Earnings summaries and quarterly performance for Good Times Restaurants.

Executive leadership at Good Times Restaurants.

Board of directors at Good Times Restaurants.

Research analysts who have asked questions during Good Times Restaurants earnings calls.

Recent press releases and 8-K filings for GTIM.

Good Times Restaurants Reports Q1 2026 Results with Decreased Revenue and Flat Profitability

GTIM

Earnings

Demand Weakening

New Projects/Investments

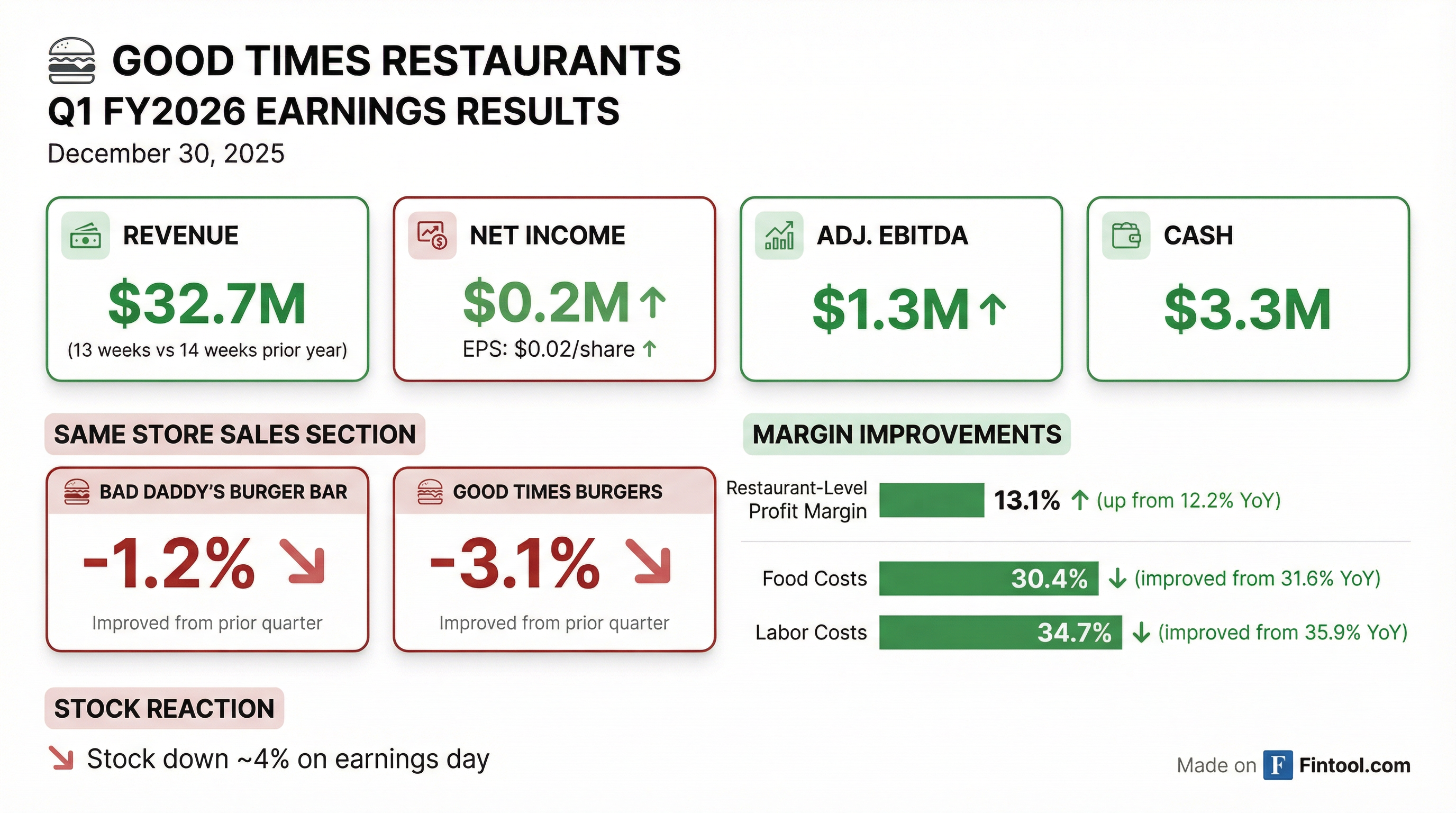

- Good Times Restaurants reported total revenues of $32.7 million for Q1 2026, representing a 10% decrease from the prior year.

- Net income to common shareholders was $0.2 million or $0.02 per share, and Adjusted EBITDA was $1.3 million, both remaining flat compared to Q1 2025.

- Both Bad Daddy's and Good Times brands experienced negative same-store sales in Q1 2026, with -1.2% for Bad Daddy's and -3.1% for Good Times, though both showed sequential improvement from the prior quarter and continued improvement into Q2.

- The company ended the quarter with $3.3 million in cash and $1.8 million of long-term debt, with the primary cash deployment priority being paying down the remaining debt.

1 day ago

Good Times Restaurants Reports Q1 2026 Results with Revenue Decrease and Flat Profitability

GTIM

Earnings

Demand Weakening

New Projects/Investments

- Good Times Restaurants reported Q1 2026 total revenues decreased approximately 10% to $32.7 million, with net income remaining flat at $0.2 million or $0.02 per share and Adjusted EBITDA flat at $1.3 million compared to the prior year quarter.

- Same-store sales remained negative for both brands, with Bad Daddy's decreasing 1.2% and Good Times decreasing 3.1%, though both showed sequential improvement.

- Operational initiatives included Good Times transitioning to cook-to-order with a 10% larger patty and an enhanced loyalty program achieving over a 7% attachment rate. Bad Daddy's is shifting to a Burger of the Month platform and plans to add a protein bowl to its core menu.

- The company ended the quarter with $3.3 million in cash and $1.8 million in long-term debt, prioritizing debt repayment as its first use of cash, followed by building cash, and then resuming share repurchases and Bad Daddy's development.

1 day ago

Good Times Restaurants Reports Q1 2026 Results with Sequential Sales Improvement

GTIM

Earnings

New Projects/Investments

Share Buyback

- Good Times Restaurants reported Q1 2026 total revenues of $32.7 million, a 10% decrease year-over-year, with net income of $0.2 million and Adjusted EBITDA of $1.3 million.

- Both Bad Daddy's and Good Times brands showed sequential improvement in same-store sales, decreasing 1.2% and 3.1% respectively for the quarter.

- Operational initiatives include Good Times' transition to cook-to-order fresh Angus beef patties and an enhanced loyalty program that boosted attachment rates from 3-4% to over 7%.

- The company's capital allocation priorities are to first pay down the remaining $1.8 million in long-term debt, then build additional cash, and subsequently resume share repurchases and pursue Bad Daddy's development.

1 day ago

Good Times Restaurants Inc. Reports Q1 2026 Financial Results

GTIM

Earnings

Demand Weakening

Guidance Update

- Good Times Restaurants Inc. reported total revenues of $32.7 million for the first fiscal quarter ended December 30, 2025.

- Net income attributable to common shareholders was $0.2 million ($0.02 per share) for the quarter.

- Adjusted EBITDA for the quarter was $1.3 million.

- Same Store Sales for company-owned Bad Daddy’s restaurants decreased 1.2% and for Good Times restaurants decreased 3.1% compared to the first quarter of fiscal 2025.

- The company concluded the quarter with $3.3 million in cash and $1.8 million in long-term debt.

1 day ago

Good Times Restaurants Reports Q1 2026 Results

GTIM

Earnings

Demand Weakening

- Good Times Restaurants reported total revenues of $32.7 million for the first fiscal quarter ended December 30, 2025.

- The company achieved net income attributable to common shareholders of $0.2 million ($0.02 per share) and Adjusted EBITDA of $1.3 million for the quarter.

- Same store sales decreased 1.2% for company-owned Bad Daddy’s restaurants and 3.1% for Good Times restaurants compared to the first fiscal quarter of 2025.

- As of December 30, 2025, the company held $3.3 million in cash and had $1.8 million in long-term debt.

1 day ago

GTIM Reports Challenging Q4 2025 Results with Anticipated Q1 2026 Improvement

GTIM

Earnings

Demand Weakening

Guidance Update

- Good Times Restaurants Inc. reported a 5.1% decrease in total revenues to $34 million for Q4 2025, leading to a net loss of $3,000 and negative Adjusted EBITDA of $74,000.

- The Bad Daddy's concept experienced a 4.6% decrease in same-store sales in Q4 2025, with total restaurant sales decreasing to $24 million, primarily due to reduced customer traffic and higher food and labor costs. However, same-store sales improved sequentially into Q1 2026, down approximately 1.6% through the first 11 weeks.

- The Good Times concept saw a 6.6% decrease in same-store sales in Q4 2025, which represented a 240 basis point sequential improvement from the prior quarter, with total restaurant sales decreasing to $9.7 million, also impacted by elevated beef, bacon, and egg prices. Same-store sales for Good Times were down approximately 3.6% through the first 11 weeks of Q1 2026.

- Management attributed the challenging fourth quarter to soft sales and significantly elevated ground beef costs, but anticipates improvement in same-store sales and Adjusted EBITDA for the first quarter of fiscal 2026.

Dec 23, 2025, 10:00 PM

Good Times Restaurants Reports Q4 2025 Revenue Decline and Negative Adjusted EBITDA

GTIM

Earnings

Demand Weakening

Guidance Update

- Good Times Restaurants (GTIM) reported a 5.1% decrease in total revenues to $34 million for Q4 2025, with fiscal year 2025 revenues down 0.5% to $141.6 million.

- The company posted a net loss of $3,000 (0 cents per share) and negative Adjusted EBITDA of $74,000 for Q4 2025, a significant decline from net income of $0.2 million and Adjusted EBITDA of $1.3 million in Q4 2024.

- Same-store sales declined for both concepts in Q4 2025, with Good Times down 6.6% and Bad Daddy's down 4.6%. However, both brands showed sequential improvement into Q1 fiscal 2026, with Good Times same-store sales down approximately 3.6% and Bad Daddy's down approximately 1.6% through the first 11 weeks.

- Profitability was negatively impacted by elevated costs, including record high ground beef prices and increased labor expenses due to sales deleverage and higher wage rates.

- Management projects improvement in same-store sales and Adjusted EBITDA for Q1 fiscal 2026, driven by anticipated lower input costs and operational adjustments.

Dec 23, 2025, 10:00 PM

Good Times Restaurants Reports Challenging Q4 2025 Results with Negative Adjusted EBITDA

GTIM

Earnings

Demand Weakening

Profit Warning

- Good Times Restaurants Inc. reported a 5.1% decrease in total revenues to $34 million for Q4 2025, resulting in a net loss to common shareholders of $3,000 and negative $74,000 in Adjusted EBITDA.

- Both Bad Daddy's and Good Times concepts experienced same-store sales declines in Q4 2025, with Bad Daddy's down 4.6% and Good Times down 6.6%.

- Profitability was significantly impacted by record high ground beef prices and increased labor costs, leading to higher food and beverage costs and labor costs for both concepts.

- Management anticipates improved same-store sales and Adjusted EBITDA for Q1 2026, with expectations for quarter-over-quarter improvement in food and beverage costs.

Dec 23, 2025, 10:00 PM

Good Times Restaurants Reports Weaker Q4 FY2025 Performance

GTIM

Earnings

Demand Weakening

Profit Warning

- Good Times Restaurants reported fiscal 2025 fourth-quarter revenue fell to $34.0 million, representing a 5% decline, with full-year revenue at $141.6 million, slightly down from fiscal 2024.

- Same-store sales declined 6.6% at Good Times and 4.6% at Bad Daddy's in Q4, with "significantly elevated" ground beef prices identified as a key driver of weaker profitability.

- Bad Daddy's, the company's largest revenue generator, experienced a $1.7 million decrease in total restaurant sales to $24.0 million in Q4, partly due to reduced customer traffic and a restaurant closure.

- Management noted sequential moderation in same-store sales and improvement in the first quarter of fiscal 2026, particularly at Bad Daddy's Colorado locations, and plans to boost restaurant-level margins through cost reductions and modest menu price increases.

Dec 23, 2025, 9:54 PM

Good Times Restaurants Inc. Reports Q4 and Fiscal Year 2025 Financial Results

GTIM

Earnings

Demand Weakening

Guidance Update

- Good Times Restaurants Inc. reported a net loss attributable to common shareholders of $3 thousand for the fourth quarter of fiscal year 2025, with a fiscal year net income of $1.0 million.

- Total Revenues for fiscal year 2025 decreased 0.5% to $141.6 million, and Total Restaurant Sales for company-owned restaurants decreased $2.0 million to $33.6 million for the fourth quarter.

- Same Store Sales for Good Times restaurants decreased 6.6% in Q4 2025 and 5.0% for the fiscal year, while Bad Daddy's restaurants experienced a 4.6% decrease in Q4 2025 and a 2.1% decrease for the fiscal year.

- Adjusted EBITDA was ($0.1) million for the fourth quarter and $4.3 million for the fiscal year 2025.

- The CEO noted weakness in sales during the second half of fiscal year 2025 but observed sequential Same Store Sales improvement in the first quarter of fiscal 2026 for both brands.

Dec 23, 2025, 9:05 PM

Quarterly earnings call transcripts for Good Times Restaurants.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more