Earnings summaries and quarterly performance for INCYTE.

Executive leadership at INCYTE.

Hervé Hoppenot

Chief Executive Officer

Pablo Cagnoni

President, Research and Development

Sheila Denton

Executive Vice President and General Counsel

Steven Stein

Executive Vice President and Chief Medical Officer

Thomas Tray

Chief Accounting Officer and Principal Financial Officer

Board of directors at INCYTE.

Research analysts who have asked questions during INCYTE earnings calls.

Jay Olson

Oppenheimer & Co. Inc.

7 questions for INCY

Evan Seigerman

BMO Capital Markets

6 questions for INCY

Marc Frahm

TD Cowen

6 questions for INCY

Salveen Richter

Goldman Sachs

6 questions for INCY

Tazeen Ahmad

Bank of America

6 questions for INCY

Brian Abrahams

RBC Capital Markets

5 questions for INCY

Jessica Fye

JPMorgan Chase & Co.

5 questions for INCY

Derek Archila

Wells Fargo

4 questions for INCY

Eric Schmidt

Cantor Fitzgerald & Co.

4 questions for INCY

James Shin

Analyst

4 questions for INCY

David Lebowitz

Citigroup Inc.

3 questions for INCY

Gavin Clark-Gartner

Evercore ISI

3 questions for INCY

Kripa Devarakonda

Truist Securities

3 questions for INCY

Matthew Phipps

William Blair

3 questions for INCY

Michael Schmidt

Guggenheim Securities

3 questions for INCY

Salim Syed

Mizuho Securities

3 questions for INCY

Srikripa Devarakonda

Truist Financial Corporation

3 questions for INCY

Stephen Willey

Stifel

3 questions for INCY

Vikram Purohit

Morgan Stanley

3 questions for INCY

Andrew Berens

Leerink Partners

2 questions for INCY

Andy Chen

Wolfe Research, LLC

2 questions for INCY

Ash Verma

UBS

2 questions for INCY

Brandon Frith

Wolfe Research, LLC

2 questions for INCY

Erik Lavington

Mizuho Financial Group, Inc.

2 questions for INCY

Madeline

William Blair

2 questions for INCY

Parth Patel

Morgan Stanley

2 questions for INCY

Rosemary Li

Guggenheim Securities

2 questions for INCY

Andrew Behrens

Lyrinx Partners

1 question for INCY

Ashwani Verma

UBS Group AG

1 question for INCY

Conor MacKay

BMO Capital Markets

1 question for INCY

Crypto Vericonda

True Securities

1 question for INCY

Dingding Shi

Jefferies

1 question for INCY

Eric Schmitt

Cantor Fitzgerald

1 question for INCY

Kelly Hsieh

Jefferies

1 question for INCY

Kelly Shi

Jefferies

1 question for INCY

Matthew Dellatorre

Goldman Sachs Group Inc.

1 question for INCY

Paul Jeng

Guggenheim Partners

1 question for INCY

Peter Lawson

Barclays PLC

1 question for INCY

Ren Benjamin

Citizen at JPM

1 question for INCY

Reni Benjamin

Citizens JMP Securities

1 question for INCY

Stephen Willey

Stifel Financial Corp.

1 question for INCY

Tazim Ahmed

Bank of America

1 question for INCY

Recent press releases and 8-K filings for INCY.

- On February 24, 2026, China’s NMPA accepted the NDA for ruxolitinib phosphate cream in mild to moderate atopic dermatitis and granted it Priority Review (review shortened from 200 to 130 days).

- Phase III data in China showed strong efficacy at week 8: 63.0% of patients achieved IGA 0/1 versus 9.2% for placebo, and 78.0% achieved EASI 75 versus 15.4% (both P < 0.001).

- The acceptance marks a key expansion beyond vitiligo for Dermavon’s dermatology portfolio, which also includes Comekibart Injection and CMS-D001 for moderate-to-severe AD.

- Over 52.5 million mild-to-moderate AD patients in China stand to benefit from accelerated access if approval follows the Priority Review timeline.

- Knight’s Brazilian affiliate submitted a marketing authorization application to ANVISA for NIKTIMVO® (axatilimab) in chronic graft-versus-host disease after failure of at least two prior lines of systemic therapy in patients ≥6 years old.

- Under the amended August 2025 agreement, Knight holds exclusive Latin American distribution rights for axatilimab and retifanlimab, with Incyte responsible for development, manufacturing and supply.

- NIKTIMVO® received FDA approval in August 2024 for chronic GVHD in adult and pediatric patients ≥40 kg after failure of two or more prior systemic therapies.

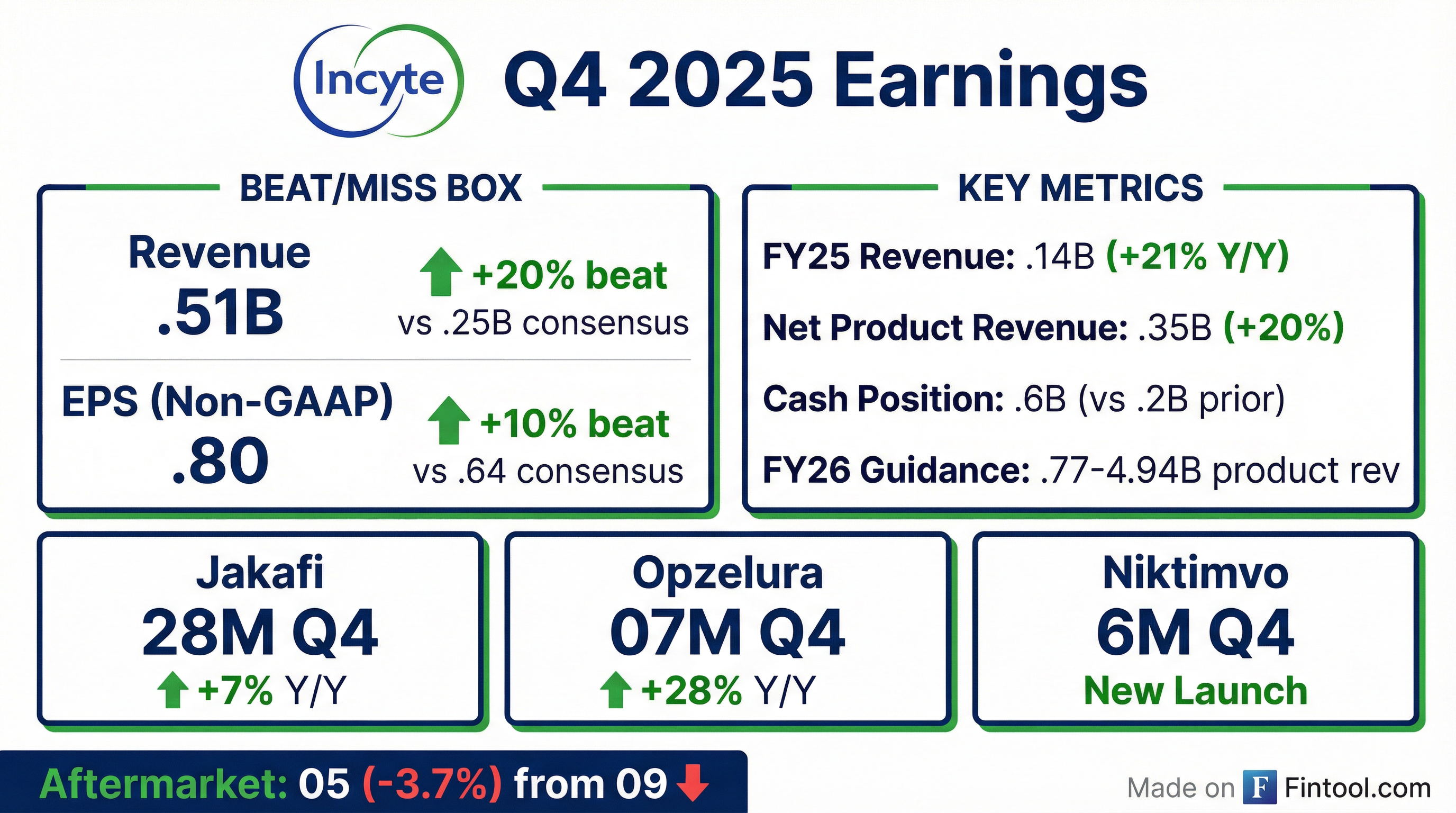

- Incyte delivered Q4 revenues of $1.51 billion (up 28% YoY) and full-year 2025 revenues of $5.14 billion (up 21%), with Q4 net product revenues of $1.22 billion (+20%) and FY net product revenues of $4.35 billion (+20%).

- Core product performance was strong: Jakafi sales of $828 million in Q4 (+7% YoY) and $3.093 billion for the year (+11%); Opzelura sales of $207 million in Q4 (+28%) and $678 million FY (+33%); and the hematology/oncology portfolio delivered $187 million in Q4 (+121%) and $583 million FY (+83%).

- For 2026, Incyte forecasts total revenues of $4.77–4.94 billion (up 10%–13% YoY), including Jakafi $3.22–3.27 billion, Opzelura $750–790 million, and hematology/oncology $800–880 million; it expects GAAP R&D and SG&A expenses of $3.495–3.675 billion (+4% at midpoint).

- The pipeline advances with 14 pivotal trials across seven assets in 2026 and regulatory submissions for Jakafi XR, Opzelura (moderate AD), and povorcitinib, targeting approvals in late 2026/early 2027.

- Incyte delivered Q4 2025 total revenue of $1.51 billion (+28% y/y) and full-year revenue of $5.14 billion (+21% y/y); Q4 net sales were $1.22 billion (+20% y/y) and FY net sales $4.35 billion (+20% y/y).

- Jakafi posted $828 million in Q4 (+7% y/y) and $3.093 billion for full-year 2025 (+11% y/y); core business ex-Jakafi sales rose 53% y/y in Q4 to $1.26 billion, with >30% growth expected in 2026.

- Management set 2026 revenue guidance at $4.77 – $4.94 billion (10–13% growth), including Jakafi $3.22 – 3.27 billion, Opzelura $750 – 790 million, and hematology/oncology $800 – 880 million.

- FY 2025 GAAP R&D expenses were $2.05 billion (ongoing R&D +8% y/y) and GAAP SG&A $1.38 billion (+11% y/y); 2026 combined R&D+SG&A is guided to $3.495 – 3.675 billion (≈+4% y/y).

- Incyte delivered FY 2025 total revenue of $5.14 B (+21% YoY) and Q4 2025 net sales of $1.223 B (+20% YoY).

- FY 2025 product net sales: Jakafi $3.093 B (+11% YoY), Opzelura $678 M (+33% YoY), and Hematology & Oncology $583 M (+83% YoY).

- Core business ex-Jakafi net sales reached $1.26 B in FY 2025, up 53% YoY.

- FY 2026 guidance: total net sales of $4.77–4.94 B, with Jakafi $3.22–3.27 B, Opzelura $750–790 M, and Hematology & Oncology $800–880 M.

- YTD 2025 R&D expenses were $2.05 B (–21% YoY) with ongoing R&D up 8%; FY 2026 GAAP R&D & SG&A expense guidance is $3.495–3.675 B.

- Incyte reported Q4 2025 total revenues of $1.51 billion (+28% YoY) and full-year 2025 revenues of $5.14 billion (+21%), with net product sales of $1.22 billion in Q4 (+20%) and $4.35 billion for the year (+20%).

- Jakafi sales reached $828 million in Q4 (+7%) and $3.093 billion for FY 2025 (+11%), while OPZELURA sales were $207 million in Q4 (+28%) and $678 million for FY (+33%), and hematology/oncology net sales hit $187 million in Q4 (+121%) and $583 million for FY (+83%).

- For 2026, management set full-year revenue guidance of $4.77 billion–$4.94 billion (10%–13% growth), including Jakafi of $3.22 billion–$3.27 billion, OPZELURA of $750 million–$790 million, hematology/oncology of $800 million–$880 million, and core business ex-Jakafi growth of ~30%.

- The company emphasized a broad late-stage pipeline, with 14 pivotal trials across seven assets, pending approvals for Jakafi XR (mid-2026) and povorcitinib in HS, and an sBLA submission for MONJUVI in first-line DLBCL in H1 2026.

- Incyte posted Q4 2025 revenue of $1.51 billion and non-GAAP EPS of $1.80, driven by Jakafi (+7% to $828 million) and Opzelura (+28% to $207 million), though rising R&D and U.S. oncology launch costs weighed on profitability.

- The company issued 2026 revenue guidance of $4.77 billion to $4.94 billion, well below the roughly $5.53 billion consensus.

- Year-end cash and marketable securities totaled $3.6 billion, up from about $2.2 billion at the end of 2024.

- Shares tumbled about 5.7% to $102.85 in early trading as investors reacted to the weaker outlook.

- Total revenue of $1.51 billion in Q4 2025 (+28% Y/Y) and $5.14 billion for full-year 2025 (+21% Y/Y).

- Total net product revenue of $1.22 billion in Q4 2025 (+20% Y/Y) and $4.35 billion for full-year 2025 (+20% Y/Y), exceeding prior guidance of $4.23–$4.32 billion.

- GAAP net income of $299 million in Q4 2025 (diluted EPS $1.46) and $1.287 billion for the full year (diluted EPS $6.41).

- 2026 total net product revenue guidance set at $4.77–$4.94 billion.

- Cash, cash equivalents and marketable securities of $3.6 billion as of December 31, 2025.

- Incyte delivered Q4 total revenue of $1.51 billion (+28% Y/Y) and FY 2025 total revenue of $5.14 billion (+21%).

- Total net product revenue was $1.22 billion in Q4 (+20%) and $4.35 billion for FY 2025 (+20%), above the full-year guidance range of $4.23–$4.32 billion.

- As of December 31, 2025, Incyte held $3.6 billion in cash, cash equivalents and marketable securities, up from $2.2 billion a year earlier.

- For 2026, the company expects total net product revenue of $4.77–$4.94 billion and GAAP R&D plus SG&A expenses of $3.495–$3.675 billion.

- Incyte announced a positive CHMP opinion for Zynyz® (Retifanlimab) plus carboplatin and paclitaxel as first-line therapy in adults with advanced squamous cell carcinoma of the anal canal (SCAC) in Europe.

- The recommendation is based on Phase 3 POD1UM-303/InterAACT2 results showing a 37 % reduction in risk of progression or death (p=0.0006) and median progression-free survival of 9.3 vs. 7.4 months versus placebo plus chemotherapy.

- Upon European Commission approval, Zynyz would be the first PD-1 immunotherapy option for advanced SCAC in Europe.

- SCAC is rare, with a global prevalence of about 1–2 cases per 100,000 people, and higher incidence in women.

Quarterly earnings call transcripts for INCYTE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more