Earnings summaries and quarterly performance for FIRST US BANCSHARES.

Executive leadership at FIRST US BANCSHARES.

James F. House

President and Chief Executive Officer

Beverly J. Dozier

Senior Vice President, Corporate Secretary and Assistant Treasurer

Eric H. Mabowitz

Senior Executive Vice President, Chief Risk Officer, Chief Compliance Officer, and CRA Officer

Matthew A. Parker

Senior Vice President, Principal Accounting Officer and Director of Financial Reporting

Thomas S. Elley

Senior Executive Vice President, Chief Financial Officer, Treasurer and Assistant Secretary

William C. Mitchell

Senior Executive Vice President, Consumer Lending

Board of directors at FIRST US BANCSHARES.

Aubrey S. Miller

Director

Bruce N. Wilson

Director

David P. Hale

Director

J. Lee McPhearson

Director

Jack W. Meigs

Director

Marlene M. McCain

Director

Robert C. Field

Director

Robert Stephen Briggs

Vice Chairperson of the Board and Lead Independent Director

S. Nathan Gordon

Director

Staci M. Pierce

Director

Tracy E. Thompson

Director

Research analysts covering FIRST US BANCSHARES.

Recent press releases and 8-K filings for FUSB.

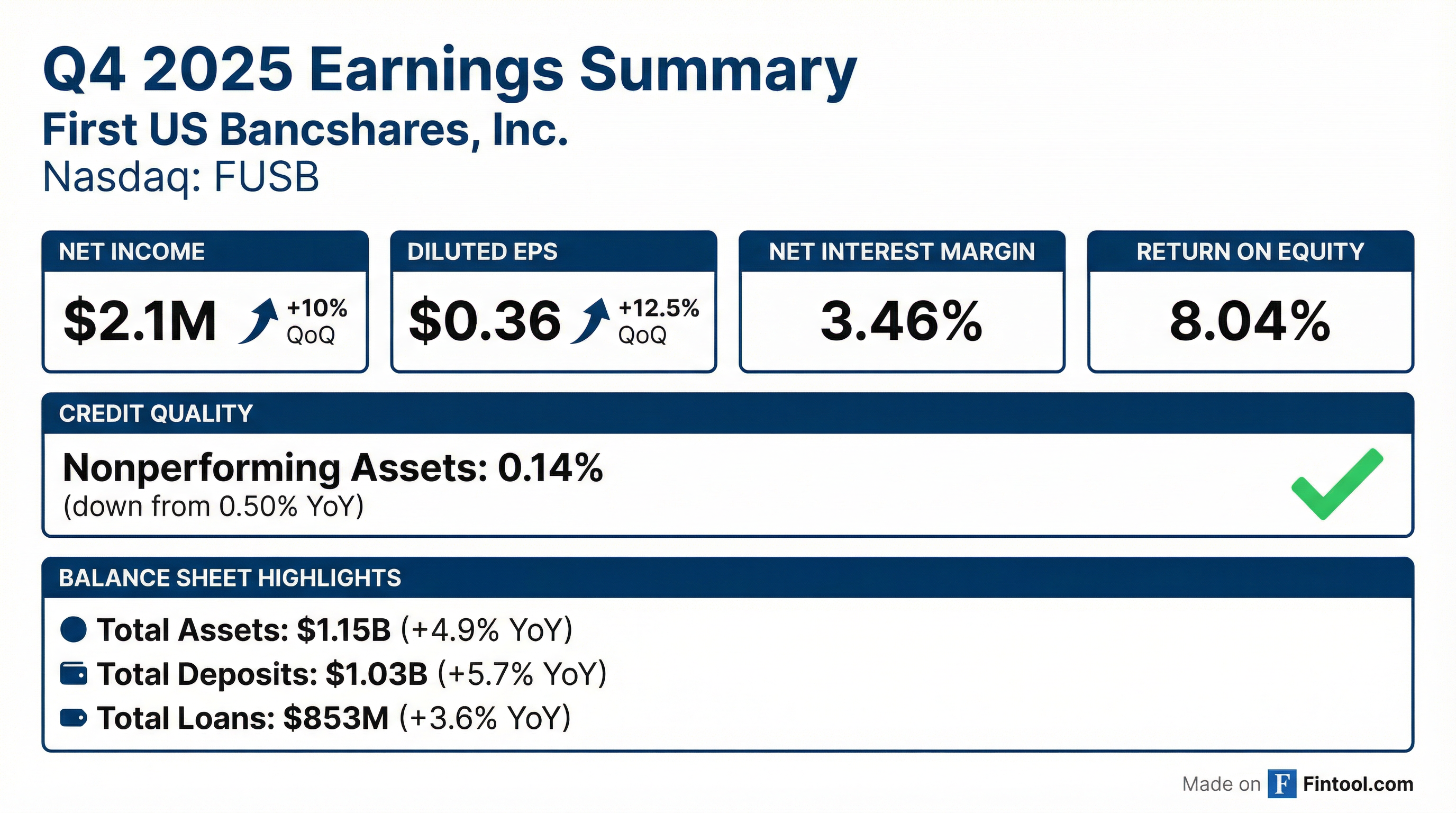

- First US Bancshares, Inc. reported net income of $2.1 million, or $0.36 per diluted share, for Q4 2025, marking a 10% improvement compared to the prior quarter and a 24% increase from Q4 2024. For the full year 2025, net income totaled $6.0 million, or $1.00 per diluted share.

- The company demonstrated continued improvement in loan portfolio credit metrics, with nonperforming assets decreasing to $1.6 million (0.14% of total assets) as of December 31, 2025, from $5.5 million (0.50% of total assets) as of December 31, 2024. Net charge-offs as a percentage of average loans were 0.08% during Q4 2025, a substantial decrease from 0.61% in Q3 2025.

- Total loans decreased by $14.5 million in Q4 2025, primarily due to decreases in commercial real estate, construction, and indirect consumer categories, though total loans increased by $30.0 million (3.6%) for the full year 2025.

- The company declared a cash dividend of $0.07 per share in Q4 2025, consistent with previous quarters, and repurchased 88,000 shares of its common stock at a weighted average price of $13.93 per share during the quarter. The share repurchase program was expanded by an additional 1,000,000 shares in Q4 2025.

- First US Bancshares reported net income of $2.1 million, or $0.36 per diluted share, for the fourth quarter of 2025, representing a 10% improvement from the prior quarter and a 24% increase compared to the fourth quarter of 2024. For the full year 2025, net income totaled $6.0 million, or $1.00 per diluted share, a decrease from $8.2 million, or $1.33 per diluted share, in 2024.

- The company saw continued improvement in loan portfolio credit metrics, with nonperforming assets decreasing to 0.14% of total assets as of December 31, 2025, from 0.50% as of December 31, 2024. Net charge-offs as a percentage of average loans significantly decreased to 0.08% during 4Q2025 from 0.61% during 3Q2025.

- First US Bancshares repurchased 88,000 shares of its common stock in 4Q2025 at a weighted average price of $13.93 per share, and declared a cash dividend of $0.07 per share. Total loans increased by 3.6% for the full year 2025, reaching $853.0 million as of December 31, 2025, despite a quarterly decrease.

- First US Bancshares, Inc. (FUSB) announced on November 19, 2025, that its Board of Directors has expanded the Company's existing share repurchase program.

- The Board authorized the repurchase of an additional 1,000,000 shares of common stock.

- The expiration of the repurchase program has been extended from December 31, 2025, to December 31, 2026.

- Prior to this expansion, 852,813 shares remained available for repurchase under the existing program.

- First US Bancshares, Inc. (FUSB) filed an 8-K on October 29, 2025, to furnish its investor presentation materials, which include a review of financial results and trends through September 30, 2025.

- For Q3 2025, diluted EPS was $0.32, and the net interest margin improved to 3.60%.

- The company reported a decrease in nonperforming assets as a percentage of total assets to 0.19% in Q3 2025, down from 0.33% in Q2 2025.

- Total deposits increased by $15.6 million, or 1.6%, in Q3 2025, with core deposits representing 83.6% of total deposits as of September 30, 2025.

- As of September 30, 2025, FUSB's tangible book value was $16.79 per share, and the company had $1,147 million in total assets, $868 million in total loans, and $1,002 million in total deposits.

- First US Bancshares, Inc. reported net income of $1.9 million, or $0.32 per diluted share, for the third quarter ended September 30, 2025, which is a significant increase from $0.2 million, or $0.03 per diluted share, in the prior quarter.

- The company's CEO stated that the return to solid earnings was primarily due to a substantial decrease in the provision for credit losses from the second quarter, the resolution of credit issues with two commercial loans, and net charge-offs from consumer indirect loans returning to more normalized levels.

- Asset quality improved, with nonperforming assets decreasing to 0.19% of total assets as of September 30, 2025, down from 0.50% at December 31, 2024.

- For the third quarter of 2025, net interest income was $9.662 million, and the net interest margin was 3.60%.

- First US Bancshares, Inc. reported net income of $1.9 million, or $0.32 per diluted share, for the third quarter of 2025 (3Q2025), a significant increase from $0.2 million, or $0.03 per diluted share, in 2Q2025.

- Net interest income increased by 2.0% to $9.662 million in 3Q2025 compared to 2Q2025, with the net interest margin rising to 3.60% from 3.59% in the prior quarter.

- The provision for credit losses decreased substantially to $0.6 million in 3Q2025 from $2.7 million in 2Q2025, primarily due to the resolution of credit issues and decreased net charge-offs.

- Total deposits increased by $15.6 million (1.6%) to $1,002.472 million as of September 30, 2025, while total loans decreased by $3.9 million to $867.520 million during 3Q2025.

- The company declared a cash dividend of $0.07 per share for 3Q2025 and repurchased 40,000 shares at a weighted average price of $13.38 per share during the nine months ended September 30, 2025.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more