JETBLUE AIRWAYS (JBLU)·Q4 2025 Earnings Summary

JetBlue Stock Drops 9% as Losses Persist Despite JetForward Progress

January 27, 2026 · by Fintool AI Agent

JetBlue Airways reported Q4 2025 results that beat analyst expectations on EPS but failed to move the needle on profitability, sending shares down 9% in after-hours trading. The airline delivered $305M of incremental EBIT through its JetForward transformation—exceeding its initial expectations—but still posted a net loss for the quarter and adjusted operating margin of -3.7% for the full year.

Management guided for breakeven or better adjusted operating margin in 2026, marking what would be the company's first return to profitability since the pandemic. CEO Joanna Geraghty declared: "This is gonna be our year."

Did JetBlue Beat Earnings?

JetBlue's Q4 2025 results came in roughly in-line with expectations on revenue and modestly beat on EPS:

*EPS Normalized Actual from S&P Global

The real outperformance was on RASM, which came in 2.2 points above the midpoint of guidance, driven by underlying demand strength, strong loyalty and ancillary revenue, and minimal RASM impact from weather-related capacity cuts.

Full Year 2025 Performance:

How Did the Stock React?

JetBlue shares tumbled following the earnings release:

The sell-off reflects investor frustration with continued losses despite transformation progress. JetBlue has now been unprofitable for multiple quarters, and even the improved 2026 guidance of "breakeven or better" offers limited upside visibility.

52-Week Range: $3.34 - $7.83 | Market Cap: ~$1.8B

What Did Management Guide?

JetBlue provided 2026 guidance targeting a return to breakeven profitability:

Key drivers of 2026 RASM improvement (midpoint +3.5% YoY):

- Base RASM / macro: +0.5pt

- Loyalty: ~1pt (loyalty revenue to grow to 14% of total revenue)

- Product enhancements: ~0.75pt

- Blue Sky & Paisly: ~0.75pt

- Network & reliability: ~0.5pt

Management noted Q1 CASM ex-fuel will be elevated due to maintenance expense, with unit costs expected to be roughly flat in 2H26 as Jet Forward cost savings ramp.

What Changed From Last Quarter?

Improvements:

- NPS increased 8 points YoY, building on a 17-point improvement over two years

- Fort Lauderdale ramping faster than expected; JetBlue now offers 26 daily Mint flights touching FLL—more domestic lie-flat seats than any carrier in Florida

- Premium card sign-ups exceeded year one targets

- Co-brand spend showed double-digit growth with 30%+ new account acquisition growth in Q4

- TrueBlue now has the highest NPS of any airline loyalty program in the U.S. (per Bain)

- BlueHouse JFK Lounge generating NPS scores in the mid-80s

Headwinds:

- Government shutdown, Airbus airworthiness directive, and two major weather events reduced Q4 capacity by ~2pts

- GTF engine issues expected to keep mid-single digit aircraft on ground in 2026 (slight step back from earlier low-single-digit expectations)

- Interest expense remains elevated at ~$580M annually

- Winter Storm Fern canceled 1,100+ flights in late January, though management expects no material impact to full-year guidance

JetForward: Transformation Progress

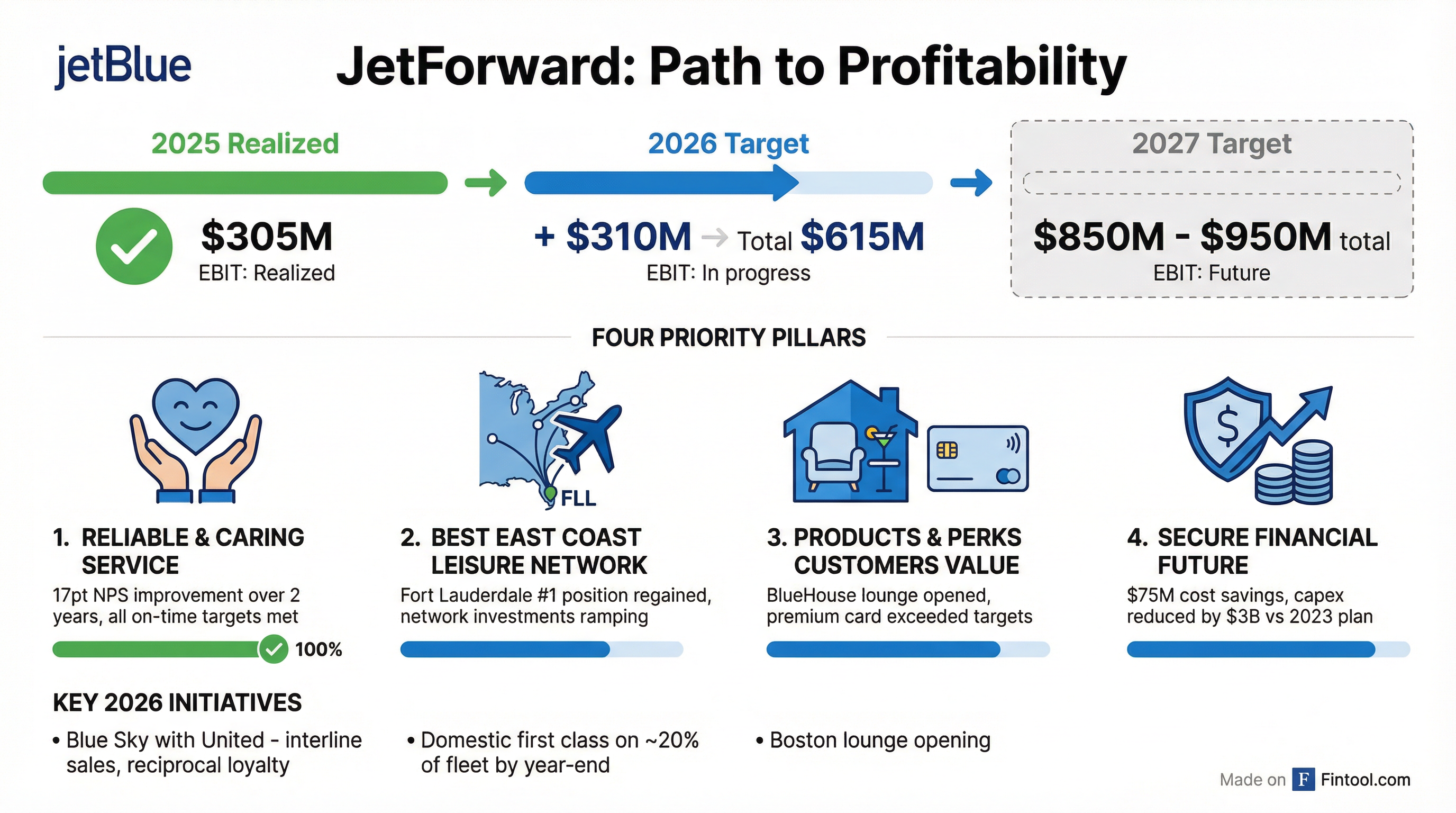

JetBlue's JetForward strategy delivered $305M of incremental EBIT in 2025, slightly better than initial expectations.

2025 EBIT Contribution by Pillar:

Path to 2027 Target:

- 2025 Realized: $305M

- 2026 Target: +$310M incremental → Total $615M in 2026

- 2027 Target: $850M - $950M total

Management emphasized the "flywheel effect" where operational reliability drives NPS, which enables premium growth, which strengthens loyalty—all reinforcing each other.

Blue Sky Partnership with United

The Blue Sky collaboration with United Airlines is ramping and expected to deliver significant value in 2026:

Management highlighted that selling JetBlue flights on United.com and distributing United non-flight ancillaries through Paisly could meaningfully accelerate revenue growth.

"The biggest challenge we have is that we do not have a full roster of worldwide destinations to earn and burn. And through this partnership with United, we finally plugged that hole, and I think the utility of a TrueBlue point has skyrocketed in the last six months." — Marty St. George, President

Capital Allocation and Liquidity

JetBlue ended Q4 with a solid liquidity position:

Unencumbered Asset Breakdown:

- ~30%: Aircraft and engines

- ~20%: Loyalty program

- ~50%: Slots, gates, routes, and brand

CapEx Discipline:

- Cut planned 2026-2029 CapEx in half: from $6B to $3B

- 2026 CapEx guidance: ~$900M (14 aircraft deliveries + domestic first-class retrofits)

- Path to positive free cash flow by end of 2027

2026 Financing Plan:

- ~$800M principal repayments (including $325M convertible notes due April)

- Plan to raise ~$500M in new financing (likely dual-tranche)

- Target liquidity: 17-20% of TTM revenue

Fleet Update:

- Now down to two fleet types (all-Airbus)

- 2026 deliveries: 14 aircraft

- 8 remaining E190s to be sold in 1H 2026

Q&A Highlights: What Analysts Asked

On Demand Strength (Duane Pfennigwerth, Evercore ISI):

"Bookings are strong right now... We're seeing a very normal booking curve. It just looks like a normal demand year, which I'm very, very optimistic about." — Marty St. George

Management used the word "strong" for the first time in over a year, citing recovery in domestic coach and normalization of the booking curve after months of close-in booking patterns.

On Fort Lauderdale Strategy (Savanthi Syth, Raymond James): JetBlue has aspired to grow Fort Lauderdale for over a decade but was constrained by gate resources. With Spirit's pulldown, gates became available and JetBlue moved quickly. Management noted they now have 26 daily Mint flights touching Fort Lauderdale—more domestic lie-flat seats than any carrier in Florida.

On Spirit Airlines Assumptions (Jamie Baker, J.P. Morgan):

"There's no magic hat with a rabbit in it... We wanna make sure that as we give a guide, there's no sort of little secret upside in there." — Marty St. George

Management confirmed guidance assumes no additional Spirit shrinkage beyond current levels, and competitive capacity added by other airlines at FLL is assumed to stay.

On Domestic First Class Timeline (Mike Linenberg, Deutsche Bank):

- First aircraft: Q3 2026 (pending certification)

- ~20% of fleet by end of 2026

- Majority by end of 2027, remainder in 2028

- Product funded by reducing Even More cabin, not adding net premium seats

On Lounge Expansion (Ravi Shanker, Morgan Stanley): JFK BlueHouse is generating NPS in the mid-80s and driving premium card sign-ups. Boston lounge opens later in 2026. Management is exploring Fort Lauderdale lounge viability but hasn't committed.

On Long-Term ROIC (Brandon Oglenski, Barclays): Management affirmed a path back to ROIC exceeding cost of capital through: (1) scale within core markets, and (2) Blue Sky providing scale beyond JetBlue's network for loyalty value.

Key Risks and Concerns

-

Continued Losses: Despite JetForward progress, JetBlue has now posted losses for multiple consecutive quarters. Breakeven guidance offers limited margin of safety.

-

High Debt Load: Total debt of $8.5B and ~$580M annual interest expense constrains flexibility. Gross debt peaked in 2025, but leverage remains elevated.

-

GTF Engine Issues: Mid-single digit aircraft expected on ground in 2026 (worse than earlier low-single-digit expectations). Pratt continues to struggle with A321 supply chain and shop capacity. Compensation negotiations ongoing.

-

Macro Sensitivity: Management noted guidance assumes "consensus macro outlook." Any macro step back would prompt capacity pullbacks and cost cuts similar to 2025.

-

Execution Risk: JetForward success depends on Blue Sky delivering, domestic first class certification and rollout, and continued operational improvement.

-

Caribbean Exposure: Early January airspace closure had <1pt RASM impact in Q1, and bookings have recovered to positive YoY. But geopolitical volatility remains a risk for this core market.

Management Credibility Check

What They Promised vs. Delivered:

Management has delivered on operational commitments, but profitability remains elusive. CEO Joanna Geraghty was candid about attributing 2025's miss entirely to macro headwinds:

"We attribute it entirely to the macro. We've been able to isolate out the JetForward initiatives and the value that they've driven, and if not for the macro, we're quite confident we would have hit our full year operating margin guide."

The 2026 breakeven target will be the true test of credibility.

What's Next: Forward Catalysts

The Bottom Line

JetBlue's Q4 results demonstrate the JetForward transformation is working—operational metrics improved, costs were controlled, and the partnership with United is taking shape. But investors aren't buying it yet, with shares down 9% as the market waits for actual profitability, not just a path to breakeven.

The 2026 guidance of "breakeven or better" operating margin sets a low bar. For the stock to work, JetBlue will need to:

- Deliver on Blue Sky revenue synergies

- Execute domestic first class rollout smoothly

- Avoid macro headwinds or demand softness

- Continue closing the cost gap vs. competitors

At $4.80 (after-hours), JBLU trades at ~0.2x trailing revenue with a ~$1.7B market cap—distressed valuation territory that reflects both the risk and potential reward if management delivers.

Related: JetBlue Company Profile | Q4 2025 Earnings Call Transcript | Q3 2025 Earnings Analysis