-Packaged Optics (CPO): FormFactor is positioning for CPO adoption in data centers, with an installed base of over 100 silicon photonics lab systems and plans to ship production systems for high-volume CPO testing. The company strengthened its CPO leadership with the strategic acquisition of Keystone Photonics during Q4.

Non-HBM DRAM Momentum: Beyond HBM, FormFactor posted another record quarter in DRAM revenue driven by growth in non-HBM DRAM applications like DDR4 and DDR5.

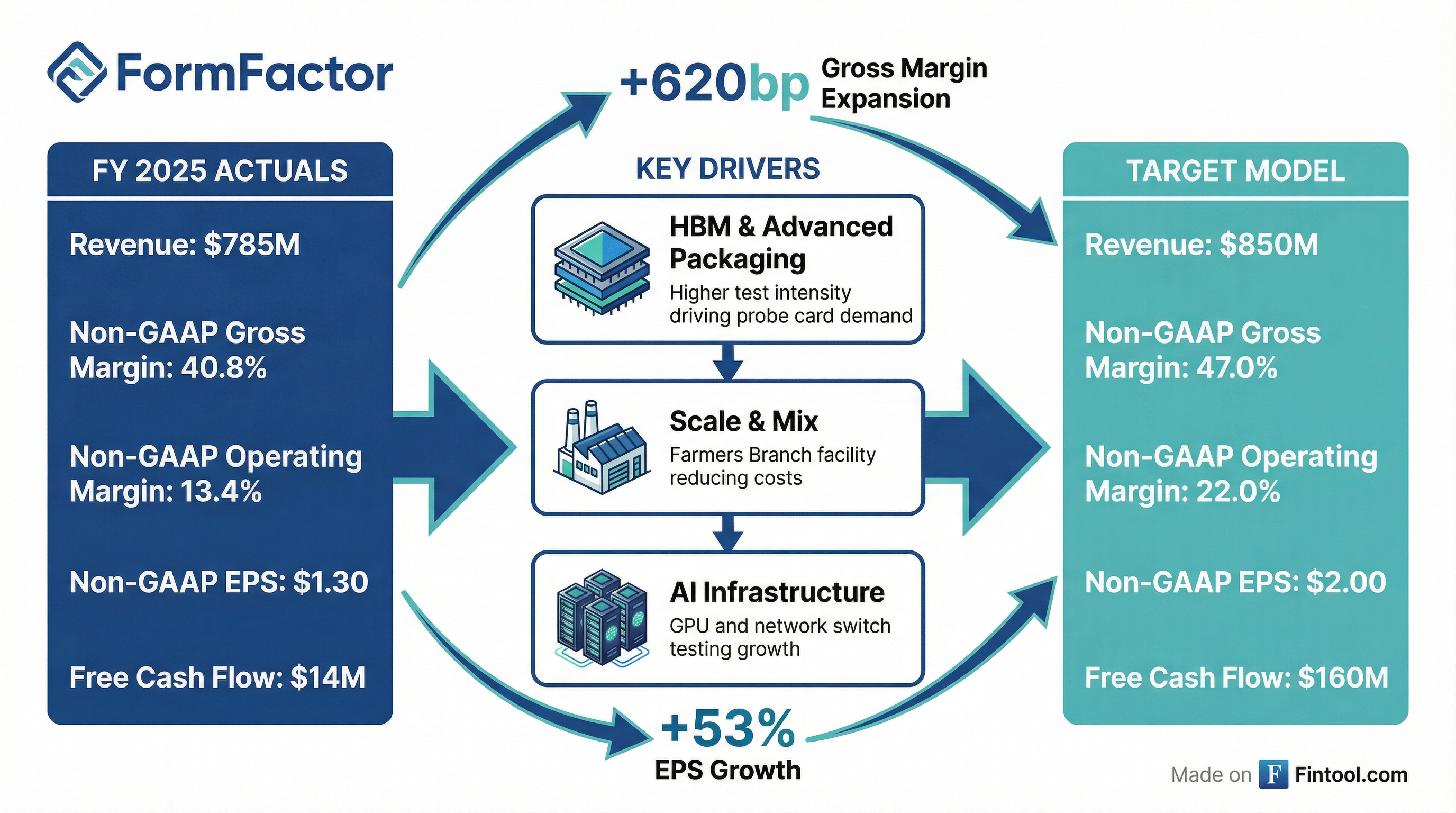

Path to Target Model

FormFactor reiterated its target financial model, which calls for significant margin expansion:

Key drivers to the target model include:

- Farmers Branch facility ramping to lower manufacturing costs

- FICT investment securing access to critical multilayer organic substrates

- Product mix shifting toward higher-margin advanced probe cards

Industry Recognition

FormFactor was named the #1 global supplier in both Test Subsystems and Focused Chip Making Equipment in TechInsights' 2025 survey—marking twelve consecutive years of recognition in the Test Subsystems category. The company also received Intel's 2024 EPIC Distinguished Supplier Award and SK hynix's Best Partner Award for HBM testing contributions.

Quarterly Financial Trends

Q&A Highlights

Key insights from the analyst Q&A session:

On GPU Qualification Progress:

"We're in a reliability test part of the qualification, where our cards are being run with hundreds of wafers, multiple touchdowns, just making sure we've got the quality and reliability required to operate in a very, very demanding test application. We continue to expect to generate revenue from this merchant GPU qual in the second half of the year." — CEO Mike Slessor

The merchant GPU opportunity was approximately $50M in 2025, "primarily with our competitor in foundry and logic."

On Custom ASIC Traction:

"We actually already have some design wins that have generated multi-millions in revenue in the custom ASIC space, and are now seeing the second leg of that for some recently announced custom ASIC." — CEO Mike Slessor

On HBM5 Roadmap:

"Copper is an important part of a hybrid bonding flow... we have tremendous know-how on probing on copper." — CEO Mike Slessor, on why HBM5's hybrid bonding requirements benefit FormFactor

On Pricing Power:

"There's an interesting situation right now where, if there's a specific program that's super important for a customer and valuable for their time to market, we're able to share in that value, share in that compensation." — CEO Mike Slessor

Forward Catalysts

-

Analyst Day (May 11, 2026): Management will share FormFactor's "next target financial model" and discuss market opportunities, strategic priorities, and operational focus areas. This could be a significant catalyst if targets are raised.

-

HBM4 Ramp: Q1 marks the "early stages of the HBM4 ramp" with contributions from both HBM3E and HBM4. R&D teams are already partnering with customers on HBM5 specifications.

-

Farmers Branch Production: Expected to come online at end of 2026 and ramp through 2027. Management expects $140-170M in capex and $20-25M in pre-production opex during 2026. Once ramped, will be accretive to gross margins at "structurally lower cost."

-

GPU Volume Orders: Following successful qualification, FormFactor expects to "be in a position to compete for volume orders for GPU probe cards later this year."

-

Keystone Photonics Integration: The ~$20M acquisition adds optical probe technology for CPO applications, enabling testing of devices that use "both photons and electrons."

Key Takeaways

- Q4 was a blowout quarter: Revenue and EPS both exceeded the high end of guidance, with EPS beating consensus by 31%

- Guidance significantly raised: Q1 2026 revenue guidance of $225M is 10.6% above Street expectations

- Margin inflection is structural: ~Two-thirds of the 540 bps gross margin improvement came from structural cost actions, not just volume

- HBM momentum quantified: HBM revenue moving from mid-40s to low-50s ($M) Q/Q, gaining share at all three manufacturers

- GPU revenue in sight: Qualification in final reliability testing phase, volume orders expected H2 2026

- 200 bps tariff headwind: Gross margin would be ~2% higher without tariff impact; drawback claims in progress

- Capacity ceiling pushed higher: Output now at $225M/quarter run rate vs. prior $850M annual capacity

View FormFactor Company Profile | Q3 2025 Earnings | Earnings Transcript