Earnings summaries and quarterly performance for FORMFACTOR.

Executive leadership at FORMFACTOR.

Board of directors at FORMFACTOR.

Research analysts who have asked questions during FORMFACTOR earnings calls.

Craig Ellis

B. Riley Securities

6 questions for FORM

David Duley

Steelhead Securities LLC

6 questions for FORM

Brian Chin

Stifel Financial Corp.

5 questions for FORM

Charles Shi

Needham & Company

4 questions for FORM

Christian Schwab

Craig-Hallum Capital Group

4 questions for FORM

Robert Mertens

TD Cowen

3 questions for FORM

Thomas Diffely

D.A. Davidson & Co.

3 questions for FORM

Elizabeth Sun

Citi

2 questions for FORM

Matthew Prisco

Cantor Fitzgerald

2 questions for FORM

Vedvati Shrotre

Evercore ISI

2 questions for FORM

Yu Shi

Susquehanna International Group, LLP

2 questions for FORM

Auguste Richard

Northland Capital Markets

1 question for FORM

David Silver

CL King & Associates

1 question for FORM

Denis Pyatchanin

Stifel Financial Corp.

1 question for FORM

Gus Richard

Northland Capital Markets

1 question for FORM

Krish Sankar

TD Cowen

1 question for FORM

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

1 question for FORM

Tom Diffely

D.A. Davidson Companies

1 question for FORM

Recent press releases and 8-K filings for FORM.

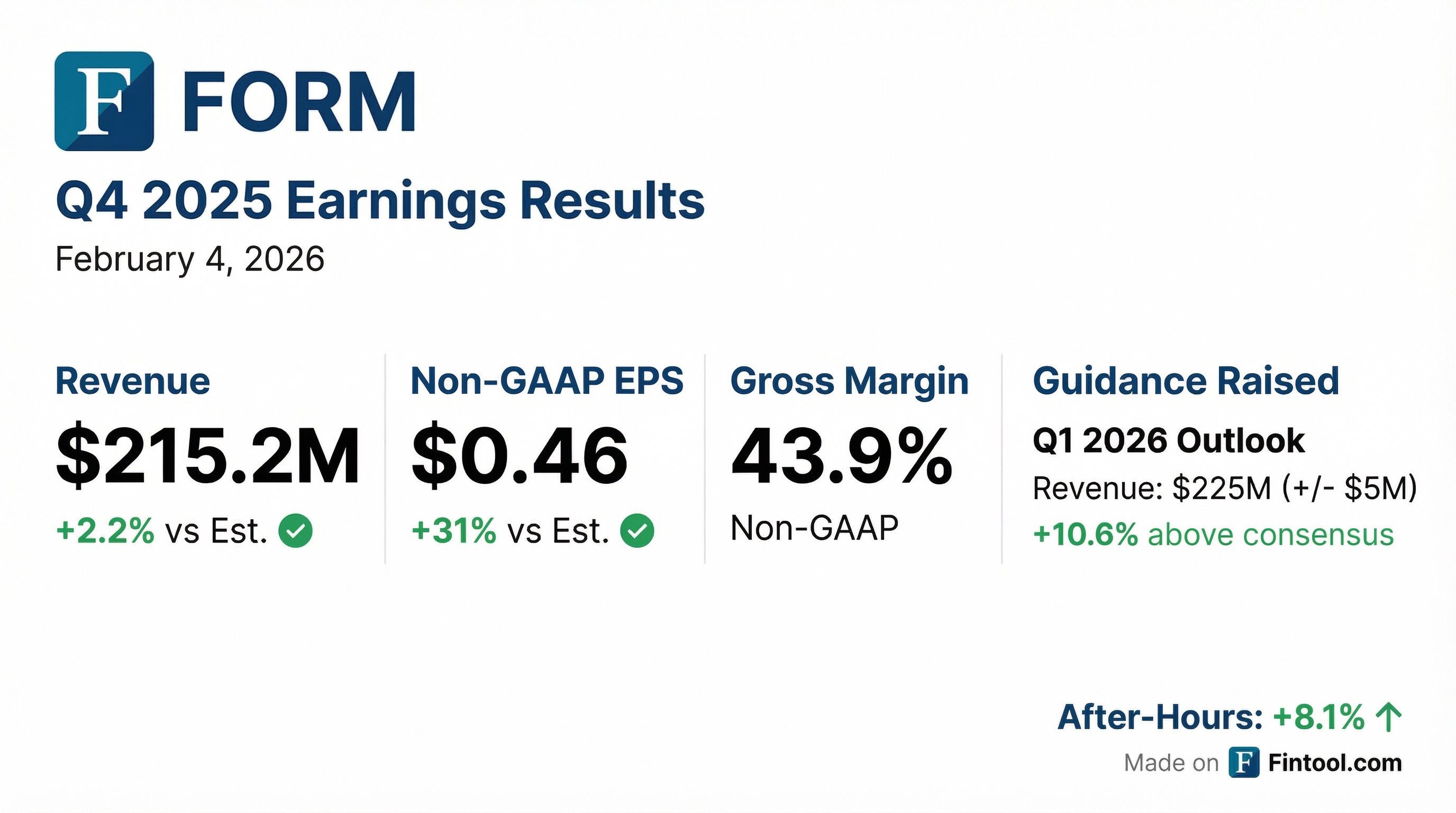

- FormFactor reported record Q4 2025 revenue of $215.2 million and non-GAAP EPS of $0.46, both exceeding prior quarter results and outlook ranges.

- The company projects continued growth with a Q1 2026 revenue outlook of $225 million ±$5 million and non-GAAP EPS of $0.45 ±$0.04.

- Non-GAAP gross margin significantly improved to 43.9% in Q4 2025 (up 290 basis points sequentially) and is expected to reach 45% ±150 basis points in Q1 2026, aligning with the target model adjusted for tariffs.

- Growth is driven by strong demand in advanced packaging and high-performance compute, with record DRAM probe card revenue in Q4 2025 and an anticipated all-time DRAM record in Q1 2026 due to HBM strength, alongside increasing foundry and logic demand from data center applications.

- Strategic initiatives include the December acquisition of Keystone Photonics to strengthen co-package optics leadership and the Farmers Branch site expansion, expected to come online later in 2026 to boost capacity and further expand gross margins.

- FormFactor reported record quarterly and annual revenue in Q4 2025, with $215.2 million in revenue, 43.9% non-GAAP gross margin, and $0.46 non-GAAP EPS, all exceeding the high end of their outlook.

- The company provided strong Q1 2026 guidance, expecting $225 million ±$5 million in revenue, 45% ±150 basis points non-GAAP gross margin, and $0.45 ±$0.04 non-GAAP EPS, indicating continued sequential growth and gross margin improvement.

- FormFactor is making faster-than-expected progress on gross margin expansion, achieving a 540 basis point cumulative improvement through Q4 2025 and forecasting an additional 110 basis points in Q1 2026, driven by operational effectiveness and workforce reallocation.

- Growth is fueled by strong demand in advanced packaging and high-performance compute markets, including record DRAM probe card revenue in Q4 2025 (non-HBM) and an anticipated new record in Q1 2026 driven by HBM strength (HBM3E and HBM4 ramp), with Q1 HBM revenue expected in the low $50 million range.

- Strategic investments include the $20 million acquisition of Keystone Photonics to strengthen co-packaged optics test capabilities and significant capital expenditure of $140 million to $170 million over 2026 for the Farmers Branch site, which will increase capacity and further expand gross margins.

- FormFactor reported record revenue of $215.2 million for Q4 2025, exceeding both third-quarter results and the high end of their outlook range, with non-GAAP gross margins of 43.9% and non-GAAP earnings per share of $0.46.

- For Q1 2026, the company expects revenues of $225 million ±$5 million, non-GAAP gross margins of 45% ±150 basis points, and non-GAAP earnings per share of $0.45 ±$0.04.

- The company achieved a cumulative improvement of 540 basis points in gross margins through Q4 2025 and is on track to reach its target model gross margins of 45% (adjusted for tariff impact) within 2026.

- Strategic investments include the Farmers Branch site, expected to come online later in 2026 to provide increased capacity and lower costs, with projected cash expenditures of $140 million to $170 million over 2026. The company also acquired Keystone Photonics in December to strengthen its leadership in co-packaged optics (CPO) test.

- Form Factor reported strong Q4 2025 actual results, with revenue of $215.2 million, Non-GAAP gross margin of 43.9%, and Non-GAAP diluted EPS of $0.46, all exceeding the high end of its outlook range.

- For the full year 2025, the company achieved revenue of $785 million, Non-GAAP gross margin of 40.8%, Non-GAAP diluted EPS of $1.30, and free cash flow of $14 million.

- The company provided a positive outlook for Q1 2026, projecting revenue of $225 million +/- $5 million, gross margin of 45.0% +/- 1.5%, and diluted EPS of $0.45 +/- $0.04, driven by strong demand in advanced packaging and high-performance-compute markets.

- Form Factor received significant industry recognition, earning the SK hynix Best Partner Award in November 2024 and Intel's 2024 EPIC Distinguished Supplier Award in March 2024.

- The company's target financial model projects $850 million in revenue, 47.0% Non-GAAP Gross Margin, 22.0% Non-GAAP Operating Margin, $2.00 Non-GAAP Diluted EPS, and $160 million in Free Cash Flow.

- FormFactor, Inc. achieved record revenue of $215.2 million in the fourth quarter of fiscal 2025, an increase of 6.2% from the prior quarter and 13.6% year-over-year, surpassing the high end of their outlook range. For the full fiscal year 2025, revenue reached a record $785.0 million, up 2.8% from fiscal 2024.

- The company's non-GAAP diluted EPS for Q4 2025 was $0.46, exceeding the outlook, and non-GAAP gross margin was 43.9%, also above expectations and demonstrating a 540 basis point improvement in the second half of 2025.

- For the first quarter ending March 29, 2026, FormFactor projects continued growth with an outlook for non-GAAP revenue of $225 million +/- $5 million and non-GAAP diluted EPS of $0.45 +/- $0.04.

- Growth was primarily driven by High Bandwidth Memory (HBM) and an increase in non-HBM DRAM applications, with a continued focus on capacity expansion and gross-margin improvement throughout 2026. The company also enhanced its position in co-packaged optics testing through the strategic acquisition of Keystone Photonics.

- FormFactor reported record revenue of $785.0 million for fiscal year 2025, a 2.8% increase from fiscal 2024, and $215.2 million for the fourth quarter of fiscal 2025, up 13.6% from the fourth quarter of fiscal 2024.

- GAAP net income for the fourth quarter of fiscal 2025 was $23.2 million, or $0.29 per fully-diluted share, while non-GAAP net income was $36.6 million, or $0.46 per fully-diluted share.

- Non-GAAP gross margin for the fourth quarter of fiscal 2025 improved to 43.9%, compared to 41.0% in the third quarter of fiscal 2025.

- The company provided an outlook for the first quarter ending March 29, 2026, expecting revenue of $225 million +/- $5 million and non-GAAP net income per diluted share of $0.45 +/- $0.04.

- Key drivers included record DRAM revenue from non-HBM applications and strengthened leadership in co-packaged optics testing through the strategic acquisition of Keystone Photonics.

- FormFactor reported Q3 2025 non-GAAP revenue of $202.7 million and diluted EPS of $0.33, exceeding its outlook midpoint. The company projects Q4 2025 non-GAAP revenue of $210 million +/- $5 million and diluted EPS of $0.35 +/- $0.04.

- The company targets $850 million in revenue and $2.00 non-GAAP diluted EPS in its target model, aiming for a 47.0% non-GAAP gross margin and 22.0% non-GAAP operating margin.

- FormFactor has been recognized as the #1 global supplier in Test Subsystems and Focused Chip Making Equipment by TechInsights' 2025 survey and received Intel's 2024 EPIC Distinguished Supplier Award and the SK hynix Best Partner Award in 2024.

- The company benefits from secular trends in semiconductor content, AI, and advanced packaging, with its Advanced Probe Cards market growing at an 8% CAGR and Engineering Systems at a 3% CAGR, while FormFactor's own CAGR for these segments is higher.

- FormFactor maintains a highly resilient business model supported by a flexible cost structure, strong balance sheet, and an active acquisition strategy, including a new $150 million revolving credit facility in July 2025.

- FormFactor reported trailing 12-month revenues of approximately $750 million and guided Q4 to an $800-plus million annual runway, reflecting business growth.

- The company is on track to achieve its 47% gross margin target in 2026, having guided Q4 to 42%, up from 41% in Q3 and 38.5% in Q2 of last year, despite a 200 basis points headwind from tariffs.

- Operational efficiency initiatives include factory consolidation, a reduction in force, and the ramp-up of a new, cost-effective manufacturing site in Farmers Branch, Texas, expected to begin production by the end of 2026.

- Key growth drivers include strong market share in High Bandwidth Memory (HBM), competitive advantages in high-speed and high-power wafer test for GPU/AI ASICs, and an upswing in DDR5 probe card business, alongside emerging opportunities in co-packaged optics.

- FormFactor reported trailing 12-month revenues of approximately $750 million, with Q4 guidance suggesting an $800-plus million annual revenue run rate. The company is focused on improving gross margins, guiding Q4 to 42% from Q3's 41%, and aims to reach its target model of 47% gross margins in 2026.

- Key growth drivers include strong market share in High Bandwidth Memory (HBM), particularly with SK Hynix, and competitive advantages in high-speed and high-power testing for HBM and GPU/AI ASIC applications. The company is also seeing an upswing in DDR5 probe card business and expects DRAM shortages to persist.

- Operational improvements include a factory realignment and consolidation, with two California sites closing and a new, more cost-effective site in Farmers Branch, Texas, ramping up production from late 2026 into 2027. These actions are intended to create a more efficient and flexible manufacturing footprint, reducing reliance on product mix and volume for margin targets.

- FormFactor is expanding its presence in Co-Packaged Optics (CPO) through its engineering systems segment and the recent acquisition of Keystone Photonics, aiming to integrate electrical and optical probing technologies.

- FormFactor reported trailing 12-month revenues of approximately $750 million, with Q4 2025 revenue guided to an $800+ million annual run rate. The company aims to improve gross margins from a low of 38.5% in Q2 2025 to 42% in Q4 2025, targeting 47% in 2026.

- To enhance operational efficiency and cost structure, FormFactor announced factory realignment and consolidation, including the closure of two California sites (Baldwin Park immediately and Carlsbad by the end of 2026) and a reduction in force. A new, more cost-effective site in Farmers Branch, Texas, acquired in May 2025, will begin production in late 2026 and ramp into 2027.

- The company maintains a strong market share in High Bandwidth Memory (HBM), particularly with SK Hynix, driven by its differentiated probe card technology for 11 gigabit per second operating frequencies. FormFactor is also expanding its presence in GPU and AI ASIC test and sees growth in co-packaged optics (CPO), a 10-year investment now transitioning to production, supported by the acquisition of Keystone Photonics.

- FormFactor anticipates a record quarter for DRAM probe cards in Q4 2025, primarily driven by DDR5 demand, indicating a broader upswing in the conventional DRAM business.

Quarterly earnings call transcripts for FORMFACTOR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more