Earnings summaries and quarterly performance for HASBRO.

Executive leadership at HASBRO.

Christian P. Cocks

Chief Executive Officer

Gina Goetter

Chief Financial Officer and Chief Operating Officer

Holly Barbacovi

Executive Vice President and Chief People Officer

John Hight

President, Wizards of the Coast and Digital Gaming

Tarrant Sibley

Executive Vice President, Chief Legal Officer and Corporate Secretary

Tim Kilpin

President, Toys, Board Games, Licensing and Entertainment

Board of directors at HASBRO.

Darin S. Harris

Director

Elizabeth Hamren

Director

Frank D. Gibeau

Director

Hope F. Cochran

Director

Laurel J. Richie

Director

Lisa Gersh

Director

Mary Beth West

Director

Owen Mahoney

Director

Richard S. Stoddart

Chair of the Board

Research analysts who have asked questions during HASBRO earnings calls.

Arpine Kocharyan

UBS

6 questions for HAS

Eric Handler

Roth Capital Partners, LLC

6 questions for HAS

James Hardiman

Citigroup

6 questions for HAS

Kylie Cohu

Jefferies Financial Group Inc.

6 questions for HAS

Christopher Horvers

JPMorgan Chase & Co.

5 questions for HAS

Stephen Laszczyk

Goldman Sachs

5 questions for HAS

Alexander Perry

Bank of America

4 questions for HAS

Jaime Katz

Morningstar

3 questions for HAS

Megan Christine Alexander

Morgan Stanley

3 questions for HAS

Gerrick Johnson

Seaport Research

2 questions for HAS

Megan Alexander

Morgan Stanley

2 questions for HAS

Andrew Crum

Stifel, Nicolaus & Company, Incorporated

1 question for HAS

Christian Carlino

JPMorgan Chase & Co.

1 question for HAS

Frederick Wightman

Wolfe Research, LLC

1 question for HAS

Megan Clapp

Morgan Stanley

1 question for HAS

Recent press releases and 8-K filings for HAS.

- On February 20, 2026, Hasbro entered into a Fourth Amended and Restated Revolving Credit Agreement providing a $1.1 billion senior unsecured facility, with an option to add $550 million of incremental commitments, extending its maturity to February 20, 2031.

- The facility includes sub‐limits of $75 million for letters of credit and $50 million for swing‐line loans, replacing the prior agreement dated September 5, 2023.

- Borrowings will accrue interest at the company’s choice of Base Rate, Term Benchmark Rate or Daily Benchmark Rate plus spreads of 0–50 bps on Base Rate loans and 75–150 bps on benchmark rate loans; unused commitments incur a fee tied to leverage or ratings.

- The agreement contains standard covenants, including maintaining a Consolidated Interest Coverage Ratio ≥ 3.00:1 and a Consolidated Net Total Leverage Ratio ≤ 3.75:1 for Q1, Q2 and Q4 (≤ 4.00:1 for Q3).

- Hasbro returns to North American Toy Fair with a dynamic lineup of new products across flagship franchises—including BABY ALIVE, DUNGEONS & DRAGONS, MONOPOLY, NERF, PLAY-DOH and TRANSFORMERS—to deepen fan engagement through immersive storytelling.

- The company announced multi-year licensing partnerships: a 2027 launch with Warner Bros. Discovery for Harry Potter, and movie-tie-in deals with Legendary Entertainment for Street Fighter (Oct. 16, 2026) and Amazon MGM for Voltron.

- Key product reveals include FURBY Vibes (swappable glasses and music-driven play), the first PEPPA PIG George figure featuring a hearing aid, and the BEYBLADE X Sneak Attack Battle Set slated for July 2026.

- Hasbro further extends its entertainment-driven growth with Netflix’s KPop Demon Hunters toy collection and the upcoming Magic: The Gathering | Teenage Mutant Ninja Turtles Universes Beyond set (launching March 6).

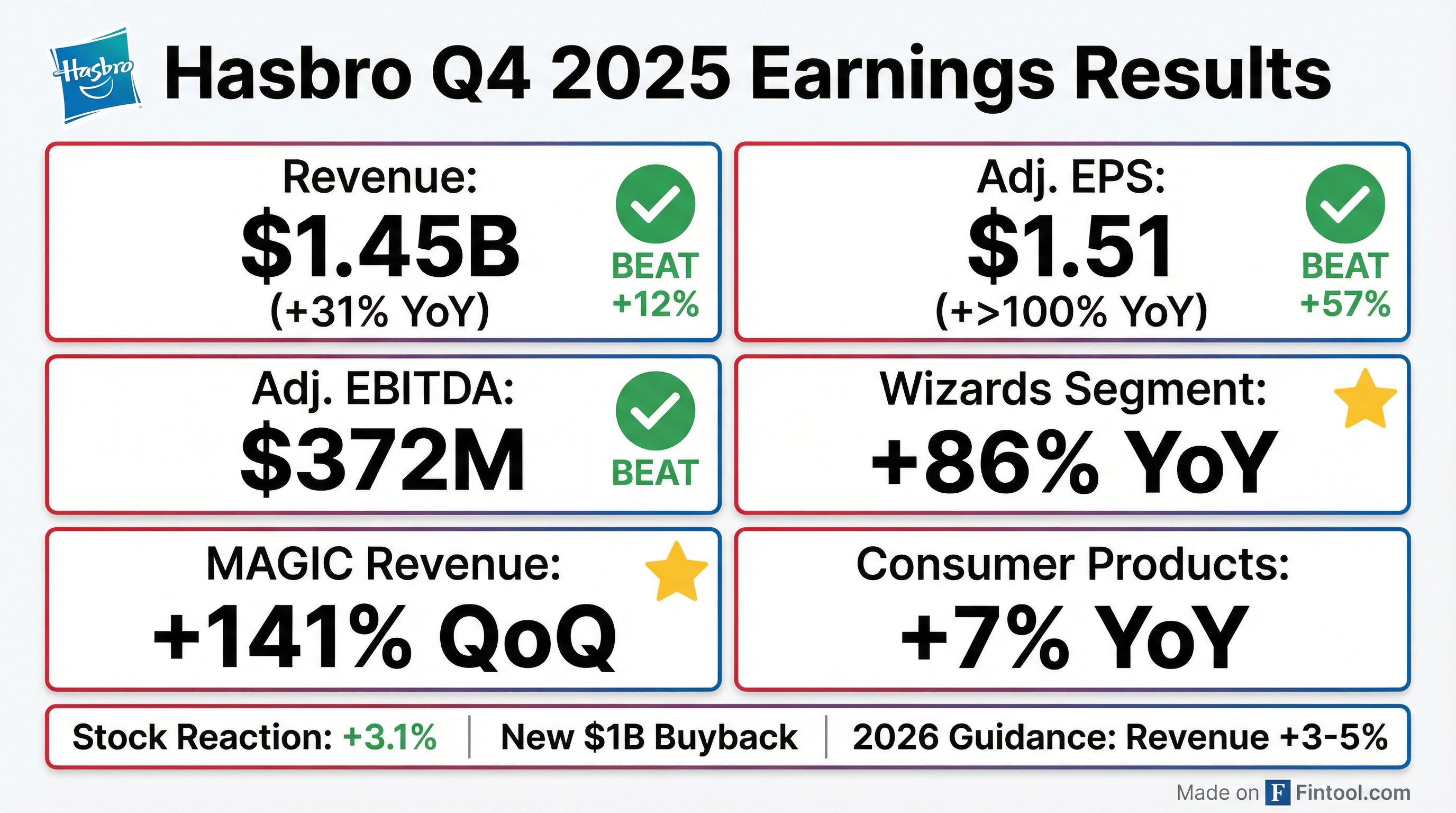

- Q4 revenue rose 31% YoY to $1,446 M, driven by an 86% increase in Wizards of the Coast & Digital Gaming and 7% Consumer Products growth.

- Adjusted operating profit improved by $202 M to $315 M, yielding a 21.8% adjusted operating margin, up ~12 pts year-over-year.

- Adjusted EPS was $1.51, reflecting favorable mix and improved profitability.

- The company deployed ~$105 M on debt reduction through repurchases and prefunding.

- Q4 2025 net revenue of $1.5 billion (+31% YoY), adjusted operating profit of $315 million (+180%) and adjusted EPS of $1.51

- FY 2025 net revenue reached $4.7 billion (+14%), adjusted operating profit was $1.1 billion (+36%) with a 24.2% margin, and adjusted EPS of $5.54

- Wizards of the Coast drove Q4 revenue of $630 million (+86%; 45% operating margin) and FY revenue of $2.2 billion (+45%; 46% margin)

- 2026 guidance: consolidated revenue growth of 3–5% (constant currency), operating margins of 24–25%, and adjusted EBITDA of $1.4–1.45 billion

- Hasbro reported Q4 2025 net revenue of $1.5 billion, up 31% YoY, with adjusted operating profit of $315 million, up 180%, a 21.8% operating margin, and adjusted EPS of $1.51.

- For full-year 2025, net revenue rose 14% to $4.7 billion, adjusted operating profit increased 36% to $1.1 billion (margin 24.2%), and adjusted EPS reached $5.54.

- In Q4, Wizards of the Coast delivered $630 million in revenue, up 86%, with operating profit of $284 million (45% margin), while Consumer Products posted $800 million in revenue, up 7%, and operating profit of $54 million.

- The company generated $893 million of operating cash flow, ended 2025 with $777 million of cash, returned $393 million to shareholders via dividends, and reduced gross leverage to 2.3×.

- For 2026, Hasbro forecasts 3–5% consolidated revenue growth (constant currency), 24–25% operating margins, and $1.4–$1.45 billion of adjusted EBITDA, with mid-single-digit growth in Wizards and low-single-digit growth in Consumer Products.

- Hasbro delivered Q4 net revenue of $1.5 billion (up 31% YoY) and adjusted operating profit of $315 million (up 180%, 21.8% margin); for the full year, revenue was $4.7 billion (up 14%) and adjusted operating profit reached a record $1.1 billion (24.2% margin).

- In Q4, Wizards of the Coast revenue rose 86% to $630 million with a 45% operating margin, while Consumer Products revenue grew 7% to $800 million.

- For 2026, Hasbro expects consolidated revenue growth of 3–5% on a constant-currency basis, operating margins of 24–25%, and adjusted EBITDA of $1.4–1.45 billion; Wizards is guided to mid-single-digit revenue growth and low-40% margins, and Consumer Products to low-single-digit revenue growth with 6–8% margins.

- The company generated $893 million of operating cash flow, ended 2025 with $777 million of cash, returned $393 million to shareholders in dividends, reached 2.3x gross leverage, and launched a $1 billion share repurchase program.

- Hasbro and Warner Bros. Discovery Global Consumer Products agreed a multi-year global licensing partnership starting in 2027, naming Hasbro the primary toy licensee for the Harry Potter universe, covering the films, Fantastic Beasts and the upcoming HBO series.

- Hasbro will develop dolls, role-play items, action figures, collectibles, interactive plush and board games tied to the franchise.

- The deal supports Hasbro’s franchise-focused strategy around the 25th anniversary of the first film; the HBO Original series is set to premiere in 2027 with a new cast.

- Announcement drove Hasbro shares up ~6.7%, though analysts noted a gray-zone Altman Z-Score and recent insider selling; observers also expect crossovers with Nerf, Super Soaker and Magic: The Gathering.

- Hasbro delivered Q4 adjusted EPS of $1.51 surpassing theStreet estimate of $0.95 and achieved 31% year-over-year revenue growth to $1.5 billion; Wizards of the Coast & Digital Gaming revenue jumped 86% to $630 million, while Consumer Products revenue was $800 million.

- Full-year 2025 revenues rose 14% to $4.7 billion, driven by a 45% increase in Wizards & Digital Gaming, offsetting a 4% decline in both Consumer Products and Entertainment.

- Management authorized a $1.0 billion share repurchase program and reiterated the quarterly dividend, underscoring confidence in cash flow post-restructuring.

- For 2026, the company forecasts mid-single-digit revenue growth, adjusted operating margins of 24–25%, and adjusted EBITDA of $1.40–1.45 billion.

- Hasbro Q4 2025 revenues rose 31% YoY, driven by Wizards & Digital Gaming (+86%); Q4 adjusted operating profit was $315 million with a 21.8% margin.

- Full-year 2025 revenue increased 14% to $4.70 billion; adjusted operating profit was $1.14 billion (+36%) with an adjusted operating margin of 24.2%.

- Operating cash flow of $893 million and $225 million of debt reduction; the Board declared a quarterly dividend of $0.70 per share and authorized a $1.0 billion share repurchase program.

- 2026 guidance: revenue growth of 3–5% in constant currency, adjusted operating margin of 24–25%, and adjusted EBITDA of $1.40–1.45 billion.

- Full-year revenue increased 14%, driven by 45% Wizards of the Coast segment growth and 59% MAGIC: THE GATHERING expansion

- Adjusted operating profit rose 36% to $1.14 billion with a 24.2% margin; reported net loss was $2.30 per share vs. $5.54 adjusted EPS

- Q4 revenue rose 31% with $315 million adjusted operating profit (21.8% margin) and $1.51 adjusted EPS

- Declared $0.70 dividend, returned $393 million to shareholders, announced $1 billion share buyback and reduced $225 million of debt

- 2026 outlook: 3–5% revenue growth, 24–25% adjusted operating margin, and $1.40–1.45 billion adjusted EBITDA

Quarterly earnings call transcripts for HASBRO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more