Green Plains (GPRE)·Q4 2025 Earnings Summary

Green Plains Swings to Profit as 45Z Tax Credits Transform Ethanol Economics

February 5, 2026 · by Fintool AI Agent

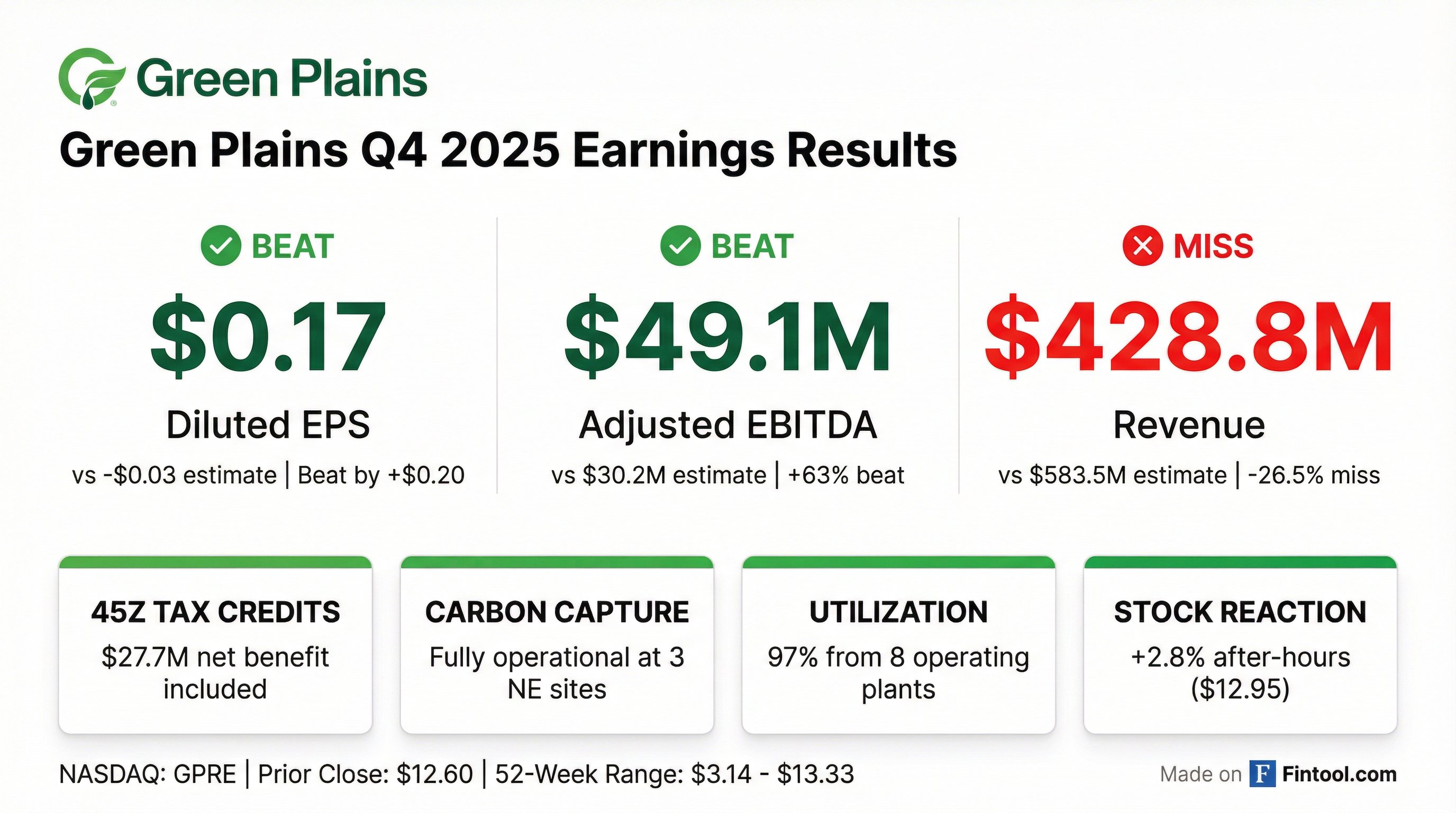

Green Plains Inc. (NASDAQ: GPRE) delivered a dramatic turnaround in Q4 2025, swinging from a year-ago loss of $0.86 per share to a profit of $0.17 per share—a $1.03 improvement driven primarily by the new 45Z clean fuel production tax credit . While revenue missed estimates by a wide margin due to plant sales and lower ethanol volumes, the earnings and EBITDA beat signals the company's restructuring is paying off. Shares rose 2.8% in after-hours trading to $12.95.

Did Green Plains Beat Earnings?

EPS: Beat by $0.20 — Green Plains reported diluted EPS of $0.17 versus consensus of -$0.03, returning to profitability for the first time in four quarters .

Adjusted EBITDA: Beat by 63% — Adjusted EBITDA came in at $49.1M versus consensus of $30.2M, a significant outperformance driven by higher ethanol crush margins and 45Z credits .

Revenue: Missed by 26.5% — Revenue of $428.8M fell short of the $584.0M in Q4 2024 and the $583.5M consensus estimate, primarily due to the sale of the Obion, Tennessee plant and cessation of a third-party marketing agreement .

What Are 45Z Tax Credits and Why Do They Matter?

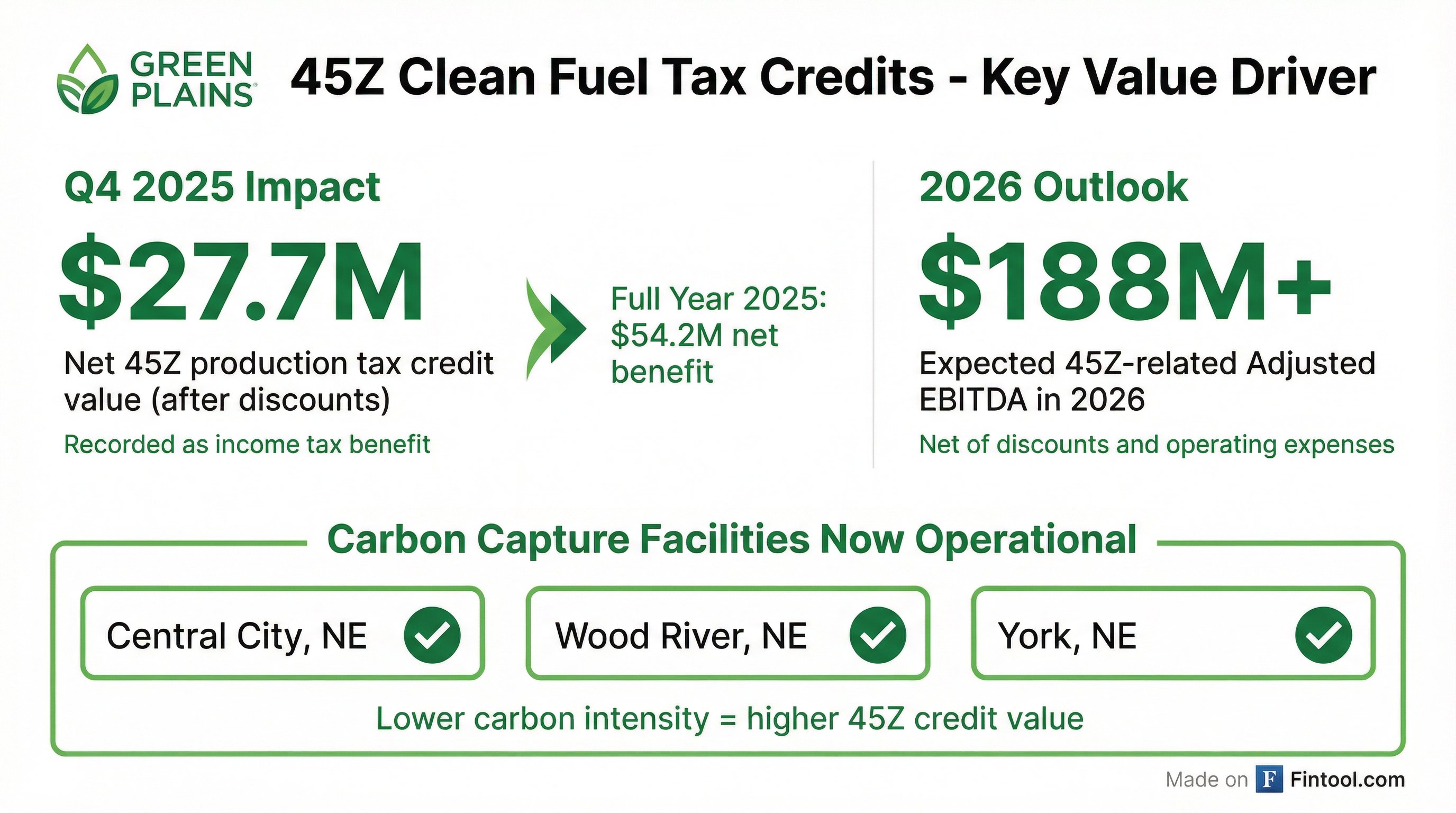

The 45Z clean fuel production tax credit became the single most important driver of Green Plains' financial performance in 2025. This credit rewards producers of clean transportation fuels based on their carbon intensity (CI) score—the lower the carbon footprint, the higher the credit value .

Q4 2025 Impact: The company recorded $27.7M in 45Z production tax credit value (net of discounts) in Q4, recognized as an income tax benefit .

Full Year 2025: Total 45Z benefit reached $54.2M (net of valuation allowance) for the twelve months ended December 31, 2025 .

2026 Outlook: Management expects to generate at least $188M in 45Z-related Adjusted EBITDA in 2026, net of discounts and applicable operating expenses :

- Advantage Nebraska: >$150M Adjusted EBITDA opportunity

- Remaining facilities: >$38M expected 45Z generation

- All plants are on track to qualify for 45Z credits in 2026

The carbon capture facilities at Central City, Wood River, and York, Nebraska are now fully operational with all five compressors online, capturing more than 90% of the CO2 being produced . Advantage Nebraska is sequestering CO2 in Wyoming, and compression stations/piping are sized to accommodate future capacity expansion .

What Did Management Say?

"As we close out 2025, a year marked by both challenges and meaningful achievements... Our team has delivered strong operational execution across the fleet while maintaining an exceptional safety record. As always, safety remains the center of everything we do. Nothing we accomplish matters unless we send people home safely every day." — Chris Osowski, President and CEO

"2025 was a year of change, and our team has thrived while confronting challenges. The plants are producing more than what was previously thought possible. Our carbon project and the resulting earnings are being delivered. The balance sheet has been transformed and de-risked." — Chris Osowski, President and CEO

"2026 is looking to be a positive year for Green Plains and the ethanol industry." — Ann Reis, Chief Financial Officer

Management struck a confident tone, emphasizing operational discipline over volume growth. Notably, CEO Osowski introduced Ann Reis as the new CFO, who brings "tremendous industry experience" to the role, particularly in tax credit monetization efforts .

Updated Production Capacity: Management announced a 10% increase in stated production capacity to 730 million gallons per year (excluding Fairmont), reflecting proven ability to produce above nameplate :

What Were the Key Q&A Highlights?

On 45Z Credit Monetization for 2026: Management is "actively marketing" 2026 credits and expressed confidence in the platform's ability to deliver. While specific pricing wasn't disclosed, CFO Ann Reis noted strong counterparty interest and highlighted key factors affecting pricing: insurance coverage, balance sheet strength, credit duration, and PWA (prevailing wage and apprenticeship) compliance .

On CI Reduction Projects: CEO Osowski outlined $5-10M of efficiency projects with "very fast returns" payable within 2 years, focused primarily on Nebraska locations. Additional larger investments targeting electrical and natural gas consumption reduction are being evaluated .

On the $188M Carbon Opportunity Bridge: The $188M breaks down as: ~$150M from three Nebraska carbon capture facilities (including $15-20M voluntary credits), plus ~$38M from remaining facilities qualifying under 45Z. The increase from prior guidance reflects Obion plant sale adjustments and assumes 380M gallons at 5 CI points reduction .

On-Farm Practices Upside: The new Treasury proposed 45Z regulations include recognition of CI improvements from on-farm practices. Since Green Plains buys a majority of corn directly from farmers (vs. commercial channels), management sees "upside" to the $188M estimate from this provision .

On Q1 2026 Outlook: "We're in much better shape as an industry and also our company compared to last year... We're confident to show a very good number for Q1, especially when you compare it to the year prior." Management noted significant Q1 production margin is already locked in .

On Natural Gas Hedging: The company was "fully hedged on nat gas" heading into Q1, avoiding margin impact from the recent price spike despite minor weather-related production hiccups .

How Did the Stock React?

GPRE shares closed at $12.60 on February 4, 2026 and rose to $12.95 in after-hours trading (+2.8%) following the earnings release . This represents a remarkable recovery from the 52-week low of $3.14, with shares now up approximately 300% from those lows.

The stock is now trading near its 52-week high, suggesting the market had begun pricing in the 45Z credit benefits ahead of this confirmation.

What Changed From Last Quarter?

Q3 2025 vs Q4 2025 Comparison:

Key changes from Q3 to Q4:

- Carbon capture operational: Three Nebraska facilities now running, lowering CI scores

- 45Z credits recognized: First full quarter of 45Z benefit flowing through financials

- Higher utilization: 97% utilization from eight operating plants

- Improved crush margins: Consolidated ethanol crush margin of $44.4M vs negative in Q4 2024

- Record performance: Four plants set ethanol production records in 2025

Segment Performance

Green Plains operates two reportable segments:

The sharp decline in Agribusiness & Energy Services revenue reflects the cessation of the third-party ethanol marketing agreement with Tharaldson Ethanol effective April 1, 2025 .

Operating Data Q4 2025 :

- Ethanol production: 178.8M gallons at 97% capacity (vs 209.5M in Q4 2024)

- Distillers grains: 378K equivalent dried tons

- Ultra-High Protein: 60K tons (+11% YoY)

- Renewable corn oil: 64.6M pounds

- Corn consumed: 60.4M bushels

Management noted that updated ethanol production capacity reflects the company's proven ability to produce beyond nameplate capacity .

Liquidity and Capital Position

The company significantly improved its balance sheet in 2025 through several strategic transactions :

- September 2025: Sold Obion, TN plant for $170M, used proceeds to eliminate $130.7M junior mezzanine debt

- October 2025: Completed $200M convertible note exchange enhancing financial flexibility

- December 2025: Expanded tax credit monetization agreement to additional facilities

Full Year 2025 Results

While the full year showed a larger GAAP loss, Adjusted EBITDA increased fivefold, reflecting the operational improvements and 45Z benefits that ramped through the year.

Risks and Concerns

-

Policy Risk: The 45Z credit is subject to potential changes in government tax policy, including modifications under the "One Big Beautiful Bill Act" mentioned in the forward-looking statements

-

Revenue Dependence on Credits: Without 45Z benefits, the core ethanol production business would still be unprofitable on a GAAP basis

-

Volume Decline: Ethanol production volumes declined 14.7% YoY as the company optimized its plant footprint

-

Commodity Exposure: Results remain sensitive to corn, ethanol, and distillers grains pricing

-

Accounting Uncertainty: The company is considering early adoption of ASU 2025-10, which could change how 45Z credits are presented in financial statements

2026 Strategic Priorities and Guidance

CEO Osowski outlined five strategic capital allocation priorities for 2026 :

- Energy efficiency and CI reduction projects — Already underway, some completable within 2026

- Carbon sequestration for non-pipeline plants — Evaluating how to capture carbon before Summit pipeline comes online

- Debottlenecking/expansion opportunities — FEL engineering in progress; compression stations and piping sized for more capacity

- On-site grain storage and receiving speed — Lower feedstock costs, reduce operational risk, improve CI scores

- Balance capital structure and returning capital to shareholders — Debt reduction and buybacks under consideration

2026 Financial Guidance:

Operational Excellence Update: Plants running at $0.03/gallon lower total OpEx year-over-year, with "a few more pennies" targeted in 2026 .

Forward Catalysts

- 2026 45Z Credit Sale Agreement: Announcement expected "in the near future" with strong counterparty interest

- On-Farm Practices CI Benefit: New Treasury guidance creates upside to $188M carbon opportunity

- E15 Year-Round Approval: Long-term catalyst despite missing recent bill; strong bipartisan support continues

- Carbon Capture Optimization: All five compressors online, capturing >90% of CO2 with further optimization ongoing

- Accounting Change: ASU 2025-10 early adoption decision in Q1 2026 could affect 45Z presentation

- Madison Permit Expansion: Working with State of Illinois to increase permitted production levels

Data sourced from Green Plains Inc. Form 8-K filed February 5, 2026, Q4 2025 Earnings Call Transcript, and S&P Global.

View Full 8-K Filing | Earnings Call Transcript | Company Overview | Prior Earnings: Q3 2025